As per Intent Market Research, the Monoclonal Antibodies Market was valued at USD 92.5 Billion in 2024-e and will surpass USD 141.8 Billion by 2030; growing at a CAGR of 6.3% during 2025-2030.

The monoclonal antibodies (mAbs) market is one of the most promising and rapidly expanding sectors in the global biopharmaceutical industry. Monoclonal antibodies are laboratory-produced molecules designed to act as substitutes for natural antibodies, offering precise and targeted therapeutic approaches to a wide range of diseases, including cancer, autoimmune disorders, and infectious diseases. The market for these biologics has been growing steadily due to the increasing prevalence of chronic conditions, advancements in biotechnology, and the continuous rise in healthcare expenditure globally. Moreover, the efficacy and specificity of monoclonal antibodies in treating complex diseases have contributed significantly to their widespread adoption in clinical settings.

The monoclonal antibodies market is characterized by strong competition among both large pharmaceutical companies and emerging biotech firms. These players are continuously investing in research and development to expand the scope of monoclonal antibody applications, improve their production methods, and create next-generation therapies. Technological innovations, such as recombinant DNA technology and advancements in hybridoma technology, are further contributing to market growth by improving production efficiency and enabling the development of more targeted therapies. Additionally, factors such as increased healthcare awareness, favorable regulatory environments, and the growing demand for personalized medicine are all expected to drive the market forward in the coming years. However, challenges such as the high cost of development, regulatory hurdles, and the rising presence of biosimilars could impact the growth trajectory of the market.

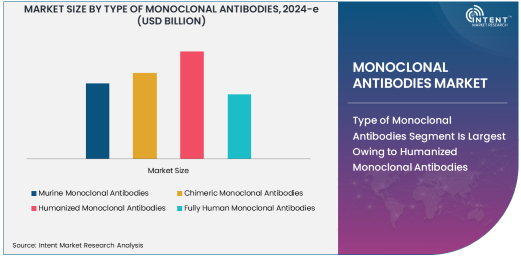

Type of Monoclonal Antibodies Segment Is Largest Owing to Humanized Monoclonal Antibodies

The monoclonal antibodies market is one of the most dynamic sectors in the biopharmaceutical industry, offering innovative treatments for a range of diseases, including cancer, autoimmune disorders, and infectious diseases. The development and production of monoclonal antibodies (mAbs) have revolutionized therapeutic approaches, with various types of mAbs designed to target specific antigens in the body. These therapies are designed to provide high specificity and efficiency in treating diseases that were previously difficult to manage. Within the mAb market, humanized monoclonal antibodies have gained significant attention due to their high efficacy and reduced immunogenicity compared to other antibody types.

Humanized monoclonal antibodies have emerged as the largest subsegment within the "Type of Monoclonal Antibodies" category, owing to their widespread application and improved patient tolerance. These antibodies are engineered to be more similar to human antibodies, reducing the risk of immune system rejection. Their high specificity for target antigens makes them highly effective in treating various diseases, especially cancers and autoimmune conditions. The growth of humanized antibodies is driven by their superior performance in clinical trials, which has led to their approval for a wide range of therapies, including well-known drugs like Rituximab and Trastuzumab. Their increasing use in cancer immunotherapy and their potential in treating chronic diseases are key factors driving the growth of this subsegment.

Applications Segment Is Largest Owing to Cancer Therapy

The applications of monoclonal antibodies span various therapeutic areas, making them versatile and valuable in modern medicine. As the global burden of chronic diseases, particularly cancer, continues to rise, monoclonal antibodies have become critical tools in the fight against malignancies. These therapies work by targeting specific molecules involved in cancer cell proliferation or by modulating the immune system to recognize and destroy cancer cells more effectively. Cancer therapy remains one of the largest application areas for monoclonal antibodies, significantly contributing to the market's expansion.

Cancer therapy is the largest subsegment within the applications category, driven by a robust pipeline of monoclonal antibody-based treatments targeting various forms of cancer, such as breast cancer, lung cancer, and leukemia. The success of therapies like Herceptin (trastuzumab) and Rituxan (rituximab) has spurred continued research and development into new cancer-specific antibodies, fueling the growth of the subsegment. The increasing approval of monoclonal antibody drugs for cancer indications, along with the rising incidence of cancer worldwide, ensures that cancer therapy will remain a dominant focus in the monoclonal antibodies market for the foreseeable future.

End-User Segment Is Largest Owing to Pharmaceutical & Biotech Companies

The end-user segment of the monoclonal antibodies market is composed of various groups that benefit from these therapies, including hospitals, research institutions, pharmaceutical and biotech companies, and diagnostic laboratories. The pharmaceutical and biotechnology companies subsegment has emerged as the largest within this category. These companies play a pivotal role in the development, manufacturing, and commercialization of monoclonal antibodies, and they account for a significant share of the market.

Pharmaceutical and biotech companies are the largest end-users of monoclonal antibodies due to their involvement in the entire lifecycle of mAbs, from research and development to regulatory approval and market launch. These companies invest heavily in biotechnology innovations and collaborations to develop monoclonal antibodies that target specific diseases with higher precision and fewer side effects. The market is further driven by the increasing number of these companies conducting clinical trials to expand the applications of monoclonal antibodies in treating not only cancer but also other diseases such as autoimmune disorders and infectious diseases.

Production Process Segment Is Fastest Growing Owing to Recombinant DNA Technology

The production process of monoclonal antibodies is essential for ensuring their quality, efficacy, and cost-effectiveness. The choice of production technology can significantly impact the yield, scalability, and speed of development. Among the various production technologies available, recombinant DNA technology has emerged as the fastest growing subsegment in recent years. Recombinant DNA technology involves the use of genetically engineered cells to produce monoclonal antibodies in large quantities, offering significant advantages in terms of efficiency and scalability.

Recombinant DNA technology has rapidly gained traction due to its ability to produce monoclonal antibodies with high purity and consistency. This method allows for the large-scale production of humanized or fully human antibodies, addressing the growing demand for these therapies. The increased adoption of recombinant DNA technology is also driven by advancements in genetic engineering, which have made the process more cost-effective and faster compared to traditional methods like hybridoma technology. As a result, recombinant DNA technology is expected to remain the fastest-growing subsegment in the monoclonal antibodies production process category.

Distribution Channel Segment Is Fastest Growing Owing to Online Sales

The distribution of monoclonal antibodies involves various channels through which these therapies are delivered to healthcare providers, research institutions, and patients. The most common distribution channels include direct sales, distributors, and online sales platforms. Among these, online sales have become the fastest growing channel due to the increasing digitalization of the healthcare sector and the growing preference for online platforms for purchasing medical products.

Online sales have become increasingly popular in the monoclonal antibodies market as patients and healthcare providers seek convenient, time-saving methods of accessing treatments. The rise of telemedicine and e-health platforms, particularly after the COVID-19 pandemic, has accelerated the adoption of online sales for monoclonal antibodies. This channel provides patients with easier access to therapies, especially in regions with limited access to specialized healthcare centers. The growing trend of personalized medicine and home healthcare is also contributing to the growth of online sales as a key distribution channel in the market.

North America Is Largest Region in Monoclonal Antibodies Market

North America remains the largest region in the monoclonal antibodies market, driven by the high demand for advanced medical treatments and the presence of leading pharmaceutical companies. The region benefits from a well-established healthcare infrastructure, extensive research capabilities, and a favorable regulatory environment. The United States, in particular, is home to some of the world’s largest biotechnology firms that specialize in the development and commercialization of monoclonal antibodies.

The dominance of North America in the monoclonal antibodies market is further supported by the high adoption rate of monoclonal antibody therapies for cancer treatment and autoimmune diseases. With an aging population and a rising incidence of chronic diseases, the demand for monoclonal antibodies is expected to continue growing in the region. Additionally, favorable reimbursement policies and a strong healthcare ecosystem make North America the leading market for monoclonal antibody therapies globally.

Competitive Landscape: Leading Companies and Market Dynamics

The monoclonal antibodies market is highly competitive, with several large pharmaceutical and biotechnology companies dominating the landscape. Leading companies such as Roche, AbbVie, Merck & Co., Amgen, and Johnson & Johnson are major players, consistently driving innovation through their robust portfolios of monoclonal antibody-based therapies. These companies leverage extensive R&D capabilities and strong manufacturing networks to meet the growing demand for monoclonal antibodies worldwide.

The competitive dynamics are also shaped by strategic partnerships, mergers, and acquisitions aimed at expanding product pipelines and enhancing technological capabilities. As the demand for monoclonal antibodies continues to rise, companies are focusing on improving their therapeutic offerings, exploring new disease indications, and increasing production efficiency. Additionally, the increasing number of biosimilar monoclonal antibodies entering the market is intensifying competition, offering cost-effective alternatives to traditional branded therapies. As a result, the market is expected to witness significant innovation and consolidation in the coming years.

Recent Developments:

- Roche announced the launch of its new monoclonal antibody treatment for non-small cell lung cancer (NSCLC), following positive clinical trial results.

- Amgen completed its acquisition of a leading biotech firm focused on monoclonal antibody therapies for autoimmune diseases.

- Regeneron Pharmaceuticals received FDA approval for its novel monoclonal antibody to treat severe asthma, enhancing its immunotherapy portfolio.

- Bristol-Myers Squibb entered into a partnership with a European biotechnology company to co-develop monoclonal antibody treatments for cancer.

- Johnson & Johnson announced a new collaboration with a gene therapy company to integrate monoclonal antibody technologies in its oncology pipeline.

List of Leading Companies:

- Roche

- AbbVie

- Merck & Co.

- Johnson & Johnson

- Amgen

- Bristol-Myers Squibb

- Sanofi

- Novartis

- AstraZeneca

- Regeneron Pharmaceuticals

- GSK (GlaxoSmithKline)

- Eli Lilly

- Pfizer

- Takeda Pharmaceutical Company

- Boehringer Ingelheim

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 92.5 Billion |

|

Forecasted Value (2030) |

USD 141.8 Billion |

|

CAGR (2025 – 2030) |

6.3% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Monoclonal Antibodies Market By Type (Murine Monoclonal Antibodies, Chimeric Monoclonal Antibodies, Humanized Monoclonal Antibodies, Fully Human Monoclonal Antibodies), By Application (Cancer Therapy, Autoimmune Diseases, Infectious Diseases, Inflammatory Diseases), By End-User (Hospitals, Research & Academic Institutes, Pharmaceutical & Biotech Companies, Contract Research Organizations, Diagnostic Laboratories), By Production Process (Hybridoma Technology, Phage Display Technology, Transgenic Mouse Technology, Recombinant DNA Technology), By Distribution Channel (Direct Sales, Distributors, Online Sales) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Roche, AbbVie, Merck & Co., Johnson & Johnson, Amgen, Bristol-Myers Squibb, Sanofi, Novartis, AstraZeneca, Regeneron Pharmaceuticals, GSK (GlaxoSmithKline), Eli Lilly, Pfizer, Takeda Pharmaceutical Company, Boehringer Ingelheim |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Monoclonal Antibodies Market, by Type of Monoclonal Antibodies (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Murine Monoclonal Antibodies |

|

4.2. Chimeric Monoclonal Antibodies |

|

4.3. Humanized Monoclonal Antibodies |

|

4.4. Fully Human Monoclonal Antibodies |

|

5. Monoclonal Antibodies Market, by Applications (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Cancer Therapy |

|

5.2. Autoimmune Diseases |

|

5.3. Infectious Diseases |

|

5.4. Inflammatory Diseases |

|

5.5. Other Therapeutic Applications |

|

6. Monoclonal Antibodies Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Hospitals |

|

6.2. Research & Academic Institutes |

|

6.3. Pharmaceutical & Biotech Companies |

|

6.4. Contract Research Organizations (CROs) |

|

6.5. Diagnostic Laboratories |

|

7. Monoclonal Antibodies Market, by Production Process (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Hybridoma Technology |

|

7.2. Phage Display Technology |

|

7.3. Transgenic Mouse Technology |

|

7.4. Recombinant DNA Technology |

|

8. Monoclonal Antibodies Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Direct Sales |

|

8.2. Distributors |

|

8.3. Online Sales |

|

8.4. Others |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Monoclonal Antibodies Market, by Type of Monoclonal Antibodies |

|

9.2.7. North America Monoclonal Antibodies Market, by Applications |

|

9.2.8. North America Monoclonal Antibodies Market, by End-User |

|

9.2.9. North America Monoclonal Antibodies Market, by Production Process |

|

9.2.10. North America Monoclonal Antibodies Market, by Distribution Channel |

|

9.2.11. By Country |

|

9.2.11.1. US |

|

9.2.11.1.1. US Monoclonal Antibodies Market, by Type of Monoclonal Antibodies |

|

9.2.11.1.2. US Monoclonal Antibodies Market, by Applications |

|

9.2.11.1.3. US Monoclonal Antibodies Market, by End-User |

|

9.2.11.1.4. US Monoclonal Antibodies Market, by Production Process |

|

9.2.11.1.5. US Monoclonal Antibodies Market, by Distribution Channel |

|

9.2.11.2. Canada |

|

9.2.11.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. Roche |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. AbbVie |

|

11.3. Merck & Co. |

|

11.4. Johnson & Johnson |

|

11.5. Amgen |

|

11.6. Bristol-Myers Squibb |

|

11.7. Sanofi |

|

11.8. Novartis |

|

11.9. AstraZeneca |

|

11.10. Regeneron Pharmaceuticals |

|

11.11. GSK (GlaxoSmithKline) |

|

11.12. Eli Lilly |

|

11.13. Pfizer |

|

11.14. Takeda Pharmaceutical Company |

|

11.15. Boehringer Ingelheim |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Monoclonal Antibodies Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Monoclonal Antibodies Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Monoclonal Antibodies Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA