As per Intent Market Research, the Metaverse in E-commerce Market was valued at USD 7.9 billion in 2024-e and will surpass USD 106.0 billion by 2030; growing at a CAGR of 54.3% during 2024 - 2030.

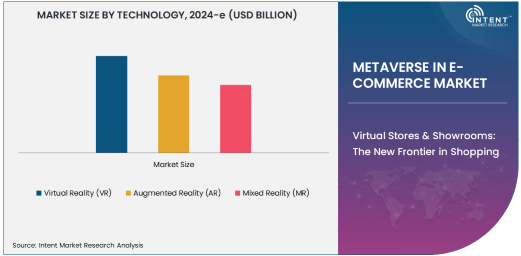

The Metaverse is poised to revolutionize the e-commerce market by integrating immersive technologies such as Virtual Reality (VR), Augmented Reality (AR), and Mixed Reality (MR). These technologies enable businesses to create innovative, engaging shopping experiences that bridge the gap between online and physical retail. With the growing demand for personalized, interactive, and experiential shopping, the Metaverse offers a new frontier where consumers can explore virtual stores, try out products in virtual environments, and engage with brands in ways that were previously unimaginable. Retailers and e-commerce platforms are increasingly adopting Metaverse solutions to enhance customer engagement and drive sales.

This market is driven by the rising popularity of social commerce, online shopping, and virtual product trials, which have gained significant momentum in recent years. As more consumers expect seamless, immersive, and personalized shopping experiences, the Metaverse offers e-commerce companies the tools to meet these demands. The ability to try products virtually, visit virtual showrooms, and engage in social commerce activities is expected to enhance customer satisfaction, improve brand loyalty, and open new revenue streams for businesses in the retail sector.

Virtual Stores & Showrooms: The New Frontier in Shopping

Virtual stores and showrooms powered by Virtual Reality (VR) are reshaping how consumers engage with products online. These virtual spaces allow customers to walk through digitally-rendered environments that mimic physical stores, providing a fully immersive shopping experience. Instead of browsing through static product images or traditional online listings, customers can interact with products in 3D, visualize their use in real life, and even receive recommendations based on their preferences. This allows shoppers to engage in a more natural and enjoyable process, reducing the uncertainty of online shopping.

The rise of virtual stores and showrooms is being driven by the demand for more engaging and personalized shopping experiences. Consumers are increasingly looking for ways to interact with products before making purchasing decisions, and VR offers the ability to do this in a virtual setting. Brands and retailers are leveraging this technology to create unique, branded environments that elevate the online shopping experience and increase consumer confidence in their purchase decisions. As the technology matures and becomes more accessible, the adoption of virtual stores and showrooms is expected to increase, transforming the online retail landscape.

Augmented Reality (AR) in Virtual Product Trials: Enhancing Purchase Confidence

Augmented Reality (AR) is one of the most widely adopted Metaverse technologies in e-commerce, particularly for virtual product trials. AR allows consumers to visualize products in their own environment before making a purchase, giving them a more accurate understanding of how the product will look and function in real life. Whether it's trying on clothing, seeing how furniture fits into a room, or experimenting with different makeup shades, AR provides consumers with the opportunity to make informed decisions without the need for physical interaction with the product.

The application of AR in virtual product trials is growing rapidly, with many e-commerce platforms and retailers incorporating this technology into their shopping experiences. The ability to "try before you buy" in a digital format reduces purchase hesitations and enhances customer satisfaction. It also offers a significant advantage for brands in terms of reducing return rates, as customers are more likely to be satisfied with their purchases when they have had a chance to see and interact with products in an immersive, virtual environment. As AR technology becomes more sophisticated and accessible, its role in e-commerce is expected to continue to grow.

Social Commerce: The Integration of Social Media and E-commerce in the Metaverse

Social commerce, which combines social media with e-commerce, is gaining traction as a major application of the Metaverse in retail. Through immersive experiences, consumers can shop directly within social media platforms, interact with brands, and even make purchases in virtual environments. Social commerce in the Metaverse enables consumers to shop while engaging with their friends and influencers, creating a more interactive and social experience than traditional online shopping. This integration of social interaction with e-commerce is becoming a key factor in driving sales, as it allows brands to tap into the growing influence of social media in consumer behavior.

The increasing popularity of live streaming and influencer-driven content is driving the growth of social commerce in the Metaverse. Retailers are capitalizing on these trends by offering live product demos, virtual events, and interactive shopping experiences where customers can ask questions, view products in real-time, and make purchases seamlessly within the virtual space. As social media platforms continue to evolve and integrate Metaverse technologies, social commerce will likely become an integral part of the e-commerce landscape, further blurring the lines between social interaction and online shopping.

Personalized Shopping Experience: Tailoring Retail to Individual Preferences

Personalized shopping experiences are becoming a cornerstone of the Metaverse in e-commerce, with retailers increasingly using data and immersive technologies to tailor their offerings to individual consumers. Through AI-driven recommendations, customized virtual environments, and interactive product displays, the Metaverse enables businesses to create highly personalized shopping journeys for their customers. This can include personalized product suggestions based on past shopping behavior, customized virtual showrooms based on a shopper’s preferences, and even the ability to interact with virtual store assistants that guide users through the shopping process.

Personalization in the Metaverse enhances the online shopping experience by making it more relevant and engaging. Consumers are more likely to purchase from brands that understand their preferences and offer tailored experiences, and the Metaverse provides a unique platform for delivering these kinds of personalized interactions. As more retailers adopt Metaverse technologies to enhance personalization, this trend is expected to play a crucial role in shaping the future of e-commerce by improving customer engagement, increasing conversion rates, and fostering brand loyalty.

E-commerce Platforms and Retailers: The Primary End-Users

E-commerce platforms, retailers, and brand owners are the primary end-users of Metaverse technologies in the e-commerce sector. These businesses are leveraging VR, AR, and MR to create immersive shopping experiences that appeal to the modern consumer's desire for engagement, personalization, and interactivity. Large e-commerce platforms such as Amazon and Alibaba are exploring Metaverse-based solutions, offering virtual storefronts and immersive shopping environments that enhance the online shopping journey.

Brand owners and manufacturers are also adopting Metaverse technologies to showcase their products in innovative ways and build stronger connections with customers. By offering virtual trials, immersive showrooms, and personalized experiences, these companies can improve customer engagement and drive sales. As the demand for Metaverse-driven experiences grows, more retailers and brands are expected to invest in these technologies to stay competitive in the evolving e-commerce landscape.

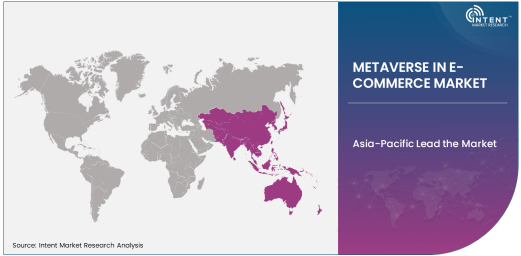

Asia-Pacific Lead the Market

Asia-Pacific leads the Metaverse in e-commerce market, with strong adoption of immersive technologies and online shopping solutions. In Asia-Pacific, rapid advancements in technology, along with a large and tech-savvy consumer base, are driving the demand for Metaverse-based e-commerce solutions. Countries like China, Japan, and South Korea are at the forefront of incorporating immersive technologies into online retail, with consumers embracing new shopping formats that offer greater convenience and interactivity.

The region is expected to maintain their dominance as Metaverse technologies continue to evolve and become more accessible to businesses and consumers alike. With increasing investments from both established e-commerce platforms and new startups, the Metaverse in e-commerce market is set to experience significant growth, particularly in regions that are quick to adopt new technologies and explore innovative shopping experiences.

Leading Companies and Competitive Landscape

The competitive landscape in the Metaverse in e-commerce market is characterized by a mix of established tech giants and emerging startups. Leading companies such as Meta (formerly Facebook), Microsoft, and Google are providing the infrastructure and tools necessary for creating immersive shopping experiences in the Metaverse. These companies are investing heavily in the development of AR and VR technologies, which are central to the evolution of Metaverse-driven e-commerce platforms.

Additionally, e-commerce giants like Amazon, Alibaba, and Shopify are integrating Metaverse technologies into their platforms to offer virtual storefronts and personalized shopping experiences. Startups focusing on Metaverse-based shopping experiences, virtual product trials, and social commerce are also emerging, further intensifying competition in the market. As the Metaverse in e-commerce market grows, companies that can innovate and create engaging, immersive shopping experiences will likely gain a competitive edge, driving further investment and development in this exciting space.

Recent Developments:

- Meta Platforms (Oculus) launched a new virtual shopping platform that allows users to interact with products and make purchases in a fully immersive virtual store environment.

- Amazon.com, Inc. introduced augmented reality shopping features in its app, allowing customers to visualize products in their homes before purchasing.

- Nike, Inc. expanded its presence in the metaverse by creating a virtual store and allowing customers to try on digital sneakers via VR and AR.

- Alibaba Group unveiled a mixed-reality shopping experience at its virtual mall, blending physical and digital interactions for a new kind of retail experience.

- Walmart Inc. announced a partnership with an AR company to develop virtual shopping solutions, enhancing customer engagement with 3D product trials and personalized shopping options.

List of Leading Companies:

- Meta Platforms (Oculus)

- Amazon.com, Inc.

- Alibaba Group

- Shopify Inc.

- Nike, Inc.

- Walmart Inc.

- Microsoft Corporation

- Tencent Holdings

- JD.com, Inc.

- eBay Inc.

- Rakuten, Inc.

- Zalando SE

- Adobe Inc.

- Snap Inc.

- Farfetch Limited

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 7.9 billion |

|

Forecasted Value (2030) |

USD 106.0 billion |

|

CAGR (2025 – 2030) |

54.3% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Metaverse in E-commerce Market By Technology (Virtual Reality [VR], Augmented Reality [AR], Mixed Reality [MR]), By Application (Virtual Stores & Showrooms, Online Shopping Experience, Virtual Product Trials, Social Commerce, Personalized Shopping Experience), By End-User (Retailers & E-commerce Platforms, Brand Owners & Manufacturers, Online Shoppers & Consumers, Third-Party Marketplaces), By Distribution Channel (Direct Sales, Online Platforms, Mobile Applications), and By Region; Global Insights & Forecast (2024 - 2030) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Meta Platforms (Oculus), Amazon.com, Inc., Alibaba Group, Shopify Inc., Nike, Inc., Walmart Inc., Microsoft Corporation, Tencent Holdings, JD.com, Inc., eBay Inc., Rakuten, Inc., Zalando SE, Adobe Inc., Snap Inc., Farfetch Limited |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Metaverse in E-commerce Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Virtual Reality (VR) |

|

4.2. Augmented Reality (AR) |

|

4.3. Mixed Reality (MR) |

|

5. Metaverse in E-commerce Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Virtual Stores & Showrooms |

|

5.2. Online Shopping Experience |

|

5.3. Virtual Product Trials |

|

5.4. Social Commerce |

|

5.5. Personalized Shopping Experience |

|

6. Metaverse in E-commerce Market, by End-User (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Retailers & E-commerce Platforms |

|

6.2. Brand Owners & Manufacturers |

|

6.3. Online Shoppers & Consumers |

|

6.4. Third-Party Marketplaces |

|

7. Metaverse in E-commerce Market, by Distribution Channel (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Direct Sales |

|

7.2. Online Platforms |

|

7.3. Mobile Applications |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Metaverse in E-commerce Market, by Technology |

|

8.2.7. North America Metaverse in E-commerce Market, by Application |

|

8.2.8. North America Metaverse in E-commerce Market, by End-User |

|

8.2.9. North America Metaverse in E-commerce Market, by Distribution Channel |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Metaverse in E-commerce Market, by Technology |

|

8.2.10.1.2. US Metaverse in E-commerce Market, by Application |

|

8.2.10.1.3. US Metaverse in E-commerce Market, by End-User |

|

8.2.10.1.4. US Metaverse in E-commerce Market, by Distribution Channel |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Meta Platforms (Oculus) |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Amazon.com, Inc. |

|

10.3. Alibaba Group |

|

10.4. Shopify Inc. |

|

10.5. Nike, Inc. |

|

10.6. Walmart Inc. |

|

10.7. Microsoft Corporation |

|

10.8. Tencent Holdings |

|

10.9. JD.com, Inc. |

|

10.10. eBay Inc. |

|

10.11. Rakuten, Inc. |

|

10.12. Zalando SE |

|

10.13. Adobe Inc. |

|

10.14. Snap Inc. |

|

10.15. Farfetch Limited |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Metaverse in E-commerce Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Metaverse in E-commerce Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Metaverse in E-commerce Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA