As per Intent Market Research, the Magnesium Hydroxide Market was valued at USD 2.4 Billion in 2024-e and will surpass USD 4.4 Billion by 2030; growing at a CAGR of 9.2% during 2025-2030.

Magnesium Hydroxide has established itself as a versatile chemical compound with widespread applications across various industries, including pharmaceuticals, food, agriculture, and construction. Due to its non-toxic properties and effectiveness in neutralizing acids, the demand for Magnesium Hydroxide continues to grow, driven by increasing environmental regulations and the need for sustainable solutions. The market is evolving rapidly, with a strong emphasis on product innovation, regulatory compliance, and expanding application areas.

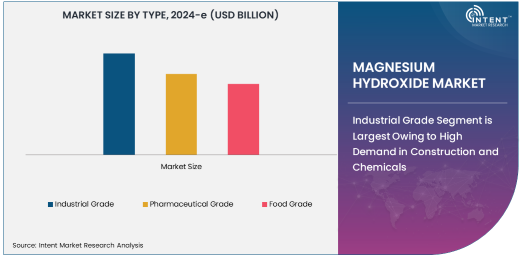

Industrial Grade Segment is Largest Owing to High Demand in Construction and Chemicals

The Industrial Grade segment of Magnesium Hydroxide dominates the market, primarily driven by its extensive use in construction and chemical industries. It serves as a crucial component for fire suppression, wastewater treatment, and as a pH regulator in various industrial processes. With the construction sector witnessing significant growth globally, the demand for industrial-grade Magnesium Hydroxide continues to rise. Moreover, its use in neutralizing acidic emissions and supporting industrial applications has solidified its position as the largest subsegment.

Pharmaceutical Grade Segment is Fastest Growing Due to Increasing Healthcare Applications

The Pharmaceutical Grade Magnesium Hydroxide segment is experiencing rapid growth, fueled by the rising need for antacids and drug formulations. In the healthcare sector, its role in neutralizing stomach acids and controlling pH balance in various medications is irreplaceable. The shift towards higher standards in pharmaceutical production and the continuous demand for quality healthcare solutions have driven the growth of this subsegment. As regulations become more stringent, the adoption of pharmaceutical-grade Magnesium Hydroxide is expected to expand further.

Food Grade Segment is Largest in Supporting Regulatory Compliance and Consumer Safety

The Food Grade segment of Magnesium Hydroxide holds a significant share in the market, primarily due to its use in food and beverage applications for maintaining food safety standards. As consumers become more health-conscious and regulatory bodies tighten safety norms, the demand for food-grade Magnesium Hydroxide has surged. Its non-reactive nature and ability to neutralize acidity in food products have made it indispensable, ensuring compliance with global food safety regulations.

Agriculture Segment is Fastest Growing Driven by Rising Demand for pH Regulation and Fertilizer Stabilization

The Agriculture segment is witnessing the fastest growth in Magnesium Hydroxide usage, driven by the increasing need for pH adjustment and nutrient stabilization in soil. Magnesium Hydroxide helps regulate soil acidity, enabling optimal crop growth and enhancing soil quality. With the agriculture sector facing challenges such as declining soil fertility, the adoption of Magnesium Hydroxide for agricultural purposes is projected to grow at a rapid pace, supported by sustainable farming practices.

Fastest Growing Region in Magnesium Hydroxide Market is Asia-Pacific

The Asia-Pacific region has emerged as the fastest-growing market for Magnesium Hydroxide, primarily due to rapid industrialization, urbanization, and a surge in agricultural activities. Countries such as China, India, and Southeast Asian nations are driving this growth, fueled by increased demand in construction, food safety, and environmental management. Additionally, stringent government regulations in these regions are pushing industries to adopt eco-friendly and safe chemical alternatives, further boosting the demand for Magnesium Hydroxide.

Competitive Landscape and Leading Companies

The Magnesium Hydroxide market is highly competitive, with key players striving to innovate and expand their product portfolios. Companies such as Tosoh Corporation, Brenntag AG, and Huber Engineered Materials are at the forefront, leveraging their expertise in chemical manufacturing and meeting stringent industry standards. The competitive landscape is marked by collaborations, acquisitions, and advancements in product quality, ensuring companies stay ahead in catering to evolving market demands.

Recent Developments:

- Tosoh Corporation launched a new Pharmaceutical Grade Magnesium Hydroxide product for medical applications.

- Brenntag AG completed an acquisition of a major supplier, expanding its market share in the Chemical Grade Magnesium Hydroxide sector.

- Huber Engineered Materials received regulatory approval for its eco-friendly Magnesium Hydroxide formulation for fire suppression.

- Kyowa Chemical Industry Co., Ltd. introduced a high-purity, pharmaceutical-grade Magnesium Hydroxide for drug formulations.

- Maruo Calcium Co., Ltd. expanded its manufacturing facility for increased production capacity of Magnesium Hydroxide.

List of Leading Companies:

- Tosoh Corporation

- Martin Marietta Materials

- Huber Engineered Materials

- Spectrum Chemical Manufacturing

- Magnezit Group

- The Jordahl Company

- Yunnan Non-Ferrous Chihong Zinc & Germanium Co.

- Shanghai Yijin Chemical Co., Ltd.

- Kyowa Chemical Industry Co., Ltd.

- Brenntag AG

- FMC Corporation

- Nakamura Chemicals

- Innophos Holdings, Inc.

- Maruo Calcium Co., Ltd.

- GEO Specialty Chemicals, Inc.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 2.4 Billion |

|

Forecasted Value (2030) |

USD 4.4 Billion |

|

CAGR (2025 – 2030) |

9.2% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Magnesium Hydroxide Market By Type (Industrial Grade, Pharmaceutical Grade, Food Grade), By Application (Pharmaceuticals, Food & Beverage, Agriculture, Personal Care, Construction, Chemicals), and By Region |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Tosoh Corporation, Martin Marietta Materials, Huber Engineered Materials, Spectrum Chemical Manufacturing, Magnezit Group, The Jordahl Company, Yunnan Non-Ferrous Chihong Zinc & Germanium Co., Shanghai Yijin Chemical Co., Ltd., Kyowa Chemical Industry Co., Ltd., Brenntag AG, FMC Corporation, Nakamura Chemicals, Innophos Holdings, Inc., Maruo Calcium Co., Ltd., GEO Specialty Chemicals, Inc. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Magnesium Hydroxide Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Industrial Grade |

|

4.2. Pharmaceutical Grade |

|

4.3. Food Grade |

|

5. Magnesium Hydroxide Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Pharmaceuticals |

|

5.2. Food & Beverage |

|

5.3. Agriculture |

|

5.4. Personal Care |

|

5.5. Construction |

|

5.6. Chemicals |

|

6. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Regional Overview |

|

6.2. North America |

|

6.2.1. Regional Trends & Growth Drivers |

|

6.2.2. Barriers & Challenges |

|

6.2.3. Opportunities |

|

6.2.4. Factor Impact Analysis |

|

6.2.5. Technology Trends |

|

6.2.6. North America Magnesium Hydroxide Market, by Type |

|

6.2.7. North America Magnesium Hydroxide Market, by Application |

|

6.2.8. By Country |

|

6.2.8.1. US |

|

6.2.8.1.1. US Magnesium Hydroxide Market, by Type |

|

6.2.8.1.2. US Magnesium Hydroxide Market, by Application |

|

6.2.8.2. Canada |

|

6.2.8.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

6.3. Europe |

|

6.4. Asia-Pacific |

|

6.5. Latin America |

|

6.6. Middle East & Africa |

|

7. Competitive Landscape |

|

7.1. Overview of the Key Players |

|

7.2. Competitive Ecosystem |

|

7.2.1. Level of Fragmentation |

|

7.2.2. Market Consolidation |

|

7.2.3. Product Innovation |

|

7.3. Company Share Analysis |

|

7.4. Company Benchmarking Matrix |

|

7.4.1. Strategic Overview |

|

7.4.2. Product Innovations |

|

7.5. Start-up Ecosystem |

|

7.6. Strategic Competitive Insights/ Customer Imperatives |

|

7.7. ESG Matrix/ Sustainability Matrix |

|

7.8. Manufacturing Network |

|

7.8.1. Locations |

|

7.8.2. Supply Chain and Logistics |

|

7.8.3. Product Flexibility/Customization |

|

7.8.4. Digital Transformation and Connectivity |

|

7.8.5. Environmental and Regulatory Compliance |

|

7.9. Technology Readiness Level Matrix |

|

7.10. Technology Maturity Curve |

|

7.11. Buying Criteria |

|

8. Company Profiles |

|

8.1. Tosoh Corporation |

|

8.1.1. Company Overview |

|

8.1.2. Company Financials |

|

8.1.3. Product/Service Portfolio |

|

8.1.4. Recent Developments |

|

8.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

8.2. Martin Marietta Materials |

|

8.3. Huber Engineered Materials |

|

8.4. Spectrum Chemical Manufacturing |

|

8.5. Magnezit Group |

|

8.6. The Jordahl Company |

|

8.7. Yunnan Non-Ferrous Chihong Zinc & Germanium Co. |

|

8.8. Shanghai Yijin Chemical Co., Ltd. |

|

8.9. Kyowa Chemical Industry Co., Ltd. |

|

8.10. Brenntag AG |

|

8.11. FMC Corporation |

|

8.12. Nakamura Chemicals |

|

8.13. Innophos Holdings, Inc. |

|

8.14. Maruo Calcium Co., Ltd. |

|

8.15. GEO Specialty Chemicals, Inc. |

|

9. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Magnesium Hydroxide Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Magnesium Hydroxide Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Magnesium Hydroxide Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA