As per Intent Market Research, the Microbiome Sequencing Service Market was valued at USD 1.4 billion in 2024-e and will surpass USD 4.1 billion by 2030; growing at a CAGR of 19.7% during 2025 - 2030.

The microbiome sequencing service market has witnessed significant growth, driven by the increasing recognition of the critical role of microbiomes in human health, agriculture, and the environment. Microbiome sequencing enables the comprehensive analysis of microbial communities, providing valuable insights into their composition, diversity, and function. With advancements in sequencing technologies, such as 16S rRNA sequencing, whole genome sequencing (WGS), and shotgun metagenomic sequencing, this market has evolved to support applications in clinical diagnostics, research, agriculture, and food industries. The growing demand for personalized medicine and the increasing focus on understanding microbiomes' impact on disease prevention, treatment, and overall health are further fueling market expansion.

As the healthcare and pharmaceutical industries continue to embrace microbiome research, the demand for microbiome sequencing services has grown substantially. Similarly, agricultural and biotechnology sectors are exploring the use of microbiome data to improve crop yield, soil health, and pest management. The continuous advancements in sequencing techniques and bioinformatics tools are enhancing the accuracy and efficiency of microbiome profiling, leading to new discoveries and applications across various industries.

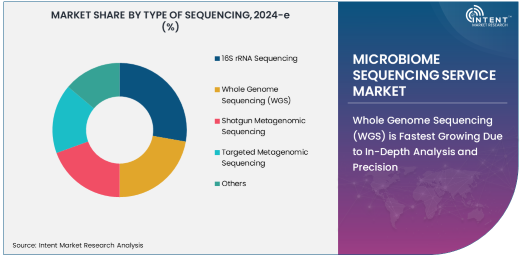

Whole Genome Sequencing (WGS) is Fastest Growing Due to In-Depth Analysis and Precision

Whole genome sequencing (WGS) is the fastest-growing segment within the microbiome sequencing service market, owing to its ability to provide a comprehensive, high-resolution view of an organism's genetic makeup. WGS allows for the analysis of entire genomes, enabling the identification of genetic variations and the study of complex microbial communities in greater detail. This makes it particularly valuable in clinical diagnostics and pharmaceutical applications, where understanding the genetic basis of diseases, including microbial infections, is crucial.

In clinical diagnostics, WGS is increasingly used to detect pathogens, identify antibiotic resistance markers, and uncover genetic predispositions to diseases, offering more precise and personalized treatment options. The ability to assess the entire microbial genome makes WGS an invaluable tool for researchers, pharmaceutical companies, and clinicians, contributing to its rapid adoption and market growth.

Sequencing Services Are the Largest Segment Owing to Their Critical Role in Microbiome Profiling

Sequencing services represent the largest segment within the microbiome sequencing service market, as they form the foundation of microbiome analysis. These services encompass various types of sequencing, including 16S rRNA sequencing, whole genome sequencing, and shotgun metagenomic sequencing, each offering unique insights into microbial communities. The demand for sequencing services is particularly high in clinical diagnostics, research, and agriculture, where accurate and comprehensive microbiome data is essential for decision-making.

Sequencing services are essential for generating the raw data required for microbiome profiling. In clinical settings, sequencing services help in identifying the microbial composition of patients, enabling personalized treatment plans based on the microbiome's influence on health. In agriculture, these services are used to analyze soil health and improve crop productivity. As sequencing technology becomes more advanced and accessible, sequencing services continue to dominate the market.

Research & Academia Leads the Market Owing to Increasing Focus on Microbiome Research

The research and academia sector is the leading end-use industry for microbiome sequencing services, as academic and research institutions are at the forefront of studying the microbiome’s role in health, disease, and environmental interactions. Research institutions utilize microbiome sequencing to explore the complex relationships between microbiomes and various biological processes, making significant contributions to the growing body of knowledge in genomics, immunology, and microbiology.

This growing body of research is pivotal in advancing understanding of the microbiome's role in human diseases such as cancer, obesity, and autoimmune disorders, which in turn drives demand for microbiome sequencing services. The continuous funding and development of microbiome-related research projects in both public and private sectors contribute to the ongoing growth of the research and academia segment.

Asia-Pacific Region Leads the Market Owing to Growing Research Investments and Healthcare Advancements

The Asia-Pacific (APAC) region is the largest market for microbiome sequencing services, driven by increasing investments in research and development, advancements in healthcare infrastructure, and the growing adoption of personalized medicine. Countries like China, Japan, and India are witnessing rapid developments in the biotechnology and healthcare sectors, which have led to an increased focus on microbiome research and its applications.

Moreover, the increasing prevalence of lifestyle diseases and the growing awareness of the microbiome’s impact on health are driving demand for microbiome sequencing services in the region. The growing number of research institutions and healthcare providers adopting microbiome sequencing for clinical and research applications further strengthens APAC’s position as the leading region in this market.

Competitive Landscape and Leading Companies

The competitive landscape in the microbiome sequencing service market is highly fragmented, with several established players and emerging startups offering diverse solutions. Leading companies include Illumina, Thermo Fisher Scientific, and Qiagen, which offer a wide range of sequencing platforms and services tailored for microbiome analysis. These companies are heavily investing in research and development to advance sequencing technologies, improve data accuracy, and expand the range of services available to researchers and clinicians.

The market also sees growing competition from specialized service providers that focus on niche applications, such as custom microbiome profiling, data analysis, and bioinformatics support. As the demand for microbiome-based diagnostics and personalized treatments continues to grow, the competitive landscape is expected to evolve with more companies focusing on innovation and offering integrated solutions to cater to the needs of healthcare, research, and agriculture industries.

Recent Developments:

- In December 2024, Illumina, Inc. announced a partnership with a leading pharmaceutical company to develop microbiome-based therapies. This collaboration will leverage sequencing technology to identify biomarkers for personalized treatments.

- In November 2024, Thermo Fisher Scientific Inc. launched a new microbiome sequencing platform, offering faster results and enhanced accuracy for research applications. This platform aims to streamline microbiome analysis in clinical and research settings.

- In October 2024, BGI Group expanded its microbiome sequencing services to include personalized gut health testing. This new service is expected to cater to the growing demand for consumer-based microbiome diagnostics.

- In September 2024, QIAGEN N.V. introduced an integrated platform for microbiome research, combining sample preparation, sequencing, and bioinformatics. This platform aims to simplify the workflow for researchers and clinicians.

- In August 2024, Oxford Nanopore Technologies Ltd. launched a mobile microbiome sequencing device for field-based applications. This innovation is expected to revolutionize microbiome analysis in remote locations and during travel.

List of Leading Companies:

- Illumina, Inc.

- Thermo Fisher Scientific Inc.

- BGI Group

- QIAGEN N.V.

- Oxford Nanopore Technologies Ltd.

- 10x Genomics, Inc.

- Bio-Rad Laboratories, Inc.

- Novogene Co., Ltd.

- Fulgent Genetics, Inc.

- Zymo Research Corporation

- PerkinElmer, Inc.

- Genomics PLC

- LGC Group

- GENEWIZ, Inc.

- Macrogen Inc.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.4 billion |

|

Forecasted Value (2030) |

USD 4.1 billion |

|

CAGR (2025 – 2030) |

19.7% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Microbiome Sequencing Service Market By Type of Sequencing (16S rRNA Sequencing, Whole Genome Sequencing (WGS), Shotgun Metagenomic Sequencing, Targeted Metagenomic Sequencing), By Service (Sequencing Services, Data Analysis and Interpretation, Bioinformatics Support, Custom Microbiome Profiling), By End-Use (Clinical Diagnostics, Research & Academia, Pharmaceuticals, Agriculture & Biotechnology, Food & Beverages) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Illumina, Inc., Thermo Fisher Scientific Inc., BGI Group, QIAGEN N.V., Oxford Nanopore Technologies Ltd., 10x Genomics, Inc., Bio-Rad Laboratories, Inc., Novogene Co., Ltd., Fulgent Genetics, Inc., Zymo Research Corporation, PerkinElmer, Inc., Genomics PLC, LGC Group, GENEWIZ, Inc., Macrogen Inc. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Microbiome Sequencing Service Market, by Type of Sequencing (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. 16S rRNA Sequencing |

|

4.2. Whole Genome Sequencing (WGS) |

|

4.3. Shotgun Metagenomic Sequencing |

|

4.4. Targeted Metagenomic Sequencing |

|

4.5. Others |

|

5. Microbiome Sequencing Service Market, by Service (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Sequencing Services |

|

5.2. Data Analysis and Interpretation |

|

5.3. Bioinformatics Support |

|

5.4. Custom Microbiome Profiling |

|

5.5. Others |

|

6. Microbiome Sequencing Service Market, by End-Use (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Clinical Diagnostics |

|

6.2. Research & Academia |

|

6.3. Pharmaceuticals |

|

6.4. Agriculture & Biotechnology |

|

6.5. Food & Beverages |

|

6.6. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Microbiome Sequencing Service Market, by Type of Sequencing |

|

7.2.7. North America Microbiome Sequencing Service Market, by Service |

|

7.2.8. North America Microbiome Sequencing Service Market, by End-Use |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Microbiome Sequencing Service Market, by Type of Sequencing |

|

7.2.9.1.2. US Microbiome Sequencing Service Market, by Service |

|

7.2.9.1.3. US Microbiome Sequencing Service Market, by End-Use |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Illumina, Inc. |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Thermo Fisher Scientific Inc. |

|

9.3. BGI Group |

|

9.4. QIAGEN N.V. |

|

9.5. Oxford Nanopore Technologies Ltd. |

|

9.6. 10x Genomics, Inc. |

|

9.7. Bio-Rad Laboratories, Inc. |

|

9.8. Novogene Co., Ltd. |

|

9.9. Fulgent Genetics, Inc. |

|

9.10. Zymo Research Corporation |

|

9.11. PerkinElmer, Inc. |

|

9.12. Genomics PLC |

|

9.13. LGC Group |

|

9.14. GENEWIZ, Inc. |

|

9.15. Macrogen Inc. |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Microbiome Sequencing Service Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Microbiome Sequencing Service Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Microbiome Sequencing Service Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA