As per Intent Market Research, the Multiservice Provisioning Platform Market was valued at USD 2.1 billion in 2024-e and will surpass USD 3.5 billion by 2030; growing at a CAGR of 8.4% during 2025 - 2030.

The multiservice provisioning platform (MSP) market is growing as telecommunications and internet service providers look for more integrated and efficient ways to manage their networks and services. These platforms enable the consolidation of multiple services, providing greater flexibility in network management and service delivery. As the demand for bandwidth-intensive services, such as video streaming, cloud computing, and Internet of Things (IoT) applications, increases, MSPs are key to ensuring seamless network performance. These platforms facilitate efficient network management, traffic control, service provisioning, and optimization, which are critical for maintaining the speed and reliability required by modern digital services.

The market is driven by the increasing complexity of networks, which require advanced tools to handle various types of services. Moreover, the rapid expansion of 5G networks, along with the growing demand for high-speed internet and seamless connectivity, has fueled the need for multiservice provisioning platforms. These platforms play a pivotal role in enabling service providers to deliver quality services while managing network resources effectively, thus supporting the growing digital ecosystem.

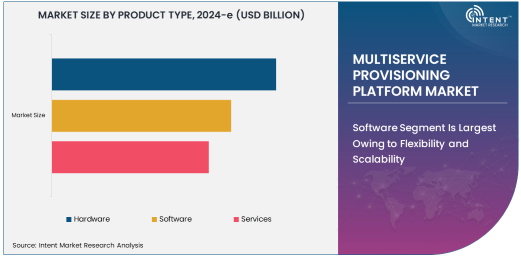

Software Segment Is Largest Owing to Flexibility and Scalability

The software segment is the largest within the multiservice provisioning platform market, owing to its flexibility and scalability in managing multiple services. Software-based solutions provide the necessary tools to control and optimize network traffic, service delivery, and bandwidth allocation, all from a central platform. These solutions are essential for service providers who need to integrate new services, adjust bandwidth in real-time, and manage multiple types of service traffic, such as data, voice, and video, with high efficiency.

Software-based platforms allow service providers to quickly adapt to changing demands, whether they are related to customer usage patterns, regulatory requirements, or the rollout of new services. Additionally, these platforms can be upgraded or scaled easily, enabling service providers to meet evolving customer needs and market conditions. As telecommunications and internet service providers continue to move toward software-centric, cloud-based infrastructures, the demand for multiservice provisioning software will continue to grow, maintaining its status as the largest segment in the market.

Network Management Is Fastest Growing Application Owing to Complexities in Modern Networks

Network management is the fastest growing application within the multiservice provisioning platform market, driven by the increasing complexity of modern networks. With the advent of 5G, the growing number of connected devices, and the surge in data traffic, managing networks efficiently has become more challenging. MSPs offer critical solutions to help telecommunications and internet service providers monitor, control, and optimize network performance in real-time, ensuring that networks are reliable, secure, and capable of handling vast amounts of data.

The growth of network management applications is also fueled by the need for proactive maintenance and the ability to predict and resolve issues before they affect service quality. The rise of network virtualization, software-defined networks (SDN), and network functions virtualization (NFV) further increases the complexity of managing networks, driving the demand for advanced MSP solutions. As these technologies continue to gain momentum, the network management application within the MSP market is expected to experience substantial growth, outpacing other applications.

Telecommunication Service Providers Are Largest End-User Owing to Network Expansion and Service Diversity

Telecommunication service providers are the largest end-user segment in the multiservice provisioning platform market, driven by the ongoing expansion of network infrastructure and the diversity of services they offer. These service providers require sophisticated tools to manage increasingly complex networks, which are expected to support a growing range of services, including traditional voice, broadband internet, and emerging technologies like 5G and IoT. MSPs allow telecom companies to efficiently manage these services, ensuring optimal performance and user experience.

As telecom providers continue to upgrade their infrastructure to handle higher data speeds, lower latency, and more devices, the need for multiservice provisioning platforms will only intensify. Furthermore, these platforms provide telecom companies with the flexibility to introduce new services quickly and manage existing ones with greater efficiency. With the expansion of both consumer and enterprise markets, telecommunication service providers are set to remain the largest end-user segment in the multiservice provisioning platform market.

North America Is Largest Region Owing to Advanced Telecom Infrastructure and Innovation

North America is the largest region in the multiservice provisioning platform market, owing to its advanced telecom infrastructure and the constant innovation taking place within the telecommunications industry. The United States and Canada have some of the most developed telecom networks in the world, with high-speed broadband, extensive 4G and 5G coverage, and a diverse range of services offered by major telecom players. These regions are at the forefront of adopting new technologies, such as 5G, SDN, and NFV, all of which require sophisticated multiservice provisioning platforms for efficient management and optimization.

The region's strong technological innovation, combined with a competitive telecom industry, has accelerated the adoption of multiservice provisioning platforms. As telecom providers in North America continue to upgrade their networks to meet the demands of new services and applications, the region's dominance in the MSP market is expected to continue. North America’s regulatory environment, which encourages the deployment of advanced technologies, further supports the region's position as the largest market for multiservice provisioning platforms.

Leading Companies and Competitive Landscape

The multiservice provisioning platform market is competitive, with several key players leading the charge in technological innovation and market penetration. Prominent companies in the market include Cisco Systems, Juniper Networks, Ericsson, Nokia, Huawei Technologies, and ZTE Corporation. These companies offer a wide range of multiservice provisioning platforms, including hardware, software, and services, catering to the needs of telecommunications and internet service providers worldwide.

The competitive landscape is shaped by continuous advancements in technology, with companies focusing on developing software-driven solutions, integration capabilities, and automation tools that enhance network management and service provisioning. Collaborations, mergers, and acquisitions are common strategies to expand product portfolios and market reach. The increasing demand for 5G and the expansion of IoT networks are expected to provide opportunities for innovation and growth in the multiservice provisioning platform market, making it an exciting and evolving space for key industry players.

Recent Developments:

- In December 2024, Cisco Systems launched a new multiservice provisioning platform tailored for 5G networks, offering improved bandwidth management and service automation.

- In November 2024, Huawei announced the deployment of its latest provisioning platform for optical networks, enhancing service delivery in high-demand areas.

- In October 2024, Juniper Networks unveiled a new network automation solution as part of its multiservice provisioning platform, improving operational efficiency for ISPs.

- In September 2024, ADVA Optical Networking introduced a next-generation multiservice provisioning platform designed to optimize network performance for managed service providers.

- In August 2024, Nokia Corporation launched an advanced SDN-based multiservice provisioning platform aimed at reducing operational costs for telecommunication service providers.

List of Leading Companies:

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- Juniper Networks, Inc.

- Nokia Corporation

- Ericsson

- ZTE Corporation

- Ciena Corporation

- ADVA Optical Networking

- Infinera Corporation

- Fujitsu Ltd.

- Mitsubishi Electric Corporation

- Versa Networks

- Arista Networks

- Extreme Networks

- Tellabs

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 2.1 billion |

|

Forecasted Value (2030) |

USD 3.5 billion |

|

CAGR (2025 – 2030) |

8.4% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Multiservice Provisioning Platform Market By Product Type (Hardware, Software, Services), By Application (Network Management, Bandwidth Management, Service Provisioning), By End-User (Telecommunication Service Providers, Internet Service Providers (ISPs), Managed Service Providers (MSPs)) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Cisco Systems, Inc., Huawei Technologies Co., Ltd., Juniper Networks, Inc., Nokia Corporation, Ericsson, ZTE Corporation, Ciena Corporation, ADVA Optical Networking, Infinera Corporation, Fujitsu Ltd., Mitsubishi Electric Corporation, Versa Networks, Arista Networks, Extreme Networks, Tellabs |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Multiservice Provisioning Platform Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Hardware |

|

4.2. Software |

|

4.3. Services |

|

5. Multiservice Provisioning Platform Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Network Management |

|

5.2. Bandwidth Management |

|

5.3. Service Provisioning |

|

5.4. Others |

|

6. Multiservice Provisioning Platform Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Telecommunication Service Providers |

|

6.2. Internet Service Providers (ISPs) |

|

6.3. Managed Service Providers (MSPs) |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Multiservice Provisioning Platform Market, by Product Type |

|

7.2.7. North America Multiservice Provisioning Platform Market, by Application |

|

7.2.8. North America Multiservice Provisioning Platform Market, by End-User |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Multiservice Provisioning Platform Market, by Product Type |

|

7.2.9.1.2. US Multiservice Provisioning Platform Market, by Application |

|

7.2.9.1.3. US Multiservice Provisioning Platform Market, by End-User |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Cisco Systems, Inc. |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Huawei Technologies Co., Ltd. |

|

9.3. Juniper Networks, Inc. |

|

9.4. Nokia Corporation |

|

9.5. Ericsson |

|

9.6. ZTE Corporation |

|

9.7. Ciena Corporation |

|

9.8. ADVA Optical Networking |

|

9.9. Infinera Corporation |

|

9.10. Fujitsu Ltd. |

|

9.11. Mitsubishi Electric Corporation |

|

9.12. Versa Networks |

|

9.13. Arista Networks |

|

9.14. Extreme Networks |

|

9.15. Tellabs |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Multiservice Provisioning Platform Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Multiservice Provisioning Platform Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Multiservice Provisioning Platform Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA