As per Intent Market Research, the Metal and Ceramic Injection Molding Market was valued at USD 3.5 billion and will surpass USD 8.0 billion by 2030; growing at a CAGR of 12.5% during 2024 - 2030.

The Metal and Ceramic Injection Molding (MIM and CIM) market is evolving rapidly as industries seek innovative, cost-effective, and efficient manufacturing techniques. These injection molding processes combine the precision and flexibility of traditional plastic injection molding with the strength and versatility of metals and ceramics. Metal Injection Molding (MIM) and Ceramic Injection Molding (CIM) are ideal for producing complex, high-performance parts with intricate designs, minimal material waste, and excellent dimensional accuracy. These processes are increasingly being adopted across various industries, including automotive, aerospace, healthcare, electronics, and consumer goods, due to their ability to deliver precision-engineered components in a wide range of materials.

MIM and CIM offer significant advantages over traditional manufacturing methods. They provide the ability to manufacture parts with complex geometries that would be difficult or impossible to achieve with conventional casting or machining techniques. The ability to integrate multiple components into a single part, reducing assembly time and costs, is another key benefit. This is particularly attractive in sectors like automotive, where there is increasing demand for lightweight yet durable parts that contribute to better fuel efficiency and performance. In the healthcare and medical industries, MIM and CIM are used to produce precision medical devices, implants, and surgical instruments that require high mechanical strength and intricate design. The growing focus on patient-specific solutions and minimally invasive procedures is further driving demand for these technologies.

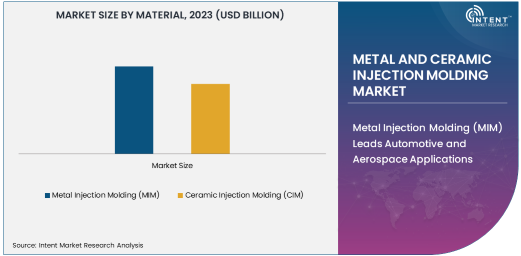

Metal Injection Molding (MIM) Leads Automotive and Aerospace Applications

Among the materials used in the market, Metal Injection Molding (MIM) is a key player in the production of parts for industries requiring strength, high precision, and intricate shapes. The automotive sector, in particular, is a major adopter of MIM technology. Components like gears, connectors, valves, and engine parts can be produced with high strength and durability, meeting the performance demands of modern vehicles. As automotive manufacturers continue to focus on reducing weight, improving efficiency, and lowering costs, MIM is seen as a solution to achieve these objectives while maintaining component performance.

In the aerospace industry, MIM is also widely used to produce lightweight yet high-strength components, such as turbine blades, brackets, and fasteners. Aerospace applications demand parts that can withstand extreme temperatures, pressure, and mechanical stress, all of which can be achieved with MIM components. These benefits are further accentuated by the industry's continuous push towards more efficient and cost-effective manufacturing processes.

Ceramic Injection Molding (CIM) Grows in Electronics and Medical Applications

While Metal Injection Molding (MIM) is dominant in certain sectors, Ceramic Injection Molding (CIM) is gaining significant traction in industries that require high-performance ceramic parts. The electronics sector, for example, uses CIM to produce parts such as capacitors, insulators, and sensors that require high density, uniformity, and excellent electrical insulation properties. As electronics become smaller and more complex, the demand for precision ceramic components is increasing, positioning CIM as an essential process for meeting these evolving needs.

CIM is also playing a key role in the healthcare industry, especially for medical devices and implants. Ceramic materials, such as zirconia and alumina, are widely used in applications that require biocompatibility, durability, and resistance to wear and corrosion. The precision and versatility of CIM allow manufacturers to create custom implants and surgical tools that meet stringent quality and performance standards.

Sintering Process Gains Momentum in Technology Segment

Within the technology segment, the sintering process is the fastest-growing subsegment, owing to its crucial role in enhancing material properties after injection molding. Sintering improves the strength, density, and durability of molded components, making it an indispensable step in MIM and CIM production.

The adoption of advanced sintering technologies, such as vacuum sintering and hot isostatic pressing, is driving innovation in this segment. These methods enable the production of high-performance components for critical applications in industries like aerospace and industrial manufacturing. As the demand for robust and reliable parts continues to rise, the sintering process is expected to witness significant growth in the coming years.

North America Dominates with Advanced Manufacturing Infrastructure

Geographically, North America leads the market, supported by its advanced manufacturing infrastructure and strong presence of key end-use industries such as automotive, healthcare, and aerospace. The region’s focus on technological innovation and adoption of high-performance materials has driven the growth of MIM and CIM technologies.

Additionally, the increasing demand for lightweight and energy-efficient components in the automotive and aerospace sectors has further strengthened North America’s position. The presence of major players and ongoing R&D investments in injection molding technologies are expected to sustain the region's dominance in the global market.

Market Dynamics and Competitive Landscape

The Metal and Ceramic Injection Molding market is expected to experience robust growth driven by technological advancements, the increasing complexity of product designs, and the rising demand for high-performance components in various industries. The automotive, healthcare, aerospace, and electronics industries are the primary drivers of this growth, with demand for lightweight, durable, and cost-efficient parts continuing to rise.

Leading companies in the market are focusing on innovation, process optimization, and material advancements to improve the capabilities of MIM and CIM technologies. These companies are investing in R&D to expand the range of applications and improve the efficiency and cost-effectiveness of their manufacturing processes. Additionally, strategic partnerships and acquisitions are enabling companies to strengthen their position in the global market.

The competitive landscape of the Metal and Ceramic Injection Molding market is characterized by the presence of established players and emerging companies vying for market share. Major players are focusing on expanding their product portfolios, increasing production capacities, and offering customized solutions to meet the evolving needs of their customers. Companies that are able to combine technical expertise with cost-effective solutions and meet the specific demands of industries like automotive, aerospace, and healthcare are likely to dominate the market in the coming years.

Recent Developments:

- Indo-MIM announced the expansion of its metal injection molding capabilities to cater to the growing demand in the automotive and healthcare sectors.

- Dynacast introduced new ceramic injection molding solutions for producing high-precision components in the electronics industry.

- Argen GmbH unveiled a new advanced MIM process to create complex dental and medical components with improved strength and precision.

- Advanced Powder Products (APP) developed a new sintering technology to enhance the production speed and quality of metal injection molded parts.

- Sandvik Materials Technology launched a new line of metal powders designed specifically for MIM processes, improving material properties for aerospace applications.

List of Leading Companies:

- Indo-MIM

- Argen GmbH

- MIM International

- Dynacast

- Philips Medical Systems

- Ceramic Injection Molding (CIM) Group

- PMT - Powder Metallurgical Technologies

- Advanced Powder Products (APP)

- SinterCast

- Sandvik Materials Technology

- SinterMetal Technologies

- Schunk Carbon Technology

- Sumitomo Electric Industries, Ltd.

- ARC Group Worldwide

- Form Technologies

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 3.5 billion |

|

Forecasted Value (2030) |

USD 8.0 billion |

|

CAGR (2024 – 2030) |

12.5% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Metal and Ceramic Injection Molding Market By Material (Metal Injection Molding [MIM], Ceramic Injection Molding [CIM]), By End-User Industry (Automotive, Healthcare & Medical, Aerospace, Electronics, Consumer Goods, Industrial Manufacturing), By Technology (Injection Molding Process, Sintering Process), By Application (Automotive Parts, Medical Devices, Aerospace Components, Electronic Components, Industrial Tools and Equipment) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Indo-MIM, Argen GmbH, MIM International, Dynacast, Philips Medical Systems, Ceramic Injection Molding (CIM) Group, PMT - Powder Metallurgical Technologies, Advanced Powder Products (APP), SinterCast, Sandvik Materials Technology, SinterMetal Technologies, Schunk Carbon Technology, Sumitomo Electric Industries, Ltd., ARC Group Worldwide, Form Technologies |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Metal and Ceramic Injection Molding Market, by Material (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Metal Injection Molding (MIM) |

|

4.2. Ceramic Injection Molding (CIM) |

|

5. Metal and Ceramic Injection Molding Market, by End-User Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Automotive |

|

5.2. Healthcare & Medical |

|

5.3. Aerospace |

|

5.4. Electronics |

|

5.5. Consumer Goods |

|

5.6. Industrial Manufacturing |

|

5.7. Others |

|

6. Metal and Ceramic Injection Molding Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Injection Molding Process |

|

6.2. Sintering Process |

|

7. Metal and Ceramic Injection Molding Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Automotive Parts |

|

7.2. Medical Devices |

|

7.3. Aerospace Components |

|

7.4. Electronic Components |

|

7.5. Industrial Tools and Equipment |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Metal and Ceramic Injection Molding Market, by Material |

|

8.2.7. North America Metal and Ceramic Injection Molding Market, by End-User Industry |

|

8.2.8. North America Metal and Ceramic Injection Molding Market, by Technology |

|

8.2.9. North America Metal and Ceramic Injection Molding Market, by Application |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Metal and Ceramic Injection Molding Market, by Material |

|

8.2.10.1.2. US Metal and Ceramic Injection Molding Market, by End-User Industry |

|

8.2.10.1.3. US Metal and Ceramic Injection Molding Market, by Technology |

|

8.2.10.1.4. US Metal and Ceramic Injection Molding Market, by Application |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Indo-MIM |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Argen GmbH |

|

10.3. MIM International |

|

10.4. Dynacast |

|

10.5. Philips Medical Systems |

|

10.6. Ceramic Injection Molding (CIM) Group |

|

10.7. PMT - Powder Metallurgical Technologies |

|

10.8. Advanced Powder Products (APP) |

|

10.9. SinterCast |

|

10.10. Sandvik Materials Technology |

|

10.11. SinterMetal Technologies |

|

10.12. Schunk Carbon Technology |

|

10.13. Sumitomo Electric Industries, Ltd. |

|

10.14. ARC Group Worldwide |

|

10.15. Form Technologies |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Metal and Ceramic Injection Molding Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Metal and Ceramic Injection Molding Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Metal and Ceramic Injection Molding Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA