As per Intent Market Research, the Muslin Bedding Market was valued at USD 0.6 billion in 2024-e and will surpass USD 1.1 billion by 2030; growing at a CAGR of 9.4% during 2025 - 2030.

The muslin bedding market is experiencing notable growth due to rising consumer preferences for soft, breathable, and lightweight bedding materials. Muslin, known for its airy texture and durability, is gaining popularity across various demographics, particularly among individuals seeking comfortable and sustainable bedding solutions. Its natural composition, often derived from cotton, appeals to environmentally conscious consumers, further driving market demand.

Innovations in fabric blends, including organic and sustainable options, are broadening the appeal of muslin bedding. Additionally, the increasing adoption of muslin bedding in commercial settings such as hotels and luxury accommodations is contributing to market expansion. The growth of e-commerce platforms has also made muslin bedding more accessible, allowing brands to cater to global audiences with ease.

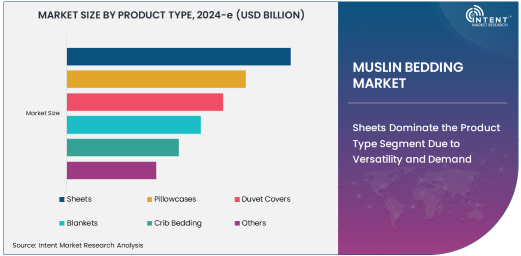

Sheets Dominate the Product Type Segment Due to Versatility and Demand

Among product types, sheets account for the largest market share, driven by their versatile use and essential role in bedding sets. Muslin sheets are favored for their breathability and lightweight nature, making them ideal for warm climates and sensitive skin.Other products, including pillowcases and duvet covers, also hold significant market shares, with consumers seeking complete muslin bedding ensembles. Crib bedding is another rapidly growing segment, as parents increasingly prioritize soft and safe materials for infants.

100% Cotton Muslin Leads the Material Type Segment for Its Natural Appeal

100% cotton muslin dominates the material type segment, offering unmatched softness and breathability. Its hypoallergenic properties make it an attractive choice for consumers with sensitive skin or allergies. Organic muslin is also gaining traction, reflecting the rising demand for sustainable and eco-friendly products. Blended muslin and other variations cater to consumers seeking enhanced durability and affordability, allowing brands to address a broader range of preferences and budgets.

Residential End-User Segment Drives Demand Due to Comfort Preferences

The residential segment represents the largest end-user base for muslin bedding, with consumers increasingly seeking comfort and aesthetics in their personal spaces. The growth of interior design trends emphasizing minimalist and natural aesthetics has further fueled demand for muslin bedding. The commercial segment, including hotels and luxury accommodations, is also experiencing significant growth as establishments strive to enhance guest experiences with premium bedding options. The use of muslin bedding in commercial spaces adds a touch of sophistication while ensuring comfort.

Online Retailers Lead Distribution Channels Due to Convenience

Online retailers dominate the distribution channel segment, providing consumers with the convenience of browsing, comparing, and purchasing muslin bedding from the comfort of their homes. The rise of e-commerce platforms has enabled brands to reach a global audience, offering detailed product descriptions, customer reviews, and promotional deals that drive sales. Offline stores, including specialty bedding shops and departmental stores, continue to play a vital role, particularly for consumers who prefer tactile experiences before making a purchase. Specialty stores often provide customized offerings and expert advice, catering to niche markets.

North America and Europe Drive Market Growth Due to High Demand for Premium Bedding

North America and Europe are key regions in the muslin bedding market, driven by high consumer awareness and a preference for premium bedding products. In these regions, the trend towards sustainable and organic materials further boosts the adoption of muslin bedding. The Asia-Pacific region is also emerging as a significant market, fueled by a growing middle class, increasing disposable income, and rising awareness of high-quality bedding products. Manufacturers in this region are capitalizing on cost-effective production to cater to both local and international markets.

Competitive Landscape

The muslin bedding market features several prominent players, including Aden + Anais, Little Unicorn, Pottery Barn Kids, Crane & Canopy, and Parachute Home. These companies focus on product quality, design innovation, and sustainability to maintain a competitive edge.

Brands are increasingly leveraging social media and influencer marketing to reach wider audiences. Additionally, collaborations with interior designers and home decor brands help expand product visibility. Offering eco-friendly certifications and emphasizing sustainable practices are becoming key strategies to attract environmentally conscious consumers.

Recent Developments:

- In December 2024, Aden + Anais launched a new collection of organic muslin bedding for infants and toddlers.

- In November 2024, Little Unicorn introduced eco-friendly packaging for its bedding products to enhance sustainability.

- In October 2024, SwaddleDesigns expanded its muslin bedding line to include vibrant and customizable patterns.

- In September 2024, Burt's Bees Baby collaborated with retail chains to distribute its muslin crib bedding range.

- In August 2024, Ely’s & Co. announced a partnership with online marketplaces to expand global reach.

List of Leading Companies:

- Aden + Anais

- Little Unicorn

- Burt's Bees Baby

- Loulou Lollipop

- Tilly & Goose

- Cambrass

- SwaddleDesigns

- Hudson Baby

- Ely’s & Co.

- Mushie

- Trend Lab

- Snuggle Hunny Kids

- Morphy Richards Textiles

- Mama Designs

- Pehr Designs

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 0.6 billion |

|

Forecasted Value (2030) |

USD 1.1 billion |

|

CAGR (2025 – 2030) |

9.4% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Muslin Bedding Market By Product Type (Sheets, Pillowcases, Duvet Covers, Blankets, Crib Bedding), By Material Type (100% Cotton Muslin, Blended Muslin, Organic Muslin), By End-User (Residential, Commercial (e.g., Hotels)), By Distribution Channel (Online Retailers, Offline Stores, Specialty Bedding Stores) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Aden + Anais, Little Unicorn, Burt's Bees Baby, Loulou Lollipop, Tilly & Goose, Cambrass, SwaddleDesigns, Hudson Baby, Ely’s & Co., Mushie, Trend Lab, Snuggle Hunny Kids, Morphy Richards Textiles, Mama Designs, Pehr Designs |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Muslin Bedding Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Sheets |

|

4.2. Pillowcases |

|

4.3. Duvet Covers |

|

4.4. Blankets |

|

4.5. Crib Bedding |

|

4.6. Others |

|

5. Muslin Bedding Market, by Material Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. 100% Cotton Muslin |

|

5.2. Blended Muslin |

|

5.3. Organic Muslin |

|

5.4. Others |

|

6. Muslin Bedding Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Residential |

|

6.2. Commercial (e.g., Hotels) |

|

6.3. Others |

|

7. Muslin Bedding Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Online Retailers |

|

7.2. Offline Stores |

|

7.3. Specialty Bedding Stores |

|

7.4. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Muslin Bedding Market, by Product Type |

|

8.2.7. North America Muslin Bedding Market, by Material Type |

|

8.2.8. North America Muslin Bedding Market, by End-User |

|

8.2.9. North America Muslin Bedding Market, by Distribution Channel |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Muslin Bedding Market, by Product Type |

|

8.2.10.1.2. US Muslin Bedding Market, by Material Type |

|

8.2.10.1.3. US Muslin Bedding Market, by End-User |

|

8.2.10.1.4. US Muslin Bedding Market, by Distribution Channel |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Aden + Anais |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Little Unicorn |

|

10.3. Burt's Bees Baby |

|

10.4. Loulou Lollipop |

|

10.5. Tilly & Goose |

|

10.6. Cambrass |

|

10.7. SwaddleDesigns |

|

10.8. Hudson Baby |

|

10.9. Ely’s & Co. |

|

10.10. Mushie |

|

10.11. Trend Lab |

|

10.12. Snuggle Hunny Kids |

|

10.13. Morphy Richards Textiles |

|

10.14. Mama Designs |

|

10.15. Pehr Designs |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Muslin Bedding Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Muslin Bedding Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Muslin Bedding Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA