sales@intentmarketresearch.com

+1 463-583-2713

Medical Gas Equipment Market By Type (Medical Gases {Pure Medical Gases, Medical Gas Mixtures}, Medical Gas Equipment {Equipment Accessories, Gas Delivery Systems, Cryogenic Products}), By Application (Therapeutic Applications, Pharmaceutical Manufacturing & Research, Diagnostic Applications), By End User (Hospitals & Clinics, Home Healthcare, Pharmaceutical & Biotechnology Companies, Academic & Research Institutions) and By Region; Global Insights & Forecast (2024 – 2030)

As per Intent Market Research, the Medical Gas Equipment Market was valued at USD 19.0 billion in 2023 and will surpass USD 28.0 billion by 2030; growing at a CAGR of 5.7% during 2024 - 2030.

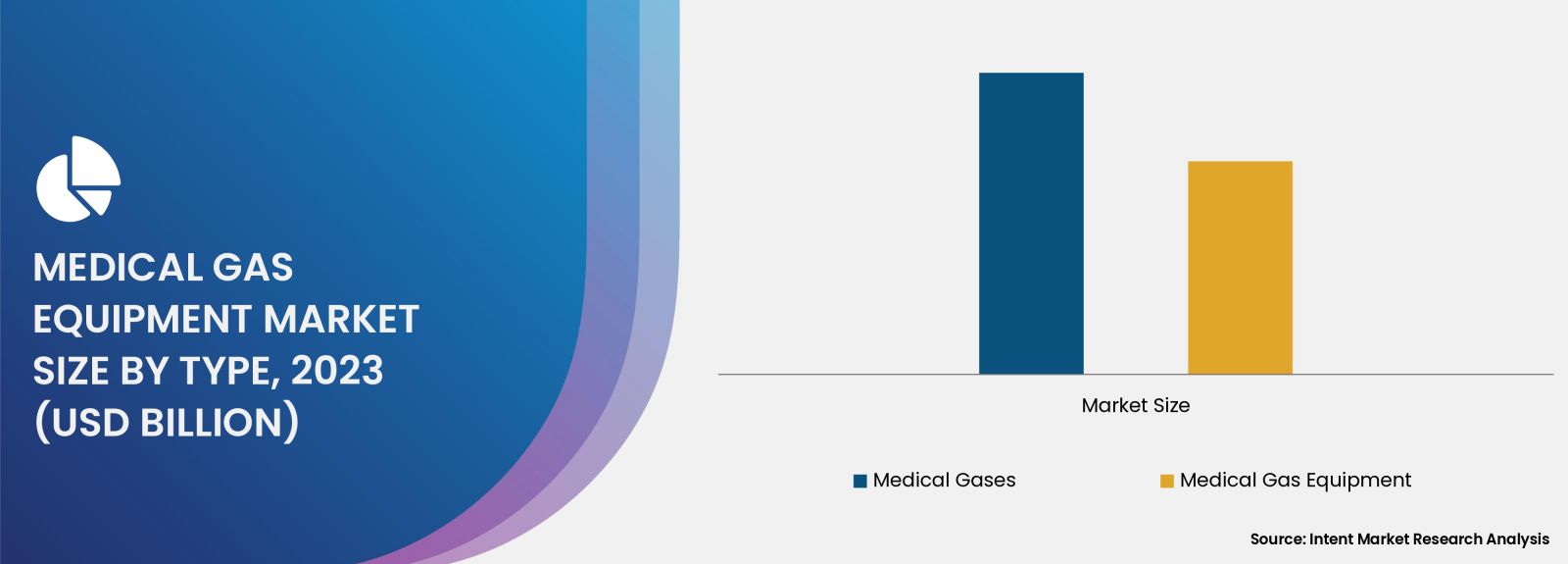

Medical Gases Segment to Dominate the Medical Gas and Equipment Market

In 2023, the medical gases segment dominated the medical gas and equipment market by type, driven by its essential role in healthcare. These gases are crucial for various medical procedures, including anesthesia, respiration, and surgeries. For example, oxygen is vital for life support in critical care, while nitrous oxide is primarily used for anesthesia. The growing prevalence of chronic respiratory diseases and the rising number of surgeries have significantly increased demand for medical gases, fueling market growth. Additionally, innovations in devices such as gas monitoring systems and portable oxygen concentrators are enhancing patient care, further boosting the market.

North America is Projected to Have the Largest Market Size During the Forecast Period

The North American region is expected to lead the medical gas and equipment market, driven by its advanced healthcare infrastructure, which includes large medical device manufacturers and major pharmaceutical companies. The growing incidence of chronic conditions like COPD, asthma, and cardiovascular diseases, which often require long-term medical gas therapy, is a significant factor. Additionally, the aging population in North America has increased the demand for home healthcare services and respiratory therapies, both of which rely on medical gases. The Food and Drug Administration (FDA) enforces stringent regulations on these products to ensure safety and efficiency.

The report focuses on estimating the current market potential in terms of the total addressable market for all the segments, sub-segments, and regions. In the process, all the high-growth and upcoming technologies were identified and analyzed to measure their impact on the current and future market. The report also identifies the key stakeholders, their business gaps, and their purchasing behavior. This information is essential for developing effective marketing strategies and creating products or services that meet the needs of the target market. The report also covers a detailed analysis of the competitive landscape which includes major players, their recent developments, growth strategies, product benchmarking, and manufacturing operations among others. Also, brief insights on start-up ecosystem and emerging companies is also included as part of this report.

Report Objectives:

The report will help you answer some of the most critical questions in the Medical Gas Equipment Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the Medical Gas Equipment Market?

- What is the size of the Medical Gas Equipment Market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 19.0 billion |

|

Forecasted Value (2030) |

USD 28.0 billion |

|

CAGR (2024 – 2030) |

5.7% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Medical Gas Equipment Market By Type (Medical Gases {Pure Medical Gases, Medical Gas Mixtures}, Medical Gas Equipment {Equipment Accessories, Gas Delivery Systems, Cryogenic Products}), By Application (Therapeutic Applications, Pharmaceutical Manufacturing & Research, Diagnostic Applications), By End User (Hospitals & Clinics, Home Healthcare, Pharmaceutical & Biotechnology Companies, Academic & Research Institutions) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3.Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Medical Gas Equipment Market, by Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Medical Gases |

|

4.1.1. Pure Medical Gases |

|

4.1.1.1. Oxygen |

|

4.1.1.2. Carbon Dioxide |

|

4.1.1.3. Nitrogen |

|

4.1.1.4. Nitrous Oxide |

|

4.1.1.5. Medical Air |

|

4.1.1.6. Others |

|

4.1.2. Medical Gas Mixtures |

|

4.1.2.1. Blood-Gas Mixtures |

|

4.1.2.2. Lung Diffusion Mixtures |

|

4.1.2.3. Nitrous Oxide- Oxygen Mixtures |

|

4.1.2.4. Carbon Dioxide- Oxygen Mixtures |

|

4.1.2.5. Laser-Gas Mixtures |

|

4.1.2.6. Anaerobic Gas Mixtures |

|

4.1.2.7. Aerobic Gas Mixtures |

|

4.1.2.8. Helium- Oxygen Mixtures |

|

4.1.2.9. Others |

|

4.2. Medical Gas Equipment |

|

4.2.1. Equipment Accessories |

|

4.2.1.1. Vacuum Systems |

|

4.2.1.2. Manifolds |

|

4.2.1.3. Regulators |

|

4.2.1.4. Flowmeters |

|

4.2.1.5. Valves With Integrated Pressure Regulators |

|

4.2.1.6. Monitoring Systems |

|

4.2.1.7. Medical Air Compressors |

|

4.2.1.8. Others |

|

4.2.2. Gas Delivery Systems |

|

4.2.3. Cryogenic Products |

|

5. Medical Gas Equipment Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Therapeutic Applications |

|

5.1.1. Respiratory Therapies |

|

5.1.2. Cardiovascular Therapies |

|

5.1.3. Anesthesia Delivery |

|

5.1.4. Cryosurgery |

|

5.1.5. Others |

|

5.2. Pharmaceutical Manufacturing & Research |

|

5.3. Diagnostic Applications |

|

5.3.1. Medical Imaging |

|

5.3.2. General Laboratory Applications |

|

5.4. Others |

|

6. Medical Gas Equipment Market, by End User (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Hospitals & Clinics |

|

6.2. Home Healthcare |

|

6.3. Pharmaceutical & Biotechnology Companies |

|

6.4. Academic & Research Institutions |

|

6.5. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Medical Gas Equipment Market, by Type |

|

7.2.7. North America Medical Gas Equipment Market, by Application |

|

7.2.8. North America Medical Gas Equipment Market, by End User |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Medical Gas Equipment Market, by Type |

|

7.2.9.1.2. US Medical Gas Equipment Market, by Application |

|

7.2.9.1.3. US Medical Gas Equipment Market, by End User |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Air Liquide Healthcare |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Air Products and Chemicals, Inc.. |

|

9.3. AIYO NIPPON SANSO CORPORATION |

|

9.4. Atlas Copco North America LLC. |

|

9.5. GCE Group |

|

9.6. Genstar Technologies |

|

9.7. Linde Plc |

|

9.8. Messer SE & Co. KGaA |

|

9.9. Norco |

|

9.10. Rotarex |

|

9.11. SOL Spa |

|

10. Appendix |

Let us connect with you TOC

A comprehensive market research approach was employed to gather and analyze data on the Medical Gas Equipment Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Medical Gas Equipment Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Medical Gas Equipment ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Medical Gas Equipment Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

Available Formats