As per Intent Market Research, the Microneedling Market was valued at USD 597.3 million in 2024-e and will surpass USD 944.4 million by 2030; growing at a CAGR of 6.8% during 2025 - 2030.

The microneedling market is a rapidly growing sector within the global aesthetics industry, driven by the increasing demand for non-invasive treatments that enhance skin appearance and address common dermatological concerns. Microneedling involves the use of fine needles to create controlled micro-injuries in the skin, which stimulates collagen production and promotes skin rejuvenation. The market is expected to expand further due to technological advancements in microneedling devices, the increasing popularity of minimally invasive cosmetic procedures, and growing awareness of skin health.

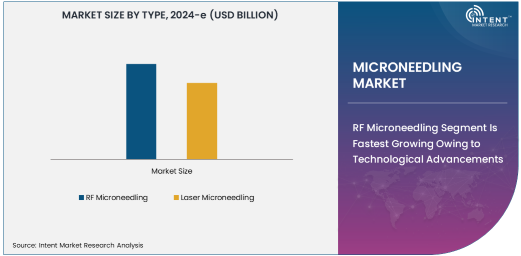

RF Microneedling Segment Is Fastest Growing Owing to Technological Advancements

The RF microneedling segment is experiencing the fastest growth in the market, primarily due to its technological advancements and enhanced efficacy. RF microneedling combines traditional microneedling with radiofrequency energy, offering deeper penetration of the skin and enhancing collagen production. This dual approach not only improves skin texture and tone but also treats deeper layers of the skin, making it effective for a wider range of skin concerns, including fine lines, wrinkles, and skin laxity. As patients seek more effective and non-invasive skin rejuvenation methods, RF microneedling has gained substantial traction.

The growing preference for RF microneedling is also driven by the increasing availability of advanced devices and innovations in the aesthetics industry. These devices come with features such as adjustable needle depth and energy settings, providing customizable treatments tailored to individual patient needs. Furthermore, RF microneedling treatments are considered safe for a variety of skin types, contributing to its widespread adoption among both practitioners and patients.

Dermapen Product Segment Is Largest Due to Its Popularity and Effectiveness

The Dermapen product segment holds the largest share in the microneedling market. This is primarily because of its ease of use, versatility, and ability to deliver consistent and effective results. Dermapen is a motorized device that uses fine needles to create micro-channels in the skin, promoting natural healing and collagen production. Its precision in needle depth and speed offers superior control during treatments, allowing practitioners to effectively address a wide range of skin concerns, from acne scars to general skin rejuvenation.

The Dermapen's popularity is further boosted by its minimal downtime and reduced risk of complications compared to traditional microneedling devices, such as dermarollers. This has made it a preferred choice for both medical professionals and aesthetic clinics. Additionally, the growing trend toward at-home microneedling devices has contributed to the widespread adoption of Dermapen due to its ease of use and accessibility for non-professional users.

Skin Rejuvenation Application Is Largest Owing to High Demand for Aesthetic Treatments

The skin rejuvenation application segment dominates the microneedling market, driven by the rising demand for non-surgical anti-aging treatments. Microneedling is widely used for improving skin texture, tone, and elasticity, making it a go-to solution for individuals seeking to reduce the appearance of fine lines, wrinkles, and age spots. As consumers increasingly opt for minimally invasive procedures over traditional facelift surgeries, skin rejuvenation has emerged as the top application for microneedling.

The effectiveness of microneedling in stimulating collagen and elastin production is a significant factor in its popularity for skin rejuvenation. Moreover, the treatment is versatile and can be used on various areas of the face and body, including the delicate under-eye area, neck, and hands, which further drives its demand. The expanding awareness of skin health and the growing preference for preventive skincare are also key contributors to the increasing popularity of microneedling for skin rejuvenation.

Biotechnology and Pharmaceutical Companies End-User Segment Is Largest Due to Research and Development

The biotechnology and pharmaceutical companies end-user segment holds the largest share in the microneedling market. This is due to the significant investments made by these companies in research and development (R&D) for new treatments and technologies. Microneedling is increasingly being explored in clinical trials and studies for its potential in drug delivery, tissue regeneration, and scar healing, making it a critical tool for innovation in the pharmaceutical and biotechnology sectors.

These companies are leveraging microneedling's ability to enhance skin penetration for the delivery of therapeutic agents, including stem cells and growth factors. This has led to the development of new microneedling-based products for medical purposes beyond aesthetics, such as in wound healing and scar treatment. The growing collaboration between pharmaceutical companies and skincare technology manufacturers further strengthens the role of biotech and pharma companies in the microneedling market.

North America Region Is Largest Owing to High Adoption of Aesthetic Treatments

North America is the largest region in the microneedling market, driven by a high level of awareness and acceptance of aesthetic procedures. The region has a well-established healthcare infrastructure, with a strong presence of dermatology clinics and cosmetic surgery centers offering microneedling services. In addition, the United States and Canada have seen a significant rise in the adoption of non-invasive treatments, fueled by an aging population and increasing consumer demand for effective anti-aging solutions.

North America also leads in terms of technological advancements, with several key players in the microneedling device manufacturing and aesthetics industries based in the region. The regulatory environment in North America supports the growth of the market, with the FDA approving many microneedling devices for clinical use. Moreover, the increasing preference for minimally invasive cosmetic procedures and the availability of skilled practitioners contribute to North America's dominance in the microneedling market.

Leading Companies and Competitive Landscape

The microneedling market is characterized by the presence of several key players that lead in product innovation and market expansion. Companies such as Dermaroller GmbH, Crown Aesthetics, and Cutera are at the forefront of driving technological advancements in microneedling devices. These companies focus on enhancing the efficacy and safety of their products by integrating features such as adjustable needle depth, RF energy, and precision control.

The competitive landscape is marked by strategic partnerships, mergers, and acquisitions, with companies collaborating to expand their market reach and improve their product offerings. The market is also seeing a rise in the number of small and medium-sized enterprises developing new microneedling devices, particularly in emerging markets. As consumer demand for non-invasive aesthetic treatments continues to grow, companies are investing in R&D to offer innovative and effective solutions that cater to a wider range of skin concerns and user preferences.

Recent Developments:

- Dermaroller GmbH introduced a new dermapen device featuring enhanced needle technology for improved skin penetration and patient comfort.

- Cynosure expanded its product portfolio by acquiring Aesthetic Group, a move aimed at strengthening its position in the microneedling market.

- Lumenis Be Ltd. announced FDA approval for its latest RF microneedling device, offering advanced features for skin rejuvenation treatments.

- Alma Lasers formed strategic partnerships with top dermatology clinics to promote the adoption of its microneedling technologies.

- Venus Concept expanded its distribution network in the Asia-Pacific region, aiming to increase market share in emerging markets.

List of Leading Companies:

- Dermaconcepts

- Dermaroller GmbH

- Crown Aesthetics

- Beijing Sanhe Beauty S & T Co., Ltd.

- Aesthetic Group

- Cutera

- Lumenis Be Ltd.

- Cynosure

- Lutronic

- DermaQuip

- EndyMed Medical

- Quanta System S.p.A.

- Syneron Candela

- Alma Lasers

- Venus Concept

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 597.3 Million |

|

Forecasted Value (2030) |

USD 944.4 Million |

|

CAGR (2025 – 2030) |

6.8% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Microneedling Market By Type (RF Microneedling, Laser Microneedling), By Product (Dermapen, Dermaroller, Derma-Stamp), By Application (Skin Rejuvenation, Acne Scar Treatment, Traumatic & Surgical Scars), By End-User (Biotechnology and Pharmaceutical Companies, Academic and Research Institutions, Diagnostic Laboratories, Contract Research Organizations) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Dermaconcepts, Dermaroller GmbH, Crown Aesthetics, Beijing Sanhe Beauty S & T Co., Ltd., Aesthetic Group, Cutera, Lumenis Be Ltd., Cynosure, Lutronic, DermaQuip, EndyMed Medical, Quanta System S.p.A., Syneron Candela, Alma Lasers, Venus Concept |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Microneedling Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. RF Microneedling |

|

4.2. Laser Microneedling |

|

5. Microneedling Market, by Product (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Dermapen |

|

5.2. Dermaroller |

|

5.3. Derma-Stamp |

|

6. Microneedling Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Skin Rejuvenation |

|

6.2. Acne Scar Treatment |

|

6.3. Traumatic & Surgical Scars |

|

7. Microneedling Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Biotechnology and Pharmaceutical Companies |

|

7.2. Academic and Research Institutions |

|

7.3. Diagnostic Laboratories |

|

7.4. Contract Research Organizations (CROs) |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Microneedling Market, by Type |

|

8.2.7. North America Microneedling Market, by Product |

|

8.2.8. North America Microneedling Market, by Application |

|

8.2.9. North America Microneedling Market, by End-User |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Microneedling Market, by Type |

|

8.2.10.1.2. US Microneedling Market, by Product |

|

8.2.10.1.3. US Microneedling Market, by Application |

|

8.2.10.1.4. US Microneedling Market, by End-User |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Dermaconcepts |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Dermaroller GmbH |

|

10.3. Crown Aesthetics |

|

10.4. Beijing Sanhe Beauty S & T Co., Ltd. |

|

10.5. Aesthetic Group |

|

10.6. Cutera |

|

10.7. Lumenis Be Ltd. |

|

10.8. Cynosure |

|

10.9. Lutronic |

|

10.10. DermaQuip |

|

10.11. EndyMed Medical |

|

10.12. Quanta System S.p.A. |

|

10.13. Syneron Candela |

|

10.14. Alma Lasers |

|

10.15. Venus Concept |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Microneedling Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Microneedling Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Microneedling Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA