As per Intent Market Research, the Methadone Hydrochloride Market was valued at USD 1.1 billion in 2024-e and will surpass USD 1.8 billion by 2030; growing at a CAGR of 8.3% during 2024 - 2030.

The methadone hydrochloride market is witnessing substantial growth due to the increasing prevalence of opioid addiction and chronic pain management requirements globally. Methadone hydrochloride, a synthetic opioid used primarily in opioid dependence treatment and pain management, is essential in medical practices aimed at stabilizing individuals addicted to opioids and alleviating severe pain. As the opioid crisis continues to affect various regions, the demand for methadone as a treatment option has grown significantly, making it a crucial component in addiction rehabilitation programs. Additionally, the use of methadone for pain management, particularly for cancer patients or those with chronic conditions, supports its growing presence in healthcare systems worldwide.

The market is expected to expand as the global healthcare landscape increasingly emphasizes both addiction treatment and chronic pain management. With healthcare systems across the world adopting more comprehensive strategies for opioid dependence and chronic pain management, methadone hydrochloride remains a central player in therapeutic regimens. Alongside this, the growing availability of methadone through various distribution channels contributes to its widespread use, offering enhanced accessibility for patients and healthcare providers alike.

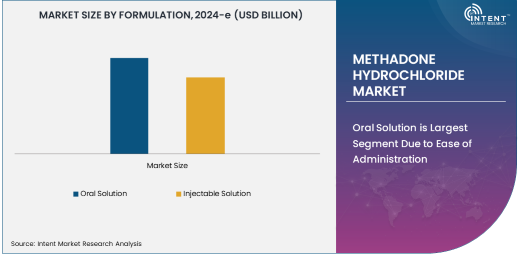

Oral Solution is Largest Segment Due to Ease of Administration

The oral solution formulation of methadone hydrochloride holds the largest share of the market due to its convenience and ease of administration, particularly in the treatment of opioid dependence. Oral solutions allow patients to consume the drug in a controlled manner, making it easier to manage the dosage, and reducing the risks associated with misuse. This formulation is often preferred in outpatient addiction treatment programs where daily administration under medical supervision is required to prevent withdrawal symptoms and reduce cravings.

In addition to addiction treatment, the oral solution formulation is also used in pain management settings, providing a versatile treatment option for patients suffering from chronic pain. The ability to tailor doses for individual patients and the relatively straightforward administration process contribute to the oral solution's widespread adoption. As a result, the demand for this formulation is expected to remain strong, especially in addiction treatment centers and pain management clinics.

Opioid Dependence Treatment is Largest Application Segment Due to Growing Opioid Crisis

Opioid dependence treatment is the largest application segment for methadone hydrochloride, driven by the ongoing global opioid crisis. Methadone is widely used in opioid replacement therapy (ORT) to help individuals reduce opioid withdrawal symptoms and cravings while avoiding the euphoric effects of illicit opioid use. With increasing efforts by governments, healthcare providers, and organizations to combat the opioid epidemic, the demand for methadone as part of opioid substitution therapy (OST) has risen sharply.

As part of a comprehensive treatment plan, methadone allows individuals to stabilize their lives and gradually taper off opioid dependence under professional supervision. The rise in opioid addiction rates, particularly in North America and parts of Europe, ensures that opioid dependence treatment remains the leading application segment for methadone hydrochloride, with strong growth anticipated as addiction treatment programs continue to scale up globally.

Hospitals End-User Segment is Largest Due to Intensive Care and Supervision

Hospitals represent the largest end-user segment for methadone hydrochloride, largely due to the critical nature of opioid dependence treatment and pain management in hospital settings. Hospitals are central to the administration of methadone, particularly in the initial stages of opioid replacement therapy (ORT) and when managing patients in intensive care or those undergoing major surgeries. These settings provide the necessary supervision and monitoring to ensure the safe and effective use of methadone, especially when administered intravenously or in high doses for pain management.

The hospital setting is also crucial in managing complex pain cases, such as those related to cancer or severe trauma, where methadone is often used as part of a multimodal pain management strategy. As opioid dependence continues to be a significant public health issue and the demand for pain relief in acute settings remains high, hospitals will continue to be the primary consumers of methadone hydrochloride.

Direct Sales is Largest Distribution Channel Due to Bulk Purchases

Direct sales dominate the distribution channel segment for methadone hydrochloride, driven by bulk purchases made by hospitals, addiction treatment centers, and healthcare institutions. Direct sales allow for more efficient supply chain management, ensuring that large volumes of methadone are delivered directly to healthcare providers, especially in the case of ongoing addiction treatment programs and hospitals managing chronic pain patients.

The direct sales channel also facilitates long-term contracts, which ensure a steady supply of methadone for healthcare providers, thereby enhancing treatment continuity for opioid-dependent patients and individuals in pain management programs. This distribution model remains the most effective for managing the consistent demand for methadone in both inpatient and outpatient settings, driving its prevalence in the market.

North America is Largest Region Due to High Opioid Dependency Rates

North America is the largest market for methadone hydrochloride, primarily due to the high rates of opioid dependence and chronic pain management needs in the region. The opioid epidemic in the United States and Canada has driven the adoption of methadone as a first-line treatment option for opioid addiction. Methadone is a key component of the opioid substitution therapy (OST) programs implemented across the region, making it an essential medication in the fight against the opioid crisis.

In addition to opioid dependence treatment, the demand for methadone in pain management is also significant in North America, where chronic pain conditions are highly prevalent. With a well-established healthcare infrastructure and increasing government support for opioid dependence treatment programs, North America will continue to hold the largest share of the methadone hydrochloride market.

Leading Companies and Competitive Landscape

The methadone hydrochloride market is highly competitive, with several global pharmaceutical companies involved in its production and distribution. Leading companies include manufacturers like Mylan, Teva Pharmaceuticals, and Hikma Pharmaceuticals, which offer a range of formulations of methadone hydrochloride, catering to both addiction treatment and pain management needs. These companies focus on maintaining high production standards, ensuring the availability of methadone through various distribution channels to meet the needs of healthcare providers and patients.

The competitive landscape is influenced by the increasing emphasis on addressing opioid addiction, with companies exploring strategic partnerships and collaborations with healthcare providers, addiction treatment centers, and government bodies. Additionally, as the demand for methadone continues to grow, these companies are investing in expanding their production capacities and improving the accessibility of methadone, particularly in regions most affected by the opioid epidemic. As the market evolves, the emphasis will likely shift towards ensuring the availability of affordable and effective treatments for opioid dependence and chronic pain management.

Recent Developments:

- Johnson & Johnson launched a new methadone-based oral solution aimed at enhancing the efficacy of opioid addiction treatment.

- Teva Pharmaceuticals received FDA approval for a new injectable methadone hydrochloride formulation for pain management.

- Mallinckrodt Pharmaceuticals expanded its methadone production capacity to meet increasing demand for opioid dependence treatment.

- Mylan N.V. introduced a cost-effective generic methadone hydrochloride solution for opioid dependence treatment in healthcare facilities.

- Novartis International AG entered into a strategic partnership with rehabilitation centers to offer methadone therapy as part of comprehensive addiction treatment.

List of Leading Companies:

- Johnson & Johnson

- Teva Pharmaceutical Industries Ltd.

- Mallinckrodt Pharmaceuticals

- Mylan N.V.

- Novartis International AG

- Hikma Pharmaceuticals

- Sun Pharmaceutical Industries Ltd.

- Purdue Pharma

- Zydus Cadila

- Fresenius Kabi AG

- AbbVie Inc.

- Aurobindo Pharma

- Apotex Inc.

- Lupin Pharmaceuticals

- Glenmark Pharmaceuticals

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.1 billion |

|

Forecasted Value (2030) |

USD 1.8 billion |

|

CAGR (2025 – 2030) |

8.3% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Methadone Hydrochloride Market By Formulation (Oral Solution, Injectable Solution), By Application (Opioid Dependence Treatment, Pain Management, Others), By End-User (Hospitals, Clinics, Home Care Settings), By Distribution Channel (Direct Sales, Distributors, Online Pharmacies) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Johnson & Johnson, Teva Pharmaceutical Industries Ltd., Mallinckrodt Pharmaceuticals, Mylan N.V., Novartis International AG, Hikma Pharmaceuticals, Sun Pharmaceutical Industries Ltd., Purdue Pharma, Zydus Cadila, Fresenius Kabi AG, AbbVie Inc., Aurobindo Pharma, Apotex Inc., Lupin Pharmaceuticals, Glenmark Pharmaceuticals |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Methadone Hydrochloride Market, by Formulation (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Oral Solution |

|

4.2. Injectable Solution |

|

5. Methadone Hydrochloride Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Opioid Dependence Treatment |

|

5.2. Pain Management |

|

5.3. Others |

|

6. Methadone Hydrochloride Market, by End-User (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Hospitals |

|

6.2. Clinics |

|

6.3. Home Care Settings |

|

7. Methadone Hydrochloride Market, by Distribution Channel (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Direct Sales |

|

7.2. Distributors |

|

7.3. Online Pharmacies |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Methadone Hydrochloride Market, by Formulation |

|

8.2.7. North America Methadone Hydrochloride Market, by Application |

|

8.2.8. North America Methadone Hydrochloride Market, by End-User |

|

8.2.9. North America Methadone Hydrochloride Market, by Distribution Channel |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Methadone Hydrochloride Market, by Formulation |

|

8.2.10.1.2. US Methadone Hydrochloride Market, by Application |

|

8.2.10.1.3. US Methadone Hydrochloride Market, by End-User |

|

8.2.10.1.4. US Methadone Hydrochloride Market, by Distribution Channel |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Johnson & Johnson |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Teva Pharmaceutical Industries Ltd. |

|

10.3. Mallinckrodt Pharmaceuticals |

|

10.4. Mylan N.V. |

|

10.5. Novartis International AG |

|

10.6. Hikma Pharmaceuticals |

|

10.7. Sun Pharmaceutical Industries Ltd. |

|

10.8. Purdue Pharma |

|

10.9. Zydus Cadila |

|

10.10. Fresenius Kabi AG |

|

10.11. AbbVie Inc. |

|

10.12. Aurobindo Pharma |

|

10.13. Apotex Inc. |

|

10.14. Lupin Pharmaceuticals |

|

10.15. Glenmark Pharmaceuticals |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Methadone Hydrochloride Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Methadone Hydrochloride Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Methadone Hydrochloride Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA