As per Intent Market Research, the Microprocessor Market was valued at USD 112.3 billion in 2024-e and will surpass USD 181.0 billion by 2030; growing at a CAGR of 8.3% during 2025 - 2030.

The microprocessor market continues to experience robust growth, driven by technological advancements, increasing consumer demand for smart devices, and the proliferation of IoT. These processors are the backbone of modern computing, powering applications across diverse industries. Segmentation by architecture, end-use industry, technology, application, and region reveals the unique dynamics and growth trajectories within this market.

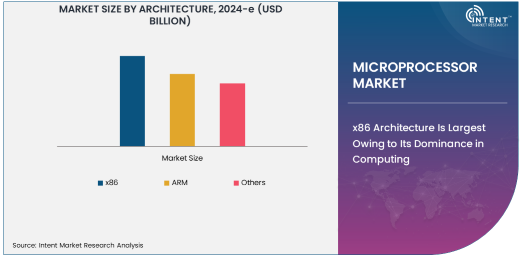

x86 Architecture Is Largest Owing to Its Dominance in Computing

The x86 architecture dominates the microprocessor market, accounting for the largest share due to its widespread adoption in laptops, desktops, and servers. Known for its compatibility and performance, x86 is the backbone of computing systems across various sectors, including corporate IT and cloud infrastructures. Its robust ecosystem of software and hardware integration further cements its position in the market.

As enterprise demand for high-performance computing grows, x86 processors continue to evolve with multi-core capabilities and energy efficiency enhancements. Their presence in both consumer and enterprise-level devices ensures sustained relevance, even amid growing competition from alternative architectures like ARM.

Automotive Segment Is Fastest Growing Owing to Electrification Trends

The automotive industry is the fastest-growing segment, propelled by advancements in electric and autonomous vehicles. Microprocessors are crucial for powering advanced driver-assistance systems (ADAS), in-vehicle infotainment, and powertrain control systems. The shift toward electrification and smart mobility drives significant demand for automotive-grade microprocessors.

Major players are focusing on developing processors optimized for safety-critical applications, low latency, and high reliability. The integration of AI capabilities into automotive processors further accelerates growth, enabling real-time data processing for enhanced vehicle performance and safety.

Quad-Core Technology Is Largest Owing to Balanced Performance and Efficiency

Quad-core processors hold the largest share in the technology segment, striking an ideal balance between performance and power consumption. They are widely adopted in mid-range consumer devices such as smartphones, tablets, and laptops, offering sufficient processing power for multitasking and gaming.

Their affordability and versatility make them a preferred choice for a broad spectrum of applications, from everyday computing to complex industrial automation tasks. Manufacturers continually innovate in this space, integrating AI and machine learning capabilities to maintain their market dominance.

Smartphones & Tablets Application Is Fastest Growing Owing to Rising Global Penetration

The smartphones and tablets segment is experiencing rapid growth, fueled by increasing global adoption of mobile devices and the rollout of 5G networks. Microprocessors designed for mobile devices are becoming more powerful, energy-efficient, and AI-capable, catering to the growing consumer demand for high-performance handheld devices.

Emerging markets play a significant role in this growth, as smartphone penetration accelerates. Advanced processors enable seamless gaming, video streaming, and productivity applications, positioning this subsegment as a key driver in the microprocessor market.

Asia-Pacific Is Fastest Growing Owing to Manufacturing and Consumption Boom

Asia-Pacific is the fastest-growing regional market for microprocessors, driven by the region's position as a global manufacturing hub and its burgeoning consumer electronics industry. Countries like China, South Korea, and Taiwan dominate semiconductor manufacturing, while India and Southeast Asia emerge as growing markets for consumer electronics and IoT devices.

Government initiatives supporting digital transformation and increased investments in R&D contribute to the region's growth. Asia-Pacific's diverse industrial landscape, spanning consumer electronics, automotive, and industrial automation, ensures sustained demand for advanced microprocessors.

Competitive Landscape

The microprocessor market is characterized by intense competition among leading players like Intel, AMD, ARM, Qualcomm, and NVIDIA. These companies focus on innovation, strategic partnerships, and acquisitions to expand their market share. For instance, recent developments in AI-integrated processors and energy-efficient designs underscore the competitive dynamics.

Collaboration with end-use industries and investments in R&D are critical strategies for maintaining leadership. As the market evolves, emerging players and niche technologies, such as RISC-V architecture, pose both challenges and opportunities for established companies.

Recent Developments:

- Intel launched its next-generation Meteor Lake processors with AI capabilities in December 2024.

- NVIDIA acquired a leading semiconductor start-up specializing in AI chips in November 2024.

- ARM introduced a new series of high-performance processors for automotive applications in October 2024.

- Qualcomm announced a strategic partnership with Samsung to develop 5G-integrated microprocessors in late 2024.

- AMD received regulatory approval for its $1.5 billion acquisition of a cloud-specialized chip company in September 2024.

List of Leading Companies:

- Intel Corporation

- AMD (Advanced Micro Devices)

- ARM Limited

- Qualcomm Technologies, Inc.

- NVIDIA Corporation

- Samsung Electronics Co., Ltd.

- Broadcom Inc.

- MediaTek Inc.

- Apple Inc.

- Texas Instruments Incorporated

- IBM Corporation

- STMicroelectronics N.V.

- NXP Semiconductors N.V.

- Marvell Technology Group

- Huawei Technologies Co., Ltd.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 112.3 Billion |

|

Forecasted Value (2030) |

USD 181.0 Billion |

|

CAGR (2025 – 2030) |

8.3% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Microprocessor Market By Architecture (x86, ARM, RISC, MIPS), By End-Use Industry (Consumer Electronics, Automotive, Healthcare, Industrial, Aerospace & Defense), By Technology (Dual-Core, Quad-Core, Octa-Core), By Application (Laptops & Desktops, Smartphones & Tablets, Servers, Embedded Systems) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Intel Corporation, AMD (Advanced Micro Devices), ARM Limited, Qualcomm Technologies, Inc., NVIDIA Corporation, Samsung Electronics Co., Ltd., Broadcom Inc., MediaTek Inc., Apple Inc., Texas Instruments Incorporated, IBM Corporation, STMicroelectronics N.V., NXP Semiconductors N.V., Marvell Technology Group, Huawei Technologies Co., Ltd. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Microprocessor Market, by Architecture (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. x86 |

|

4.2. ARM |

|

4.3. Others |

|

5. Microprocessor Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Consumer Electronics |

|

5.2. Automotive |

|

5.3. Healthcare |

|

5.4. Industrial |

|

5.5. Aerospace & Defense |

|

6. Microprocessor Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Dual-Core |

|

6.2. Quad-Core |

|

6.3. Octa-Core |

|

6.4. Others |

|

7. Microprocessor Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Laptops & Desktops |

|

7.2. Smartphones & Tablets |

|

7.3. Servers |

|

7.4. Embedded Systems |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Microprocessor Market, by Architecture |

|

8.2.7. North America Microprocessor Market, by End-Use Industry |

|

8.2.8. North America Microprocessor Market, by Technology |

|

8.2.9. North America Microprocessor Market, by Application |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Microprocessor Market, by Architecture |

|

8.2.10.1.2. US Microprocessor Market, by End-Use Industry |

|

8.2.10.1.3. US Microprocessor Market, by Technology |

|

8.2.10.1.4. US Microprocessor Market, by Application |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Intel Corporation |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. AMD (Advanced Micro Devices) |

|

10.3. ARM Limited |

|

10.4. Qualcomm Technologies, Inc. |

|

10.5. NVIDIA Corporation |

|

10.6. Samsung Electronics Co., Ltd. |

|

10.7. Broadcom Inc. |

|

10.8. MediaTek Inc. |

|

10.9. Apple Inc. |

|

10.10. Texas Instruments Incorporated |

|

10.11. IBM Corporation |

|

10.12. STMicroelectronics N.V. |

|

10.13. NXP Semiconductors N.V. |

|

10.14. Marvell Technology Group |

|

10.15. Huawei Technologies Co., Ltd. |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Microprocessor Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Microprocessor Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Microprocessor Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA