As per Intent Market Research, the Motorcycle Boot Market was valued at USD 1.1 Billion in 2024-e and will surpass USD 1.9 Billion by 2030; growing at a CAGR of 7.9% during 2025-2030.

The global motorcycle boot market has witnessed significant growth due to the increasing demand for protective and stylish footwear among riders. As the need for safety gear intensifies, motorcycle boots have become a crucial part of a rider’s attire, offering protection against injuries while enhancing comfort. Motorcycle boots are designed to cater to various riding styles, from professional racing to casual commuting, each requiring specialized features. In addition, advancements in materials and design have expanded the range of options available, making them more versatile and comfortable. The market is expected to continue expanding, driven by growing motorcycle adoption worldwide, especially in emerging markets.

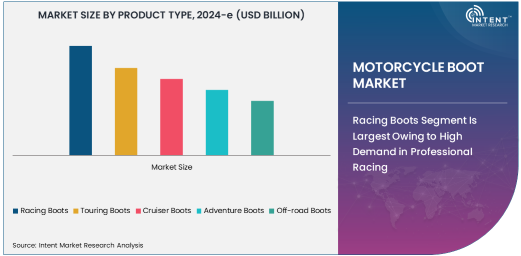

Racing Boots Segment Is Largest Owing to High Demand in Professional Racing

Racing boots represent the largest subsegment in the motorcycle boot market, mainly due to their essential role in professional racing. These boots are engineered for maximum protection and performance, ensuring that riders have the necessary support during high-speed races. Racing boots often come with advanced features such as reinforced soles, ankle protection, and heat-resistant materials to withstand extreme conditions. The growing popularity of motorcycle racing events like MotoGP and Superbike World Championship has further fueled demand for these specialized boots. As the sport continues to thrive globally, racing boots are expected to dominate the product category, especially in regions with a strong racing culture.

Leather Motorcycle Boots Lead in Material Preference

Leather remains the most popular material in motorcycle boots due to its durability, protection, and comfort. Leather boots offer a high level of abrasion resistance, crucial for protecting the rider’s feet and ankles in the event of a crash. These boots also provide superior comfort and flexibility, which is why many riders opt for leather options for both recreational and professional riding. The demand for leather motorcycle boots is further supported by their aesthetic appeal, as they tend to offer a more stylish look compared to synthetic or textile options. Despite the rise of alternative materials, leather's legacy in the motorcycle boot market ensures its dominance in terms of market share.

Professional Racing End-Use Dominates the Market

The professional racing end-use segment holds a significant share of the motorcycle boot market, driven by the essential need for safety in competitive environments. Riders participating in high-speed events require boots that not only offer comfort but also provide robust protection against injuries. These boots are designed with a focus on performance, featuring lightweight yet durable materials, precise fit, and specialized safety mechanisms such as ankle guards and toe sliders. The increasing number of professional racing events and the emphasis on rider safety contribute to the growth of this segment, with racing boots being a necessity for all participants in competitive motorsports.

Online Retail Distribution Channel Expands Rapidly

The online retail segment is experiencing the fastest growth in the motorcycle boot market, driven by the increasing adoption of e-commerce. With the convenience of shopping from home, riders are increasingly purchasing their motorcycle boots online, where they have access to a wide variety of options, prices, and customer reviews. Online retailers such as Amazon, eBay, and specialized motorcycle gear platforms offer both branded and non-branded boots, catering to different consumer preferences. The ability to easily compare products and the availability of discounts further contribute to the growth of this distribution channel. As internet penetration continues to rise, especially in developing countries, the online retail channel is expected to maintain its rapid growth.

Full-Length Motorcycle Boots Are the Most Popular Design

Full-length motorcycle boots dominate the design segment, as they provide the highest level of protection and comfort for riders. These boots offer complete ankle and shin protection, making them the preferred choice for both professional racers and everyday riders. Full-length boots are designed to withstand the rigors of long-distance rides, providing stability and support to prevent fatigue. While short and mid-length boots are more lightweight and convenient for casual riders, full-length boots remain the go-to option for those seeking maximum protection during high-risk activities like racing or off-road adventures. As safety regulations and rider awareness increase, the demand for full-length motorcycle boots is projected to remain strong.

Asia Pacific Region Is the Fastest Growing Market

Asia Pacific is the fastest-growing region in the motorcycle boot market, driven by the rapid increase in motorcycle adoption, particularly in countries like India, China, and Southeast Asian nations. The growing middle class, coupled with an expanding interest in both professional and recreational motorcycling, has led to a surge in demand for protective gear, including motorcycle boots. Additionally, the region is home to several motorcycle manufacturing giants, which further boosts the local market. The rise in motorcycle racing events and the increasing focus on safety standards contribute to the expansion of the motorcycle boot market in this region. As disposable incomes rise and awareness of safety gear improves, the Asia Pacific market is expected to see sustained growth in the coming years.

Leading Companies and Competitive Landscape

The motorcycle boot market is characterized by the presence of several key players that dominate the industry, including Alpinestars, Dainese, ICON Motosports, Sidi Sport Srl, and REV'IT! These companies focus on innovation and product development to meet the increasing demand for high-performance and durable motorcycle boots. Alpinestars, for example, continues to push boundaries with its technology-driven racing boots, while Dainese remains a top choice for both professional and recreational riders due to its stylish yet functional designs. The competitive landscape is shaped by constant technological advancements, such as the introduction of smart features in boots for enhanced protection. Moreover, collaboration with motorcycle manufacturers and sponsorship of racing events allows these companies to maintain their competitive edge in the market. As competition intensifies, companies are also focusing on expanding their product lines to cater to diverse consumer needs, ranging from casual riders to professional racers.

Recent Developments:

- Alpinestars Launches New Off-road Boots: Alpinestars has unveiled a new line of off-road boots, specifically designed for riders who demand flexibility and protection in rough terrains.

- Dainese Expands into Online Retail Market: Dainese has increased its online presence by launching an e-commerce platform dedicated to motorcycle gear, including boots, enhancing global accessibility.

- Sidi Sport Introduces Eco-friendly Boots: Sidi Sport announced the launch of their eco-friendly motorcycle boots made from sustainable and recycled materials, appealing to environmentally-conscious consumers.

- Gaerne Partners with Major Motorcycle Racing Teams: Gaerne has signed exclusive deals with major professional racing teams to provide high-performance boots tailored to elite racers.

- Harley-Davidson Updates Motorcycle Boot Collection: Harley-Davidson released a refreshed line of motorcycle boots, combining style with advanced safety features for both everyday riders and enthusiasts.

List of Leading Companies:

- Alpinestars

- Dainese

- Sidi Sport Srl

- ICON Motosports

- REV'IT!

- Gaerne

- Wolverine Worldwide, Inc.

- O'Neal Racing

- TCX Boots

- Shark Helmets

- Harley-Davidson

- Dr. Martens

- Forma Boots

- Klim

- Biltwell, Inc

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.1 Billion |

|

Forecasted Value (2030) |

USD 1.9 Billion |

|

CAGR (2025 – 2030) |

7.9% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Motorcycle Boot Market By Product Type (Racing Boots, Touring Boots, Cruiser Boots, Adventure Boots, Off-road Boots), By Material (Leather Motorcycle Boots, Synthetic Motorcycle Boots, Textile Motorcycle Boots, Waterproof Motorcycle Boots), By End-Use (Professional Racing, Recreational Riding, Daily Commuting, Off-road Adventures, Touring), By Distribution Channel (Online Retail, Offline Retail, Direct Sales, Specialty Stores), By Design (Short Motorcycle Boots, Mid-length Motorcycle Boots, Full-length Motorcycle Boots) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Alpinestars, Dainese, Sidi Sport Srl, ICON Motosports, REV'IT!, Gaerne, Wolverine Worldwide, Inc., O'Neal Racing, TCX Boots, Shark Helmets, Harley-Davidson, Dr. Martens, Forma Boots, Klim, Biltwell, Inc |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Motorcycle Boot Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Racing Boots |

|

4.2. Touring Boots |

|

4.3. Cruiser Boots |

|

4.4. Adventure Boots |

|

4.5. Off-road Boots |

|

5. Motorcycle Boot Market, by Material (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Leather Motorcycle Boots |

|

5.2. Synthetic Motorcycle Boots |

|

5.3. Textile Motorcycle Boots |

|

5.4. Waterproof Motorcycle Boots |

|

6. Motorcycle Boot Market, by End-Use (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Professional Racing |

|

6.2. Recreational Riding |

|

6.3. Daily Commuting |

|

6.4. Off-road Adventures |

|

6.5. Touring |

|

7. Motorcycle Boot Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Online Retail |

|

7.2. Offline Retail |

|

7.3. Direct Sales |

|

7.4. Specialty Stores |

|

8. Motorcycle Boot Market, by Design (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Short Motorcycle Boots |

|

8.2. Mid-length Motorcycle Boots |

|

8.3. Full-length Motorcycle Boots |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Motorcycle Boot Market, by Product Type |

|

9.2.7. North America Motorcycle Boot Market, by Material |

|

9.2.8. North America Motorcycle Boot Market, by End-Use |

|

9.2.9. North America Motorcycle Boot Market, by Distribution Channel |

|

9.2.10. North America Motorcycle Boot Market, by Design |

|

9.2.11. By Country |

|

9.2.11.1. US |

|

9.2.11.1.1. US Motorcycle Boot Market, by Product Type |

|

9.2.11.1.2. US Motorcycle Boot Market, by Material |

|

9.2.11.1.3. US Motorcycle Boot Market, by End-Use |

|

9.2.11.1.4. US Motorcycle Boot Market, by Distribution Channel |

|

9.2.11.1.5. US Motorcycle Boot Market, by Design |

|

9.2.11.2. Canada |

|

9.2.11.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. Alpinestars |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. Dainese |

|

11.3. Sidi Sport Srl |

|

11.4. ICON Motosports |

|

11.5. REV'IT! |

|

11.6. Gaerne |

|

11.7. Wolverine Worldwide, Inc. |

|

11.8. O'Neal Racing |

|

11.9. TCX Boots |

|

11.10. Shark Helmets |

|

11.11. Harley-Davidson |

|

11.12. Dr. Martens |

|

11.13. Forma Boots |

|

11.14. Klim |

|

11.15. Biltwell, Inc |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Motorcycle Boot Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Motorcycle Boot Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Motorcycle Boot Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA