As per Intent Market Research, the Multiple Sclerosis Therapeutic Market was valued at USD 26.3 billion in 2024-e and will surpass USD 40.3 billion by 2030; growing at a CAGR of 7.3% during 2025 - 2030.

The multiple sclerosis (MS) therapeutic market is witnessing significant growth, driven by the increasing prevalence of multiple sclerosis, advancements in drug development, and the rising demand for more effective and personalized treatment options. MS is a chronic autoimmune disease that affects the central nervous system, leading to a wide range of symptoms including muscle weakness, fatigue, and cognitive impairment. The global MS therapeutic market has seen an uptick in research and development efforts aimed at finding more effective treatments, with a strong focus on disease-modifying therapies (DMTs) that help to reduce disease progression and manage relapses. In addition to traditional treatments, new drug formulations and advancements in immunotherapy are also contributing to market growth.

The MS therapeutic market is further propelled by the increasing awareness of the disease, improving diagnostic technologies, and better healthcare infrastructure, particularly in developed markets. With the advent of oral therapies and the growing use of monoclonal antibodies, patients now have a wider range of options that cater to their specific needs. As the global population ages, the demand for MS treatments is expected to rise, driving growth across the pharmaceutical industry and providing numerous opportunities for companies focusing on innovative therapies.

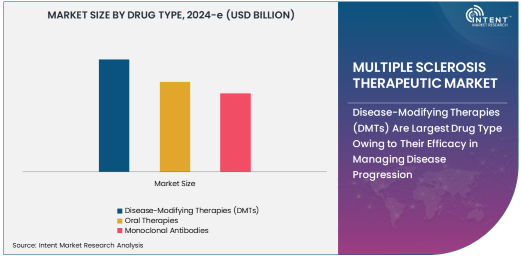

Disease-Modifying Therapies (DMTs) Are Largest Drug Type Owing to Their Efficacy in Managing Disease Progression

Disease-modifying therapies (DMTs) are the largest drug type in the MS therapeutic market, owing to their proven efficacy in managing disease progression and reducing relapses. DMTs work by targeting specific components of the immune system to reduce inflammation and prevent the immune system from attacking the central nervous system, which is a hallmark of MS. These therapies are considered the gold standard for managing MS and are used for various types of the disease, including relapsing-remitting multiple sclerosis (RRMS) and secondary progressive multiple sclerosis (SPMS). DMTs include a wide range of drugs, including injectable medications, oral therapies, and monoclonal antibodies, which help to modify the course of the disease, slow progression, and prevent future relapses.

The demand for DMTs is particularly high in developed markets, where healthcare systems are advanced, and patients have greater access to a variety of treatment options. The success of DMTs in reducing disability progression and improving quality of life has solidified their place as the dominant drug type in the MS therapeutic market. As pharmaceutical companies continue to innovate and bring new DMTs to market, this segment is expected to remain the largest and continue driving growth in the MS therapeutic landscape.

Oral Therapies Are Fastest Growing Drug Type Owing to Patient Convenience and Improved Efficacy

Oral therapies are the fastest-growing drug type in the MS therapeutic market, driven by the convenience they offer to patients and their improved efficacy compared to traditional injectable treatments. Oral MS medications provide a more convenient alternative for patients who previously had to rely on injections or intravenous (IV) treatments. Oral therapies have significantly improved patient adherence to treatment plans, as they are easier to administer and can be taken at home, eliminating the need for frequent hospital visits or self-injection.

The growing popularity of oral therapies is also attributed to the development of drugs that offer enhanced disease-modifying effects and a more favorable side-effect profile. Drugs like fingolimod and dimethyl fumarate have demonstrated significant success in clinical trials, and as new oral therapies enter the market, this segment is expected to see continued growth. Patients' preference for oral medications, combined with advancements in treatment efficacy, makes oral therapies the fastest-growing drug type in the MS therapeutic market.

Relapsing-Remitting Multiple Sclerosis (RRMS) Is Largest Indication Owing to High Prevalence

Relapsing-remitting multiple sclerosis (RRMS) is the largest indication in the MS therapeutic market, owing to its higher prevalence among individuals diagnosed with MS. RRMS is characterized by clearly defined periods of relapses followed by partial or complete recovery. This form of MS accounts for approximately 85% of all MS cases, making it the most common subtype of the disease. The high prevalence of RRMS has led to significant advancements in therapeutic options, particularly disease-modifying therapies (DMTs), which are designed to manage relapses, reduce disease activity, and slow the progression of disability.

The large patient population for RRMS has driven substantial investment in the development of effective treatments. With ongoing advancements in the formulation of both oral and injectable therapies, RRMS remains a primary focus for pharmaceutical companies. As healthcare access improves globally, the number of RRMS patients seeking treatment options is expected to continue rising, ensuring that this indication remains the largest in the MS therapeutic market.

Primary Progressive Multiple Sclerosis (PPMS) Is Fastest Growing Indication Owing to New Targeted Therapies

Primary progressive multiple sclerosis (PPMS) is the fastest-growing indication in the MS therapeutic market, driven by the emergence of new therapies specifically designed to target this more aggressive and progressive form of MS. PPMS is characterized by a gradual worsening of symptoms from the onset, with no distinct relapses or remissions, making it more challenging to treat. However, recent advancements in treatment options, such as ocrelizumab, a monoclonal antibody approved for PPMS, have shown promising results in slowing disease progression and improving quality of life for patients.

As new therapies targeting PPMS are introduced, the market for this indication is expected to grow rapidly. The increasing focus on progressive forms of MS, along with a better understanding of the disease's pathophysiology, is helping to shape the future of PPMS treatment. With continued research and the approval of novel drugs, PPMS is projected to remain the fastest-growing indication in the MS therapeutic market.

Injectable Medications Are Largest Route of Administration Owing to Long-established Use in MS Treatment

Injectable medications are the largest route of administration in the MS therapeutic market, owing to their long-established use and effectiveness in treating various forms of MS. Injectable drugs, such as interferons and glatiramer acetate, have been the cornerstone of MS treatment for decades. These medications work by modulating the immune system to reduce inflammation and prevent attacks on the nervous system. While newer oral therapies have gained popularity, injectable medications remain widely used due to their proven track record in reducing relapse rates and slowing disease progression.

Injectable medications are particularly favored in the treatment of relapsing forms of MS, where regular dosing can help manage relapses and improve long-term outcomes. Despite the rise of oral therapies, injectable treatments continue to play a crucial role in MS management, particularly for patients who may not respond well to oral medications or prefer a treatment that offers sustained release over time. This longstanding use and clinical effectiveness ensure that injectable medications remain the largest route of administration in the market.

Home Care Is Largest End-User Owing to Convenience and Patient Preference

Home care is the largest end-user segment in the MS therapeutic market, driven by the increasing preference for at-home treatment options and the ability to manage symptoms with minimal hospital visits. With the development of self-injectable medications and oral therapies, patients are increasingly able to manage their MS treatment in the comfort of their homes. This shift toward home care is particularly evident in patients with relapsing forms of MS, who can benefit from regular self-administered treatments without the need for frequent hospital or clinic visits.

Home care allows patients to maintain their independence while managing their condition, which is crucial for improving quality of life. Additionally, home care solutions reduce the burden on healthcare systems by decreasing hospital admissions and outpatient visits. The growing adoption of home care options, combined with advances in drug delivery systems and patient monitoring, ensures that this end-user segment remains the largest in the MS therapeutic market.

North America Is Largest Region Owing to Advanced Healthcare Infrastructure and High Adoption of MS Treatments

North America is the largest region in the MS therapeutic market, owing to its advanced healthcare infrastructure, high levels of healthcare spending, and widespread adoption of MS treatments. The United States, in particular, is the largest market for MS therapeutics, driven by a high prevalence of MS and strong healthcare policies that support the availability of cutting-edge treatments. The region is home to numerous pharmaceutical companies that are at the forefront of developing new drugs for MS, as well as a robust network of hospitals and clinics that provide specialized care for MS patients.

Furthermore, the high rate of insurance coverage and access to healthcare services in North America ensures that a large proportion of MS patients receive appropriate care and treatment. With a well-established market for MS therapies and ongoing advancements in treatment options, North America is expected to maintain its leadership in the global MS therapeutic market.

Leading Companies and Competitive Landscape

The MS therapeutic market is highly competitive, with several pharmaceutical companies leading the way in developing and commercializing new treatments. Key players in the market include Biogen Inc., Novartis International AG, Sanofi S.A., Merck & Co., and Bristol-Myers Squibb Company. These companies are focused on developing innovative therapies, including disease-modifying treatments, oral therapies, and monoclonal antibodies, to address the evolving needs of MS patients.

The competitive landscape is characterized by significant research and development activities, with a focus on expanding treatment options for progressive forms of MS and improving patient outcomes. Collaborations between pharmaceutical companies and healthcare providers are also common, allowing for the development of tailored treatment plans that offer the best results for MS patients. As new drugs enter the market and treatment options expand, the competition in the MS therapeutic market is expected to intensify, with companies aiming to capture market share through differentiated and more effective therapies.

Recent Developments:

- In December 2024, Roche launched a new version of Ocrelizumab aimed at improving patient adherence and reducing side effects in MS treatment.

- In November 2024, Biogen Idec received FDA approval for a new oral treatment for relapsing-remitting multiple sclerosis, promising fewer side effects.

- In October 2024, Novartis expanded its MS portfolio with the introduction of a new injectable medication for managing secondary progressive MS.

- In September 2024, Teva Pharmaceutical Industries Ltd. announced a partnership with a biotech firm to develop a new drug targeting progressive MS.

- In August 2024, Merck & Co. completed a clinical trial for its latest MS treatment, showing promising results in reducing disease progression.

List of Leading Companies:

- Roche

- Biogen Idec

- Novartis

- Merck & Co.

- Sanofi

- Teva Pharmaceutical Industries Ltd.

- Bayer

- EMD Serono

- Mylan N.V.

- Celgene Corporation

- AbbVie Inc.

- Genzyme (A Sanofi Company)

- Janssen Biotech, Inc.

- UCB S.A.

- GlaxoSmithKline (GSK)

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 26.3 billion |

|

Forecasted Value (2030) |

USD 40.3 billion |

|

CAGR (2025 – 2030) |

7.3% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Multiple Sclerosis Therapeutic Market By Drug Type (Disease-Modifying Therapies (DMTs), Oral Therapies, Monoclonal Antibodies), By Indication (Relapsing-Remitting Multiple Sclerosis, Primary Progressive Multiple Sclerosis, Secondary Progressive Multiple Sclerosis), By Route of Administration (Oral, Injectable, Intravenous), By End-User (Hospitals, Clinics, Home Care) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Roche, Biogen Idec, Novartis, Merck & Co., Sanofi, Teva Pharmaceutical Industries Ltd., Bayer, EMD Serono, Mylan N.V., Celgene Corporation, AbbVie Inc., Genzyme (A Sanofi Company), Janssen Biotech, Inc., UCB S.A., GlaxoSmithKline (GSK) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Multiple Sclerosis Therapeutic Market, by Drug Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Disease-Modifying Therapies (DMTs) |

|

4.1.1. Interferons |

|

4.1.2. Glatiramer Acetate |

|

4.1.3. Natalizumab |

|

4.1.4. Dimethyl Fumarate |

|

4.2. Oral Therapies |

|

4.2.1. Teriflunomide |

|

4.2.2. Fingolimod |

|

4.3. Monoclonal Antibodies |

|

4.3.1. Ocrelizumab |

|

4.3.2. Alemtuzumab |

|

5. Multiple Sclerosis Therapeutic Market, by Indication (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Relapsing-Remitting Multiple Sclerosis |

|

5.2. Primary Progressive Multiple Sclerosis |

|

5.3. Secondary Progressive Multiple Sclerosis |

|

6. Multiple Sclerosis Therapeutic Market, by Route of Administration (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Oral |

|

6.2. Injectable |

|

6.3. Intravenous |

|

7. Multiple Sclerosis Therapeutic Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Hospitals |

|

7.2. Clinics |

|

7.3. Home Care |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Multiple Sclerosis Therapeutic Market, by Drug Type |

|

8.2.7. North America Multiple Sclerosis Therapeutic Market, by Indication |

|

8.2.8. North America Multiple Sclerosis Therapeutic Market, by Route of Administration |

|

8.2.9. North America Multiple Sclerosis Therapeutic Market, by End-User |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Multiple Sclerosis Therapeutic Market, by Drug Type |

|

8.2.10.1.2. US Multiple Sclerosis Therapeutic Market, by Indication |

|

8.2.10.1.3. US Multiple Sclerosis Therapeutic Market, by Route of Administration |

|

8.2.10.1.4. US Multiple Sclerosis Therapeutic Market, by End-User |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Roche |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Biogen Idec |

|

10.3. Novartis |

|

10.4. Merck & Co. |

|

10.5. Sanofi |

|

10.6. Teva Pharmaceutical Industries Ltd. |

|

10.7. Bayer |

|

10.8. EMD Serono |

|

10.9. Mylan N.V. |

|

10.10. Celgene Corporation |

|

10.11. AbbVie Inc. |

|

10.12. Genzyme (A Sanofi Company) |

|

10.13. Janssen Biotech, Inc. |

|

10.14. UCB S.A. |

|

10.15. GlaxoSmithKline (GSK) |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Multiple Sclerosis Therapeutic Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Multiple Sclerosis Therapeutic Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Multiple Sclerosis Therapeutic Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA