As per Intent Market Research, the Municipal Sludge Dewatering Equipment Market was valued at USD 1.2 billion in 2024-e and will surpass USD 1.9 billion by 2030; growing at a CAGR of 7.3% during 2025 - 2030.

The municipal sludge dewatering equipment market plays a crucial role in modern wastewater treatment processes, particularly for the treatment of municipal sewage and industrial wastewater. These systems are designed to reduce the volume of sludge generated during the treatment of wastewater, improving efficiency in disposal and management. With growing concerns around water quality, environmental regulations, and waste management, the demand for efficient dewatering technologies has seen an upward trend. This has been further accelerated by the increasing need for municipalities and wastewater treatment plants to adhere to stringent environmental standards.

The market is driven by the rise in urbanization, which leads to higher volumes of wastewater generation, necessitating more advanced and efficient dewatering systems. Moreover, with the increasing emphasis on sustainability and the reuse of water, the treatment and disposal of sludge are becoming critical elements of environmental management strategies. Technological advancements, such as automation and energy-efficient equipment, are also contributing to the growth of the market, enabling systems to operate with reduced operational costs and increased effectiveness.

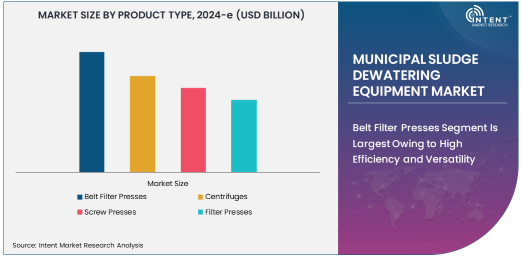

Belt Filter Presses Segment Is Largest Owing to High Efficiency and Versatility

Belt filter presses are the largest segment in the municipal sludge dewatering equipment market, owing to their high efficiency, versatility, and reliability. These systems are widely used in both municipal and industrial wastewater treatment plants to remove excess water from sludge, resulting in a solid that is easier to handle and dispose of. Belt filter presses are known for their ability to handle large volumes of sludge, making them ideal for high-capacity applications.

The demand for belt filter presses is particularly high due to their versatility, as they can be used in various industries beyond municipal wastewater treatment, including food and beverage, paper and pulp, and mining. These systems also offer ease of operation, low maintenance, and the ability to produce a high-quality dewatered cake with minimal water content. As the global focus shifts toward more sustainable and efficient waste treatment processes, the belt filter press continues to dominate the municipal sludge dewatering equipment market.

Sludge Treatment Application Is Fastest Growing Owing to Increasing Wastewater Management Needs

The sludge treatment application is the fastest growing in the municipal sludge dewatering equipment market, driven by the increasing need for effective wastewater and sludge management solutions. As urban populations grow, so does the volume of wastewater and sludge generated, making efficient treatment and disposal critical. Sludge treatment involves the removal of excess water, reducing the volume of sludge and making it easier to transport, handle, and dispose of in compliance with environmental regulations.

This growth is largely attributed to the rising awareness of environmental sustainability and the need for advanced treatment methods that minimize the ecological impact of wastewater sludge. Sludge treatment equipment is essential for reducing harmful pollutants, recovering useful resources from the sludge, and ensuring that treated sludge can be safely disposed of or reused. As industries and municipalities continue to invest in more efficient wastewater management systems, the demand for advanced sludge treatment technologies is expected to grow rapidly, further boosting the market.

Municipalities End-User Is Largest Owing to Growing Urbanization

Municipalities represent the largest end-user segment in the municipal sludge dewatering equipment market, driven by the increasing demand for wastewater treatment solutions in urban areas. Rapid urbanization, population growth, and rising concerns about water quality are pushing municipalities to invest in advanced technologies for managing wastewater and sludge more efficiently. As urban centers expand, the volume of wastewater generated increases, necessitating more effective dewatering and treatment equipment.

Municipalities face growing pressure to meet stringent environmental regulations and ensure the safe disposal of wastewater and sludge. Consequently, the adoption of dewatering equipment in municipal wastewater treatment plants has become essential. Furthermore, municipalities are under constant pressure to implement sustainable practices, making the efficient treatment of sludge even more critical. As a result, this segment is expected to maintain its dominance in the market, with ongoing investments in infrastructure and technology.

North America Is Largest Region Owing to Advanced Infrastructure and Regulatory Standards

North America is the largest region in the municipal sludge dewatering equipment market, owing to its advanced infrastructure, stringent environmental regulations, and high adoption of innovative wastewater treatment technologies. The region, particularly the United States and Canada, has a well-established network of municipalities and wastewater treatment plants that require reliable and efficient dewatering systems. The focus on sustainability and compliance with environmental laws further fuels the demand for advanced dewatering equipment.

The presence of major players in the region, along with substantial investments in wastewater infrastructure, supports the growth of the municipal sludge dewatering equipment market in North America. Furthermore, the increasing emphasis on reducing the environmental impact of wastewater treatment processes, coupled with the push for water reuse and resource recovery, positions North America as a key market for municipal sludge dewatering solutions. As the region continues to invest in modernizing its wastewater treatment facilities, North America is expected to remain the dominant market for municipal sludge dewatering equipment.

Leading Companies and Competitive Landscape

The municipal sludge dewatering equipment market is highly competitive, with several key players leading the industry through innovation, product development, and strategic partnerships. Prominent companies in the market include Veolia Environnement, Alfa Laval, Dewaco, WesTech Engineering, and Evoqua Water Technologies. These companies offer a variety of dewatering solutions, including belt filter presses, centrifuges, screw presses, and filter presses, catering to the diverse needs of municipalities, wastewater treatment plants, and industrial users.

The competitive landscape is characterized by a focus on technological advancements such as automation, energy-efficient systems, and improved sludge processing capabilities. Companies are also increasingly providing integrated solutions that combine dewatering equipment with water treatment systems for a more comprehensive approach to wastewater management. The growing demand for sustainable solutions and regulatory compliance is driving the competition, with players striving to enhance product performance and expand their market reach through strategic acquisitions and partnerships. As the market continues to evolve, companies will focus on developing cost-effective, high-performance dewatering technologies to maintain a competitive edge.

Recent Developments:

- In December 2024, Alfa Laval announced the release of a new, energy-efficient screw press for sludge dewatering, aimed at municipal wastewater treatment plants.

- In November 2024, Andritz AG launched a fully automated belt filter press system that significantly reduces energy consumption in sludge dewatering applications.

- In October 2024, Xylem Inc. introduced a new centrifugal dewatering system designed to handle high volumes of municipal sludge in urban treatment facilities.

- In September 2024, Veolia North America expanded its dewatering equipment portfolio with a new hybrid centrifuge system that enhances sludge separation efficiency.

- In August 2024, SPX FLOW unveiled an advanced sludge dewatering unit that reduces operational costs by up to 30% for industrial wastewater treatment applications.

List of Leading Companies:

- Alfa Laval

- Andritz AG

- Dewaco

- FLSmidth

- GEA Group

- Xylem Inc.

- Veolia North America

- Siemens AG

- Hubbell Inc.

- Landia A/S

- SPX FLOW

- JX Nippon Mining & Metals

- WAMGROUP

- Metso Outotec

- Graver Technologies

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.2 billion |

|

Forecasted Value (2030) |

USD 1.9 billion |

|

CAGR (2025 – 2030) |

7.3% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Municipal Sludge Dewatering Equipment Market By Product Type (Belt Filter Presses, Centrifuges, Screw Presses, Filter Presses), By End-User (Municipalities, Wastewater Treatment Plants, Industrial Wastewater Treatment), By Application (Water Treatment, Sludge Treatment, Environmental Management) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Alfa Laval, Andritz AG, Dewaco, FLSmidth, GEA Group, Xylem Inc., Veolia North America, Siemens AG, Hubbell Inc., Landia A/S, SPX FLOW, JX Nippon Mining & Metals, WAMGROUP, Metso Outotec, Graver Technologies |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Municipal Sludge Dewatering Equipment Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Belt Filter Presses |

|

4.2. Centrifuges |

|

4.3. Screw Presses |

|

4.4. Filter Presses |

|

5. Municipal Sludge Dewatering Equipment Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Municipalities |

|

5.2. Wastewater Treatment Plants |

|

5.3. Industrial Wastewater Treatment |

|

6. Municipal Sludge Dewatering Equipment Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Water Treatment |

|

6.2. Sludge Treatment |

|

6.3. Environmental Management |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Municipal Sludge Dewatering Equipment Market, by Product Type |

|

7.2.7. North America Municipal Sludge Dewatering Equipment Market, by End-User |

|

7.2.8. North America Municipal Sludge Dewatering Equipment Market, by Application |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Municipal Sludge Dewatering Equipment Market, by Product Type |

|

7.2.9.1.2. US Municipal Sludge Dewatering Equipment Market, by End-User |

|

7.2.9.1.3. US Municipal Sludge Dewatering Equipment Market, by Application |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Alfa Laval |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Andritz AG |

|

9.3. Dewaco |

|

9.4. FLSmidth |

|

9.5. GEA Group |

|

9.6. Xylem Inc. |

|

9.7. Veolia North America |

|

9.8. Siemens AG |

|

9.9. Hubbell Inc. |

|

9.10. Landia A/S |

|

9.11. SPX FLOW |

|

9.12. JX Nippon Mining & Metals |

|

9.13. WAMGROUP |

|

9.14. Metso Outotec |

|

9.15. Graver Technologies |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Municipal Sludge Dewatering Equipment Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Municipal Sludge Dewatering Equipment Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Municipal Sludge Dewatering Equipment Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA