As per Intent Market Research, the Metal Building Systems Market was valued at USD 17.3 billion and will surpass USD 33.5 billion by 2030; growing at a CAGR of 9.9% during 2024 - 2030.

The Metal Building Systems market is experiencing robust growth, driven by the increasing demand for durable, versatile, and cost-effective construction solutions across various industries. Metal building systems, which include pre-engineered, modular, and custom metal buildings, are widely used for industrial, commercial, agricultural, and residential applications. These systems are favored for their speed of construction, flexibility in design, and longevity, making them a preferred choice for a range of sectors including construction, agriculture, manufacturing, and warehousing.

The growth of the metal building systems market is also being propelled by advancements in materials, especially steel and aluminum, which offer superior strength, corrosion resistance, and ease of maintenance. The increasing adoption of these materials in building systems has significantly contributed to their expanding use in both small- and large-scale construction projects. Furthermore, metal buildings offer enhanced energy efficiency and sustainability, key considerations as industries move towards more eco-friendly building practices.

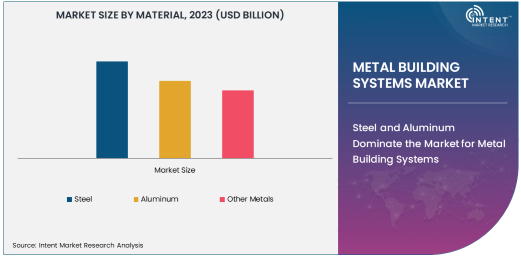

Steel and Aluminum Dominate the Market for Metal Building Systems

Among the various materials used in metal building systems, steel remains the dominant choice due to its excellent strength, durability, and cost-effectiveness. Steel is widely used in pre-engineered metal buildings (PEMB) as well as modular and custom metal buildings. Steel's resistance to corrosion and its ability to withstand harsh environmental conditions make it a popular choice for industrial, commercial, and agricultural applications. Aluminum, known for its lightweight nature, corrosion resistance, and ease of fabrication, is also gaining traction, particularly in commercial and residential applications where aesthetic appeal and ease of installation are priorities.

In industrial construction, steel and aluminum metal buildings are used for factories, warehouses, and distribution centers due to their capacity to handle large spans, heavy loads, and demanding environmental conditions. These materials also contribute to cost-effective construction timelines and lower overall expenses, a significant factor driving the adoption of metal buildings in the industrial sector. The agricultural sector also benefits from metal building systems, particularly in the construction of storage facilities, barns, and livestock housing, where durability and low maintenance are crucial.

Pre-Engineered Metal Buildings (PEMB) Lead the Market

Pre-engineered metal buildings (PEMB) are the leading type of metal building systems in the market. PEMBs are prefabricated off-site and assembled on-site, significantly reducing construction time and labor costs. These buildings are widely used across industries such as commercial, industrial, and agricultural, where the demand for flexible, fast, and scalable solutions is high.

PEMBs are commonly utilized in warehousing, manufacturing plants, and retail facilities, providing durable and customizable spaces that can be easily adapted to suit specific needs. The pre-engineered approach allows for rapid construction, reducing project timelines and minimizing disruption to ongoing business operations. Furthermore, PEMBs are designed with energy efficiency in mind, offering insulation options that contribute to lower operating costs for businesses.

As the demand for more energy-efficient and cost-effective solutions rises, modular metal buildings are also gaining traction. These buildings are pre-fabricated in sections that are easily transported and assembled at the desired location. Modular metal buildings offer a high degree of flexibility and customization, making them ideal for both industrial and commercial applications.

Modular and Custom Metal Buildings Cater to Specific Needs

Modular metal buildings are becoming increasingly popular due to their scalability and ease of relocation. These buildings are ideal for temporary structures, such as construction site offices, storage units, and even emergency housing, due to their ability to be quickly assembled and disassembled. The modular approach is highly beneficial for sectors such as agriculture, where flexibility and adaptability are important for rapidly changing business needs, as well as for retailers who require quick setup times for new locations.

Custom metal buildings, on the other hand, are tailored to meet specific requirements for more complex or unique projects. Custom metal building systems offer significant flexibility in design, allowing for the construction of large-span buildings, multi-story structures, and specialized facilities for sectors like aerospace, automotive, and manufacturing. These buildings are engineered to provide high performance under specific conditions, such as extreme weather or heavy machinery usage, making them ideal for industrial sectors requiring heavy-duty infrastructure.

Applications in Various Sectors Drive Market Expansion

The metal building systems market finds widespread application across multiple sectors, including industrial, commercial, agricultural, and residential construction. In the industrial sector, metal buildings are used for manufacturing plants, warehouses, and distribution centers, where strength, space optimization, and cost efficiency are key considerations. In the commercial sector, metal buildings are ideal for office spaces, retail stores, and recreational facilities, offering quick construction times and durability.

In the agricultural sector, metal building systems are used for barns, greenhouses, and storage sheds, providing long-lasting and low-maintenance structures for farmers. With the increasing focus on sustainable farming practices, metal buildings are gaining popularity due to their energy efficiency and minimal environmental impact. The residential sector also benefits from metal building systems, particularly in regions prone to extreme weather, where metal structures offer enhanced protection against storms and other natural disasters.

The growth of the retail sector is another key driver for the market, as metal buildings provide retailers with flexible and cost-effective solutions for constructing stores, warehouses, and distribution centers. The demand for flexible and customizable retail spaces is driving the adoption of metal building systems, particularly for businesses that need to quickly adapt to changing market conditions.

Asia-Pacific Leads the Global Market Growth

Geographically, the Asia-Pacific region leads the metal building systems market, supported by rapid urbanization, industrial growth, and government-led infrastructure development. Countries like China, India, and Indonesia are investing heavily in industrial parks, logistics hubs, and smart city projects, driving the demand for metal building systems.

The region’s cost-competitive labor and abundant availability of raw materials further strengthen its market position. Additionally, the rising focus on green building initiatives has boosted the adoption of sustainable construction practices, including metal building systems, in the region.

Growth Prospects and Competitive Landscape

The metal building systems market is projected to continue growing as industries seek more cost-effective and sustainable construction solutions. As environmental regulations become more stringent, the demand for energy-efficient, recyclable, and low-maintenance buildings is expected to rise. Additionally, innovations in building materials and construction technologies are likely to drive further advancements in metal building systems, making them even more attractive to industries across the board.

The competitive landscape of the market is fragmented, with numerous key players offering a range of products and services. Companies that can offer flexible, customizable solutions and cater to the specific needs of industries such as automotive, manufacturing, and retail will maintain a competitive edge. Additionally, companies focusing on the development of energy-efficient and environmentally sustainable building solutions are likely to benefit from the growing demand for green building technologies.

Recent Developments:

- Nucor Corporation expanded its steel production capacity, aiming to meet the rising demand for metal building systems in the industrial and commercial sectors.

- ArcelorMittal launched a new line of sustainable steel products designed specifically for use in energy-efficient metal building systems.

- Butler Manufacturing unveiled a modular building system that reduces construction time and energy consumption, ideal for agricultural and commercial applications.

- Zamil Steel entered into a strategic partnership with a leading construction firm to provide custom-engineered metal buildings for large-scale industrial projects.

- Kingspan Group announced the development of a new insulation solution for metal building systems, improving energy efficiency for commercial and industrial use.

List of Leading Companies:

- Nucor Corporation

- ArcelorMittal

- Butler Manufacturing (a subsidiary of BlueScope Steel)

- Lindab AB

- Zamil Steel

- Kingspan Group

- Aegis Metal Framing

- McElroy Metal

- Varco Pruden Buildings

- United Steel Structures, Inc.

- Reliance Steel & Aluminum Co.

- Steel Building Systems, Inc.

- Ceco Building Systems

- MBCI (Manufactured Buildings & Components, Inc.)

- Morton Buildings, Inc.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 17.3 billion |

|

Forecasted Value (2030) |

USD 33.5 billion |

|

CAGR (2024 – 2030) |

9.9% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Metal Building Systems Market By Material (Steel, Aluminum), By Type (Pre-engineered Metal Buildings, Modular Metal Buildings, Custom Metal Buildings), By Application (Industrial, Commercial, Agricultural, Residential), By End-User Industry (Construction, Agriculture, Retail, Manufacturing, Warehousing) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Nucor Corporation, ArcelorMittal, Butler Manufacturing (a subsidiary of BlueScope Steel), Lindab AB, Zamil Steel, Kingspan Group, Aegis Metal Framing, McElroy Metal, Varco Pruden Buildings, United Steel Structures, Inc., Reliance Steel & Aluminum Co., Steel Building Systems, Inc., Ceco Building Systems, MBCI (Manufactured Buildings & Components, Inc.), Morton Buildings, Inc. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Metal Building Systems Market, by Material (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Steel |

|

4.2. Aluminum |

|

4.3. Other Metals |

|

5. Metal Building Systems Market, by Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Pre-engineered Metal Buildings |

|

5.2. Modular Metal Buildings |

|

5.3. Custom Metal Buildings |

|

6. Metal Building Systems Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Industrial |

|

6.2. Commercial |

|

6.3. Agricultural |

|

6.4. Residential |

|

7. Metal Building Systems Market, by End-User Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Construction |

|

7.2. Agriculture |

|

7.3. Retail |

|

7.4. Manufacturing |

|

7.5. Warehousing |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Metal Building Systems Market, by Material |

|

8.2.7. North America Metal Building Systems Market, by Type |

|

8.2.8. North America Metal Building Systems Market, by Application |

|

8.2.9. North America Metal Building Systems Market, by End-User Industry |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Metal Building Systems Market, by Material |

|

8.2.10.1.2. US Metal Building Systems Market, by Type |

|

8.2.10.1.3. US Metal Building Systems Market, by Application |

|

8.2.10.1.4. US Metal Building Systems Market, by End-User Industry |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Nucor Corporation |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. ArcelorMittal |

|

10.3. Butler Manufacturing (a subsidiary of BlueScope Steel) |

|

10.4. Lindab AB |

|

10.5. Zamil Steel |

|

10.6. Kingspan Group |

|

10.7. Aegis Metal Framing |

|

10.8. McElroy Metal |

|

10.9. Varco Pruden Buildings |

|

10.10. United Steel Structures, Inc. |

|

10.11. Reliance Steel & Aluminum Co. |

|

10.12. Steel Building Systems, Inc. |

|

10.13. Ceco Building Systems |

|

10.14. MBCI (Manufactured Buildings & Components, Inc.) |

|

10.15. Morton Buildings, Inc. |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Metal Building Systems Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Metal Building Systems Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Metal Building Systems Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA