As per Intent Market Research, the Medical Footwear Market was valued at USD 9.3 Billion in 2024-e and will surpass USD 16.0 Billion by 2030; growing at a CAGR of 8.0%during 2025-2030.

The medical footwear market is experiencing steady growth due to the increasing prevalence of chronic health conditions such as diabetes, arthritis, and other foot-related issues, which demand specialized footwear for both comfort and treatment. With the rise in awareness about foot health and the importance of proper footwear in preventing and managing various medical conditions, the demand for medical footwear has significantly increased. These specialized shoes offer features such as enhanced arch support, cushioning, and protection, catering to patients with specific medical needs, which has made them essential in improving the quality of life for many individuals.

The market is also being driven by a growing aging population, which is more susceptible to conditions like diabetic foot ulcers, plantar fasciitis, and other musculoskeletal disorders. Furthermore, the advancements in footwear technology, such as the use of orthopedic designs and materials, have made medical footwear not only functional but also more fashionable and appealing to consumers. As healthcare systems globally emphasize prevention and management of chronic diseases, the medical footwear market is set to continue its upward trajectory.

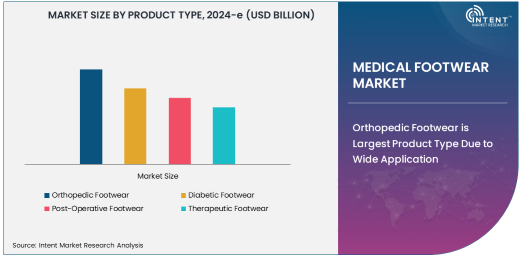

Orthopedic Footwear is Largest Product Type Due to Wide Application

Orthopedic Footwear is the largest product type segment, accounting for a significant share of the medical footwear market. These shoes are designed to support foot health, alleviate pain, and prevent further damage in individuals with foot disorders, musculoskeletal conditions, and those recovering from surgery. The segment’s large share is attributed to the wide range of applications of orthopedic footwear, particularly among individuals suffering from conditions such as arthritis, plantar fasciitis, and flat feet.

The growing awareness regarding the importance of foot health, coupled with an increasing number of orthopedic conditions, is driving the demand for orthopedic footwear. Moreover, the market for orthopedic footwear is expanding as it is increasingly designed to be fashionable, allowing patients to address medical needs without sacrificing style. As an essential tool for enhancing mobility and reducing pain, orthopedic footwear is in high demand among both the elderly population and active individuals with specific foot-related health concerns.

Synthetic Material Dominates Market Due to Durability and Comfort

Synthetic Materials dominate the material segment of the medical footwear market. These materials are preferred due to their lightweight properties, durability, comfort, and ability to be molded to the foot’s specific shape. The use of synthetic materials has enabled manufacturers to produce medical footwear that combines functionality with comfort, making it an attractive option for both patients and consumers seeking footwear for general use.

The demand for synthetic materials in medical footwear is further driven by the increasing need for shoes that offer high levels of breathability, flexibility, and moisture control, as well as those that are easier to clean and maintain. These advantages make synthetic materials an ideal choice for creating comfortable and long-lasting footwear, particularly in therapeutic and diabetic footwear segments, which require specific designs to prevent pressure points and provide maximum support.

Women Lead End-User Segment Due to Higher Demand for Specialized Footwear

Women are the largest end-user segment in the medical footwear market, largely due to the higher prevalence of foot-related health issues in women compared to men. Conditions such as plantar fasciitis, bunions, and flat feet are common among women, especially as they age or experience hormonal changes such as pregnancy and menopause, which can affect foot structure and function.

Women are also more likely to seek specialized footwear, including orthopedic and therapeutic shoes, for preventive and therapeutic purposes. The demand is further fueled by a growing awareness of foot health and the availability of women-specific medical footwear that combines medical benefits with stylish designs. As women increasingly prioritize foot health, the market for women’s medical footwear continues to expand.

Online Retailers Are Fastest-Growing Distribution Channel

Online Retailers are the fastest-growing distribution channel for medical footwear, driven by the increasing trend of online shopping and the growing availability of specialized products. The convenience of shopping from home and the ability to access a wide variety of footwear options without the limitations of traditional brick-and-mortar stores has contributed significantly to the growth of online retail.

E-commerce platforms offer consumers easy access to medical footwear, with detailed product descriptions, customer reviews, and sizing guides, which help in making informed purchasing decisions. The rise of online retailers has also encouraged manufacturers to develop user-friendly websites and partnerships with major online platforms, thus expanding their reach and market presence. As consumers continue to shift towards online shopping, the online retail channel is expected to lead the medical footwear market’s distribution in the coming years.

North America Leads Regional Market Due to High Healthcare Awareness

North America is the largest regional market for medical footwear, driven by high healthcare awareness and the growing demand for specialized medical products. The United States, in particular, is a major hub for medical footwear, with a large consumer base of individuals seeking footwear solutions for conditions like diabetes and orthopedic disorders.

The region’s well-developed healthcare infrastructure, coupled with a high standard of living, contributes to the strong demand for medical footwear. Additionally, the aging population in North America is a key factor in driving the market, as older individuals are more likely to require specialized footwear for foot health management. The continuous development of innovative products tailored to the needs of North American consumers further supports the region’s dominance in the global market.

Competitive Landscape

The medical footwear market is highly competitive, with several leading companies offering a range of specialized products. Key players include Dr. Comfort, Orthofeet, Aetrex Worldwide, and New Balance. These companies are focusing on product innovation, offering designs that balance medical functionality with comfort and style.

The competitive landscape is characterized by a mix of established global players and smaller, specialized manufacturers. Many companies are increasingly emphasizing research and development to create footwear that meets the specific needs of different patient groups. Partnerships between medical professionals, shoe designers, and manufacturers are also common as companies look to enhance their product offerings and stay ahead in a growing and competitive market.

Recent Developments:

- In December 2024, Dr. Comfort introduced a new line of diabetic shoes designed with advanced arch support and extra padding for enhanced comfort.

- In November 2024, Orthofeet Inc. launched a new collection of orthopedic shoes that incorporate memory foam technology for better cushioning and foot alignment.

- In October 2024, Propet USA expanded its product range to include a new series of post-operative footwear designed for quick recovery after foot surgery.

- In September 2024, Aetrex Worldwide, Inc. unveiled a new online tool that allows customers to customize their medical footwear according to their unique foot shape and needs.

- In August 2024, Bauerfeind AG introduced an innovative therapeutic footwear line designed to alleviate pain from heel spurs and plantar fasciitis.

List of Leading Companies:

- Drew Shoe Corporation

- Orthofeet Inc.

- Dr. Comfort

- SoleTech, Inc.

- Aetrex Worldwide, Inc.

- Propet USA

- New Balance Athletics, Inc.

- Saucony, Inc.

- Brooks Running

- Spenco Medical Corporation

- Rockport

- Bauerfeind AG

- Birkenstock GmbH & Co. KG

- Foot Science International Ltd.

- TalarMade

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 9.3 Billion |

|

Forecasted Value (2030) |

USD 16.0 Billion |

|

CAGR (2025 – 2030) |

8.0% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Medical Footwear Market by Product Type (Orthopedic Footwear, Diabetic Footwear, Post-Operative Footwear, Therapeutic Footwear), Material (Leather, Synthetic, Fabric, Rubber), End-User (Men, Women, Children), Distribution Channel (Online Retailers, Retail Stores, Medical Supply Stores) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Drew Shoe Corporation, Orthofeet Inc., Dr. Comfort, SoleTech, Inc., Aetrex Worldwide, Inc., Propet USA, New Balance Athletics, Inc., Saucony, Inc., Brooks Running, Spenco Medical Corporation, Rockport, Bauerfeind AG, Birkenstock GmbH & Co. KG, Foot Science International Ltd., TalarMade |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Medical Footwear Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Orthopedic Footwear |

|

4.2. Diabetic Footwear |

|

4.3. Post-Operative Footwear |

|

4.4. Therapeutic Footwear |

|

5. Medical Footwear Market, by Material (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Leather |

|

5.2. Synthetic |

|

5.3. Fabric |

|

5.4. Rubber |

|

6. Medical Footwear Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Men |

|

6.2. Women |

|

6.3. Children |

|

7. Medical Footwear Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Online Retailers |

|

7.2. Retail Stores |

|

7.3. Medical Supply Stores |

|

7.4. |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Medical Footwear Market, by Product Type |

|

8.2.7. North America Medical Footwear Market, by Material |

|

8.2.8. North America Medical Footwear Market, by End-User |

|

8.2.9. North America Medical Footwear Market, by Distribution Channel |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Medical Footwear Market, by Product Type |

|

8.2.10.1.2. US Medical Footwear Market, by Material |

|

8.2.10.1.3. US Medical Footwear Market, by End-User |

|

8.2.10.1.4. US Medical Footwear Market, by Distribution Channel |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Drew Shoe Corporation |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Orthofeet Inc. |

|

10.3. Dr. Comfort |

|

10.4. SoleTech, Inc. |

|

10.5. Aetrex Worldwide, Inc. |

|

10.6. Propet USA |

|

10.7. New Balance Athletics, Inc. |

|

10.8. Saucony, Inc. |

|

10.9. Brooks Running |

|

10.10. Spenco Medical Corporation |

|

10.11. Rockport |

|

10.12. Bauerfeind AG |

|

10.13. Birkenstock GmbH & Co. KG |

|

10.14. Foot Science International Ltd. |

|

10.15. TalarMade |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Medical Footwear Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Medical Footwear Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Medical Footwear Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA