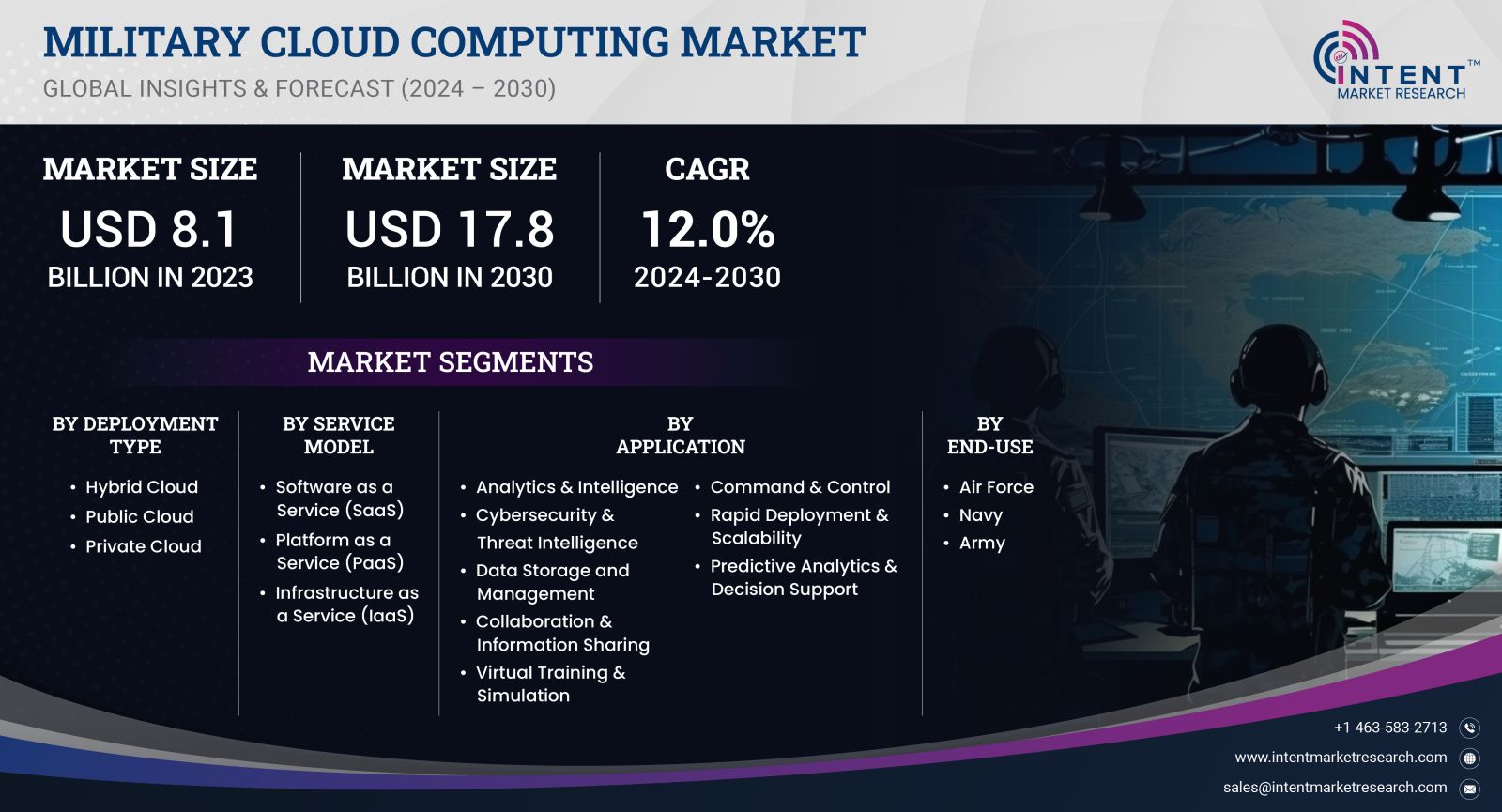

As per Intent Market Research, the Military Cloud Computing Market was valued at USD 8.1 billion in 2023-e and will surpass USD 17.8 billion by 2030; growing at a CAGR of 12.0% during 2024 - 2030.

The military cloud computing market has emerged as a pivotal sector in the defense industry, driven by the increasing need for efficient data management, enhanced communication, and improved operational capabilities. Cloud computing offers military organizations the ability to streamline operations, reduce costs, and enhance agility in various domains, including logistics, intelligence, and training. The growing reliance on advanced technologies, such as artificial intelligence (AI) and big data analytics, has further accelerated the adoption of cloud solutions in military applications. As defense agencies around the globe prioritize modernization efforts, the military cloud computing market is poised for significant growth in the coming years.

Infrastructure-as-a-Service (IaaS) Segment is Largest Owing to Scalability and Cost Efficiency

The Infrastructure-as-a-Service (IaaS) segment is recognized as the largest within the military cloud computing market. This sub-segment provides the foundational infrastructure necessary for military operations, including storage, processing power, and networking resources. The appeal of IaaS lies in its ability to offer scalable resources that can be adjusted according to the specific demands of military operations. With defense forces requiring rapid deployment of IT resources to support diverse missions, IaaS provides a flexible and cost-effective solution.

Moreover, the increasing frequency of cyber threats necessitates robust infrastructure that can adapt to emerging challenges. Military organizations are investing heavily in IaaS to ensure they have the capacity to respond to these threats while maintaining operational efficiency. Additionally, the ability to integrate advanced analytics and AI tools with IaaS platforms enhances data processing capabilities, enabling military leaders to make informed decisions swiftly. As a result, IaaS remains the backbone of military cloud computing, facilitating a transition to more efficient and effective defense operations.

Platform-as-a-Service (PaaS) Segment is Fastest Growing Owing to Innovation and Development

The Platform-as-a-Service (PaaS) segment is the fastest-growing sub-segment in the military cloud computing market. PaaS provides a comprehensive environment for developers to build, test, and deploy applications without the complexities of managing the underlying infrastructure. This capability is particularly beneficial for military organizations, which often require customized solutions to meet unique operational needs. The rapid evolution of technology and the necessity for agile application development drive the growth of PaaS within the defense sector.

As military forces seek to innovate and develop applications that enhance operational readiness and situational awareness, the demand for PaaS is expected to soar. PaaS allows for quicker iteration and deployment of applications, enabling defense organizations to stay ahead of technological advancements. Furthermore, as military operations become increasingly data-driven, the ability to create and utilize advanced applications through PaaS platforms is crucial for achieving strategic objectives. Consequently, the PaaS segment is poised for substantial growth as military entities prioritize innovation and efficiency.

Software-as-a-Service (SaaS) Segment is Largest Owing to Enhanced Collaboration and Communication

The Software-as-a-Service (SaaS) segment stands out as the largest in the military cloud computing market, primarily due to its ability to facilitate enhanced collaboration and communication among military personnel. SaaS solutions offer a range of applications tailored to defense needs, including communication tools, logistics management systems, and training platforms. The shift to SaaS is driven by the necessity for real-time information sharing and collaboration in mission-critical situations, enabling military organizations to operate effectively in diverse environments.

Additionally, SaaS platforms eliminate the need for extensive on-premise IT infrastructure, significantly reducing maintenance costs and improving access to applications from various devices. This flexibility allows military personnel to work remotely or in the field while staying connected to essential resources. The adoption of SaaS applications has been further propelled by the increasing focus on joint operations and interoperability among allied forces. As military agencies continue to embrace digital transformation, the SaaS segment will play a crucial role in driving efficiency and effectiveness across the defense landscape.

Managed Services Segment is Fastest Growing Owing to Outsourcing Trends

The Managed Services segment is rapidly emerging as the fastest-growing area within the military cloud computing market. This sub-segment focuses on providing comprehensive IT management solutions, enabling military organizations to outsource their IT needs to specialized service providers. The growing complexity of military IT infrastructures and the need for enhanced cybersecurity measures are driving this trend, as defense agencies look to leverage the expertise of third-party vendors to manage and protect their data.

Managed services offer numerous benefits, including cost reduction, improved service quality, and access to the latest technology. By outsourcing IT operations, military organizations can focus on their core mission while ensuring that their cloud infrastructure is secure and efficient. The rise of cyber threats necessitates a proactive approach to cybersecurity, further underscoring the value of managed services in the defense sector. As the military continues to seek innovative solutions to address its operational challenges, the Managed Services segment is expected to witness significant growth.

Regionally, North America Dominates Owing to Technological Advancements and Investment

North America is the dominant region in the military cloud computing market, driven by significant technological advancements and substantial investment in defense-related IT infrastructure. The United States, in particular, leads the way in adopting cloud computing solutions for military applications, fueled by a robust defense budget and a commitment to modernization. The U.S. Department of Defense has prioritized cloud initiatives, leading to the establishment of various cloud-based platforms and services that enhance operational efficiency.

The presence of major cloud service providers in North America further bolsters the region's market dominance. Companies such as Amazon Web Services, Microsoft Azure, and Google Cloud are actively engaging with military clients, offering tailored solutions that meet stringent security and operational requirements. The region's strong emphasis on research and development, coupled with collaboration between public and private sectors, positions North America as a leader in military cloud computing. As military organizations continue to explore advanced technologies, the demand for cloud solutions is expected to expand significantly in this region.

Competitive Landscape and Leading Companies

The military cloud computing market is characterized by a competitive landscape dominated by several key players. Leading companies in this space include Amazon Web Services (AWS), Microsoft Corporation, IBM Corporation, and Oracle Corporation. These firms are at the forefront of developing innovative cloud solutions tailored to the unique needs of military organizations, focusing on security, scalability, and interoperability.

The competitive dynamics of the military cloud computing market are influenced by ongoing partnerships, strategic alliances, and mergers and acquisitions among technology providers. Companies are increasingly collaborating with defense agencies to co-develop cloud solutions that enhance operational efficiency and effectiveness. Additionally, as military organizations prioritize cybersecurity, cloud service providers are investing heavily in securing their platforms and meeting compliance standards. This competitive environment fosters innovation and drives advancements in military cloud computing technologies, ensuring that defense forces have access to the best tools available for their operations.

Report Objectives

The report will help you answer some of the most critical questions in the Military Cloud Computing Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the military cloud computing market?

- What is the size of the military cloud computing market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 8.1 billion |

|

Forecasted Value (2030) |

USD 17.8 billion |

|

CAGR (2024-2030) |

12.0% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Military Cloud Computing Market By Deployment Type (Hybrid Cloud, Public Cloud, Private Cloud), By Service Model (Software as a Service, Platform as a Service, Infrastructure as a Service), By Application (Analytics & Intelligence, Cybersecurity & Threat Intelligence, Virtual Training & Simulation, Command & Control), By End Use (Air Force, Navy, Army) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy & Rest of Europe), Asia Pacific (China, Japan, South Korea, India, and rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Research Assumptions |

|

1.4.Study Limitations |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.1.1.Top-Down Method |

|

2.1.2.Bottom-Up Method |

|

2.1.3.Factor Impact Analysis |

|

2.2.Insights & Data Collection Process |

|

2.2.1.Secondary Research |

|

2.2.2.Primary Research |

|

2.3.Data Mining Process |

|

2.3.1.Data Analysis |

|

2.3.2.Data Validation and Revalidation |

|

2.3.3.Data Triangulation |

|

3.Executive Summary |

|

3.1.Major Markets & Segments |

|

3.2.Highest Growing Regions and Respective Countries |

|

3.3.Impact of Growth Drivers & Inhibitors |

|

3.4.Regulatory Overview by Country |

|

4.Military Cloud Computing Market, by Deployment Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

4.1.Hybrid Cloud |

|

4.2.Public Cloud |

|

4.3.Private Cloud |

|

5.Military Cloud Computing Market, by Service Model (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

5.1.Software as a Service (SaaS) |

|

5.1.1.Logistics And Supply Chain Management |

|

5.1.2.Cybersecurity Solutions |

|

5.1.3.Collaboration And Communication |

|

5.1.4.Geographic Information Systems (GIS) |

|

5.2.Platform as a Service (PaaS) |

|

5.2.1.Integration And Orchestration |

|

5.2.2.Application Testing and Quality |

|

5.2.3.Analytics And Reporting |

|

5.2.4.Application Development and Platforms |

|

5.2.5.Data Management |

|

5.3.Infrastructure as a Service (IaaS) |

|

5.3.1.Disaster Recovery & Backup |

|

5.3.2.Primary Storage |

|

5.3.3.Archiving |

|

5.3.4.Compute |

|

6.Military Cloud Computing Market, by Application (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Analytics & Intelligence |

|

6.2.Cybersecurity & Threat Intelligence |

|

6.3.Data Storage and Management |

|

6.4.Collaboration & Information Sharing |

|

6.5.Virtual Training & Simulation |

|

6.6.Command & Control |

|

6.7.Rapid Deployment & Scalability |

|

6.8.Predictive Analytics & Decision Support |

|

7.Military Cloud Computing Market, by End-use (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Air Force |

|

7.2.Navy |

|

7.3.Army |

|

8.Regional Analysis (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

8.1.Regional Overview |

|

8.2.North America |

|

8.2.1.Regional Trends & Growth Drivers |

|

8.2.2.Barriers & Challenges |

|

8.2.3.Opportunities |

|

8.2.4.Factor Impact Analysis |

|

8.2.5.Technology Trends |

|

8.2.6.North America Military Cloud Computing Market, by Deployment Type |

|

8.2.7.North America Military Cloud Computing Market, by Service Model |

|

8.2.8.North America Military Cloud Computing Market, by Application |

|

8.2.9.North America Military Cloud Computing Market, by End-use |

|

*Similar segmentation will be provided at each regional level |

|

8.3.By Country |

|

8.3.1.US |

|

8.3.1.1.US Military Cloud Computing Market, by Deployment Type |

|

8.3.1.2.US Military Cloud Computing Market, by Service Model |

|

8.3.1.3.US Military Cloud Computing Market, by Application |

|

8.3.1.4.US Military Cloud Computing Market, by End-use |

|

8.3.2.Canada |

|

*Similar segmentation will be provided at each country level |

|

8.4.Europe |

|

8.5.APAC |

|

8.6.Latin America |

|

8.7.Middle East & Africa |

|

9.Competitive Landscape |

|

9.1.Overview of the Key Players |

|

9.2.Competitive Ecosystem |

|

9.2.1.Platform Manufacturers |

|

9.2.2.Subsystem Manufacturers |

|

9.2.3.Service Providers |

|

9.2.4.Software Providers |

|

9.3.Company Share Analysis |

|

9.4.Company Benchmarking Matrix |

|

9.4.1.Strategic Overview |

|

9.4.2.Product Innovations |

|

9.5.Start-up Ecosystem |

|

9.6.Strategic Competitive Insights/ Customer Imperatives |

|

9.7.ESG Matrix/ Sustainability Matrix |

|

9.8.Manufacturing Network |

|

9.8.1.Locations |

|

9.8.2.Supply Chain and Logistics |

|

9.8.3.Product Flexibility/Customization |

|

9.8.4.Digital Transformation and Connectivity |

|

9.8.5.Environmental and Regulatory Compliance |

|

9.9.Technology Readiness Level Matrix |

|

9.10.Technology Maturity Curve |

|

9.11.Buying Criteria |

|

10.Company Profiles |

|

10.1.Oracle |

|

10.1.1.Company Overview |

|

10.1.2.Company Financials |

|

10.1.3.Product/Service Portfolio |

|

10.1.4.Recent Developments |

|

10.1.5.IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2.Alphabet |

|

10.3.Microsoft |

|

10.4.AWS |

|

10.5.Dell |

|

10.6.Capgemini |

|

10.7.IBM |

|

10.8.Thales |

|

10.9.Cisco |

|

10.10.Rackspace Technology |

|

11.Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Military Cloud Computing Market. In the process, the analysis was also done to estimate the parent market and relevant adjacencies to major the impact of them on the military cloud computing Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the military cloud computing ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Estimation

A combination of top-down and bottom-up approaches was utilized to estimate the overall size of the military cloud computing market. These methods were also employed to estimate the size of various subsegments within the market. The market size estimation methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size estimates, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size estimates.

NA