As per Intent Market Research, the Microscopy Devices Market was valued at USD 10.1 billion in 2024-e and will surpass USD 15.4 billion by 2030; growing at a CAGR of 6.3% during 2025 - 2030.

The microscopy devices market plays a pivotal role in enabling advanced research and analysis across various scientific and industrial domains. With continuous technological advancements, microscopy devices are now indispensable in fields such as life sciences, material sciences, nanotechnology, and semiconductor industries. The market is poised for robust growth, driven by increasing investments in research and development, rising demand for high-resolution imaging, and the growing prevalence of nanotechnology in diverse applications.

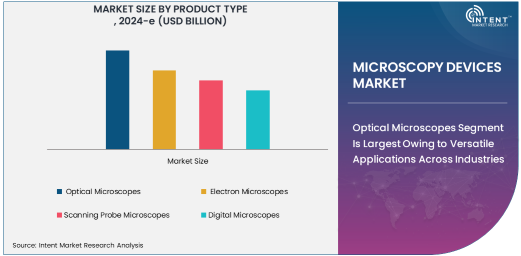

Optical Microscopes Segment Is Largest Owing to Versatile Applications Across Industries

Optical microscopes dominate the microscopy devices market due to their extensive use in academic research, healthcare diagnostics, and industrial applications. Their versatility, cost-effectiveness, and ease of use make them the most widely adopted type of microscope. Within this segment, confocal microscopes are particularly prominent in life sciences research, offering high-resolution imaging and the ability to analyze live cells in real-time.

The increasing adoption of optical microscopes in educational institutions and hospitals further bolsters their market presence. The integration of digital imaging technologies and advanced software has enhanced their utility, making optical microscopes indispensable in both routine and specialized research.

Nanotechnology Drives Fastest Growth in the Application Segment

Nanotechnology is emerging as the fastest-growing application segment in the microscopy devices market. The demand for high-precision imaging tools to analyze nanoscale materials and phenomena has surged with the advancement of nanotechnology in electronics, materials science, and biomedical research. Scanning probe microscopes (SPMs) are particularly significant in this field due to their ability to provide atomic-level imaging and manipulation.

The application of nanotechnology spans industries such as electronics, where it aids in the development of semiconductor chips, and medicine, where it contributes to drug delivery systems and diagnostics. As industries increasingly rely on nanoscale innovations, the role of microscopy in facilitating these advancements continues to expand.

Pharmaceutical & Biotechnology Industries Are Largest Among End-Users Due to Rising R&D Investments

The pharmaceutical and biotechnology industries represent the largest end-user segment for microscopy devices. These industries extensively utilize advanced microscopes for drug discovery, molecular analysis, and cell imaging. Electron microscopes, in particular, play a crucial role in understanding molecular structures and interactions, which are vital for developing new therapeutics.

The rising prevalence of chronic diseases and the growing investment in biologics and personalized medicine have further driven the adoption of microscopy devices in this sector. With an increasing focus on innovation and precision, the demand for high-resolution imaging tools in pharmaceutical and biotechnology research is set to grow.

North America Leads the Market Owing to Advanced Research Infrastructure

North America holds the largest share in the microscopy devices market, attributed to its well-established research infrastructure, significant investments in R&D, and a strong presence of leading microscopy companies. The region benefits from substantial funding for academic research, advancements in healthcare diagnostics, and the growing adoption of nanotechnology in industries such as electronics and materials science.

The United States, in particular, drives the regional market due to its cutting-edge research institutions and a robust semiconductor industry. The presence of key players offering innovative microscopy solutions further consolidates North America's market leadership.

Competitive Landscape and Key Players

The microscopy devices market is characterized by intense competition, with leading companies focusing on technological advancements and strategic collaborations to strengthen their market position. Prominent players such as Carl Zeiss AG, Thermo Fisher Scientific Inc., Nikon Corporation, Olympus Corporation, and Hitachi High-Tech Corporation dominate the market with a wide range of innovative products.

These companies are investing heavily in R&D to develop advanced imaging technologies, including AI-powered microscopes and high-resolution electron microscopes. The competitive landscape is further shaped by mergers and acquisitions, partnerships, and product launches aimed at addressing the evolving needs of various end-user industries.

Recent Developments:

- Thermo Fisher Scientific acquired Phenom-World, a leading provider of desktop scanning electron microscopes (SEM), expanding its portfolio in high-resolution imaging for industrial applications.

- Olympus introduced its new high-resolution confocal laser scanning microscope, designed for advanced life science research, offering improved imaging depth and resolution for cellular analysis.

- Zeiss introduced its new digital microscopy platform for the healthcare sector, providing enhanced imaging capabilities for clinical diagnostics and research in life sciences.

- Nikon released a new scanning electron microscope (SEM) with improved resolution and faster imaging for material science applications, including semiconductor and nanotechnology research.

List of Leading Companies:

- Carl Zeiss AG

- Thermo Fisher Scientific Inc.

- Nikon Corporation

- Olympus Corporation

- Hitachi High-Tech Corporation

- JEOL Ltd.

- Bruker Corporation

- Leica Microsystems (Danaher Corporation)

- Asylum Research (Oxford Instruments)

- FEI Company (Thermo Fisher Scientific)

- Keysight Technologies

- ZEISS Microscopy

- Leica Biosystems

- NT-MDT Spectrum Instruments

- Horiba Ltd.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 10.1 Billion |

|

Forecasted Value (2030) |

USD 15.4 Billion |

|

CAGR (2025 – 2030) |

6.3% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Microscopy Devices Market By Product Type (Optical Microscopes, Electron Microscopes, Scanning Probe Microscopes, Digital Microscopes), By Application (Life Sciences, Material Sciences, Nanotechnology, Semiconductors), By End-User (Academic & Research Institutes, Hospitals & Diagnostic Centers, Pharmaceutical & Biotechnology Industries, Electronics & Semiconductor Industries) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Carl Zeiss AG, Thermo Fisher Scientific Inc., Nikon Corporation, Olympus Corporation, Hitachi High-Tech Corporation, JEOL Ltd., Bruker Corporation, Leica Microsystems (Danaher Corporation), Asylum Research (Oxford Instruments), FEI Company (Thermo Fisher Scientific), Keysight Technologies, ZEISS Microscopy, Leica Biosystems, NT-MDT Spectrum Instruments, Horiba Ltd. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Microscopy Devices Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Optical Microscopes |

|

4.2. Electron Microscopes |

|

4.3. Scanning Probe Microscopes |

|

4.4. Digital Microscopes |

|

5. Microscopy Devices Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Life Sciences |

|

5.2. Material Sciences |

|

5.3. Nanotechnology |

|

5.4. Semiconductors |

|

5.5. Others |

|

6. Microscopy Devices Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Academic & Research Institutes |

|

6.2. Hospitals & Diagnostic Centers |

|

6.3. Pharmaceutical & Biotechnology Industries |

|

6.4. Electronics & Semiconductor Industries |

|

6.5. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Microscopy Devices Market, by Product Type |

|

7.2.7. North America Microscopy Devices Market, by Application |

|

7.2.8. North America Microscopy Devices Market, by End-User |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Microscopy Devices Market, by Product Type |

|

7.2.9.1.2. US Microscopy Devices Market, by Application |

|

7.2.9.1.3. US Microscopy Devices Market, by End-User |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Carl Zeiss AG |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Thermo Fisher Scientific Inc. |

|

9.3. Nikon Corporation |

|

9.4. Olympus Corporation |

|

9.5. Hitachi High-Tech Corporation |

|

9.6. JEOL Ltd. |

|

9.7. Bruker Corporation |

|

9.8. Leica Microsystems (Danaher Corporation) |

|

9.9. Asylum Research (Oxford Instruments) |

|

9.10. FEI Company (Thermo Fisher Scientific) |

|

9.11. Keysight Technologies |

|

9.12. ZEISS Microscopy |

|

9.13. Leica Biosystems |

|

9.14. NT-MDT Spectrum Instruments |

|

9.15. Horiba Ltd. |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Microscopy Devices Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Microscopy Devices Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Microscopy Devices Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA