As per Intent Market Research, the Magnesite Market was valued at USD 1.9 Billion in 2024-e and will surpass USD 3.6 Billion by 2030; growing at a CAGR of 9.2% during 2025-2030.

Magnesite is a crucial industrial mineral widely used across various sectors, including steelmaking, refractories, agriculture, and construction. With increasing demand for high-performance materials in metallurgy and the rise of sustainable and eco-friendly solutions, the magnesite market is witnessing steady growth globally. This is driven by advancements in extraction and processing technologies, alongside a rising focus on optimizing product quality for specific industrial applications. The market’s expansion is further fueled by the global push towards reducing environmental impact, as magnesite provides more sustainable alternatives to traditional materials.

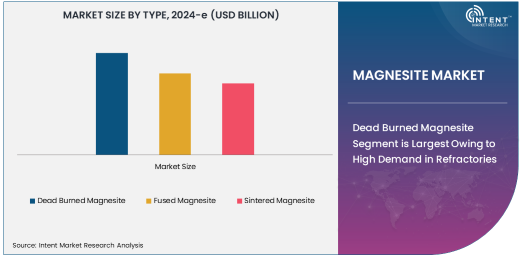

Dead Burned Magnesite Segment is Largest Owing to High Demand in Refractories

Dead burned magnesite holds the largest share within the magnesite market due to its superior thermal and chemical resistance properties. It is predominantly used in the production of refractory bricks, monolithics, and linings for furnaces, kilns, and other high-temperature industrial applications. With an expanding steel, cement, and glass industry, the demand for dead burned magnesite continues to rise. Its ability to withstand extreme temperatures and corrosive environments positions it as a preferred choice for industries requiring durability and longevity in demanding settings.

Fused Magnesite Segment is Fastest Growing Owing to Rising Use in Specialty Applications

Fused magnesite is the fastest growing subsegment within the magnesite market, attributed to its increasing use in specialty applications such as the manufacture of advanced refractory products, chemicals, and specialized abrasives. Its high purity and superior performance in high-temperature environments make it a vital component in demanding industries like automotive, aerospace, and chemical processing. Additionally, advancements in production techniques and increasing focus on environmental sustainability are driving the adoption of fused magnesite for greener industrial solutions.

Sintered Magnesite Segment Expands Rapidly in Construction and Agriculture

Sintered magnesite is experiencing rapid growth, especially in applications related to construction and agriculture. Its properties, including enhanced strength and resistance to chemical attack, make it suitable for cement additives, soil conditioning, and agriculture applications. The expanding infrastructure and agricultural sectors in emerging economies are driving the demand for sintered magnesite. Furthermore, increasing government investments in sustainable agriculture and green building practices are further boosting the uptake of this versatile material.

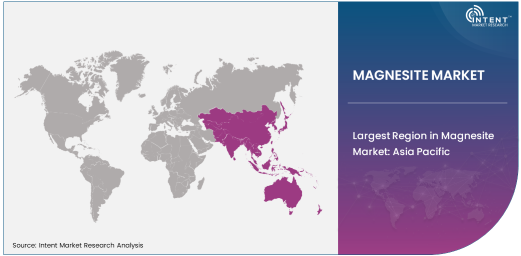

Largest Region in Magnesite Market: Asia Pacific

The Asia Pacific region dominates the magnesite market due to its robust industrial sector and high consumption across various end-use industries such as steel, cement, and chemicals. Countries like China, India, and Japan are key contributors to the region’s dominance, driven by significant investments in infrastructure, industrial development, and technological advancements in mining and processing technologies. Additionally, the increasing focus on environmental sustainability in the region has led to innovations in magnesite-based solutions, supporting its continued dominance.

Competitive Landscape and Leading Companies

The magnesite market is highly competitive, with major players focusing on product innovation, capacity expansion, and sustainability initiatives. Leading companies such as Rio Tinto, RHI Magnesita, Sibelco, and Liaoning Jinding Magnesite Group are actively engaging in mergers, acquisitions, and strategic partnerships to strengthen their market position. The competitive landscape is characterized by ongoing research and development in eco-friendly magnesite applications, technological advancements, and a commitment to meeting global industry standards for performance and sustainability

Recent Developments:

- Rio Tinto announces expansion of its magnesite mining operations in Australia to meet growing global demand.

- RHI Magnesita launches a new line of eco-friendly magnesite-based refractories.

- Sibelco acquires a key magnesite mine in Europe to strengthen its market position.

- Greensill Capital invests in a magnesite refining technology for use in sustainable agricultural applications.

- Calix Ltd. secures a major contract to supply dead burned magnesite for a new steel mill in Southeast Asia.

List of Leading Companies:

- Rio Tinto

- U.S. Magnesium

- Sibelco

- Deadburned Specialty Magnesia Ltd.

- Calix Ltd.

- RHI Magnesita

- Liaoning Jinding Magnesite Group Co., Ltd.

- Guangxi Yukun Mining Co., Ltd.

- Hunan Nonferrous Chenzhou Magnesium Co., Ltd.

- Grecian Magnesite S.A.

- Magnezit Group

- Beishan Magnesium Co., Ltd.

- Yichuan Shengyu Mining Co., Ltd.

- Kumas Magnesium Elektron

- NorMag OY

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.9 Billion |

|

Forecasted Value (2030) |

USD 3.6 Billion |

|

CAGR (2025 – 2030) |

9.2% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Magnesite Market By Type (Dead Burned Magnesite, Fused Magnesite, Sintered Magnesite), By Application (Refractories, Agriculture, Chemicals, Metallurgy, Construction), and By End-User Industry (Steel, Cement, Automotive, Glass, Chemical) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Rio Tinto, U.S. Magnesium, Sibelco, Deadburned Specialty Magnesia Ltd., Calix Ltd., RHI Magnesita, Liaoning Jinding Magnesite Group Co., Ltd., Guangxi Yukun Mining Co., Ltd., Hunan Nonferrous Chenzhou Magnesium Co., Ltd., Grecian Magnesite S.A., Magnezit Group, Beishan Magnesium Co., Ltd., Yichuan Shengyu Mining Co., Ltd., Kumas Magnesium Elektron, NorMag OY |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Magnesite Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Dead Burned Magnesite |

|

4.2. Fused Magnesite |

|

4.3. Sintered Magnesite |

|

5. Magnesite Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Refractories |

|

5.2. Agriculture |

|

5.3. Chemicals |

|

5.4. Metallurgy |

|

5.5. Construction |

|

6. Magnesite Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Steel |

|

6.2. Cement |

|

6.3. Automotive |

|

6.4. Glass |

|

6.5. Chemical |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Magnesite Market, by Type |

|

7.2.7. North America Magnesite Market, by Application |

|

7.2.8. North America Magnesite Market, by End-User Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Magnesite Market, by Type |

|

7.2.9.1.2. US Magnesite Market, by Application |

|

7.2.9.1.3. US Magnesite Market, by End-User Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Rio Tinto |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. U.S. Magnesium |

|

9.3. Sibelco |

|

9.4. Deadburned Specialty Magnesia Ltd. |

|

9.5. Calix Ltd. |

|

9.6. RHI Magnesita |

|

9.7. Liaoning Jinding Magnesite Group Co., Ltd. |

|

9.8. Guangxi Yukun Mining Co., Ltd. |

|

9.9. Hunan Nonferrous Chenzhou Magnesium Co., Ltd. |

|

9.10. Grecian Magnesite S.A. |

|

9.11. Magnezit Group |

|

9.12. Beishan Magnesium Co., Ltd. |

|

9.13. Yichuan Shengyu Mining Co., Ltd. |

|

9.14. Kumas Magnesium Elektron |

|

9.15. NorMag OY |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Magnesite Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Magnesite Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Magnesite Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA