As per Intent Market Research, the Lymphedema Treatment Market was valued at USD 0.6 Billion in 2024-e and will surpass USD 1.1 Billion by 2030; growing at a CAGR of 9.3% during 2025-2030.

The lymphedema treatment market has seen consistent growth due to the increasing prevalence of lymphedema cases, driven by factors such as cancer treatments, obesity, and genetic conditions. Lymphedema, a condition that leads to fluid retention and swelling in limbs, requires long-term management strategies. This has spurred the demand for effective treatments, including compression therapy, physical therapy, and surgical interventions. The market is segmented into treatment types, products, end-users, lymphedema types, and regions, each reflecting different aspects of patient care and therapeutic innovation. The expanding healthcare infrastructure and rising awareness about lymphedema are further contributing to the market’s growth.

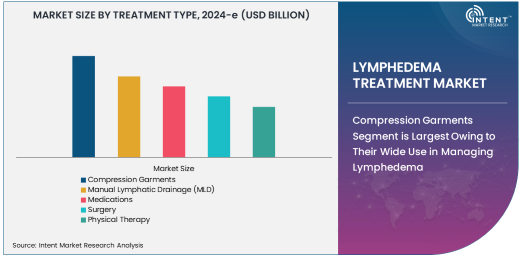

Compression Garments Segment is Largest Owing to Their Wide Use in Managing Lymphedema

Compression garments represent the largest subsegment within the treatment type category due to their proven effectiveness in managing lymphedema. These garments, including sleeves and stockings, apply pressure to the affected limbs to reduce swelling and improve lymphatic drainage. Widely recommended by healthcare professionals, compression garments are considered the cornerstone of conservative lymphedema treatment. The growth of the compression garments market is further supported by the increasing adoption of these products by patients and healthcare providers alike. They are a non-invasive solution that can be easily integrated into daily life, contributing to their widespread use across various stages of lymphedema.

The global demand for compression garments is expected to grow as more patients are diagnosed with lymphedema, particularly in developed regions where healthcare systems are robust. Additionally, improvements in the materials used in compression garments, such as breathable, lightweight fabrics, have enhanced patient comfort, making them more appealing to a broader demographic. This segment’s dominance is expected to continue as compression therapy remains a first-line approach to managing swelling and preventing complications associated with lymphedema.

Compression Bandages Segment is Fastest Growing Due to Advancements in Materials and Application Techniques

Compression bandages are the fastest growing subsegment in the product category. These bandages are increasingly used in conjunction with other therapies to manage lymphedema more effectively. With advancements in material science, modern compression bandages provide better support and more precise pressure distribution, enhancing their therapeutic efficacy. Furthermore, their affordability and ease of use make them an attractive option for many patients, including those in homecare settings, contributing to their rapid adoption.

The growth of the compression bandages segment is also fueled by the increasing prevalence of secondary lymphedema, particularly among cancer survivors. These patients often require adjustable, reusable compression bandages that can be tailored to their specific needs. As awareness of lymphedema grows, more patients are opting for these cost-effective, adaptable solutions, thus accelerating their demand in the market. The segment is expected to see significant growth, especially in emerging economies where accessibility to advanced treatments may be limited.

Hospitals End-User Segment is Largest Owing to Their Comprehensive Treatment Facilities

Hospitals represent the largest end-user segment in the lymphedema treatment market. The comprehensive treatment options available in hospitals, including advanced therapies, medical supervision, and surgical interventions, make them the preferred setting for managing severe cases of lymphedema. Hospitals are equipped with specialized equipment, such as lymphedema pumps and physical therapy tools, which provide patients with multifaceted care. Moreover, hospitals are the primary facilities for diagnosing lymphedema, which drives their prominence in this segment.

Patients diagnosed with severe or complex lymphedema often require hospitalization for intensive care and long-term management. The presence of multidisciplinary teams, including physical therapists, surgeons, and dermatologists, ensures that patients receive holistic care. As healthcare systems around the world continue to invest in infrastructure, particularly in developed regions, the hospital segment is expected to maintain its dominance in the lymphedema treatment market.

Secondary Lymphedema Segment is Largest Owing to Its Common Causes

Secondary lymphedema is the largest subsegment within the lymphedema type category, owing to its higher prevalence compared to primary lymphedema. Secondary lymphedema often results from medical treatments such as surgery, radiation therapy, or trauma that damages the lymphatic system. Among the most common causes are cancer treatments, particularly in breast, prostate, and gynecological cancers, which can lead to lymph node removal or radiation damage. As cancer survival rates increase globally, the incidence of secondary lymphedema also rises, contributing to the market’s growth.

Secondary lymphedema often requires more intensive treatment, including compression therapy, surgery, and physical therapy, driving demand for specialized products and services. The segment's prominence is further amplified by the aging population, which is more likely to experience conditions like obesity and cancer, both of which are significant risk factors for developing secondary lymphedema. As a result, this subsegment is expected to remain the largest and will continue to dominate the overall lymphedema treatment market.

North America Region is Largest Owing to Robust Healthcare Infrastructure

North America is the largest region in the lymphedema treatment market, driven by its well-established healthcare infrastructure and high awareness of lymphedema management. The United States, in particular, is a major player in this region, with a large number of healthcare facilities offering advanced lymphedema treatments. The prevalence of lymphedema in the U.S. is also high, due to the aging population and the increasing number of cancer survivors who are at risk for secondary lymphedema. The widespread use of compression therapy and the availability of specialized treatments in hospitals and clinics further solidify North America's leading position in the market.

In addition to the healthcare infrastructure, insurance coverage for chronic conditions like lymphedema in North America also plays a significant role in the region’s dominance. Patients are more likely to seek treatment and follow through with long-term management plans due to the financial support provided by health insurance. This has created a favorable environment for the growth of the lymphedema treatment market in the region. North America is expected to maintain its lead in the market through 2030, with continued advancements in treatment options and a growing focus on patient care.

Leading Companies and Competitive Landscape

The lymphedema treatment market is highly competitive, with several key players offering a range of products and services. Companies such as Tactile Medical, 3M Health Care, BSN Medical, and Medi GmbH & Co. KG are leaders in the market, providing a comprehensive portfolio of lymphedema management products, including compression garments, pumps, and bandages. These companies focus on innovation and patient-centric solutions to differentiate their offerings in an increasingly competitive market.

The competitive landscape is also shaped by strategic partnerships, acquisitions, and product launches. Companies are increasingly collaborating with healthcare providers to offer integrated solutions for lymphedema care. Additionally, advancements in treatment technology, such as more efficient compression pumps and improved compression materials, are driving product development in the market. As the market continues to expand, companies are expected to focus on geographic expansion, particularly in emerging markets, while also investing in research and development to introduce more effective treatments.

Recent Developments:

- Tactile Medical announced the launch of a new Flexitouch Plus compression therapy system, designed to improve patient outcomes for managing lymphedema with enhanced comfort and ease of use.

- Medi GmbH & Co. KG expanded its range of lymphedema treatment products, including the launch of a new line of compression garments tailored for patients with chronic lymphedema.

- 3M Health Care acquired Acelity to strengthen its position in the wound care and lymphedema treatment market, offering integrated solutions for patients dealing with lymphatic disorders.

- Essity (BSN Medical) received regulatory approval for its new Jobst compression garments designed to provide more targeted compression for patients undergoing lymphedema management.

- Arjo launched an innovative product line in Lymphedema Therapy combining advanced compression therapy systems and patient-focused features to improve patient care and treatment effectiveness.

List of Leading Companies:

- Tactile Medical

- 3M Health Care

- Kendall Healthcare

- BSN Medical

- Medi GmbH & Co. KG

- Juzo

- Lympha Press

- Arjo

- Sigvaris Group

- Lymphedema Products

- Tensys Medical

- Medi USA

- Essity (BSN Medical)

- Bio Compression Systems

- Veridian Healthcare

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 0.6 Billion |

|

Forecasted Value (2030) |

USD 1.1 Billion |

|

CAGR (2025 – 2030) |

9.3% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Lymphedema Treatment Market By Treatment Type (Compression Garments, Manual Lymphatic Drainage, Medications, Surgery, Physical Therapy), By Product (Compression Bandages, Compression Pumps, Compression Garments, Lymphedema Sleeve, Lymphedema Wraps), By End-User (Hospitals, Clinics, Homecare Settings, Specialty Centers), By Lymphedema Type (Primary Lymphedema, Secondary Lymphedema) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Tactile Medical, 3M Health Care, Kendall Healthcare, BSN Medical, Medi GmbH & Co. KG, Juzo, Lympha Press, Arjo, Sigvaris Group, Lymphedema Products, Tensys Medical, Medi USA, Essity (BSN Medical), Bio Compression Systems, Veridian Healthcare |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Lymphedema Treatment Market, by Treatment Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Compression Garments |

|

4.2. Manual Lymphatic Drainage (MLD) |

|

4.3. Medications |

|

4.4. Surgery |

|

4.5. Physical Therapy |

|

5. Lymphedema Treatment Market, by Product (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Compression Bandages |

|

5.2. Compression Pumps |

|

5.3. Compression Garments |

|

5.4. Lymphedema Sleeve |

|

5.5. Lymphedema Wraps |

|

6. Lymphedema Treatment Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Hospitals |

|

6.2. Clinics |

|

6.3. Homecare Settings |

|

6.4. Specialty Centers |

|

7. Lymphedema Treatment Market, by Lymphedema Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Primary Lymphedema |

|

7.2. Secondary Lymphedema |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Lymphedema Treatment Market, by Treatment Type |

|

8.2.7. North America Lymphedema Treatment Market, by Product |

|

8.2.8. North America Lymphedema Treatment Market, by End-User |

|

8.2.9. North America Lymphedema Treatment Market, by Lymphedema Type |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Lymphedema Treatment Market, by Treatment Type |

|

8.2.10.1.2. US Lymphedema Treatment Market, by Product |

|

8.2.10.1.3. US Lymphedema Treatment Market, by End-User |

|

8.2.10.1.4. US Lymphedema Treatment Market, by Lymphedema Type |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Tactile Medical |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. 3M Health Care |

|

10.3. Kendall Healthcare |

|

10.4. BSN Medical |

|

10.5. Medi GmbH & Co. KG |

|

10.6. Juzo |

|

10.7. Lympha Press |

|

10.8. Arjo |

|

10.9. Sigvaris Group |

|

10.10. Lymphedema Products |

|

10.11. Tensys Medical |

|

10.12. Medi USA |

|

10.13. Essity (BSN Medical) |

|

10.14. Bio Compression Systems |

|

10.15. Veridian Healthcare |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Lymphedema Treatment Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Lymphedema Treatment Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Lymphedema Treatment Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA