Microfibrillated Cellulose Market By Type (Wood-Based Microfibrillated Cellulose, Non-Wood-Based Microfibrillated Cellulose), By Application (Paper & Packaging, Composites, Paints & Coatings, Food & Beverages, Personal Care & Cosmetics, Medical & Pharmaceuticals), By Distribution Channel (Direct Sales, Distributors/Wholesalers, Retailers, Online Sales), and By Region; Global Insights & Forecast (2023 – 2030)

As per Intent Market Research, the Microfibrillated Cellulose Market was valued at USD 1.2 billion in 2024-e and will surpass USD 2.9 billion by 2030; growing at a CAGR of 15.7% during 2025 - 2030.

The microfibrillated cellulose (MFC) market is rapidly expanding as industries seek sustainable alternatives to traditional materials. Derived from natural cellulose fibers, MFC is biodegradable and offers superior mechanical properties, making it an attractive option for a wide range of applications. With growing environmental concerns and the increasing push for eco-friendly solutions, MFC is gaining traction across sectors such as paper & packaging, composites, personal care, and food & beverages. The market is experiencing significant innovation, particularly in non-wood-based cellulose sources and applications, providing further opportunities for growth.

The versatility of microfibrillated cellulose, which can improve product performance while being environmentally friendly, positions it as a key player in the global materials market. Technological advancements in MFC production and application methods are expected to support its continued growth, especially as industries increasingly prioritize sustainability and circular economy practices.

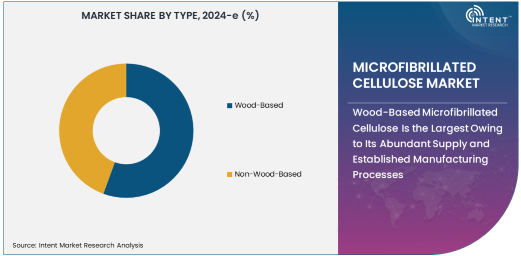

Wood-Based Microfibrillated Cellulose Is the Largest Owing to Its Abundant Supply and Established Manufacturing Processes

Wood-based microfibrillated cellulose remains the largest segment in the market, driven by the readily available and renewable source of cellulose. This type of MFC is produced from wood fibers, which offer excellent mechanical properties such as strength, stiffness, and durability. These properties make wood-based MFC particularly valuable in industries such as paper & packaging and composites, where strength and performance are crucial.

As the demand for sustainable products increases, wood-based MFC continues to be the preferred choice in many applications due to the well-established supply chain and manufacturing infrastructure. Its ability to enhance the quality of products while being biodegradable ensures its dominance in the microfibrillated cellulose market.

Paper & Packaging Is the Largest Application Segment Owing to Rising Demand for Sustainable Packaging Solutions

Paper & packaging is the largest application segment for microfibrillated cellulose, driven by the growing demand for sustainable and high-performance materials in packaging. MFC enhances the strength, durability, and quality of paper products, making it an ideal material for packaging applications. The trend toward eco-friendly, biodegradable packaging solutions is pushing manufacturers to adopt MFC, which is seen as a superior alternative to synthetic materials.

The increasing focus on reducing plastic use and improving the sustainability of packaging is expected to fuel further demand for microfibrillated cellulose in the paper & packaging industry. As industries work toward reducing their environmental footprint, MFC’s role in enhancing packaging performance and sustainability continues to grow.

Direct Sales Is the Largest Distribution Channel Owing to Strong Buyer Relationships and Customized Solutions

Direct sales is the largest distribution channel for microfibrillated cellulose, as it allows manufacturers to establish strong, direct relationships with large-volume buyers. Industries such as automotive, paper & packaging, and personal care benefit from direct sales due to the ability to offer tailored solutions to meet specific needs. This distribution method provides greater control over pricing, product quality, and customer service, making it a preferred choice for both manufacturers and large-scale buyers.

As the demand for MFC grows, direct sales channels provide a way for companies to efficiently manage supply chains and ensure that products meet the unique requirements of customers. This channel’s capacity to foster personalized service and strong business relationships ensures its continued dominance in the MFC market.

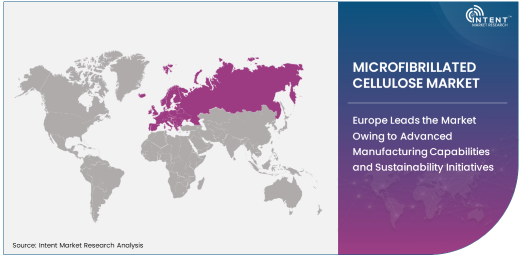

Europe Leads the Market Owing to Advanced Manufacturing Capabilities and Sustainability Initiatives

Europe dominates the microfibrillated cellulose (MFC) market, driven by the region's advanced manufacturing infrastructure and strong emphasis on sustainable materials. The use of MFC in various applications, including paper & packaging, composites, and personal care, is bolstered by regulatory support for eco-friendly and renewable alternatives. Countries such as Germany, Sweden, and Finland have emerged as key players, benefiting from well-established pulp and paper industries.

The European Union's stringent environmental policies and circular economy initiatives have further accelerated the adoption of MFC across industries. With growing consumer demand for biodegradable and high-performance materials, Europe is poised to remain a leader in this market, fostering innovation and collaboration among industry stakeholders.

Leading Companies and Competitive Landscape

The microfibrillated cellulose market is competitive, with key players such as Stora Enso, UPM-Kymmene Corporation, Celluforce, and Nippon Paper Industries leading the way in production and innovation. These companies focus on advancing MFC technology to meet growing demand in applications ranging from packaging to personal care. Research and development play a crucial role in expanding the range of MFC applications and improving its performance.

The competitive landscape is characterized by increasing collaborations and partnerships between industry players and research institutions to foster innovation. As the demand for sustainable and high-performance materials continues to rise, companies that can offer cost-effective, eco-friendly solutions while maintaining high product standards are likely to lead the market.

Recent Developments:

- In December 2024, UPM-Kymmene Corporation launched a new line of microfibrillated cellulose-based products. These products aim to replace synthetic fibers in the automotive and packaging sectors, offering a more sustainable alternative.

- In November 2024, Stora Enso introduced a new paper packaging solution incorporating microfibrillated cellulose. This move is part of their strategy to reduce plastic use in packaging and improve the strength of paper products.

- In October 2024, Celluforce announced a partnership with a major food manufacturer to develop cellulose-based packaging. This collaboration aims to introduce more sustainable and biodegradable packaging options in the food industry.

- In September 2024, Nanocellulose unveiled a new type of composite material using microfibrillated cellulose. This new material is designed for use in automotive components, offering lightweight and high-strength properties.

- In August 2024, Daicel Corporation opened a new production facility for microfibrillated cellulose in Japan. This expansion is intended to meet the growing demand for eco-friendly materials across various industries.

List of Leading Companies:

- UPM-Kymmene Corporation

- Stora Enso

- Celluforce

- Nanocellulose

- Daicel Corporation

- American Process Inc.

- BFGoodrich

- Sappi Lanaken

- Borregaard

- Blue Goose Biorefineries

- Pulpex

- Nippon Paper Industries Co., Ltd.

- Metsä Group

- GreenWood Global

- The Dow Chemical Company

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.2 billion |

|

Forecasted Value (2030) |

USD 2.9 billion |

|

CAGR (2025 – 2030) |

15.7% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Microfibrillated Cellulose Market By Type (Wood-Based Microfibrillated Cellulose, Non-Wood-Based Microfibrillated Cellulose), By Application (Paper & Packaging, Composites, Paints & Coatings, Food & Beverages, Personal Care & Cosmetics, Medical & Pharmaceuticals), By Distribution Channel (Direct Sales, Distributors/Wholesalers, Retailers, Online Sales) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

UPM-Kymmene Corporation, Stora Enso, Celluforce, Nanocellulose, Daicel Corporation, American Process Inc., BFGoodrich, Sappi Lanaken, Borregaard, Blue Goose Biorefineries, Pulpex, Nippon Paper Industries Co., Ltd., Metsä Group, GreenWood Global, The Dow Chemical Company |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Microfibrillated Cellulose Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Wood-Based |

|

4.2. Non-Wood-Based |

|

5. Microfibrillated Cellulose Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Paper & Packaging |

|

5.2. Composites |

|

5.3. Paints & Coatings |

|

5.4. Food & Beverages |

|

5.5. Personal Care & Cosmetics |

|

5.6. Medical & Pharmaceuticals |

|

5.7. Others |

|

6. Microfibrillated Cellulose Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Direct Sales |

|

6.2. Distributors/Wholesalers |

|

6.3. Retailers |

|

6.4. Online Sales |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Microfibrillated Cellulose Market, by Type |

|

7.2.7. North America Microfibrillated Cellulose Market, by Application |

|

7.2.8. North America Microfibrillated Cellulose Market, by Distribution Channel |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Microfibrillated Cellulose Market, by Type |

|

7.2.9.1.2. US Microfibrillated Cellulose Market, by Application |

|

7.2.9.1.3. US Microfibrillated Cellulose Market, by Distribution Channel |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. UPM-Kymmene Corporation |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Stora Enso |

|

9.3. Celluforce |

|

9.4. Nanocellulose |

|

9.5. Daicel Corporation |

|

9.6. American Process Inc. |

|

9.7. BFGoodrich |

|

9.8. Sappi Lanaken |

|

9.9. Borregaard |

|

9.10. Blue Goose Biorefineries |

|

9.11. Pulpex |

|

9.12. Nippon Paper Industries Co., Ltd. |

|

9.13. Metsä Group |

|

9.14. GreenWood Global |

|

9.15. The Dow Chemical Company |

|

10. Appendix |

Let us connect with you TOC

A comprehensive market research approach was employed to gather and analyze data on the Microfibrillated Cellulose Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Microfibrillated Cellulose Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Microfibrillated Cellulose Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

Available Formats