As per Intent Market Research, the Microscale 3D Printing Market was valued at USD 19.9 billion in 2024-e and will surpass USD 62.1 billion by 2030; growing at a CAGR of 20.8% during 2025 - 2030.

The microscale 3D printing market has seen significant growth due to advancements in technology, materials, and applications across various industries. Microscale 3D printing involves the use of highly precise and intricate manufacturing processes to create small-scale structures and components that cannot be achieved through traditional methods. This market is evolving rapidly, driven by demand from sectors such as aerospace, healthcare, and electronics, where precision and miniaturization are paramount. As the technology matures and becomes more cost-effective, it opens up new possibilities for innovation and customization across industries.

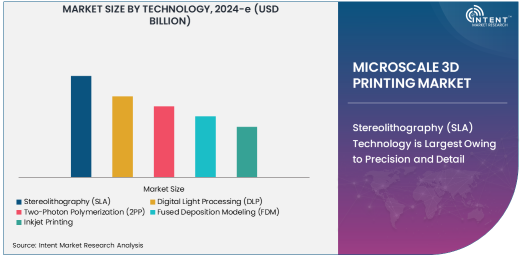

Stereolithography (SLA) Technology is Largest Owing to Precision and Detail

Among the various technologies used in microscale 3D printing, Stereolithography (SLA) is the largest due to its unmatched precision and ability to print fine details. SLA technology uses a laser to cure a photopolymer resin layer by layer, making it ideal for creating intricate designs with high resolution. Industries such as healthcare and aerospace require the high-accuracy capabilities of SLA for applications like medical implants, prototypes, and microcomponents. The technology's ability to produce smooth surfaces and complex geometries further enhances its appeal for producing microscale objects.

SLA's dominance is also attributed to its established presence in the market and its versatility across a wide range of applications. With continuous innovation in SLA printers, such as improved speed and increased material options, this technology is expected to maintain its leading position. As the demand for highly detailed and customized products grows, SLA continues to be the go-to choice for companies needing high-quality microscale 3D printed components.

Photopolymers are the Leading Material Type for Microscale 3D Printing

In terms of material types, photopolymers hold the largest share in the microscale 3D printing market. Photopolymers are the primary materials used in SLA and Digital Light Processing (DLP) technologies, offering high resolution and excellent surface finish for small-scale printing. These materials cure under UV light, allowing for precise layer-by-layer printing of microscale structures. The versatility and flexibility of photopolymers make them highly suitable for medical applications such as dental implants, hearing aids, and surgical guides, where precision is critical.

Furthermore, photopolymers are widely used in prototyping and product development, particularly in the automotive and electronics industries, where rapid prototyping is essential. Their ability to be easily modified and the relatively low cost compared to other materials make photopolymers a preferred choice in the microscale 3D printing market. As industries continue to seek cost-effective solutions without compromising quality, photopolymers are expected to retain their dominant position in the market.

Aerospace Application is Fastest Growing Owing to Demand for Lightweight Components

The aerospace application segment is the fastest growing in the microscale 3D printing market, driven by the increasing need for lightweight, durable, and complex components. Microscale 3D printing allows aerospace manufacturers to produce highly detailed parts with reduced weight, which is crucial for fuel efficiency and overall performance. The ability to create geometries that are impossible to achieve with traditional manufacturing techniques has led to a surge in demand for 3D-printed components in aerospace, from engine parts to structural components.

As aerospace companies focus on improving efficiency and reducing costs, microscale 3D printing provides a solution that meets both objectives. The technology enables the production of small, lightweight parts with complex internal structures that traditional methods cannot achieve. This innovation is particularly valuable for the development of advanced aerospace systems, including drones, satellites, and aircraft, where high precision and custom designs are often required.

Medical Devices & Healthcare End-User Industry is Largest Due to Customization Needs

The medical devices and healthcare end-user industry is the largest within the microscale 3D printing market, owing to the growing demand for custom medical solutions and personalized treatments. Microscale 3D printing allows for the creation of highly precise medical devices, including customized implants, prosthetics, and surgical tools. The ability to print complex geometries that fit an individual’s specific anatomical requirements is driving the adoption of 3D printing in healthcare.

As healthcare providers increasingly focus on personalized medicine, the demand for microscale 3D printing solutions is expected to rise significantly. The technology’s potential to revolutionize the production of medical devices and its role in advancing personalized healthcare are key factors propelling its growth within this sector. Moreover, regulatory advancements and FDA approvals for 3D-printed medical devices further contribute to the expansion of this market segment.

North America is the Largest Region Owing to Advanced Technological Infrastructure

North America is the largest region for microscale 3D printing, primarily due to its advanced technological infrastructure, high adoption of new technologies, and strong presence of key market players. The United States, in particular, has been a leader in adopting 3D printing technologies across various industries, including aerospace, healthcare, and automotive. The region benefits from significant investments in research and development, allowing companies to push the boundaries of what is possible in microscale 3D printing.

The large number of research institutes, universities, and technological hubs in North America further boosts the demand for microscale 3D printing applications in research and education. Additionally, the growing focus on reducing manufacturing costs, improving efficiency, and enhancing product customization is driving the adoption of this technology in North America. As the region continues to foster innovation, North America is expected to maintain its leadership in the microscale 3D printing market.

Leading Companies and Competitive Landscape

Key players in the microscale 3D printing market include Stratasys Ltd., 3D Systems Corporation, Formlabs, and HP Inc., among others. These companies are at the forefront of technological advancements, offering innovative solutions in microscale 3D printing. Stratasys, for example, is known for its high-precision 3D printers used in industries such as aerospace and healthcare. 3D Systems offers a wide range of 3D printing technologies and materials suitable for microscale applications, while Formlabs focuses on providing accessible and high-quality SLA printers.

The competitive landscape in the microscale 3D printing market is characterized by continuous innovation, with companies focusing on enhancing the capabilities of their printers, improving material options, and expanding their product offerings. Partnerships, acquisitions, and investments in R&D are key strategies employed by these companies to strengthen their position in the market. As the demand for high-precision, customizable products continues to rise, competition in the microscale 3D printing market is expected to intensify, with players vying to lead in various applications and industries.

List of Leading Companies:

- Stratasys Ltd.

- 3D Systems Corporation

- ExOne Company

- Nano Dimension

- Materialise NV

- Formlabs

- HP Inc.

- EOS GmbH

- Renishaw plc

- GE Additive

- Ultimaker

- Carbide 3D

- Markforged

- Sisma S.p.A.

- Arcam AB (GE Additive)

Recent Developments:

- In 2024, Stratasys unveiled its latest SLA 3D printer, designed for ultra-precise and microscale applications in the electronics and healthcare industries.

- 3D Systems Acquires Digital Metal 3D Systems expanded its metal 3D printing capabilities by acquiring Digital Metal, enhancing its microscale metal printing offerings for the automotive and aerospace sectors.

- ExOne Launches New Metal 3D Printing System ExOne introduced its new metal 3D printer capable of printing at the microscale, targeting applications in aerospace and healthcare.

- Materialise Expands Microscale 3D Printing Services Materialise has expanded its microscale 3D printing services to include custom healthcare applications, focusing on creating personalized implants and surgical tools.

- Nano Dimension Receives FDA Approval for 3D Printed Medical Devices Nano Dimension received FDA approval for its micro-scale 3D printing technology used in the production of medical devices, allowing them to enter the regulated U.S. healthcare market.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 19.9 billion |

|

Forecasted Value (2030) |

USD 62.1 billion |

|

CAGR (2025 – 2030) |

20.8% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Microscale 3D Printing Market By Technology (Stereolithography, Digital Light Processing, Two-Photon Polymerization, Fused Deposition Modeling, Inkjet Printing), By Material Type (Photopolymers, Metal Alloys, Ceramics, Composites, Polymers), By Application (Aerospace, Healthcare, Electronics, Automotive, Research & Education), By End-User Industry (Medical Devices & Healthcare, Aerospace & Defense, Automotive, Electronics, Consumer Goods & Retail) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Stratasys Ltd., 3D Printing, Additive Manufacturing, Microscale Printing, Nano Printing, SLA Printing, DLP Printing, 2PP Technology, Fused Deposition Modeling, Metal 3D Printing, Photopolymer Printing, Inkjet 3D Printing, Microfabrication, Custom Manufacturing, Prototyping, Rapid Prototyping |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Microscale 3D Printing Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Stereolithography (SLA) |

|

4.2. Digital Light Processing (DLP) |

|

4.3. Two-Photon Polymerization (2PP) |

|

4.4. Fused Deposition Modeling (FDM) |

|

4.5. Inkjet Printing |

|

5. Microscale 3D Printing Market, by Material Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Photopolymers |

|

5.2. Metal Alloys |

|

5.3. Ceramics |

|

5.4. Composites |

|

5.5. Polymers |

|

6. Microscale 3D Printing Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Aerospace |

|

6.2. Healthcare |

|

6.3. Electronics |

|

6.4. Automotive |

|

6.5. Research & Education |

|

7. Microscale 3D Printing Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Medical Devices & Healthcare |

|

7.2. Aerospace & Defense |

|

7.3. Automotive |

|

7.4. Electronics |

|

7.5. Consumer Goods & Retail |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Microscale 3D Printing Market, by Technology |

|

8.2.7. North America Microscale 3D Printing Market, by Material Type |

|

8.2.8. North America Microscale 3D Printing Market, by Application |

|

8.2.9. North America Microscale 3D Printing Market, by End-User Industry |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Microscale 3D Printing Market, by Technology |

|

8.2.10.1.2. US Microscale 3D Printing Market, by Material Type |

|

8.2.10.1.3. US Microscale 3D Printing Market, by Application |

|

8.2.10.1.4. US Microscale 3D Printing Market, by End-User Industry |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Stratasys Ltd. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. 3D Systems Corporation |

|

10.3. ExOne Company |

|

10.4. Nano Dimension |

|

10.5. Materialise NV |

|

10.6. Formlabs |

|

10.7. HP Inc. |

|

10.8. EOS GmbH |

|

10.9. Renishaw plc |

|

10.10. GE Additive |

|

10.11. Ultimaker |

|

10.12. Carbide 3D |

|

10.13. Markforged |

|

10.14. Sisma S.p.A. |

|

10.15. Arcam AB (GE Additive) |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Microscale 3D Printing Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Microscale 3D Printing Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Microscale 3D Printing Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA