As per Intent Market Research, the Metrology Software Market was valued at USD 4.3 billion in 2024-e and will surpass USD 9.6 billion by 2030; growing at a CAGR of 14.6% during 2024 - 2030.

The metrology software market is expanding rapidly, driven by the growing demand for precision measurement in various industries. Metrology software enables accurate and efficient measurement, inspection, and testing processes, which are crucial for product quality and performance. With advancements in technologies such as 3D scanning, laser tracking, and computer-aided inspection, metrology software has become integral to sectors such as automotive, aerospace, electronics, and industrial equipment. As industries increasingly focus on enhancing product quality and operational efficiency, the demand for advanced metrology solutions continues to rise, fueling market growth.

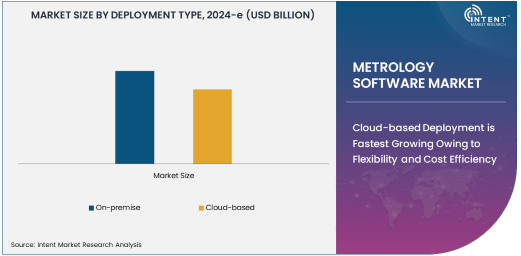

Cloud-based Deployment is Fastest Growing Owing to Flexibility and Cost Efficiency

Among the different deployment types, cloud-based metrology software is experiencing the fastest growth. Cloud-based solutions offer significant advantages over traditional on-premise systems, such as greater scalability, flexibility, and reduced upfront infrastructure costs. These features are particularly attractive to small and medium-sized enterprises (SMEs) that may not have the resources to invest in expensive on-premise systems. Cloud-based platforms also facilitate real-time data sharing and remote access, which is essential for global operations and collaborative projects. Additionally, as industries move toward digital transformation, the cloud model is becoming increasingly popular, providing manufacturers with easier integration, reduced maintenance costs, and the ability to access advanced analytics tools.

The ability to store vast amounts of data in the cloud, coupled with the ease of access for engineers and quality control teams, is driving the adoption of cloud-based metrology software. This trend is expected to continue as more companies prioritize operational efficiency and cost-effective solutions, making cloud deployment the fastest-growing segment within the metrology software market.

3D Metrology Software is Largest Owing to Demand for Precise Measurements

In terms of software type, 3D metrology software is the largest segment, due to its critical role in providing accurate measurements for complex geometries. 3D metrology software is widely used across industries that require precise and detailed measurements, such as automotive, aerospace, and industrial equipment manufacturing. With the increasing complexity of product designs and the need for higher precision, 3D metrology solutions are in high demand, as they enable accurate inspection of parts and assemblies, ensuring that components meet stringent quality standards.

The adoption of 3D metrology software has surged with the growth of industries that demand highly accurate measurements, such as aerospace and automotive, where even minute deviations can lead to costly errors. These software solutions are also essential in reducing the need for physical prototypes and accelerating the design-to-production process, further driving their popularity in the market. As precision becomes more critical in product manufacturing, 3D metrology software continues to dominate the market.

Automotive Application is Largest Owing to Stringent Quality Standards

Among the various applications, the automotive industry represents the largest segment for metrology software, driven by the sector’s focus on ensuring product quality and safety. The automotive industry relies heavily on metrology software for the design, testing, and production of parts that meet strict regulatory and quality standards. Metrology software is essential in automating inspection processes, reducing manual errors, and ensuring that components fit together precisely in complex assemblies.

In addition to ensuring product quality, metrology software is used in the development of new materials and manufacturing techniques, helping automotive manufacturers stay competitive in an industry marked by continuous innovation. With the rise of electric vehicles and the increased complexity of automotive parts, the demand for advanced metrology solutions in the automotive sector is expected to remain strong, maintaining its position as the largest application for metrology software.

Manufacturing Companies End-User is Largest Owing to Widespread Adoption

In terms of end-users, manufacturing companies are the largest segment, as metrology software is integral to their operations for ensuring quality control and precision in production processes. Manufacturing companies utilize metrology software to inspect and measure components throughout the production cycle, ensuring that products meet quality standards and are free from defects. As industries push toward greater automation and smarter production techniques, the role of metrology software in ensuring efficient and error-free manufacturing becomes even more critical.

Additionally, with the growing emphasis on Industry 4.0 and the adoption of smart factories, manufacturing companies are increasingly turning to metrology software to optimize their production lines. This trend is expected to drive continued growth in the market as manufacturing companies seek to implement advanced quality control measures and improve operational efficiency.

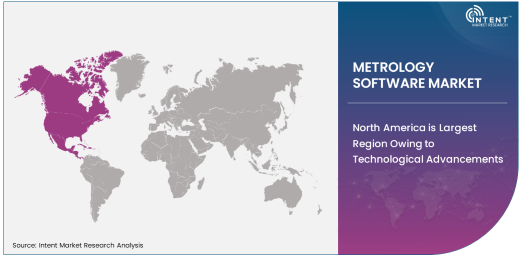

North America is Largest Region Owing to Technological Advancements

North America leads the metrology software market, primarily due to its technological advancements and the presence of several key industries, including automotive, aerospace, and electronics. The region is home to some of the most advanced manufacturing and research facilities in the world, where precision measurement is critical to product quality and innovation. Additionally, North America has witnessed significant investments in metrology technology, particularly in the United States, where industries are adopting cutting-edge solutions to streamline production processes and ensure compliance with stringent regulatory standards.

Furthermore, the increasing demand for high-precision measurement in industries like aerospace and automotive has further fueled market growth in this region. North America's strong focus on technological innovation, coupled with the growing trend toward digitalization in manufacturing, ensures that the region remains a dominant force in the metrology software market.

Leading Companies and Competitive Landscape

The metrology software market is highly competitive, with several key players driving innovation and market expansion. Leading companies such as Hexagon AB, Carl Zeiss AG, and FARO Technologies dominate the market, offering a wide range of software solutions for industries like automotive, aerospace, and industrial equipment. These companies are continually innovating, integrating new technologies such as artificial intelligence, machine learning, and cloud computing into their metrology software to improve measurement accuracy, efficiency, and scalability.

The competitive landscape is also shaped by partnerships and acquisitions, as companies seek to expand their product offerings and enter new markets. Collaboration between software developers, hardware manufacturers, and end-users is common, as the integration of metrology software with physical measurement equipment is essential for providing end-to-end solutions. As the demand for precision measurement continues to rise, the metrology software market is expected to see further consolidation and innovation, intensifying competition among leading players.

Recent Developments:

- Hexagon AB launched a new version of its metrology software, offering enhanced integration with IoT devices for real-time monitoring.

- Siemens AG introduced a new cloud-based metrology software solution aimed at optimizing automotive manufacturing processes.

- FARO Technologies, Inc. expanded its software capabilities for aerospace inspections by incorporating AI-driven analysis tools.

- Autodesk, Inc. partnered with leading automotive manufacturers to integrate its metrology software into digital twins for design validation.

- Renishaw PLC announced an update to its coordinate measuring machine (CMM) software, enhancing its precision and ease of use in industrial applications.

List of Leading Companies:

- Hexagon AB

- Dassault Systèmes

- Nikon Corporation

- Renishaw PLC

- FARO Technologies, Inc.

- Keyence Corporation

- Siemens AG

- Carl Zeiss AG

- Mitutoyo Corporation

- Autodesk, Inc.

- 3D Systems Corporation

- Aberlink Advanced Measurements Ltd.

- Ametek, Inc.

- Thermo Fisher Scientific Inc.

- Wenzel Group GmbH

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 4.3 billion |

|

Forecasted Value (2030) |

USD 9.6 billion |

|

CAGR (2025 – 2030) |

14.6% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Metrology Software Market By Deployment Type (On-premise, Cloud-based), By Type (3D Metrology Software, CMM Software, Laser Tracking Software, Computer-Aided Inspection [CAI], Optical Metrology Software), By Application (Automotive, Aerospace & Defense, Electronics, Industrial Equipment), By End-User (Manufacturing Companies, Research & Development Centers, Quality Assurance & Control) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Hexagon AB, Dassault Systèmes, Nikon Corporation, Renishaw PLC, FARO Technologies, Inc., Keyence Corporation, Siemens AG, Carl Zeiss AG, Mitutoyo Corporation, Autodesk, Inc., 3D Systems Corporation, Aberlink Advanced Measurements Ltd., Ametek, Inc., Thermo Fisher Scientific Inc., Wenzel Group GmbH |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Metrology Software Market, by Deployment Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. On-premise |

|

4.2. Cloud-based |

|

5. Metrology Software Market, by Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. 3D Metrology Software |

|

5.2. CMM Software |

|

5.3. Laser Tracking Software |

|

5.4. Computer-Aided Inspection (CAI) |

|

5.5. Optical Metrology Software |

|

6. Metrology Software Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Automotive |

|

6.2. Aerospace & Defense |

|

6.3. Electronics |

|

6.4. Industrial Equipment |

|

7. Metrology Software Market, by End-User (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Manufacturing Companies |

|

7.2. Research & Development Centers |

|

7.3. Quality Assurance & Control |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Metrology Software Market, by Deployment Type |

|

8.2.7. North America Metrology Software Market, by Type |

|

8.2.8. North America Metrology Software Market, by Application |

|

8.2.9. North America Metrology Software Market, by End-User |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Metrology Software Market, by Deployment Type |

|

8.2.10.1.2. US Metrology Software Market, by Type |

|

8.2.10.1.3. US Metrology Software Market, by Application |

|

8.2.10.1.4. US Metrology Software Market, by End-User |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Hexagon AB |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Dassault Systèmes |

|

10.3. Nikon Corporation |

|

10.4. Renishaw PLC |

|

10.5. FARO Technologies, Inc. |

|

10.6. Keyence Corporation |

|

10.7. Siemens AG |

|

10.8. Carl Zeiss AG |

|

10.9. Mitutoyo Corporation |

|

10.10. Autodesk, Inc. |

|

10.11. 3D Systems Corporation |

|

10.12. Aberlink Advanced Measurements Ltd. |

|

10.13. Ametek, Inc. |

|

10.14. Thermo Fisher Scientific Inc. |

|

10.15. Wenzel Group GmbH |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Metrology Software Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Metrology Software Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Metrology Software Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA