As per Intent Market Research, the Microcell Basestation Construction Market was valued at USD 4.5 billion in 2024-e and will surpass USD 9.0 billion by 2030; growing at a CAGR of 12.1% during 2025 - 2030.

The microcell basestation construction market is pivotal in the evolution of telecommunications infrastructure, driven by the increasing demand for faster and more reliable wireless communication networks. With the global rise in data consumption, particularly in urban areas, there is a pressing need for efficient, high-performance mobile networks. Microcells, small cells, and other compact base station technologies are being deployed to improve signal coverage and capacity in both indoor and outdoor environments. These technologies are particularly beneficial in congested urban areas where traditional macrocell towers are insufficient in providing reliable service due to high traffic loads and interference.

The surge in mobile data usage, especially with the advent of 5G networks, is further accelerating the demand for microcell basestation infrastructure. As 5G networks require a dense network of small cells to deliver high-speed connectivity, the construction of microcells and related components has become an essential part of modern telecommunication strategies. The shift toward smaller, more efficient cellular infrastructure is not only about enhancing mobile experiences but also about enabling the broader adoption of smart city technologies and IoT solutions, where real-time connectivity is crucial.

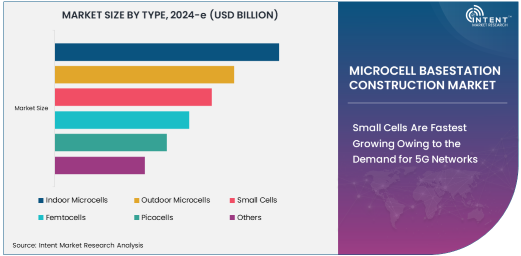

Small Cells Are Fastest Growing Owing to the Demand for 5G Networks

Among the various types of microcell basestations, small cells are the fastest growing segment, owing to their critical role in the roll-out of 5G networks. Small cells are designed to provide localized coverage, improving both capacity and data speeds in areas with high traffic, such as city centers, stadiums, and public spaces. These cells are essential for meeting the requirements of 5G, which demands a denser network of smaller, more efficient base stations to handle increased data traffic and provide ultra-low latency.

The adoption of small cells is growing rapidly, driven by the need to support the bandwidth demands of 5G technologies, which are expected to support a massive increase in connected devices and the proliferation of data-intensive applications. Small cells allow telecom operators to expand their network coverage and capacity efficiently, without the need for costly and space-consuming macrocell towers. Additionally, small cells are easier to install and maintain, making them an attractive solution for urban environments and areas with space constraints.

Power Supply Systems Are Critical Components in Microcell Basestation Construction

Among the various components required for the efficient operation of microcell basestations, power supply systems are essential. These systems are crucial for ensuring that microcells and small cells receive a stable and reliable power source to function effectively. Power supply systems for microcells include advanced backup power solutions, such as batteries and power-over-ethernet (PoE) solutions, that ensure uninterrupted service even during power outages. This is particularly important in high-traffic areas where network reliability is vital for maintaining seamless communication.

The demand for advanced power supply systems is growing rapidly, owing to the increasing need for uninterrupted and energy-efficient network operations, especially in urban environments and regions with high data usage. Telecom operators are focusing on improving the energy efficiency of their base station infrastructure, which helps to reduce operational costs while providing uninterrupted service. Additionally, advancements in power management technologies are driving the development of next-generation power supply solutions for microcell and small cell applications, further contributing to the growth of this component segment.

Telecommunications Sector Drives the Microcell Basestation Market's Growth

The telecommunications industry is the largest end-use sector for microcell basestation construction, as it directly benefits from the increased demand for improved network capacity and coverage. With the ongoing rollout of 5G networks globally, telecommunications companies are investing heavily in small cell and microcell infrastructure to meet the growing needs of their customers. These cells enhance network performance by extending coverage to underserved areas, increasing capacity in high-traffic zones, and reducing network congestion.

Telecommunications companies are also leveraging microcell basestations to optimize their existing network infrastructure, ensuring seamless connectivity for consumers and businesses. As mobile data consumption continues to rise, telecom operators are relying on these technologies to support higher-speed mobile internet, improved quality of service, and greater network reliability. The focus on next-generation networks, including 5G, is expected to sustain growth in the telecommunications sector's adoption of microcell basestation technology.

North America Leads the Market Owing to Advanced 5G Infrastructure Deployment

North America is the largest region in the microcell basestation construction market, driven by the advanced telecommunications infrastructure and the rapid deployment of 5G networks in the region. The United States, in particular, has been at the forefront of 5G adoption, with major telecom companies investing significantly in small cells and other microcell technologies to build out their 5G networks. The demand for enhanced wireless connectivity, combined with government initiatives supporting the expansion of next-generation mobile networks, has positioned North America as a leader in the microcell basestation market.

The high demand for smart city solutions, IoT applications, and data-intensive services in North America further fuels the adoption of microcell technologies. As the region continues to deploy and expand 5G infrastructure, North America is expected to maintain its leadership, driving further innovation in the microcell basestation construction market.

Competitive Landscape and Leading Companies

The microcell basestation construction market is highly competitive, with several key players dominating the industry. Leading companies such as Ericsson, Huawei, Nokia, and ZTE are at the forefront of providing microcell and small cell solutions to telecom operators worldwide. These companies are continuously innovating their products to support the deployment of 5G networks, focusing on improving network efficiency, reducing latency, and enhancing overall performance.

In addition to these established players, there is a growing presence of smaller, specialized companies that offer innovative solutions in base station components, such as antennas, base station controllers, and backhaul equipment. The competitive landscape is characterized by continuous technological advancements, strategic partnerships, and mergers and acquisitions, as companies aim to capture a larger share of the rapidly expanding market for microcell basestation construction. As the demand for 5G networks continues to grow, these companies will play a crucial role in shaping the future of mobile telecommunications infrastructure.

Recent Developments:

- In November 2024, Huawei Technologies announced the launch of a new range of microcell base stations designed for 5G networks. The product aims to enhance urban connectivity and provide better coverage in high-density areas.

- In October 2024, Ericsson signed a major deal with a leading telecom operator to deploy small cells for their 5G network expansion in Europe. This project is part of their strategy to enhance network coverage and capacity.

- In September 2024, Nokia Networks introduced an advanced base station controller for microcell and small cell integration. This new technology aims to streamline network management and improve operational efficiency for telecom operators.

- In August 2024, ZTE Corporation secured a contract for the deployment of outdoor microcells across major cities in Asia. The contract will support the rollout of 5G services and enhance network performance.

- In July 2024, CommScope announced a partnership with a global telecommunications provider to install a new generation of microcell base stations. The partnership focuses on improving wireless network coverage in urban and rural areas.

List of Leading Companies:

- Huawei Technologies Co. Ltd.

- Ericsson AB

- Nokia Networks

- ZTE Corporation

- Samsung Electronics Co. Ltd.

- Cisco Systems, Inc.

- CommScope Holding Company, Inc.

- Alcatel-Lucent (Nokia)

- FiberHome Telecommunication Technologies Co., Ltd.

- T-Mobile US, Inc.

- AT&T Inc.

- Qualcomm Incorporated

- Arista Networks, Inc.

- Juniper Networks, Inc.

- NEC Corporation

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 4.5 billion |

|

Forecasted Value (2030) |

USD 9.0 billion |

|

CAGR (2025 – 2030) |

12.1% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Microcell Basestation Construction Market By Type (Indoor Microcells, Outdoor Microcells, Small Cells, Femtocells, Picocells), By Component (Antennas, Base Station Controllers, Power Supply Systems, Backhaul Equipment, Cabling and Connectors), By End-Use (Telecommunications, Enterprise, Public Infrastructure, Smart Cities) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Huawei Technologies Co. Ltd., Ericsson AB, Nokia Networks, ZTE Corporation, Samsung Electronics Co. Ltd., Cisco Systems, Inc., CommScope Holding Company, Inc., Alcatel-Lucent (Nokia), FiberHome Telecommunication Technologies Co., Ltd., T-Mobile US, Inc., AT&T Inc., Qualcomm Incorporated, Arista Networks, Inc., Juniper Networks, Inc., NEC Corporation |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Microcell Basestation Construction Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Indoor Microcells |

|

4.2. Outdoor Microcells |

|

4.3. Small Cells |

|

4.4. Femtocells |

|

4.5. Picocells |

|

4.6. Others |

|

5. Microcell Basestation Construction Market, by Component (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Antennas |

|

5.2. Base Station Controllers |

|

5.3. Power Supply Systems |

|

5.4. Backhaul Equipment |

|

5.5. Cabling and Connectors |

|

5.6. Others |

|

6. Microcell Basestation Construction Market, by End-Use (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Telecommunications |

|

6.2. Enterprise |

|

6.3. Public Infrastructure |

|

6.4. Smart Cities |

|

6.5. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Microcell Basestation Construction Market, by Type |

|

7.2.7. North America Microcell Basestation Construction Market, by Component |

|

7.2.8. North America Microcell Basestation Construction Market, by End-Use |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Microcell Basestation Construction Market, by Type |

|

7.2.9.1.2. US Microcell Basestation Construction Market, by Component |

|

7.2.9.1.3. US Microcell Basestation Construction Market, by End-Use |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Huawei Technologies Co. Ltd. |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Ericsson AB |

|

9.3. Nokia Networks |

|

9.4. ZTE Corporation |

|

9.5. Samsung Electronics Co. Ltd. |

|

9.6. Cisco Systems, Inc. |

|

9.7. CommScope Holding Company, Inc. |

|

9.8. Alcatel-Lucent (Nokia) |

|

9.9. FiberHome Telecommunication Technologies Co., Ltd. |

|

9.10. T-Mobile US, Inc. |

|

9.11. AT&T Inc. |

|

9.12. Qualcomm Incorporated |

|

9.13. Arista Networks, Inc. |

|

9.14. Juniper Networks, Inc. |

|

9.15. NEC Corporation |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Microcell Basestation Construction Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Microcell Basestation Construction Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Microcell Basestation Construction Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA