As per Intent Market Research, the Lysosomal Acid Lipase Deficiency Treatment Market was valued at USD 233.4 Billion in 2024-e and will surpass USD 381.0 Billion by 2030; growing at a CAGR of 8.5% during 2025-2030.

The lysosomal acid lipase deficiency (LAL-D) treatment market is expanding rapidly due to increasing awareness of rare diseases and advancements in therapeutic options. LAL-D, a rare genetic condition, leads to lipid accumulation in vital organs, necessitating effective treatments to prevent life-threatening complications. With growing investments in research and development, the market is witnessing a surge in innovative therapies that promise improved patient outcomes.

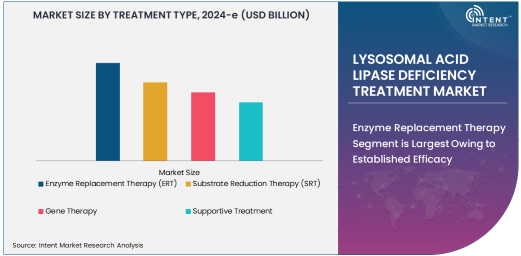

Enzyme Replacement Therapy Segment is Largest Owing to Established Efficacy

Enzyme Replacement Therapy (ERT) dominates the LAL-D treatment landscape as the most established and widely used treatment option. ERT works by supplementing the deficient enzyme, helping reduce lipid accumulation and improving liver function. Its proven efficacy and favorable safety profile have made it the first-line treatment for both pediatric and adult patients.

The widespread adoption of ERT is driven by therapies such as sebelipase alfa, which has gained regulatory approvals in multiple regions. As awareness of LAL-D increases, the demand for ERT continues to grow, solidifying its position as the largest segment in this market.

Wolman Disease Segment is Fastest Growing Due to High Unmet Needs

The Wolman disease segment is experiencing the fastest growth in the market due to its severe clinical presentation and high unmet medical needs. As a rare and life-threatening condition that manifests in infancy, Wolman disease necessitates immediate and effective intervention. Recent advancements in early diagnosis and targeted treatments are propelling this segment’s growth.

Innovations in enzyme replacement and gene therapies are addressing the urgent needs of Wolman disease patients. With increasing awareness and specialized healthcare infrastructure, the segment is poised for robust expansion over the forecast period.

Intravenous Route Segment is Largest Owing to Its Effectiveness

The intravenous (IV) route of administration holds the largest market share owing to its superior bioavailability and rapid therapeutic impact. IV administration is critical for delivering enzyme replacement therapies directly into the bloodstream, ensuring efficient distribution to target tissues.

The preference for IV treatments is further supported by advancements in hospital-based infusion centers and home infusion services, enhancing patient access and adherence. As new IV formulations are developed, this segment is expected to maintain its dominance in the coming years.

Specialty Clinics Segment is Fastest Growing Due to Focused Care

Specialty clinics are the fastest-growing end-user segment, attributed to their ability to provide focused and personalized care for rare diseases like LAL-D. These clinics are equipped with specialized staff and diagnostic tools that enable timely intervention and comprehensive disease management.

With the rise of multidisciplinary approaches to rare disease treatment, specialty clinics are becoming a preferred choice for both patients and healthcare providers. Partnerships between clinics and pharmaceutical companies are further boosting access to advanced therapies, driving this segment’s rapid growth.

North America is Largest Region Owing to Advanced Healthcare Infrastructure

North America dominates the LAL-D treatment market, driven by advanced healthcare infrastructure, high diagnostic rates, and significant investments in rare disease research. The region benefits from strong regulatory support and a favorable reimbursement environment, facilitating patient access to innovative therapies.

The United States, in particular, leads the market with its robust pipeline of enzyme replacement and gene therapies. Collaboration between research institutions and biotechnology companies is further accelerating the development of new treatment options, reinforcing North America’s leadership position.

Competitive Landscape and Leading Companies

The LAL-D treatment market is characterized by intense competition and significant investments in R&D. Leading companies such as Alexion Pharmaceuticals, Sanofi, and Takeda Pharmaceutical dominate the market with their established enzyme replacement therapies. Emerging players like Moderna and Orchard Therapeutics are making strides in gene therapy development, bringing innovative solutions to the forefront.

Strategic collaborations, mergers, and acquisitions are shaping the competitive landscape as companies strive to expand their product portfolios and geographical reach. This dynamic environment promises continued advancements in LAL-D treatment, improving the quality of life for patients worldwide.

Recent Developments:

- Alexion announced the expansion of its enzyme replacement therapy platform, targeting lipid storage disorders, including LAL-D.

- Moderna has begun trials for its innovative mRNA-based therapy, aiming to enhance treatment efficacy for lysosomal storage diseases.

- The FDA approved Sanofi's novel enzyme replacement therapy, showcasing improved outcomes for CESD patients.

- Takeda partnered with a leading biotech firm to advance gene therapy solutions for LAL-D, focusing on long-term disease management.

- Ultragenyx announced the acquisition of a biotechnology company specializing in rare disease treatments, including pipeline products for LAL-D.

List of Leading Companies:

- Alexion Pharmaceuticals, Inc.

- Pfizer Inc.

- Sanofi S.A.

- Takeda Pharmaceutical Company Limited

- Amicus Therapeutics, Inc.

- BioMarin Pharmaceutical Inc.

- Shire (now part of Takeda)

- Moderna, Inc.

- Orchard Therapeutics

- Ultragenyx Pharmaceutical Inc.

- Genzyme Corporation

- Vertex Pharmaceuticals Incorporated

- Sarepta Therapeutics, Inc.

- Horizon Therapeutics plc

- CSL Behring

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 233.4 Billion |

|

Forecasted Value (2030) |

USD 381.0 Billion |

|

CAGR (2025 – 2030) |

8.5% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Lysosomal Acid Lipase Deficiency Treatment Market By Treatment Type (Enzyme Replacement Therapy, Substrate Reduction Therapy, Gene Therapy, Supportive Treatment), By Indication (Wolman Disease, Cholesteryl Ester Storage Disease), By Route of Administration (Intravenous, Oral), By End-User (Hospitals, Specialty Clinics, Research Institutes) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Alexion Pharmaceuticals, Inc., Pfizer Inc., Sanofi S.A., Takeda Pharmaceutical Company Limited, Amicus Therapeutics, Inc., BioMarin Pharmaceutical Inc., Shire (now part of Takeda), Moderna, Inc., Orchard Therapeutics, Ultragenyx Pharmaceutical Inc., Genzyme Corporation, Vertex Pharmaceuticals Incorporated, Sarepta Therapeutics, Inc., Horizon Therapeutics plc, CSL Behring |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Lysosomal Acid Lipase Deficiency Treatment Market, by Treatment Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Enzyme Replacement Therapy (ERT) |

|

4.2. Substrate Reduction Therapy (SRT) |

|

4.3. Gene Therapy |

|

4.4. Supportive Treatment |

|

5. Lysosomal Acid Lipase Deficiency Treatment Market, by Indication (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Wolman Disease |

|

5.2. Cholesteryl Ester Storage Disease (CESD) |

|

6. Lysosomal Acid Lipase Deficiency Treatment Market, by Route of Administration (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Intravenous |

|

6.2. Oral |

|

7. Lysosomal Acid Lipase Deficiency Treatment Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Hospitals |

|

7.2. Specialty Clinics |

|

7.3. Research Institutes |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Lysosomal Acid Lipase Deficiency Treatment Market, by Treatment Type |

|

8.2.7. North America Lysosomal Acid Lipase Deficiency Treatment Market, by Indication |

|

8.2.8. North America Lysosomal Acid Lipase Deficiency Treatment Market, by Route of Administration |

|

8.2.9. North America Lysosomal Acid Lipase Deficiency Treatment Market, by End-User |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Lysosomal Acid Lipase Deficiency Treatment Market, by Treatment Type |

|

8.2.10.1.2. US Lysosomal Acid Lipase Deficiency Treatment Market, by Indication |

|

8.2.10.1.3. US Lysosomal Acid Lipase Deficiency Treatment Market, by Route of Administration |

|

8.2.10.1.4. US Lysosomal Acid Lipase Deficiency Treatment Market, by End-User |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Alexion Pharmaceuticals, Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Pfizer Inc. |

|

10.3. Sanofi S.A. |

|

10.4. Takeda Pharmaceutical Company Limited |

|

10.5. Amicus Therapeutics, Inc. |

|

10.6. BioMarin Pharmaceutical Inc. |

|

10.7. Shire (now part of Takeda) |

|

10.8. Moderna, Inc. |

|

10.9. Orchard Therapeutics |

|

10.10. Ultragenyx Pharmaceutical Inc. |

|

10.11. Genzyme Corporation |

|

10.12. Vertex Pharmaceuticals Incorporated |

|

10.13. Sarepta Therapeutics, Inc. |

|

10.14. Horizon Therapeutics plc |

|

10.15. CSL Behring |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Lysosomal Acid Lipase Deficiency Treatment Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Lysosomal Acid Lipase Deficiency Treatment Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Lysosomal Acid Lipase Deficiency Treatment Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA