As per Intent Market Research, the Monofilament Fishing Line Market was valued at USD 1.4 Billion in 2024-e and will surpass USD 2.4 Billion by 2030; growing at a CAGR of 7.9% during 2025-2030.

The global monofilament fishing line market has experienced significant growth over recent years, driven by the increasing popularity of recreational and sport fishing worldwide. Monofilament fishing lines, known for their durability, versatility, and ease of use, remain a cornerstone in the fishing tackle industry. These lines, made from a single strand of material such as nylon or fluorocarbon, cater to various fishing techniques, whether for freshwater, saltwater, or fly fishing. As innovation and new technologies continue to improve the performance of fishing lines, the market is expected to expand, with more consumers seeking high-quality products that provide better performance, strength, and resistance to abrasion.

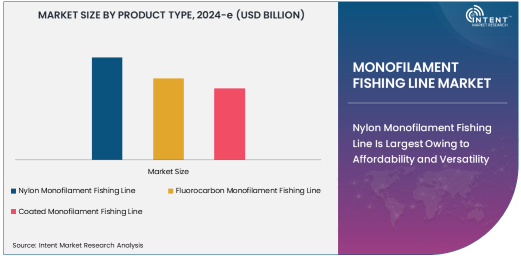

Nylon Monofilament Fishing Line Is Largest Owing to Affordability and Versatility

Among the various product types, nylon monofilament fishing line holds the largest market share due to its excellent balance of affordability and performance. Nylon lines have been the staple choice for anglers for decades, owing to their ease of use and reliability. They are particularly valued for their elasticity, making them ideal for casting over long distances and absorbing shocks during fights with fish. The nylon lines' versatility also contributes significantly to their widespread adoption, as they can be used for both freshwater and saltwater fishing applications. This broad applicability and affordability have solidified nylon’s dominance in the fishing line market.

Furthermore, nylon monofilament lines are available in various diameters and strengths, making them adaptable to different fishing conditions. Whether used in light tackle for small fish or heavier tackle for larger fish, nylon lines cater to diverse fishing techniques, enhancing their popularity across regions. The consistent demand for nylon-based fishing lines in both the recreational and professional fishing sectors continues to support their position as the dominant product type in the market.

Freshwater Fishing Is Largest End-Use Application

The freshwater fishing segment is the largest end-use application for monofilament fishing lines. With an increasing number of individuals participating in recreational fishing activities in lakes, rivers, and ponds, freshwater fishing remains a key driver for the market. Monofilament lines are well-suited for freshwater fishing due to their high flexibility and ease of use in various freshwater environments. As anglers seek dependable, cost-effective lines for these activities, freshwater fishing continues to capture the largest share of the market.

Additionally, freshwater fishing caters to a broad demographic, ranging from casual hobbyists to competitive anglers. The lower cost and greater availability of nylon monofilament lines make them particularly attractive for freshwater fishing, further reinforcing the growth of this segment. As interest in sustainable and outdoor activities continues to rise globally, the freshwater fishing market is expected to grow at a steady pace, driving demand for monofilament lines.

Online Retail Is Fastest Growing Distribution Channel

In terms of distribution channels, online retail is the fastest growing segment within the monofilament fishing line market. The rise of e-commerce platforms and the increasing trend of purchasing fishing equipment online have accelerated this growth. Consumers appreciate the convenience, variety, and often competitive prices offered by online retailers. Online platforms provide detailed product descriptions, customer reviews, and easy comparison tools that enhance the purchasing experience, contributing to the expanding share of online sales in the market.

As digital transformation reshapes consumer behavior, many fishing gear manufacturers and distributors are shifting focus to enhance their online presence. Specialized online fishing tackle shops and large-scale e-commerce platforms like Amazon have made it easier for anglers to access high-quality fishing lines without visiting physical retail locations. This shift toward e-commerce is expected to continue, further solidifying online retail as a leading channel for monofilament fishing line sales.

High Strength Monofilament Fishing Line Is Fastest Growing Strength Category

The high strength monofilament fishing line is experiencing the fastest growth within the strength subsegment. These lines are designed for more demanding fishing environments, including saltwater fishing and situations where larger fish species are targeted. High-strength lines are more resistant to abrasion, ensuring durability in rough conditions, and provide greater control when dealing with large fish. As anglers engage in more extreme fishing activities, such as big game fishing or deep-sea fishing, high-strength lines are becoming increasingly sought after.

The growing interest in competitive and professional fishing, along with advancements in materials and manufacturing technologies, has contributed to the increasing popularity of high-strength monofilament lines. These lines offer exceptional knot strength, elasticity, and overall performance, making them a preferred choice for serious anglers seeking to maximize their fishing experience.

North America Is Largest Region in the Monofilament Fishing Line Market

North America remains the largest region for the monofilament fishing line market, with the United States being the key driver. The region boasts a long-standing tradition of recreational fishing, which has grown steadily with the rise in outdoor activities. The large number of freshwater bodies, combined with a significant presence of coastal areas, makes North America a prime market for both freshwater and saltwater fishing lines. Moreover, the increasing popularity of fishing as a leisure activity among millennials has further spurred the growth in demand for high-quality fishing lines.

In addition to recreational fishing, the professional fishing sector in North America also contributes to the market’s dominance. The region's robust retail infrastructure, along with a high disposable income, enables consumers to invest in premium fishing lines, propelling market growth. As such, North America is expected to maintain its leadership position, supported by a steady consumer base and the growing inclination towards more sustainable and enjoyable outdoor activities.

Leading Companies and Competitive Landscape

The monofilament fishing line market is competitive, with key players focusing on product innovation, strategic partnerships, and geographic expansion to maintain a strong foothold. Shimano Inc., Berkley (a subsidiary of Pure Fishing), and Daiwa Corporation are some of the market leaders that have consistently introduced new product ranges to meet the evolving needs of anglers. These companies invest heavily in research and development to enhance the performance, strength, and longevity of their fishing lines, catering to both casual and professional anglers.

Other companies, such as Mammoth International Inc., Fuji Fishing Tackle, and Yo-Zuri, are also increasing their market presence through product diversification and targeting specific niches, such as fly fishing or saltwater fishing. As the market expands globally, companies are also prioritizing online retail channels to reach a broader audience. The competition remains intense as manufacturers strive to meet the demand for more durable, higher-performing fishing lines in a variety of strengths, diameters, and materials.

Recent Developments:

- Shimano recently introduced its high-strength monofilament fishing line for both freshwater and saltwater applications, aimed at providing superior performance under extreme conditions.

- Berkley, a subsidiary of Pure Fishing, launched a new range of abrasion-resistant monofilament lines for professional anglers looking for long-lasting durability in harsh environments.

- Daiwa announced a strategic collaboration with other fishing gear companies to enhance their product line and market presence, particularly in the high-end fishing equipment segment.

- Yo-Zuri introduced an upgraded version of their monofilament fishing line, focusing on improved knot strength, which is crucial for anglers who require reliability under pressure.

- Mammoth International has successfully acquired a fishing line manufacturer to expand its product portfolio and enhance its production capacity for global distribution

List of Leading Companies:

- Shimano Inc.

- Sufix (a subsidiary of Rapala VMC)

- Berkley (A subsidiary of Pure Fishing)

- Mammoth International Inc.

- Maxima Fishing Line

- Seaguar

- Fuji Fishing Tackle

- Daiwa Corporation

- Eagle Claw

- Spro

- Cabela’s

- KastKing

- P-Line

- Trik Fish

- Yo-Zuri

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.4 Billion |

|

Forecasted Value (2030) |

USD 2.4 Billion |

|

CAGR (2025 – 2030) |

7.9% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Monofilament Fishing Line Market By Product Type (Nylon Monofilament Fishing Line, Fluorocarbon Monofilament Fishing Line, Coated Monofilament Fishing Line), By End-Use Application (Freshwater Fishing, Saltwater Fishing, Fly Fishing), By Distribution Channel (Online Retail, Offline Retail, Direct Sales), By Diameter (Thin Monofilament Fishing Line, Thick Monofilament Fishing Line), By Strength (Low Strength Monofilament Fishing Line, High Strength Monofilament Fishing Line); Global Insights & Forecast (2023 – 2030) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Shimano Inc., Sufix (a subsidiary of Rapala VMC), Berkley (A subsidiary of Pure Fishing), Mammoth International Inc., Maxima Fishing Line, Seaguar, Fuji Fishing Tackle, Daiwa Corporation, Eagle Claw, Spro, Cabela’s, KastKing, P-Line, Trik Fish, Yo-Zuri |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Monofilament Fishing Line Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Nylon Monofilament Fishing Line |

|

4.2. Fluorocarbon Monofilament Fishing Line |

|

4.3. Coated Monofilament Fishing Line |

|

5. Monofilament Fishing Line Market, by End-Use Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Freshwater Fishing |

|

5.2. Saltwater Fishing |

|

5.3. Fly Fishing |

|

6. Monofilament Fishing Line Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Online Retail |

|

6.2. Offline Retail |

|

6.3. Direct Sales |

|

7. Monofilament Fishing Line Market, by Diameter (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Thin Monofilament Fishing Line |

|

7.2. Thick Monofilament Fishing Line |

|

8. Monofilament Fishing Line Market, by Strength (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Low Strength Monofilament Fishing Line |

|

8.2. High Strength Monofilament Fishing Line |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Monofilament Fishing Line Market, by Product Type |

|

9.2.7. North America Monofilament Fishing Line Market, by End-Use Application |

|

9.2.8. North America Monofilament Fishing Line Market, by Distribution Channel |

|

9.2.9. North America Monofilament Fishing Line Market, by Strength |

|

9.2.10. By Country |

|

9.2.10.1. US |

|

9.2.10.1.1. US Monofilament Fishing Line Market, by Product Type |

|

9.2.10.1.2. US Monofilament Fishing Line Market, by End-Use Application |

|

9.2.10.1.3. US Monofilament Fishing Line Market, by Distribution Channel |

|

9.2.10.1.4. US Monofilament Fishing Line Market, by Strength |

|

9.2.10.2. Canada |

|

9.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. Shimano Inc. |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. Sufix (a subsidiary of Rapala VMC) |

|

11.3. Berkley (A subsidiary of Pure Fishing) |

|

11.4. Mammoth International Inc. |

|

11.5. Maxima Fishing Line |

|

11.6. Seaguar |

|

11.7. Fuji Fishing Tackle |

|

11.8. Daiwa Corporation |

|

11.9. Eagle Claw |

|

11.10. Spro |

|

11.11. Cabela’s |

|

11.12. KastKing |

|

11.13. P-Line |

|

11.14. Trik Fish |

|

11.15. Yo-Zuri |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Monofilament Fishing Line Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Monofilament Fishing Line Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Monofilament Fishing Line Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA