Methylene Chloride Market By Type (Industrial Grade, Analytical Grade), By Application (Paints & Coatings, Pharmaceuticals, Chemical Manufacturing, Adhesives & Sealants, Metal Cleaning), By End-User (Manufacturing Industries, Research Laboratories, Pharmaceuticals Companies), By Distribution Channel (Direct Sales, Distributors), and By Region; Global Insights & Forecast (2024 - 2030)

As per Intent Market Research, the Methylene Chloride Market was valued at USD 3.6 billion in 2024-e and will surpass USD 5.3 billion by 2030; growing at a CAGR of 6.8% during 2024 - 2030.

The methylene chloride market is poised for continued growth, driven by its extensive use across industries such as paints and coatings, pharmaceuticals, chemical manufacturing, adhesives and sealants, and metal cleaning. Methylene chloride, also known as dichloromethane (DCM), is valued for its exceptional solvency power, making it a key ingredient in processes like paint stripping, degreasing, and chemical extraction. As a widely used industrial solvent, it plays a crucial role in manufacturing, where its efficiency in dissolving a variety of substances helps streamline production processes. Despite its benefits, methylene chloride faces growing regulatory pressure due to its potential health hazards, which is leading to a push for safer alternatives. Nevertheless, the compound continues to be in high demand, particularly in applications that require effective solvent properties.

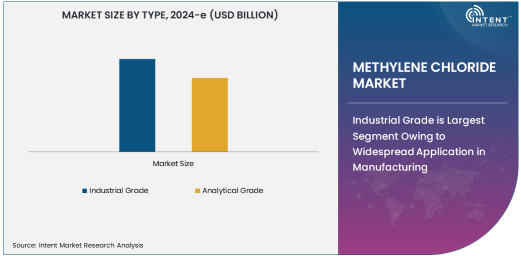

Industrial Grade is Largest Segment Owing to Widespread Application in Manufacturing

The industrial grade segment dominates the methylene chloride market, owing to its widespread use across multiple sectors, including paints and coatings, chemical manufacturing, and metal cleaning. Industrial grade methylene chloride is favored for its cost-effectiveness and high solubility, making it an essential component in large-scale manufacturing processes. In the paints and coatings industry, it is widely used as a solvent to thin paints and coatings, enabling smooth application and effective surface adhesion. Additionally, in metal cleaning, it is employed to remove oils, greases, and contaminants from machinery and components.

The demand for industrial grade methylene chloride is further supported by its use in chemical manufacturing, where it is used in the synthesis of various chemicals and as a solvent in extraction processes. Its broad range of applications across several industries ensures that industrial grade methylene chloride remains the largest segment in the market.

Paints & Coatings Application is Largest Owing to Demand for Solvents

The paints and coatings industry represents the largest application segment for methylene chloride. As a solvent, methylene chloride is essential in the formulation of paints, coatings, varnishes, and other surface treatment products. It helps in thinning paints and coatings, improving their application and drying times, and achieving the desired finish. This ability to provide a smooth and even coat is particularly important in industries like automotive, construction, and consumer goods manufacturing, where high-quality finishes are crucial.

Furthermore, methylene chloride is often used in paint stripping applications, particularly in the removal of old layers of paint from surfaces. The compound’s ability to effectively dissolve various types of paints and coatings makes it an indispensable tool in both professional and industrial paint removal processes. As the global demand for high-performance paints and coatings continues to rise, methylene chloride will remain a key ingredient in this application.

Manufacturing Industries End-User is Largest Owing to High Demand for Solvent-Based Products

Manufacturing industries are the largest end-users of methylene chloride, as the compound plays a critical role in several industrial processes. The versatility of methylene chloride as a solvent makes it a preferred choice for manufacturing various products, ranging from adhesives to paints and coatings. In the automotive, construction, and electronics industries, methylene chloride is widely used for degreasing and cleaning parts, removing oils and contaminants to ensure the proper functioning of machinery and equipment.

Additionally, methylene chloride is employed in the production of adhesives and sealants, where its ability to dissolve and blend different components helps create strong bonds and flexible sealants. The ongoing expansion of manufacturing industries worldwide, driven by the growth in sectors like automotive, construction, and electronics, continues to support the high demand for methylene chloride in industrial applications.

Direct Sales Distribution Channel is Largest Owing to Long-Term Supplier Relationships

The direct sales distribution channel is the largest segment in the methylene chloride market, as manufacturers and large-scale industrial users prefer to purchase directly from producers or suppliers. This method ensures that companies receive consistent product quality, bulk quantities, and the ability to establish long-term relationships with suppliers. Direct sales also offer the advantage of more favorable pricing structures, making it an attractive option for manufacturing companies that require large quantities of methylene chloride for their operations.

Furthermore, direct sales allow suppliers to offer customized services, such as technical support, product formulations, and packaging solutions, to better meet the specific needs of industrial customers. As a result, direct sales are particularly popular among large-scale manufacturers who rely on methylene chloride for ongoing production processes.

North America is Largest Region Owing to Established Industrial Base and Regulatory Standards

North America is the largest region in the methylene chloride market, driven by its strong industrial base, particularly in sectors such as paints and coatings, pharmaceuticals, and chemical manufacturing. The United States, in particular, has a well-established manufacturing infrastructure, where methylene chloride is used extensively for industrial applications like degreasing, paint stripping, and chemical extraction. The region’s high demand for methylene chloride is also fueled by the pharmaceutical industry, where it is used in drug manufacturing processes.

However, the region is also witnessing increased regulatory scrutiny concerning the environmental and health impacts of methylene chloride. Despite this, North America remains a dominant player in the market, with ongoing innovation in alternative chemical solutions and a growing emphasis on sustainability in manufacturing. The regulatory environment is also pushing for improved safety standards, which could lead to more refined uses of methylene chloride or the development of safer alternatives.

Leading Companies and Competitive Landscape

The methylene chloride market is competitive, with several large and medium-sized companies driving production and distribution. Key players in the market include Dow Chemical, BASF, and AkzoNobel, which are major producers of methylene chloride for industrial use. These companies are focused on maintaining their market positions by improving production efficiency, expanding their product portfolios, and ensuring regulatory compliance.

The competitive landscape is shaped by the increasing demand for methylene chloride across various industries, which has spurred innovation and the development of new formulations. Companies are also exploring ways to address environmental concerns related to methylene chloride’s use, particularly in applications like paint stripping. As regulations around the compound continue to tighten, manufacturers are investing in alternative technologies and solvent-free solutions to stay competitive while meeting stringent environmental standards. The market is expected to continue evolving as demand rises, particularly in emerging economies where industrialization is accelerating.

Recent Developments:

- Eastman Chemical Company launched a new Methylene Chloride-based solvent for the pharmaceutical sector aimed at improving process efficiency.

- BASF SE announced a partnership to develop safer alternatives to Methylene Chloride for use in industrial applications.

- SABIC expanded its production capacity for Methylene Chloride to meet growing demand from the chemical manufacturing sector.

- Solvay introduced a more environmentally friendly version of Methylene Chloride aimed at reducing health risks in industrial applications.

- AkzoNobel N.V. enhanced its product line with a new formulation of Methylene Chloride-based coatings for the automotive industry.

List of Leading Companies:

- The Dow Chemical Company

- BASF SE

- Eastman Chemical Company

- Huntsman International LLC

- SABIC

- Solvay

- Linde Group

- INEOS Group

- AkzoNobel N.V.

- Arkema S.A.

- Chevron Phillips Chemical Company

- LANXESS AG

- DuPont de Nemours, Inc.

- 3M Company

- Mitsui Chemicals, Inc.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 3.6 billion |

|

Forecasted Value (2030) |

USD 5.3 billion |

|

CAGR (2025 – 2030) |

6.8% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Methylene Chloride Market By Type (Industrial Grade, Analytical Grade), By Application (Paints & Coatings, Pharmaceuticals, Chemical Manufacturing, Adhesives & Sealants, Metal Cleaning), By End-User (Manufacturing Industries, Research Laboratories, Pharmaceuticals Companies), By Distribution Channel (Direct Sales, Distributors) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

The Dow Chemical Company, BASF SE, Eastman Chemical Company, Huntsman International LLC, SABIC, Solvay, Linde Group, INEOS Group, AkzoNobel N.V., Arkema S.A., Chevron Phillips Chemical Company, LANXESS AG, DuPont de Nemours, Inc., 3M Company, Mitsui Chemicals, Inc. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Methylene Chloride Market, by Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Industrial Grade |

|

4.2. Analytical Grade |

|

5. Methylene Chloride Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Paints & Coatings |

|

5.2. Pharmaceuticals |

|

5.3. Chemical Manufacturing |

|

5.4. Adhesives & Sealants |

|

5.5. Metal Cleaning |

|

6. Methylene Chloride Market, by End-User (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Manufacturing Industries |

|

6.2. Research Laboratories |

|

6.3. Pharmaceuticals Companies |

|

7. Methylene Chloride Market, by Distribution Channel (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Direct Sales |

|

7.2. Distributors |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Methylene Chloride Market, by Type |

|

8.2.7. North America Methylene Chloride Market, by Application |

|

8.2.8. North America Methylene Chloride Market, by End-User |

|

8.2.9. North America Methylene Chloride Market, by Distribution Channel |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Methylene Chloride Market, by Type |

|

8.2.10.1.2. US Methylene Chloride Market, by Application |

|

8.2.10.1.3. US Methylene Chloride Market, by End-User |

|

8.2.10.1.4. US Methylene Chloride Market, by Distribution Channel |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. The Dow Chemical Company |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. BASF SE |

|

10.3. Eastman Chemical Company |

|

10.4. Huntsman International LLC |

|

10.5. SABIC |

|

10.6. Solvay |

|

10.7. Linde Group |

|

10.8. INEOS Group |

|

10.9. AkzoNobel N.V. |

|

10.10. Arkema S.A. |

|

10.11. Chevron Phillips Chemical Company |

|

10.12. LANXESS AG |

|

10.13. DuPont de Nemours, Inc. |

|

10.14. 3M Company |

|

10.15. Mitsui Chemicals, Inc. |

|

11. Appendix |

Let us connect with you TOC

A comprehensive market research approach was employed to gather and analyze data on the Methylene Chloride Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Methylene Chloride Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Methylene Chloride Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

Available Formats