Micro Molding Materials Market By Material Type (Plastics, Metals, Ceramics), By Application (Automotive, Medical Devices, Electronics, Consumer Goods), By End-Use Industry (Injection Molding, 3D Printing), and By Region; Global Insights & Forecast (2023 - 2030)

As per Intent Market Research, the Micro Molding Materials Market was valued at USD 2.1 billion in 2024-e and will surpass USD 4.7 billion by 2030; growing at a CAGR of 14.3% during 2025 - 2030.

The micro molding materials market is witnessing significant growth, driven by the increasing demand for precision and miniaturization in various industries. Micro molding is a critical process for producing small, intricate parts that require high precision, often used in sectors such as automotive, medical devices, electronics, and consumer goods. As technology advances, the demand for micro components with complex geometries is expanding, fueling the need for specialized materials that can meet these high standards. The materials used in micro molding must not only support miniaturization but also possess enhanced properties such as durability, high performance, and resistance to various environmental factors.

Additionally, the rising demand for lightweight materials and the shift towards more efficient manufacturing processes are also propelling market growth. The increasing use of automation and 3D printing technologies in the production of micro parts is further driving the adoption of micro molding materials, as they enable more precise, cost-effective, and scalable manufacturing. This market is expected to expand as more industries incorporate micro molding processes into their production lines, offering innovative solutions for end-user applications.

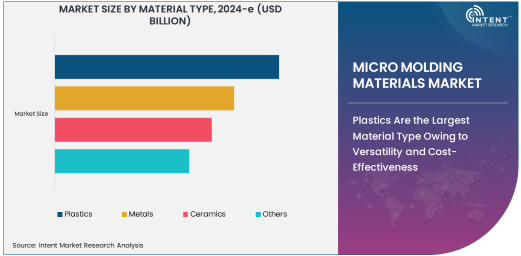

Plastics Are the Largest Material Type Owing to Versatility and Cost-Effectiveness

Plastics are the largest material type in the micro molding materials market due to their versatility, ease of molding, and cost-effectiveness. Plastics are widely used in micro molding because they can be easily molded into complex shapes and offer excellent performance in terms of strength, durability, and flexibility. The ability to use a variety of plastics, such as thermoplastics and thermosets, makes them suitable for a wide range of applications, from automotive components to medical devices and electronics. Plastics also provide a lower-cost alternative compared to metals and ceramics, making them a preferred choice for many manufacturers.

The demand for plastic-based micro molding materials is further driven by the increasing use of plastic components in industries such as automotive and electronics, where lightweight, high-performance parts are essential. In medical device applications, plastic materials are often chosen for their biocompatibility, which is crucial for devices that come into contact with the human body. As technological advancements continue to improve the properties of plastics, such as better heat resistance and mechanical strength, their dominance in the micro molding materials market is expected to remain strong.

Medical Devices Drive Application Growth Owing to Precision and Customization Needs

The medical devices application segment is witnessing rapid growth in the micro molding materials market, driven by the need for precision, customization, and biocompatibility in medical components. Medical devices, such as surgical instruments, diagnostic tools, and drug delivery devices, require highly specialized parts that are small in size but critical in their functionality. Micro molding allows for the production of these small, intricate parts with high precision, ensuring they meet the stringent requirements of the medical industry.

The need for customization in medical devices further fuels the demand for micro molding materials. As the healthcare industry continues to evolve, there is an increasing focus on personalized medicine and patient-specific solutions, requiring the development of customized micro components. These factors make the medical devices segment one of the fastest-growing applications within the micro molding materials market. The ability of micro molding to produce complex shapes with tight tolerances makes it an ideal manufacturing process for medical applications, driving innovation and expanding market opportunities.

Injection Molding Leads End-Use Industry Owing to Established Process and Efficiency

Injection molding is the leading end-use industry in the micro molding materials market, owing to its established process and high efficiency in producing small, precise parts. Injection molding is a widely used manufacturing process that involves injecting molten material into a mold to create complex shapes. The process is highly efficient and capable of producing large volumes of small parts with consistent quality, making it ideal for industries that require mass production of micro components, such as automotive, medical devices, and consumer goods.

The continued development of injection molding technologies, including improvements in mold design and material formulations, has enhanced the process's capabilities. These advancements allow manufacturers to produce micro components with greater precision, faster cycle times, and lower production costs. As a result, injection molding remains the dominant end-use industry in the micro molding materials market, with continued growth expected as the demand for high-quality, miniature parts expands across various sectors.

Asia Pacific Leads the Market Owing to Strong Manufacturing Base and Demand for Micro Parts

Asia Pacific is the leading region in the micro molding materials market, primarily driven by the strong manufacturing base in countries such as China, Japan, and South Korea. The region's dominance can be attributed to its well-established industrial infrastructure, which includes advanced molding technologies and a large number of manufacturers catering to diverse industries such as automotive, electronics, and medical devices. As these industries continue to grow, the demand for micro parts that require precise molding processes has increased, boosting the need for specialized micro molding materials.

In addition to the manufacturing strength, Asia Pacific is also home to a rapidly expanding consumer electronics market, which is driving the demand for micro components. The region is also witnessing significant advancements in the medical device industry, where micro molding is essential for producing small, high-precision components. With ongoing investments in research and development, Asia Pacific is expected to maintain its leadership position in the global micro molding materials market.

Leading Companies and Competitive Landscape

The micro molding materials market is highly competitive, with several key players providing advanced materials and molding solutions to meet the growing demand for precision micro components. Prominent companies in the market include BASF SE, Covestro AG, and Huntsman Corporation, which offer a wide range of micro molding materials, including thermoplastics, metals, and specialized materials for medical device applications. These companies are focused on developing high-performance materials that meet the stringent requirements of industries such as medical devices, automotive, and electronics.

In addition to traditional material suppliers, the market also includes companies that specialize in micro molding technologies, such as Arburg, ENGEL, and Sumitomo (SHI) Demag. These players provide advanced injection molding solutions that enable the production of micro components with high precision and efficiency. As demand for micro molded parts continues to rise, competition among these companies will intensify, driving further innovation in materials and manufacturing processes. The market is also expected to see strategic partnerships and collaborations between material suppliers, technology providers, and end-users, as companies seek to enhance their product offerings and expand their market presence.

Recent Developments:

- In November 2024, BASF SE launched a new line of high-performance plastics for micro molding applications.

- In October 2024, Dow Chemical announced a strategic partnership with Solvay to develop advanced materials for medical device molding.

- In September 2024, Covestro AG unveiled a new range of thermoplastic materials designed for micro injection molding.

- In August 2024, Sabic announced the expansion of its production facility for precision molding materials in Asia.

- In July 2024, DuPont de Nemours introduced a new series of metal materials suitable for micro molding applications.

List of Leading Companies:

- BASF SE

- Dow Chemical Company

- Sabic

- DuPont de Nemours, Inc.

- Sumitomo Chemical

- Covestro AG

- Evonik Industries

- LG Chem

- Huntsman Corporation

- Mitsubishi Chemical Corporation

- Solvay S.A.

- DSM Engineering Materials

- Asahi Kasei Corporation

- Celanese Corporation

- Eastman Chemical Company

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 2.1 billion |

|

Forecasted Value (2030) |

USD 4.7 billion |

|

CAGR (2025 – 2030) |

14.3% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Micro Molding Materials Market By Material Type (Plastics, Metals, Ceramics), By Application (Automotive, Medical Devices, Electronics, Consumer Goods), By End-Use Industry (Injection Molding, 3D Printing) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

BASF SE, Dow Chemical Company, Sabic, DuPont de Nemours, Inc., Sumitomo Chemical, Covestro AG, Evonik Industries, LG Chem, Huntsman Corporation, Mitsubishi Chemical Corporation, Solvay S.A., DSM Engineering Materials, Asahi Kasei Corporation, Celanese Corporation, Eastman Chemical Company |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Micro Molding Materials Market, by Material Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Plastics |

|

4.2. Metals |

|

4.3. Ceramics |

|

4.4. Others |

|

5. Micro Molding Materials Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Automotive |

|

5.2. Medical Devices |

|

5.3. Electronics |

|

5.4. Consumer Goods |

|

5.5. Others |

|

6. Micro Molding Materials Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Injection Molding |

|

6.2. 3D Printing |

|

6.3. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Micro Molding Materials Market, by Material Type |

|

7.2.7. North America Micro Molding Materials Market, by Application |

|

7.2.8. North America Micro Molding Materials Market, by End-Use Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Micro Molding Materials Market, by Material Type |

|

7.2.9.1.2. US Micro Molding Materials Market, by Application |

|

7.2.9.1.3. US Micro Molding Materials Market, by End-Use Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. BASF SE |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Dow Chemical Company |

|

9.3. Sabic |

|

9.4. DuPont de Nemours, Inc. |

|

9.5. Sumitomo Chemical |

|

9.6. Covestro AG |

|

9.7. Evonik Industries |

|

9.8. LG Chem |

|

9.9. Huntsman Corporation |

|

9.10. Mitsubishi Chemical Corporation |

|

9.11. Solvay S.A. |

|

9.12. DSM Engineering Materials |

|

9.13. Asahi Kasei Corporation |

|

9.14. Celanese Corporation |

|

9.15. Eastman Chemical Company |

|

10. Appendix |

Let us connect with you TOC

A comprehensive market research approach was employed to gather and analyze data on the Micro Molding Materials Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Micro Molding Materials Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Micro Molding Materials Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

Available Formats