As per Intent Market Research, the Micellar Casein Market was valued at USD 2.1 billion in 2024-e and will surpass USD 4.6 billion by 2030; growing at a CAGR of 13.7% during 2025 - 2030.

The micellar casein market has experienced steady growth due to the increasing demand for high-quality protein supplements and functional foods. Micellar casein, a slow-digesting protein, is derived from milk and is renowned for its ability to provide sustained amino acid release over a prolonged period. This characteristic makes it especially popular among athletes, fitness enthusiasts, and health-conscious consumers looking for protein supplements that support muscle growth, repair, and overall health. The market for micellar casein is expected to continue expanding as consumers increasingly turn to natural, nutrient-rich alternatives to meet their nutritional needs.

The growth in the micellar casein market is further supported by the rising awareness of the benefits of protein consumption in various aspects of health, from sports nutrition to weight management. As consumers become more knowledgeable about the nutritional value of casein and its various applications, the demand for both powdered and liquid forms of micellar casein is likely to grow, expanding the market across various regions. The versatility of micellar casein in products like protein shakes, bars, and other functional foods is also driving its popularity.

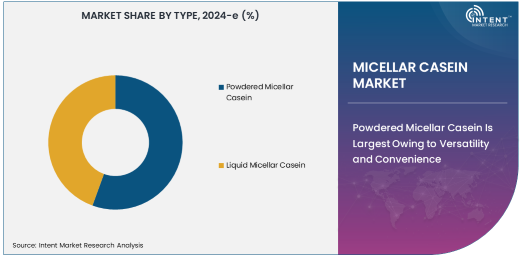

Powdered Micellar Casein Is Largest Owing to Versatility and Convenience

Powdered micellar casein is the largest segment in the market due to its versatility, ease of use, and convenience. It can be easily mixed with water or milk to create protein shakes or added to recipes for baking and cooking. The powdered form is particularly appealing to sports enthusiasts, fitness professionals, and consumers seeking a high-protein, low-fat supplement to support muscle recovery and weight management. The ability to customize serving sizes and mix it into various food products further enhances its popularity.

In addition to its use in protein shakes and supplements, powdered micellar casein is commonly incorporated into meal replacement products, energy bars, and other food items. Its slow-digesting properties make it an ideal choice for those seeking prolonged satiety, making it a staple in the diets of athletes and individuals focused on long-term muscle repair and recovery. With its diverse application range and consumer appeal, powdered micellar casein is expected to maintain its leadership in the market.

Sports Nutrition Is Fastest Growing Application Segment Due to Rising Fitness Trends

Sports nutrition is the fastest-growing application segment in the micellar casein market, driven by the increasing global interest in fitness and bodybuilding. Micellar casein is an excellent choice for individuals looking to optimize muscle recovery and growth post-exercise, and its slow digestion rate makes it ideal for consumption before sleep or during long periods between meals. As the fitness culture continues to thrive, the demand for sports nutrition products containing micellar casein is expected to rise rapidly.

The growth in sports nutrition is closely tied to the rising awareness of the importance of protein in muscle building and recovery. Micellar casein, being a high-quality source of protein, is gaining favor among athletes and fitness enthusiasts who require consistent and steady amino acid release throughout the day. With an increasing number of people incorporating fitness into their daily routines, sports nutrition products that include micellar casein are becoming essential in the diet of many health-conscious individuals.

Food & Beverages Lead the End-Use Industry Segment Owing to Widespread Application

The food & beverages industry is the largest end-use industry for micellar casein, owing to its widespread application in various food products. Micellar casein is used as an ingredient in a range of food and beverage products, including protein shakes, smoothies, energy bars, and meal replacements. Its ability to deliver a high-quality protein source with a sustained release of amino acids makes it a valuable addition to products targeting health-conscious consumers and those looking to manage their weight or build muscle.

The demand for protein-enriched foods has surged as consumers become more aware of the importance of protein in maintaining a balanced diet. This trend is driving the use of micellar casein in the food & beverages industry, with manufacturers increasingly incorporating it into their product offerings. As consumer preferences shift towards healthier and functional foods, the food & beverages industry will continue to lead in the consumption of micellar casein.

North America Leads the Micellar Casein Market Owing to High Consumer Demand for Sports Nutrition

North America is the leading region in the micellar casein market, driven by high consumer demand for sports nutrition products and protein supplements. The region's strong fitness culture and widespread awareness of the benefits of protein consumption for muscle recovery, weight management, and overall health have fueled the growth of micellar casein products. Additionally, the presence of key manufacturers and distributors in North America has contributed to the availability and accessibility of micellar casein in the region.

As the demand for protein-rich products continues to rise, North America remains a key market for micellar casein, particularly in the sports nutrition sector. The growing trend of fitness and wellness, coupled with increasing health awareness, ensures that North America will continue to be a dominant player in the global micellar casein market.

Leading Companies and Competitive Landscape

The micellar casein market is highly competitive, with several leading players focusing on innovation and product differentiation. Companies like Glanbia plc, FrieslandCampina, and Arla Foods are among the key players in the market, offering a wide range of micellar casein products catering to different consumer needs. These companies are investing in research and development to improve the quality of their products and expand their applications across various industries, including food & beverages, pharmaceuticals, and dietary supplements.

The competitive landscape is also characterized by strategic partnerships, collaborations, and mergers and acquisitions as companies look to strengthen their market position and enhance product offerings. As the demand for micellar casein continues to grow, companies are focusing on expanding their distribution networks and targeting emerging markets to capitalize on the rising awareness of the benefits of micellar casein. With a strong focus on innovation and quality, the competitive landscape of the micellar casein market is expected to remain dynamic in the coming years.

Recent Developments:

- In November 2024, Fonterra launched a new line of micellar casein-based sports nutrition products.

- In October 2024, Glanbia Nutritionals introduced a liquid micellar casein product for weight management solutions.

- In September 2024, FrieslandCampina expanded its micellar casein production facility in Europe.

- In August 2024, Lactalis Ingredients partnered with a pharmaceutical company to develop medical nutrition products using micellar casein.

- In July 2024, Leprino Foods announced the acquisition of a micellar casein processing plant in North America.

List of Leading Companies:

- Fonterra Co-operative Group Limited

- FrieslandCampina

- Arla Foods

- Glanbia Nutritionals

- Lactalis Ingredients

- Kerry Group

- Leprino Foods

- Agropur Cooperative

- Saputo Inc.

- DMK Deutsches Milchkontor GmbH

- Synlait Milk Limited

- Vitale (India)

- The Tatua Co-operative Dairy Company

- Murray Goulburn Co-operative Co. Limited

- Davisco Foods International, Inc.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 2.1 billion |

|

Forecasted Value (2030) |

USD 4.6 billion |

|

CAGR (2025 – 2030) |

13.7% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Micellar Casein Market By Type (Powdered Micellar Casein, Liquid Micellar Casein), By Application (Sports Nutrition, Infant Nutrition, Medical Nutrition, Weight Management), By End-Use Industry (Food & Beverages, Dietary Supplements, Pharmaceuticals) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Fonterra Co-operative Group Limited, FrieslandCampina, Arla Foods, Glanbia Nutritionals, Lactalis Ingredients, Kerry Group, Leprino Foods, Agropur Cooperative, Saputo Inc., DMK Deutsches Milchkontor GmbH, Synlait Milk Limited, Vitale (India), The Tatua Co-operative Dairy Company, Murray Goulburn Co-operative Co. Limited, Davisco Foods International, Inc. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Micellar Casein Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Powdered Micellar Casein |

|

4.2. Liquid Micellar Casein |

|

5. Micellar Casein Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Sports Nutrition |

|

5.2. Infant Nutrition |

|

5.3. Medical Nutrition |

|

5.4. Weight Management |

|

5.5. Others |

|

6. Micellar Casein Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Food & Beverages |

|

6.2. Dietary Supplements |

|

6.3. Pharmaceuticals |

|

6.4. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Micellar Casein Market, by Type |

|

7.2.7. North America Micellar Casein Market, by Application |

|

7.2.8. North America Micellar Casein Market, by End-Use Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Micellar Casein Market, by Type |

|

7.2.9.1.2. US Micellar Casein Market, by Application |

|

7.2.9.1.3. US Micellar Casein Market, by End-Use Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Fonterra Co-operative Group Limited |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. FrieslandCampina |

|

9.3. Arla Foods |

|

9.4. Glanbia Nutritionals |

|

9.5. Lactalis Ingredients |

|

9.6. Kerry Group |

|

9.7. Leprino Foods |

|

9.8. Agropur Cooperative |

|

9.9. Saputo Inc. |

|

9.10. DMK Deutsches Milchkontor GmbH |

|

9.11. Synlait Milk Limited |

|

9.12. Vitale (India) |

|

9.13. The Tatua Co-operative Dairy Company |

|

9.14. Murray Goulburn Co-operative Co. Limited |

|

9.15. Davisco Foods International, Inc. |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Micellar Casein Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Micellar Casein Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Micellar Casein Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA