As per Intent Market Research, the Microwave Devices Market was valued at USD 7.8 billion in 2024-e and will surpass USD 11.2 billion by 2030; growing at a CAGR of 5.3% during 2025 - 2030.

The microwave devices market is experiencing significant growth due to the increasing demand for high-frequency systems across industries such as telecommunications, aerospace & defense, automotive, and medical. These devices are essential for various applications, including communication systems, radar, satellite technologies, and medical diagnostics. With advances in 5G technology, the automotive industry's shift towards autonomous vehicles, and the growing use of microwave devices in medical equipment, the market is poised for continued expansion. This growth is driven by technological advancements in microwave components, enabling faster, more efficient signal transmission and processing across a wide range of applications.

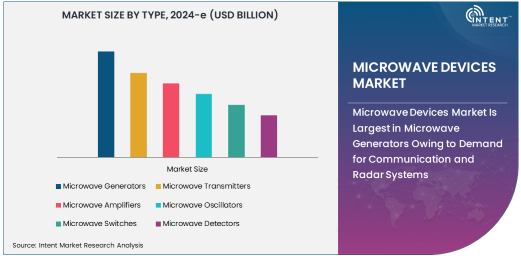

Microwave Devices Market Is Largest in Microwave Generators Owing to Demand for Communication and Radar Systems

Among the different types of microwave devices, microwave generators hold the largest market share. These devices play a crucial role in generating high-frequency microwaves for communication systems, radar applications, and broadcasting. With the rise in demand for wireless communication, including 5G networks, microwave generators are essential for ensuring reliable, long-range communication. Their use in satellite communication and defense applications further strengthens their position as the largest subsegment. The continuous advancements in microwave generator technology, such as improved power output and frequency range capabilities, are expected to drive further growth in this segment.

Microwave generators are particularly indispensable in sectors like aerospace and defense, where they are used in radar systems for surveillance, navigation, and targeting. The global push for enhanced communication infrastructure, especially in remote and rural areas, further solidifies the need for robust microwave generators to maintain strong and stable signals. As 5G technologies continue to roll out, the microwave generators’ role in enhancing telecom and satellite communications will expand, driving long-term market growth.

Microwave Devices Market Is Fastest Growing in Automotive Applications Driven by Autonomous Vehicles

Automotive applications represent the fastest-growing subsegment in the microwave devices market. The automotive industry has seen increased adoption of microwave devices, particularly for radar systems used in autonomous vehicles and advanced driver-assistance systems (ADAS). These devices are integral for collision avoidance, adaptive cruise control, and lane-keeping assistance systems. As the automotive industry moves towards greater automation and safety, the need for microwave devices that support these technologies is rapidly increasing. Microwave sensors, especially in the frequency ranges used for radar, are essential for real-time object detection and analysis in autonomous vehicles.

With the advancement of smart vehicles and electric vehicles (EVs), the demand for automotive radar systems is expected to continue its upward trajectory. As automakers invest in enhancing vehicle safety and automation, microwave devices will become even more critical. The increasing focus on reducing road accidents, improving traffic management, and enhancing vehicle communication will drive the continued expansion of microwave devices in the automotive sector.

Microwave Devices Market Is Largest in Telecommunications, Fueled by 5G Expansion

The telecommunications sector is the largest end-user industry for microwave devices, driven primarily by the growing demand for high-speed communication networks such as 5G. Microwave devices are fundamental in establishing and maintaining wireless communication infrastructures. These devices are used in base stations, satellite communication, and backhaul systems, supporting both the transmission and reception of high-frequency signals. The telecommunications industry's rapid transition from 4G to 5G networks is a major catalyst for the growth of microwave devices, as 5G requires more advanced and efficient microwave technology to handle higher data volumes with minimal latency.

As the need for faster, more reliable communication systems increases, especially in urban areas, the demand for microwave devices in telecommunications will continue to soar. The deployment of 5G technologies globally is expected to increase microwave device usage not only in terrestrial networks but also in satellite-based systems, further cementing telecommunications as the largest end-user segment in the microwave devices market.

Microwave Devices Market Is Fastest Growing in Asia Pacific Due to Technological Advancements

The Asia Pacific region is the fastest-growing market for microwave devices. This growth can be attributed to the rapid adoption of new technologies in countries like China, Japan, and India, which are leading the development of 5G infrastructure, autonomous vehicles, and advanced aerospace systems. The demand for microwave devices in telecommunications, automotive, and aerospace & defense is particularly high in this region due to the increasing investments in technology and innovation. The region's growing manufacturing capabilities, coupled with favorable government policies supporting the development of telecom and defense sectors, are expected to further drive the growth of the microwave devices market.

Asia Pacific's strong position in the global microwave devices market is also bolstered by its increasing focus on satellite communication and the widespread deployment of radar systems in defense and automotive applications. The region's ongoing technological advancements, combined with a rising demand for 5G services and autonomous driving technologies, make it the fastest-growing market for microwave devices globally.

Leading Companies in the Microwave Devices Market

The competitive landscape of the microwave devices market is characterized by the presence of several prominent players. Keysight Technologies, Rohde & Schwarz, Anritsu Corporation, and Teledyne Microwave Solutions are among the market leaders, offering a range of microwave components and testing equipment. These companies are driving innovation with continuous product advancements in microwave generators, amplifiers, oscillators, and transmitters. Additionally, companies like NXP Semiconductors and Broadcom Inc. are making significant strides in the market by offering high-performance microwave devices for consumer electronics and automotive applications.

The market is also witnessing increasing mergers and acquisitions, as companies seek to expand their product portfolios and strengthen their positions in key industries like telecommunications and aerospace & defense. The highly competitive nature of the market means that companies must continually innovate to stay ahead, with a focus on technological advancements such as 5G, radar, and satellite communication systems. Strategic partnerships and R&D investments will continue to shape the microwave devices market as companies strive to meet the evolving demands of various end-user industries.

Recent Developments:

- Keysight Technologies announced the launch of a new microwave signal generator with enhanced performance for 5G and satellite communications testing in Q2 2024.

- Rohde & Schwarz secured a major contract with a global aerospace and defense company for the supply of advanced microwave test solutions to support radar and communication systems.

- Anritsu Corporation completed the acquisition of a leading RF and microwave component manufacturer, expanding its portfolio to support next-gen wireless technologies.

- MACOM Technology Solutions unveiled a new line of high-power microwave amplifiers tailored for aerospace and defense applications, improving signal transmission capabilities.

- NXP Semiconductors received regulatory approval for a new 5G microwave chipset that will enhance signal processing in telecom infrastructure globally.

List of Leading Companies:

- Keysight Technologies

- Rohde & Schwarz

- Anritsu Corporation

- National Instruments Corporation

- Teledyne Microwave Solutions

- Microwave Technology Inc.

- NXP Semiconductors

- Texas Instruments

- Qorvo

- Broadcom Inc.

- Minicircuits

- L3Harris Technologies

- TTE (Tactical Transmitters Electronics)

- MACOM Technology Solutions

- Comtech Telecommunications Corp.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 7.8 Billion |

|

Forecasted Value (2030) |

USD 11.2 Billion |

|

CAGR (2025 – 2030) |

5.3% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Microwave Devices Market By Type (Microwave Generators, Microwave Transmitters, Microwave Amplifiers, Microwave Oscillators, Microwave Switches, Microwave Detectors), By Application (Telecommunications, Automotive, Aerospace & Defense, Medical, Industrial & Scientific, Consumer Electronics), By Frequency Range (L Band, S Band, C Band, X Band, Ku/K Band, Ka Band, V Band, W Band), By End-User Industry (Telecommunications, Automotive, Medical Devices, Aerospace & Defense, Electronics Manufacturing, Industrial and Research) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Keysight Technologies, Rohde & Schwarz, Anritsu Corporation, National Instruments Corporation, Teledyne Microwave Solutions, Microwave Technology Inc., NXP Semiconductors, Texas Instruments, Qorvo, Broadcom Inc., Minicircuits, L3Harris Technologies, TTE (Tactical Transmitters Electronics), MACOM Technology Solutions, Comtech Telecommunications Corp. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Microwave Devices Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Microwave Generators |

|

4.2. Microwave Transmitters |

|

4.3. Microwave Amplifiers |

|

4.4. Microwave Oscillators |

|

4.5. Microwave Switches |

|

4.6. Microwave Detectors |

|

5. Microwave Devices Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Telecommunications |

|

5.2. Automotive |

|

5.3. Aerospace & Defense |

|

5.4. Medical |

|

5.5. Industrial & Scientific |

|

5.6. Consumer Electronics |

|

6. Microwave Devices Market, by Frequency Range (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. L Band (1-2 GHz) |

|

6.2. S Band (2-4 GHz) |

|

6.3. C Band (4-8 GHz) |

|

6.4. X Band (8-12 GHz) |

|

6.5. Ku/K Band (12-18 GHz) |

|

6.6. Ka Band (26.5–40 GHz) |

|

6.7. V Band (40-75 GHz) |

|

6.8. W Band (75-110 GHz) |

|

7. Microwave Devices Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Telecommunications |

|

7.2. Automotive |

|

7.3. Medical Devices |

|

7.4. Aerospace & Defense |

|

7.5. Electronics Manufacturing |

|

7.6. Industrial and Research |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Microwave Devices Market, by Type |

|

8.2.7. North America Microwave Devices Market, by Application |

|

8.2.8. North America Microwave Devices Market, by End-User Industry |

|

8.2.9. By Country |

|

8.2.9.1. US |

|

8.2.9.1.1. US Microwave Devices Market, by Type |

|

8.2.9.1.2. US Microwave Devices Market, by Application |

|

8.2.9.1.3. US Microwave Devices Market, by End-User Industry |

|

8.2.9.2. Canada |

|

8.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Keysight Technologies |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Rohde & Schwarz |

|

10.3. Anritsu Corporation |

|

10.4. National Instruments Corporation |

|

10.5. Teledyne Microwave Solutions |

|

10.6. Microwave Technology Inc. |

|

10.7. NXP Semiconductors |

|

10.8. Texas Instruments |

|

10.9. Qorvo |

|

10.10. Broadcom Inc. |

|

10.11. Minicircuits |

|

10.12. L3Harris Technologies |

|

10.13. TTE (Tactical Transmitters Electronics) |

|

10.14. MACOM Technology Solutions |

|

10.15. Comtech Telecommunications Corp. |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Microwave Devices Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Microwave Devices Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Microwave Devices Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA