As per Intent Market Research, the Mushroom Market was valued at USD 50.6 billion in 2024-e and will surpass USD 72.9 billion by 2030; growing at a CAGR of 6.3% during 2025 - 2030.

The mushroom market is experiencing robust growth, driven by increasing consumer demand for healthy, sustainable, and versatile food options. Mushrooms are valued for their rich nutritional profile, including vitamins, minerals, antioxidants, and low-calorie content, making them a popular choice in the food and beverage industry. Furthermore, the growing interest in plant-based diets has bolstered the demand for mushrooms as a meat substitute. In addition to their culinary applications, mushrooms are gaining traction in the pharmaceutical and cosmetics industries due to their therapeutic properties and bioactive compounds, including polysaccharides and beta-glucans.

The market is further supported by advancements in cultivation technologies, which enhance yield and quality, and the rising popularity of organic and specialty mushrooms. Distribution channels are also expanding, with online platforms playing a significant role in meeting the demand for fresh and processed mushrooms. The increasing focus on sustainability and environmentally friendly farming practices aligns well with the mushroom market's growth trajectory.

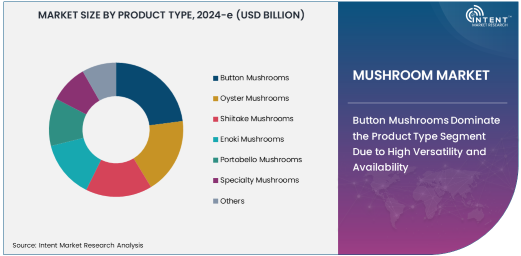

Button Mushrooms Dominate the Product Type Segment Due to High Versatility and Availability

Button mushrooms hold the largest share in the product type segment due to their widespread availability, affordability, and versatile culinary applications. These mushrooms are a staple in global cuisines and are used in various dishes, ranging from salads and soups to pasta and pizzas. Their mild flavor and smooth texture make them suitable for diverse cooking styles and food processing methods.

The ease of cultivation and high yield of button mushrooms contribute to their dominance in the market. Moreover, their extended shelf life, especially in processed forms such as canned or frozen, enhances their appeal among consumers and food manufacturers. The rising trend of healthy eating and the inclusion of button mushrooms in ready-to-eat meals further bolster their demand.

Fresh Form Segment Leads Due to Rising Consumer Preference for Natural and Unprocessed Foods

The fresh form segment leads the mushroom market, driven by consumer preferences for natural and minimally processed foods. Fresh mushrooms are highly favored for their superior taste, texture, and nutritional value. The growing demand for farm-to-table produce and the increasing availability of fresh mushrooms in supermarkets, farmers' markets, and specialty stores further support this segment's growth.

Advancements in cold chain logistics and packaging technologies ensure that fresh mushrooms reach consumers with minimal spoilage, thereby expanding their market presence. Additionally, the rising popularity of organic fresh mushrooms, cultivated without synthetic pesticides or fertilizers, appeals to health-conscious and environmentally aware consumers.

Food and Beverage Application Dominates Due to High Demand for Culinary Use

The food and beverage industry is the largest application segment for mushrooms, accounting for a significant share of the market. Mushrooms are widely used in global cuisines as a key ingredient in soups, sauces, stir-fries, and main dishes. Their unique umami flavor and ability to absorb other flavors make them a preferred choice for enhancing the taste of various dishes.

The growing popularity of plant-based diets and meat alternatives has increased the use of mushrooms in vegan and vegetarian recipes, including mushroom burgers, patties, and jerky. Additionally, the functional benefits of mushrooms, such as boosting immunity and improving gut health, are driving their incorporation into health-focused food products. This trend is further complemented by the development of innovative mushroom-based beverages, such as mushroom coffees and teas.

Supermarkets/Hypermarkets Lead Distribution Channel Segment Due to Accessibility and Variety

Supermarkets and hypermarkets are the leading distribution channel for mushrooms, offering consumers accessibility, variety, and competitive pricing. These retail outlets provide a wide range of fresh and processed mushroom products, catering to diverse consumer needs. Their extensive reach and convenient locations make them the preferred choice for mushroom purchases.

The expansion of modern retail chains and the integration of in-store technology, such as self-checkouts and personalized promotions, further enhance the shopping experience for mushroom buyers. Additionally, supermarkets and hypermarkets often feature organic and specialty mushroom varieties, appealing to health-conscious and gourmet consumers.

North America Leads Due to High Consumption and Advanced Cultivation Practices

North America is the largest regional market for mushrooms, driven by high consumption rates, advanced cultivation practices, and the increasing popularity of plant-based diets. The United States, in particular, dominates the region due to its established mushroom farming industry and strong distribution networks. The rising demand for organic and specialty mushrooms, coupled with the growing awareness of their health benefits, contributes to the market's growth in this region.

The presence of key market players and research initiatives focused on improving mushroom cultivation and processing technologies further strengthen North America's position in the global mushroom market. Additionally, the region's robust retail infrastructure, including supermarkets, hypermarkets, and online platforms, ensures wide availability of mushroom products to consumers.

Competitive Landscape and Key Players

The mushroom market is competitive, with numerous players focusing on expanding their product portfolios and distribution channels. Key companies include Monterey Mushrooms Inc., Ostrom Mushroom Farms, Costa Group, South Mill Champs, and Greenyard NV. These players are investing in research and development to introduce innovative mushroom-based products and enhance cultivation technologies.

Collaborations and acquisitions are common strategies employed by market leaders to strengthen their market presence and expand their geographic reach. The growing emphasis on sustainability and organic production methods also influences competitive strategies, with companies prioritizing eco-friendly practices to appeal to environmentally conscious consumers. As the market continues to grow, innovation and quality will remain critical factors in maintaining a competitive edge.

Recent Developments:

- In December 2024, Monaghan Mushrooms introduced a new line of organic specialty mushrooms for European markets.

- In November 2024, Monterey Mushrooms expanded its cultivation facility in Texas to increase production capacity.

- In October 2024, Bonduelle Group launched a range of frozen mushroom blends targeting health-conscious consumers.

- In September 2024, Costa Group announced a collaboration to develop innovative mushroom farming technologies.

- In August 2024, Greenyard NV acquired a leading mushroom processing company to expand its processed mushroom portfolio.

List of Leading Companies:

- Monterey Mushrooms, Inc.

- Okechamp S.A.

- Monaghan Mushrooms

- South Mill Champs

- Giorgio Fresh Co.

- Greenyard NV

- Costa Group

- Bonduelle Group

- Modern Mushroom Farms

- The Mushroom Company

- Hughes Mushroom

- Weikfield Foods Pvt. Ltd.

- Drinkwater’s Mushrooms Ltd.

- Shanghai Finc Bio-Tech Inc.

- Agro Dutch Industries Ltd.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 50.6 billion |

|

Forecasted Value (2030) |

USD 72.9 billion |

|

CAGR (2025 – 2030) |

6.3% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Mushroom Market By Product Type (Button Mushrooms, Oyster Mushrooms, Shiitake Mushrooms, Enoki Mushrooms, Portobello Mushrooms, Specialty Mushrooms), By Form (Fresh, Processed), By Application (Food and Beverages, Pharmaceutical, Cosmetics), By Distribution Channel (Supermarkets/Hypermarkets, Online Stores, Convenience Stores, Specialty Stores) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Monterey Mushrooms, Inc., Okechamp S.A., Monaghan Mushrooms, South Mill Champs, Giorgio Fresh Co., Greenyard NV, Costa Group, Bonduelle Group, Modern Mushroom Farms, The Mushroom Company, Hughes Mushroom, Weikfield Foods Pvt. Ltd., Drinkwater’s Mushrooms Ltd., Shanghai Finc Bio-Tech Inc., Agro Dutch Industries Ltd. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Mushroom Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Button Mushrooms |

|

4.2. Oyster Mushrooms |

|

4.3. Shiitake Mushrooms |

|

4.4. Enoki Mushrooms |

|

4.5. Portobello Mushrooms |

|

4.6. Specialty Mushrooms |

|

4.7. Others |

|

5. Mushroom Market, by Form (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Fresh |

|

5.2. Processed |

|

5.2.1. Canned |

|

5.2.2. Frozen |

|

5.2.3. Dried |

|

5.2.4. Others |

|

6. Mushroom Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Food and Beverages |

|

6.2. Pharmaceutical |

|

6.3. Cosmetics |

|

6.4. Others |

|

7. Mushroom Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Supermarkets/Hypermarkets |

|

7.2. Online Stores |

|

7.3. Convenience Stores |

|

7.4. Specialty Stores |

|

7.5. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Mushroom Market, by Product Type |

|

8.2.7. North America Mushroom Market, by Form |

|

8.2.8. North America Mushroom Market, by Application |

|

8.2.9. North America Mushroom Market, by Distribution Channel |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Mushroom Market, by Product Type |

|

8.2.10.1.2. US Mushroom Market, by Form |

|

8.2.10.1.3. US Mushroom Market, by Application |

|

8.2.10.1.4. US Mushroom Market, by Distribution Channel |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Monterey Mushrooms, Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Okechamp S.A. |

|

10.3. Monaghan Mushrooms |

|

10.4. South Mill Champs |

|

10.5. Giorgio Fresh Co. |

|

10.6. Greenyard NV |

|

10.7. Costa Group |

|

10.8. Bonduelle Group |

|

10.9. Modern Mushroom Farms |

|

10.10. The Mushroom Company |

|

10.11. Hughes Mushroom |

|

10.12. Weikfield Foods Pvt. Ltd. |

|

10.13. Drinkwater’s Mushrooms Ltd. |

|

10.14. Shanghai Finc Bio-Tech Inc. |

|

10.15. Agro Dutch Industries Ltd. |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Mushroom Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Mushroom Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Mushroom Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA