As per Intent Market Research, the Machine To Machine Connections Market was valued at USD 14.2 Billion in 2024-e and will surpass USD 38.9 Billion by 2030; growing at a CAGR of 15.6% during 2025-2030.

The machine to machine (M2M) connections market has witnessed rapid growth, driven by the increasing demand for seamless connectivity across industrial, healthcare, and smart city applications. With the proliferation of connected devices, organizations are investing in advanced M2M technologies to enhance automation, data exchange, and operational efficiency. As businesses seek to leverage IoT solutions for real-time data insights, the market continues to expand with new innovations shaping the landscape.

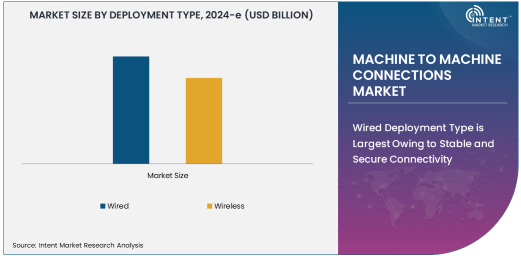

Wired Deployment Type is Largest Owing to Stable and Secure Connectivity

The wired deployment type holds the largest share in the M2M connections market due to its reliable and secure communication capabilities. Wired connections, such as Ethernet and fiber optics, are extensively used in critical applications like industrial automation and healthcare, where data integrity and consistent connectivity are essential. These technologies ensure minimal downtime and maximum security, making them the preferred choice for industries that demand high performance and stability.

5G Technology is Fastest Growing Owing to High-Speed Connectivity and Low Latency

The 5G technology segment is the fastest growing within the M2M connections market, driven by its ability to provide high-speed data transfer and ultra-low latency. As industries, including manufacturing and transportation, adopt IoT-driven solutions, 5G networks offer the necessary bandwidth and reliability for real-time communication. The rapid deployment of 5G networks in urban and industrial environments is accelerating the adoption of M2M connections for mission-critical applications.

Industrial Automation Application is Largest Owing to Widespread Deployment in Manufacturing and Operations

The industrial automation application dominates the M2M connections market, primarily due to its extensive use in manufacturing and production facilities. Automation systems rely heavily on connected devices to streamline operations, improve efficiency, and ensure real-time monitoring. With the need for predictive maintenance and continuous process optimization, industrial automation has emerged as a leading application driving M2M adoption.

Manufacturing Industry Vertical is Largest Owing to High Demand for Connected Factory Solutions

In the M2M market, the manufacturing industry vertical represents the largest segment due to its extensive use of connected devices and IoT solutions. Factories are increasingly deploying M2M technologies for automation, inventory management, and supply chain optimization. The need for real-time monitoring, predictive analytics, and asset management has made manufacturing the dominant sector driving M2M adoption.

Asia Pacific Region is Fastest Growing Owing to Expanding Industrial Base and Digital Transformation

The Asia Pacific region is the fastest-growing market for M2M connections, driven by rapid industrialization and digital transformation initiatives across countries like China, India, and Southeast Asia. With a burgeoning manufacturing sector and increasing adoption of smart cities, the demand for connected devices and IoT solutions is surging. The region’s focus on smart infrastructure and automation solutions is accelerating M2M growth at a remarkable pace.

Competitive Landscape and Leading Companies

The machine to machine connections market is highly competitive, with leading players continuously innovating to meet the demands of industrial and smart applications. Companies such as Siemens, Cisco, Ericsson, and Huawei are at the forefront, providing cutting-edge solutions that enhance connectivity and data management. Additionally, startups and smaller firms are driving advancements in niche areas like smart agriculture and healthcare IoT, further enriching the competitive landscape. The integration of AI, cybersecurity, and 5G technologies are shaping future developments in this rapidly evolving market.

Recent Developments:

- Siemens launched a new M2M platform to integrate advanced automation capabilities for industrial applications.

- Ericsson partnered with healthcare providers to expand M2M-based remote patient monitoring solutions.

- Nokia unveiled a 5G-enabled M2M solution for smart transportation systems in urban areas.

- AT&T acquired a leading M2M service provider to strengthen its IoT and connectivity offerings.

- Qualcomm introduced a new M2M chipset designed for advanced asset tracking and connected logistics solutions.

List of Leading Companies:

- Siemens

- GE

- Cisco

- Ericsson

- IBM

- Nokia

- Huawei

- Qualcomm

- Schneider Electric

- Intel

- Vodafone

- AT&T

- Bosch

- Honeywell

- Mitsubishi Electric

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 14.2 Billion |

|

Forecasted Value (2030) |

USD 38.9 Billion |

|

CAGR (2025 – 2030) |

15.6% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Machine to Machine Connections Market By Deployment Type (Wired, Wireless), By Technology (4G/LTE, 5G, LPWAN), By Application (Industrial Automation, Asset Tracking, Smart Cities), and By Industry Vertical (Manufacturing, Transportation, Energy, Healthcare) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Siemens, GE, Cisco, Ericsson, IBM, Nokia, Huawei, Qualcomm, Schneider Electric, Intel, Vodafone, AT&T, Bosch, Honeywell, Mitsubishi Electric |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Machine To Machine Connections Market, by Deployment Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Wired |

|

4.2. Wireless |

|

5. Machine To Machine Connections Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. 4G/LTE |

|

5.2. 5G |

|

5.3. LPWAN |

|

6. Machine To Machine Connections Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Industrial Automation |

|

6.2. Asset Tracking |

|

6.3. Smart Cities |

|

7. Machine To Machine Connections Market, by Industry Vertical (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Manufacturing |

|

7.2. Transportation |

|

7.3. Energy |

|

7.4. Healthcare |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Machine To Machine Connections Market, by Deployment Type |

|

8.2.7. North America Machine To Machine Connections Market, by Technology |

|

8.2.8. North America Machine To Machine Connections Market, by Application |

|

8.2.9. North America Machine To Machine Connections Market, by Industry Vertical |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Machine To Machine Connections Market, by Deployment Type |

|

8.2.10.1.2. US Machine To Machine Connections Market, by Technology |

|

8.2.10.1.3. US Machine To Machine Connections Market, by Application |

|

8.2.10.1.4. US Machine To Machine Connections Market, by Industry Vertical |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Siemens |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. GE |

|

10.3. Cisco |

|

10.4. Ericsson |

|

10.5. IBM |

|

10.6. Nokia |

|

10.7. Huawei |

|

10.8. Qualcomm |

|

10.9. Schneider Electric |

|

10.10. Intel |

|

10.11. Vodafone |

|

10.12. AT&T |

|

10.13. Bosch |

|

10.14. Honeywell |

|

10.15. Mitsubishi Electric |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Machine to Machine Connections Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Machine to Machine Connections Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Machine to Machine Connections Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA