As per Intent Market Research, the Microcars Market was valued at USD 0.8 billion in 2024-e and will surpass USD 2.4 billion by 2030; growing at a CAGR of 20.2% during 2025 - 2030.

The microcars market is experiencing notable growth, fueled by a shift in consumer preferences toward more compact, fuel-efficient vehicles that align with the need for sustainable transportation solutions in urban environments. Microcars, characterized by their small size and low fuel consumption, are gaining traction as ideal options for city dwellers seeking affordable, environmentally-friendly, and easy-to-park alternatives to traditional cars. With governments worldwide implementing stringent emission regulations and promoting eco-friendly vehicles, the market for microcars is seeing an uptick in demand. Additionally, the rising popularity of electric vehicles (EVs) and the growing emphasis on reducing carbon footprints are further accelerating this trend.

In urban centers with congested roads and limited parking space, microcars are becoming the vehicle of choice for consumers who prioritize convenience and cost-effectiveness. The adoption of microcars is also supported by the growing trend of shared mobility services and a push for innovative solutions that address the challenges of urban mobility. The introduction of electric and hybrid microcars, which offer both environmental benefits and lower operating costs, is expected to drive the market forward, appealing to a broader consumer base.

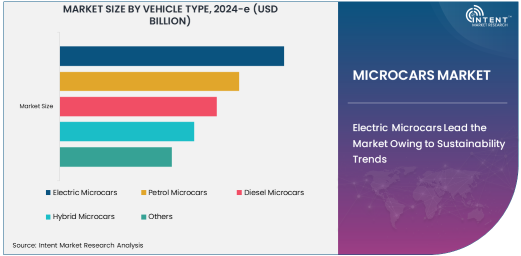

Electric Microcars Lead the Market Owing to Sustainability Trends

Electric microcars are the largest and fastest-growing segment within the microcars market, owing to the growing focus on sustainability and the shift toward zero-emission transportation. Electric vehicles (EVs) are gaining popularity worldwide due to their reduced environmental impact, lower operating costs, and the growing availability of EV infrastructure such as charging stations. Electric microcars, being compact and energy-efficient, offer the perfect solution for city driving, reducing the reliance on fossil fuels and contributing to cleaner urban air.

As governments continue to incentivize the purchase of electric vehicles through subsidies, tax rebates, and infrastructure investments, the electric microcar segment is poised to benefit from these initiatives. Furthermore, advancements in battery technology are improving the range and efficiency of electric microcars, making them more appealing to consumers who are seeking practical, eco-friendly solutions for their transportation needs. This trend is expected to sustain growth in the electric microcar market, particularly in regions with high urban population densities and supportive policies for green mobility.

Automotive Manufacturers Drive the Market’s Expansion

The automotive manufacturers segment is the largest end-use industry within the microcars market, as established automakers and new entrants alike are increasingly investing in the development and production of microcars to cater to the rising demand for compact, cost-effective, and eco-friendly vehicles. These manufacturers are responding to consumer preferences for smaller vehicles that can navigate through crowded city streets with ease and offer lower fuel consumption compared to traditional cars.

In addition to catering to individual consumers, automotive manufacturers are expanding their offerings to include microcars tailored for car-sharing services, tourism, and leisure industries. This diversification is allowing manufacturers to tap into new revenue streams while meeting the evolving needs of urban mobility. As the trend of sustainable and efficient transportation continues to gain momentum, automotive manufacturers are likely to remain at the forefront of market development.

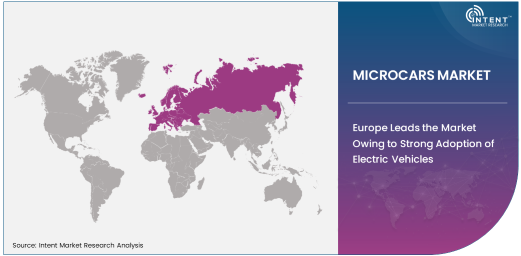

Europe Leads the Market Owing to Strong Adoption of Electric Vehicles

Europe is the largest region in the microcars market, driven by strong consumer adoption of electric vehicles, stringent emission regulations, and government initiatives aimed at reducing carbon emissions. European countries such as Germany, France, and the Netherlands have implemented policies that encourage the purchase and use of electric vehicles, including tax incentives, subsidies, and the development of EV charging infrastructure. The European Union's focus on green mobility and sustainability has further fueled the demand for electric microcars in urban areas, where their compact size and low operating costs make them particularly attractive to consumers.

Additionally, European cities with high population densities and limited parking spaces are ideal environments for microcars. The growing preference for shared mobility solutions, such as electric microcar-sharing platforms, is also contributing to the region’s dominance in the market. With continued advancements in battery technology and infrastructure, Europe is expected to maintain its leadership position in the microcars market.

Competitive Landscape and Leading Companies

The microcars market is highly competitive, with a mix of established automakers and emerging companies competing to capture market share. Key players in the market include global automotive giants such as Renault, Fiat, and Smart, which have made significant investments in the development of electric and hybrid microcars. These companies are focusing on innovation, offering stylish and efficient microcars designed for urban mobility.

In addition to traditional automakers, new entrants are leveraging cutting-edge technology to produce microcars that cater to the growing demand for electric and eco-friendly vehicles. The competitive landscape is characterized by continuous product development, with companies striving to offer vehicles that are not only energy-efficient but also affordable and technologically advanced. As the market for microcars continues to evolve, companies that can balance sustainability, affordability, and innovation are likely to emerge as the leaders in this space.

Recent Developments:

- In November 2024, Tata Motors launched an updated version of its Nano electric vehicle. The new model is expected to cater to the growing demand for affordable, electric urban mobility solutions in India.

- In October 2024, Renault S.A. revealed plans to launch a new range of electric microcars targeting European urban markets. This expansion aims to capitalize on the rising demand for low-emission vehicles.

- In September 2024, Smart Automobile Co. Ltd. introduced a new electric microcar designed specifically for car-sharing services. This model is designed for efficient, short-term rentals in major cities worldwide.

- In August 2024, Peugeot S.A. announced the development of a micro hybrid vehicle under their compact car segment. This new model combines small size with hybrid efficiency, appealing to urban commuters.

- In July 2024, Mahindra & Mahindra Ltd. entered the European microcar market with its e2o Plus electric model. This move is part of the company's strategy to expand its footprint in environmentally conscious markets.

List of Leading Companies:

- Tata Motors

- Smart Automobile Co. Ltd.

- Renault S.A.

- Peugeot S.A.

- BMW AG

- Daihatsu Motor Co., Ltd.

- Fiat Chrysler Automobiles (FCA)

- Honda Motor Co., Ltd.

- Nissan Motor Co., Ltd.

- Suzuki Motor Corporation

- Mahindra & Mahindra Ltd.

- Volkswagen Group

- Toyota Motor Corporation

- BYD Company Limited

- Citroën

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 0.8 billion |

|

Forecasted Value (2030) |

USD 2.4 billion |

|

CAGR (2025 – 2030) |

20.2% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Microcars Market By Vehicle Type (Electric Microcars, Petrol Microcars, Diesel Microcars, Hybrid Microcars), By End-Use Industry (Automotive Manufacturers, Transportation & Logistics, Tourism & Leisure, Car-Sharing Services) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Tata Motors, Smart Automobile Co. Ltd., Renault S.A., Peugeot S.A., BMW AG, Daihatsu Motor Co., Ltd., Fiat Chrysler Automobiles (FCA), Honda Motor Co., Ltd., Nissan Motor Co., Ltd., Suzuki Motor Corporation, Mahindra & Mahindra Ltd., Volkswagen Group, Toyota Motor Corporation, BYD Company Limited, Citroën |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Microcars Market, by Vehicle Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Electric Microcars |

|

4.2. Petrol Microcars |

|

4.3. Diesel Microcars |

|

4.4. Hybrid Microcars |

|

4.5. Others |

|

5. Microcars Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Automotive Manufacturers |

|

5.2. Transportation & Logistics |

|

5.3. Tourism & Leisure |

|

5.4. Car-Sharing Services |

|

5.5. Others |

|

6. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Regional Overview |

|

6.2. North America |

|

6.2.1. Regional Trends & Growth Drivers |

|

6.2.2. Barriers & Challenges |

|

6.2.3. Opportunities |

|

6.2.4. Factor Impact Analysis |

|

6.2.5. Technology Trends |

|

6.2.6. North America Microcars Market, by Vehicle Type |

|

6.2.7. North America Microcars Market, by End-Use Industry |

|

6.2.8. By Country |

|

6.2.8.1. US |

|

6.2.8.1.1. US Microcars Market, by Vehicle Type |

|

6.2.8.1.2. US Microcars Market, by End-Use Industry |

|

6.2.8.2. Canada |

|

6.2.8.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

6.3. Europe |

|

6.4. Asia-Pacific |

|

6.5. Latin America |

|

6.6. Middle East & Africa |

|

7. Competitive Landscape |

|

7.1. Overview of the Key Players |

|

7.2. Competitive Ecosystem |

|

7.2.1. Level of Fragmentation |

|

7.2.2. Market Consolidation |

|

7.2.3. Product Innovation |

|

7.3. Company Share Analysis |

|

7.4. Company Benchmarking Matrix |

|

7.4.1. Strategic Overview |

|

7.4.2. Product Innovations |

|

7.5. Start-up Ecosystem |

|

7.6. Strategic Competitive Insights/ Customer Imperatives |

|

7.7. ESG Matrix/ Sustainability Matrix |

|

7.8. Manufacturing Network |

|

7.8.1. Locations |

|

7.8.2. Supply Chain and Logistics |

|

7.8.3. Product Flexibility/Customization |

|

7.8.4. Digital Transformation and Connectivity |

|

7.8.5. Environmental and Regulatory Compliance |

|

7.9. Technology Readiness Level Matrix |

|

7.10. Technology Maturity Curve |

|

7.11. Buying Criteria |

|

8. Company Profiles |

|

8.1. Tata Motors |

|

8.1.1. Company Overview |

|

8.1.2. Company Financials |

|

8.1.3. Product/Service Portfolio |

|

8.1.4. Recent Developments |

|

8.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

8.2. Smart Automobile Co. Ltd. |

|

8.3. Renault S.A. |

|

8.4. Peugeot S.A. |

|

8.5. BMW AG |

|

8.6. Daihatsu Motor Co., Ltd. |

|

8.7. Fiat Chrysler Automobiles (FCA) |

|

8.8. Honda Motor Co., Ltd. |

|

8.9. Nissan Motor Co., Ltd. |

|

8.10. Suzuki Motor Corporation |

|

8.11. Mahindra & Mahindra Ltd. |

|

8.12. Volkswagen Group |

|

8.13. Toyota Motor Corporation |

|

8.14. BYD Company Limited |

|

8.15. Citroën |

|

9. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Microcars Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Microcars Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Microcars Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA