As per Intent Market Research, the Middle Ear Implants Market was valued at USD 1.7 billion in 2024-e and will surpass USD 2.9 billion by 2030; growing at a CAGR of 8.5% during 2025 - 2030.

The middle ear implants market is driven by the increasing prevalence of hearing impairments and advancements in implantable hearing technologies. Middle ear implants offer an innovative solution for individuals with hearing loss, particularly those who cannot benefit from conventional hearing aids. These devices are designed to improve sound conduction and enable better hearing by stimulating the middle ear structures directly. As awareness about hearing restoration solutions increases, the demand for middle ear implants is expected to grow across various regions, further supported by technological advancements and growing healthcare accessibility.

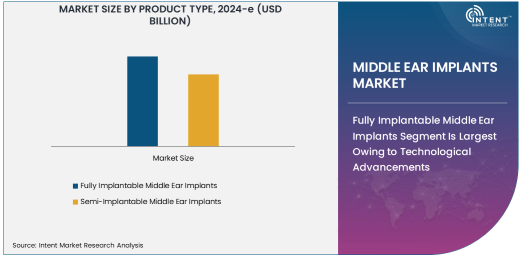

Fully Implantable Middle Ear Implants Segment Is Largest Owing to Technological Advancements

The fully implantable middle ear implants segment is currently the largest in the market. This growth is attributed to significant advancements in technology, which have made these implants more effective, comfortable, and appealing to patients. Fully implantable systems offer the advantage of being discreet and providing better sound amplification, which is particularly beneficial for individuals with severe hearing loss. Their ability to be fully integrated under the skin without external components makes them a preferred option for patients seeking a permanent and aesthetically pleasing solution. Furthermore, fully implantable devices tend to have longer life cycles, lower maintenance needs, and fewer complications, which contribute to their widespread adoption.

As the market for fully implantable implants continues to grow, companies are investing in research and development to refine these products. Innovations such as enhanced battery life, improved sound quality, and more efficient surgical implantation techniques are expanding the appeal of fully implantable systems. This segment is expected to maintain its dominance as the technology becomes more affordable and accessible to a broader patient base.

Conductive Hearing Loss Segment Is Largest Owing to Higher Prevalence

Conductive hearing loss remains the largest indication for middle ear implants. This type of hearing loss is caused by problems in the outer or middle ear, which prevent sound from being conducted properly to the inner ear. Conductive hearing loss can result from factors such as ear infections, fluid buildup, or damage to the ear drum or ossicles. Middle ear implants, particularly semi-implantable and fully implantable devices, are highly effective in treating this condition, making them the preferred choice for patients suffering from conductive hearing loss.

The large share of the conductive hearing loss segment is driven by the fact that this type of hearing loss is more common and often easier to treat with implantable devices than sensorineural hearing loss. The growing number of patients seeking treatment for conductive hearing loss, combined with the increasing availability of advanced middle ear implants, is expected to sustain this segment's leadership in the market.

Hospitals Segment Is Largest Owing to Advanced Healthcare Infrastructure

Hospitals continue to dominate the end-user segment of the middle ear implants market. This is largely due to their advanced healthcare infrastructure, ability to perform complex surgical procedures, and access to skilled professionals. Hospitals are equipped with the latest surgical technologies and highly trained specialists, making them the go-to destination for the implantation of middle ear devices. Additionally, hospitals offer comprehensive post-operative care, which is essential for ensuring the success of implant surgeries and the long-term satisfaction of patients.

The dominance of hospitals in this market is also supported by the fact that many middle ear implant procedures are high-cost and require specialized equipment and expert surgical intervention. As healthcare systems in developed countries continue to improve, hospitals are expected to maintain their strong position as the primary setting for middle ear implant procedures.

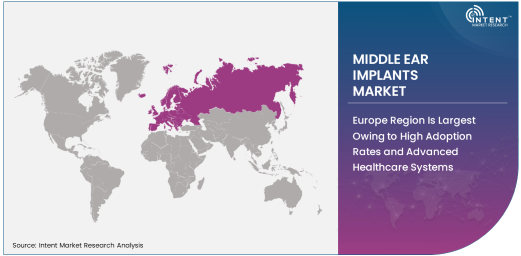

Europe Region Is Largest Owing to High Adoption Rates and Advanced Healthcare Systems

Europe is the largest regional market for middle ear implants. Several factors contribute to Europe's dominance, including well-established healthcare infrastructure, high healthcare spending, and a growing aging population. Countries such as Germany, the UK, and France have comprehensive healthcare systems that support the use of advanced hearing solutions, including middle ear implants. Moreover, European healthcare providers are increasingly adopting implantable hearing devices as part of their commitment to improving patient care and treatment outcomes for those with hearing loss.

The adoption of middle ear implants in Europe is also fueled by the rising awareness of hearing disorders, advancements in surgical techniques, and supportive reimbursement policies in many European countries. With an aging population that is more prone to hearing loss, Europe is expected to continue being a significant market player, with an increasing number of patients opting for middle ear implants as a long-term hearing solution.

Leading Companies and Competitive Landscape

The middle ear implants market is highly competitive, with several key players leading the industry in terms of technology, innovation, and market share. Leading companies in the market include Cochlear Ltd., MED-EL Corporation, Sonova Holding AG, and Oticon Medical. These companies have established themselves as leaders through their continuous focus on research and development, regulatory approvals, and strategic partnerships. They offer a wide range of middle ear implants, catering to various types of hearing loss and patient needs.

The competitive landscape is characterized by a combination of large multinational companies and smaller, specialized firms. While large companies dominate the market in terms of revenue and global presence, smaller companies with niche technologies and innovative solutions are also gaining traction. The market is expected to see continued innovation in product offerings, as companies strive to enhance the performance, comfort, and affordability of their devices. Additionally, as awareness of hearing loss treatments grows, competition will intensify, particularly in emerging markets where middle ear implants are becoming more accessible.

Recent Developments:

- Cochlear Ltd. introduced a fully implantable middle ear device designed for long-term functionality and improved patient comfort.

- MED-EL announced regulatory approval for its latest implant system designed to treat mixed and sensorineural hearing loss.

- Sonova Holding AG completed the acquisition of Ototronix to expand its presence in the middle ear implants market.

- Envoy Medical received FDA clearance for a new fully implantable hearing device, marking a breakthrough in hearing technology.

- Oticon Medical initiated collaborations with top hospitals to test the efficacy of its next-generation semi-implantable systems.

List of Leading Companies:

- Cochlear Ltd.

- MED-EL Corporation

- Sonova Holding AG

- Oticon Medical

- Envoy Medical Corporation

- Medtronic Plc

- William Demant Holding A/S

- Audicus Inc.

- Ototronix

- Starkey Hearing Technologies

- Widex A/S

- Sivantos Pte Ltd

- Zounds Hearing Inc.

- Bernafon AG

- Neuromod Devices Ltd.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.7 Billion |

|

Forecasted Value (2030) |

USD 2.9 Billion |

|

CAGR (2025 – 2030) |

8.5% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Middle Ear Implants Market By Product Type (Fully Implantable Middle Ear Implants, Semi-Implantable Middle Ear Implants), By Indication (Conductive Hearing Loss, Sensorineural Hearing Loss, Mixed Hearing Loss), By End-User (Hospitals, Ambulatory Surgical Centers, Specialized Clinics) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Cochlear Ltd., MED-EL Corporation, Sonova Holding AG, Oticon Medical, Envoy Medical Corporation, Medtronic Plc, William Demant Holding A/S, Audicus Inc., Ototronix, Starkey Hearing Technologies, Widex A/S, Sivantos Pte Ltd, Zounds Hearing Inc., Bernafon AG, Neuromod Devices Ltd. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Middle Ear Implants Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Fully Implantable Middle Ear Implants |

|

4.2. Semi-Implantable Middle Ear Implants |

|

5. Middle Ear Implants Market, by Indication (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Conductive Hearing Loss |

|

5.2. Sensorineural Hearing Loss |

|

5.3. Mixed Hearing Loss |

|

6. Middle Ear Implants Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Hospitals |

|

6.2. Ambulatory Surgical Centers |

|

6.3. Specialized Clinics |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Middle Ear Implants Market, by Product Type |

|

7.2.7. North America Middle Ear Implants Market, by Indication |

|

7.2.8. North America Middle Ear Implants Market, by End-User |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Middle Ear Implants Market, by Product Type |

|

7.2.9.1.2. US Middle Ear Implants Market, by Indication |

|

7.2.9.1.3. US Middle Ear Implants Market, by End-User |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Cochlear Ltd. |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. MED-EL Corporation |

|

9.3. Sonova Holding AG |

|

9.4. Oticon Medical |

|

9.5. Envoy Medical Corporation |

|

9.6. Medtronic Plc |

|

9.7. William Demant Holding A/S |

|

9.8. Audicus Inc. |

|

9.9. Ototronix |

|

9.10. Starkey Hearing Technologies |

|

9.11. Widex A/S |

|

9.12. Sivantos Pte Ltd |

|

9.13. Zounds Hearing Inc. |

|

9.14. Bernafon AG |

|

9.15. Neuromod Devices Ltd. |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Middle Ear Implants Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Middle Ear Implants Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Middle Ear Implants Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA