As per Intent Market Research, the Microbial Enhanced Oil Recovery Market was valued at USD 1.1 billion in 2024-e and will surpass USD 2.6 billion by 2030; growing at a CAGR of 15.8% during 2025 - 2030.

The microbial enhanced oil recovery (MEOR) market is witnessing considerable expansion as oil producers look for cost-effective and environmentally friendly solutions to enhance the recovery rates of mature and declining oilfields. MEOR techniques, utilizing microorganisms such as bacteria, fungi, and algae, have proven effective in enhancing oil mobility, reducing viscosity, and improving the overall extraction process. As oilfields become more challenging to exploit using traditional methods, the need for sustainable recovery solutions is driving the growth of MEOR technologies.

Over the years, MEOR has gained attention for its ability to increase the efficiency of oil recovery from both onshore and offshore oilfields. With a focus on minimizing environmental impact and lowering operational costs, MEOR offers an attractive alternative to conventional chemical and mechanical extraction methods. The growing focus on sustainability and technological advancements in microbial technologies is expected to continue fueling market growth in the coming years.

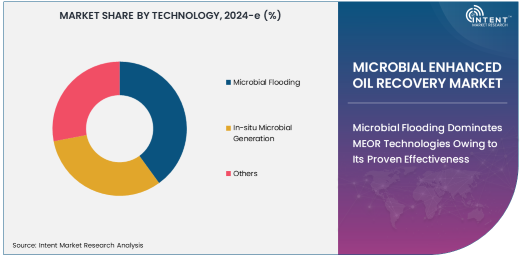

Microbial Flooding Dominates MEOR Technologies Owing to Its Proven Effectiveness

Microbial flooding is the leading technology in the MEOR market, owing to its proven ability to improve oil recovery from mature oilfields. This method involves injecting microorganisms into oil reservoirs, where they produce beneficial byproducts such as gases, acids, and surfactants that enhance oil displacement and reduce viscosity. This technology has been widely adopted in both onshore and offshore oilfields, particularly in regions with mature or declining oil reserves. As the demand for efficient and sustainable oil recovery methods continues to grow, microbial flooding remains the most widely implemented MEOR technology.

The adoption of microbial flooding is further driven by its cost-effectiveness compared to conventional oil recovery methods. This method is capable of improving recovery rates without the need for extensive infrastructure changes, making it an attractive solution for operators looking to enhance production from existing reservoirs. As a result, microbial flooding continues to lead the MEOR market and is expected to maintain its dominance in the coming years.

Bacteria Are the Primary Microorganisms Used Owing to Their Versatility

Bacteria are the most commonly used microorganisms in microbial enhanced oil recovery, owing to their versatility and ability to produce a wide range of metabolic byproducts. These byproducts help reduce oil viscosity, alter the fluid dynamics of reservoirs, and enhance oil mobility. Bacteria thrive in harsh conditions, making them well-suited for the extreme environments often found in oilfields. The ability of bacteria to generate gases, acids, and surfactants that improve oil displacement is a key factor in their widespread use in MEOR applications.

The ongoing research into bacterial strains with higher efficacy in oil recovery continues to expand the potential applications of bacteria-based MEOR. This focus on innovation is expected to drive further adoption of bacterial technologies, especially in regions with challenging oil extraction environments. As operators seek more sustainable and cost-effective methods for increasing oil recovery, bacteria-based MEOR technologies will continue to play a central role in the market.

Onshore Oilfields Lead MEOR Applications Owing to Ease of Implementation

Onshore oilfields remain the largest application segment in the microbial enhanced oil recovery market. This is primarily due to the ease of implementing MEOR technologies in onshore reservoirs. These oilfields are often mature, with production rates declining as conventional extraction methods become less effective. Microbial enhanced oil recovery offers a cost-effective solution for revitalizing these fields and boosting production without the need for significant infrastructure investments. Additionally, the accessibility of onshore fields makes it easier to introduce and monitor microbial technologies, contributing to their widespread adoption.

The continued demand for increased recovery from onshore oilfields is expected to drive the MEOR market's growth. With a large number of onshore fields reaching the end of their primary production phase, operators are increasingly turning to microbial flooding and other MEOR techniques to extract additional oil and extend the lifespan of these reservoirs.

North America Leads the Market Owing to Mature Oilfields and Technological Advancements

North America is the largest region in the microbial enhanced oil recovery market, driven by the abundance of mature oilfields and the region's early adoption of advanced oil extraction technologies. The United States, in particular, has been a pioneer in implementing microbial flooding and other MEOR methods. The vast number of mature onshore oilfields in North America presents significant opportunities for MEOR to enhance production and improve recovery rates. Additionally, North America's strong focus on sustainability and environmentally friendly practices has led to increased adoption of microbial technologies in oilfields.

The region's technological advancements in oil recovery, coupled with the rising demand for cost-effective and sustainable extraction methods, position North America as the dominant market for MEOR. As operators continue to focus on maximizing recovery from existing oilfields, North America's MEOR market is expected to maintain its leadership in the years to come.

Leading Companies and Competitive Landscape in the MEOR Market

The microbial enhanced oil recovery market is highly competitive, with several key players driving technological advancements and market expansion. Major companies such as Baker Hughes, Schlumberger, Halliburton, and Biotechniq dominate the market, offering a range of microbial technologies and solutions for oil recovery. These companies are continuously investing in research and development to enhance the efficiency of microbial agents and improve their performance in challenging reservoir conditions.

The competitive landscape is characterized by partnerships, acquisitions, and collaborations, as companies aim to expand their product offerings and strengthen their market position. The growing demand for sustainable oil recovery methods is prompting companies to focus on innovation and develop more efficient microbial technologies to meet the needs of oil operators. As the MEOR market continues to grow, these leading players are expected to maintain a strong presence through technological advancements and strategic partnerships.

Recent Developments:

- In December 2024, Baker Hughes announced the successful deployment of microbial flooding technology in offshore oil fields.

- In November 2024, Schlumberger introduced an advanced in-situ microbial generation system for enhanced oil recovery.

- In October 2024, Halliburton completed a project using microbial enhanced oil recovery for a large onshore oil reservoir.

- In September 2024, BP plc invested in microbial oil recovery technologies to increase efficiency in offshore drilling.

- In August 2024, TotalEnergies signed a partnership agreement to apply microbial flooding techniques for onshore oil recovery.

List of Leading Companies:

- Baker Hughes Company

- Schlumberger Limited

- Halliburton Company

- ExxonMobil Corporation

- TotalEnergies SE

- BP plc

- Chevron Corporation

- Royal Dutch Shell plc

- Eni S.p.A.

- PetroChina Company Limited

- Lukoil Oil Company

- Weatherford International plc

- Saipem S.p.A.

- Woodside Petroleum Ltd.

- TechnipFMC PLC

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.1 billion |

|

Forecasted Value (2030) |

USD 2.6 billion |

|

CAGR (2025 – 2030) |

15.8% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Microbial Enhanced Oil Recovery Market By Technology (Microbial Flooding, In-situ Microbial Generation), By Application (Onshore, Offshore), By Microorganisms Used (Bacteria, Fungi, Algae), By End-Use Industry (Oil & Gas, Petrochemical) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Baker Hughes Company, Schlumberger Limited, Halliburton Company, ExxonMobil Corporation, TotalEnergies SE, BP plc, Chevron Corporation, Royal Dutch Shell plc, Eni S.p.A., PetroChina Company Limited, Lukoil Oil Company, Weatherford International plc, Saipem S.p.A., Woodside Petroleum Ltd., TechnipFMC PLC |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Microbial Enhanced Oil Recovery Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Microbial Flooding |

|

4.2. In-situ Microbial Generation |

|

4.3. Others |

|

5. Microbial Enhanced Oil Recovery Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Onshore |

|

5.2. Offshore |

|

5.3. Others |

|

6. Microbial Enhanced Oil Recovery Market, by Microorganisms Used (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Bacteria |

|

6.2. Fungi |

|

6.3. Algae |

|

6.4. Others |

|

7. Microbial Enhanced Oil Recovery Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Oil & Gas |

|

7.2. Petrochemical |

|

7.3. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Microbial Enhanced Oil Recovery Market, by Technology |

|

8.2.7. North America Microbial Enhanced Oil Recovery Market, by Application |

|

8.2.8. North America Microbial Enhanced Oil Recovery Market, by Microorganisms Used |

|

8.2.9. North America Microbial Enhanced Oil Recovery Market, by End-Use Industry |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Microbial Enhanced Oil Recovery Market, by Technology |

|

8.2.10.1.2. US Microbial Enhanced Oil Recovery Market, by Application |

|

8.2.10.1.3. US Microbial Enhanced Oil Recovery Market, by Microorganisms Used |

|

8.2.10.1.4. US Microbial Enhanced Oil Recovery Market, by End-Use Industry |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Baker Hughes Company |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Schlumberger Limited |

|

10.3. Halliburton Company |

|

10.4. ExxonMobil Corporation |

|

10.5. TotalEnergies SE |

|

10.6. BP plc |

|

10.7. Chevron Corporation |

|

10.8. Royal Dutch Shell plc |

|

10.9. Eni S.p.A. |

|

10.10. PetroChina Company Limited |

|

10.11. Lukoil Oil Company |

|

10.12. Weatherford International plc |

|

10.13. Saipem S.p.A. |

|

10.14. Woodside Petroleum Ltd. |

|

10.15. TechnipFMC PLC |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Microbial Enhanced Oil Recovery Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Microbial Enhanced Oil Recovery Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Microbial Enhanced Oil Recovery Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA