As per Intent Market Research, the Metaverse in Manufacturing Market was valued at USD 4.5 billion in 2024-e and will surpass USD 24.3 billion by 2030; growing at a CAGR of 32.5% during 2024 - 2030.

The Metaverse in manufacturing market is rapidly transforming how industries approach design, production, and operations. By leveraging immersive technologies such as Virtual Reality (VR), Augmented Reality (AR), and Mixed Reality (MR), manufacturers can simulate real-world processes in a virtual environment, improving efficiency, reducing costs, and enhancing collaboration. These technologies enable manufacturers to design, test, and iterate on products virtually, allowing for faster innovation and more accurate outcomes. Additionally, they support operational improvements such as predictive maintenance, supply chain optimization, and remote troubleshooting, all of which contribute to enhanced productivity and reduced downtime.

The Metaverse also facilitates advanced training and education within the manufacturing sector. Employees can engage in hands-on, virtual training sessions, mastering complex machinery or operations without the risk of physical harm or the need for costly physical prototypes. The integration of Metaverse technologies in manufacturing is reshaping traditional processes, making them more efficient, flexible, and cost-effective. As manufacturers across various industries continue to explore the potential of the Metaverse, the market is expected to grow exponentially in the coming years, driving further advancements in automation and virtualized production systems.

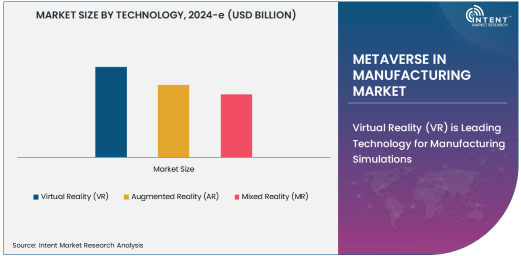

Virtual Reality (VR) is Leading Technology for Manufacturing Simulations

Virtual Reality (VR) is the leading technology for manufacturing applications, particularly in product design and prototyping. VR allows manufacturers to create and test prototypes in a fully immersive virtual environment, enabling them to identify design flaws, test different materials, and visualize products from multiple angles. This technology streamlines the product development cycle by reducing the need for physical prototypes, cutting down on material costs, and speeding up the overall design process.

VR’s ability to simulate real-world conditions is particularly beneficial in testing products under various environmental factors or stress conditions. For example, automotive manufacturers can use VR simulations to evaluate how a car will perform in different weather conditions or crash scenarios. This virtual testing process not only enhances product quality but also accelerates the time-to-market for new products. As the demand for faster, more cost-effective prototyping continues to rise, VR remains at the forefront of the Metaverse technologies transforming the manufacturing industry.

Product Design & Prototyping is Largest Application for Metaverse in Manufacturing

Product design and prototyping is the largest application of Metaverse technologies in the manufacturing sector. Manufacturers are increasingly using virtual environments to create and test product designs before moving on to physical production, allowing for faster iteration and more accurate outcomes. This application is particularly valuable in industries such as automotive, aerospace, and consumer goods, where product complexity and the cost of physical prototyping are significant concerns.

The ability to visualize and manipulate products in a virtual space enables designers to make real-time changes and optimize products for functionality, aesthetics, and manufacturability. Additionally, virtual prototyping reduces the need for costly physical models and allows manufacturers to simulate production processes to identify potential inefficiencies. As industries seek to minimize waste and maximize efficiency in the design phase, the application of Metaverse technologies in product design and prototyping continues to be a key driver of growth in the market.

Automotive Industry is Leading End-User of Metaverse Technologies

The automotive industry is the largest end-user of Metaverse technologies in manufacturing, driven by the need for advanced product design, prototyping, and simulation. Automakers are leveraging VR and AR technologies to design and test new vehicle models, simulate crash tests, and improve the assembly process. These virtual simulations allow automotive manufacturers to optimize vehicle design for performance, safety, and fuel efficiency, while also minimizing costs associated with physical testing and prototypes.

In addition to design and prototyping, the automotive industry is also utilizing the Metaverse for training and education. VR-based training programs allow technicians to practice vehicle repairs, learn about new automotive technologies, and enhance their skills without the need for real-world vehicle models. As the automotive sector continues to embrace innovative technologies, the demand for Metaverse-driven solutions is expected to grow, further driving market expansion in this segment.

Direct Sales Are Dominant Distribution Channel for Metaverse Technologies

Direct sales are the dominant distribution channel for Metaverse technologies in manufacturing, as companies prefer to purchase software and platforms directly from technology providers to ensure customized solutions that meet their specific needs. Direct sales offer manufacturers the opportunity to engage in in-depth consultations with providers, ensuring that the software and systems being implemented are tailored to their operational requirements. Additionally, direct sales allow for ongoing support and training, which is critical in the successful adoption of new technologies in complex manufacturing environments.

By working directly with technology providers, manufacturers can access the latest advancements in Metaverse solutions, such as VR and AR-based simulations and training programs, and ensure that they are integrated seamlessly into existing production workflows. This approach also allows for faster updates and improvements, helping manufacturers stay ahead in an increasingly competitive market. As the demand for Metaverse-driven solutions continues to rise, direct sales channels will remain a key factor in the distribution and adoption of these technologies in the manufacturing sector.

North America is Leading Region for Metaverse in Manufacturing Market

North America is the leading region in the Metaverse in manufacturing market, driven by technological advancements, strong industrial infrastructure, and early adoption of digitalization in manufacturing processes. The United States, in particular, is at the forefront of integrating VR, AR, and MR technologies into manufacturing operations, with a wide range of industries—from automotive to aerospace—adopting these solutions for product design, prototyping, and production optimization.

In North America, manufacturing companies are leveraging Metaverse technologies to streamline their production processes, improve product quality, and reduce costs. The region also benefits from a highly skilled workforce and significant investments in research and development, making it an ideal environment for the growth of the Metaverse in manufacturing. As more companies in North America recognize the value of immersive technologies, the region will continue to dominate the market and lead the charge in Metaverse-driven manufacturing innovations.

Leading Companies and Competitive Landscape

The competitive landscape of the Metaverse in manufacturing market is characterized by the presence of both established technology giants and specialized startups. Leading companies such as Microsoft, with its HoloLens AR technology, and Oculus (now part of Meta) are spearheading the development of immersive VR and AR solutions for manufacturing applications. These companies provide platforms and software solutions that enable manufacturers to integrate Metaverse technologies into their operations.

Additionally, several niche players, such as PTC (with its Vuforia AR platform) and Siemens (with its digital twin technologies), are offering tailored solutions for industries like automotive, aerospace, and electronics. As the demand for Metaverse technologies in manufacturing continues to grow, the competitive landscape will evolve, with both large corporations and innovative startups vying for market share by developing new tools, features, and integrations to meet the evolving needs of manufacturers. Collaboration between technology providers and manufacturing companies will also be essential in driving the adoption and success of Metaverse-based solutions in this sector.

Recent Developments:

- Siemens AG expanded its industrial metaverse offerings, integrating digital twins with real-time data to optimize manufacturing operations.

- General Electric launched a new virtual reality platform to simulate complex industrial processes and improve operator training.

- NVIDIA Corporation introduced new AI-driven virtual environments for industrial design and testing, enhancing collaboration and prototyping.

- PTC Inc. announced a partnership with leading automotive manufacturers to incorporate augmented reality in assembly line operations for greater efficiency.

- Honeywell International Inc. unveiled a mixed-reality platform for real-time remote maintenance and troubleshooting in industrial facilities.

List of Leading Companies:

- Siemens AG

- General Electric

- Dassault Systèmes

- Autodesk Inc.

- Microsoft Corporation

- PTC Inc.

- Honeywell International Inc.

- Rockwell Automation

- NVIDIA Corporation

- Bosch Rexroth AG

- ABB Group

- HP Inc.

- Ford Motor Company

- Lockheed Martin Corporation

- BMW Group

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 4.5 billion |

|

Forecasted Value (2030) |

USD 24.3 billion |

|

CAGR (2025 – 2030) |

32.5% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Metaverse in Manufacturing Market By Technology (Virtual Reality [VR], Augmented Reality [AR], Mixed Reality [MR]), By Application (Product Design & Prototyping, Manufacturing Process Simulation, Remote Operations & Maintenance, Training & Education, Supply Chain Management), By End-User (Automotive Industry, Aerospace & Defense, Electronics & Semiconductors, Industrial Equipment, Consumer Goods Manufacturing), By Distribution Channel (Direct Sales, Distributors, Online Platforms) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Siemens AG, General Electric, Dassault Systèmes, Autodesk Inc., Microsoft Corporation, PTC Inc., Honeywell International Inc., Rockwell Automation, NVIDIA Corporation, Bosch Rexroth AG, ABB Group, HP Inc., Ford Motor Company, Lockheed Martin Corporation, BMW Group |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Metaverse in Manufacturing Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Virtual Reality (VR) |

|

4.2. Augmented Reality (AR) |

|

4.3. Mixed Reality (MR) |

|

5. Metaverse in Manufacturing Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Product Design & Prototyping |

|

5.2. Manufacturing Process Simulation |

|

5.3. Remote Operations & Maintenance |

|

5.4. Training & Education |

|

5.5. Supply Chain Management |

|

6. Metaverse in Manufacturing Market, by End-User (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Automotive Industry |

|

6.2. Aerospace & Defense |

|

6.3. Electronics & Semiconductors |

|

6.4. Industrial Equipment |

|

6.5. Consumer Goods Manufacturing |

|

7. Metaverse in Manufacturing Market, by Distribution Channel (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Direct Sales |

|

7.2. Distributors |

|

7.3. Online Platforms |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Metaverse in Manufacturing Market, by Technology |

|

8.2.7. North America Metaverse in Manufacturing Market, by Application |

|

8.2.8. North America Metaverse in Manufacturing Market, by End-User |

|

8.2.9. North America Metaverse in Manufacturing Market, by Distribution Channel |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Metaverse in Manufacturing Market, by Technology |

|

8.2.10.1.2. US Metaverse in Manufacturing Market, by Application |

|

8.2.10.1.3. US Metaverse in Manufacturing Market, by End-User |

|

8.2.10.1.4. US Metaverse in Manufacturing Market, by Distribution Channel |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Siemens AG |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. General Electric |

|

10.3. Dassault Systèmes |

|

10.4. Autodesk Inc. |

|

10.5. Microsoft Corporation |

|

10.6. PTC Inc. |

|

10.7. Honeywell International Inc. |

|

10.8. Rockwell Automation |

|

10.9. NVIDIA Corporation |

|

10.10. Bosch Rexroth AG |

|

10.11. ABB Group |

|

10.12. HP Inc. |

|

10.13. Ford Motor Company |

|

10.14. Lockheed Martin Corporation |

|

10.15. BMW Group |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Metaverse in Manufacturing Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Metaverse in Manufacturing Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Metaverse in Manufacturing Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA