As per Intent Market Research, the Luxury Hair Care Market was valued at USD 17.8 billion in 2024-e and will surpass USD 37.1 billion by 2030; growing at a CAGR of 13.1% during 2025 - 2030.

The luxury hair care market is experiencing significant growth, driven by increased consumer awareness about premium hair care products and the rising trend of self-care. With consumers becoming more discerning about the ingredients and benefits of hair care solutions, demand for high-quality, sustainable, and result-oriented products has surged. The influence of social media, celebrity endorsements, and a growing preference for salon-quality treatments at home are key drivers in this space.

The market's expansion is further supported by innovations in product formulations and packaging, focusing on unique ingredients and environmentally friendly practices. Premiumization of the hair care segment has attracted a broader audience, including younger demographics and men, contributing to the sustained growth of the industry.

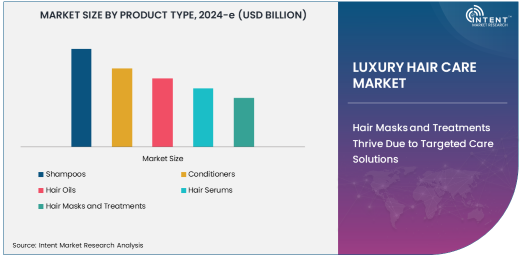

Hair Masks and Treatments Thrive Due to Targeted Care Solutions

Hair masks and treatments represent the fastest-growing product segment, fueled by the rising demand for targeted hair care solutions that address specific concerns such as damage, dryness, and frizz. These products are designed to provide intensive nourishment, repair, and rejuvenation, appealing to consumers seeking salon-like results at home.

Luxury brands are leveraging natural and exotic ingredients like argan oil, keratin, and botanical extracts to develop high-performance hair masks and treatments. Additionally, the trend toward clean beauty and cruelty-free formulations resonates strongly with eco-conscious consumers. As awareness of scalp health and holistic hair care grows, this segment is poised to expand rapidly, driven by innovation and the increasing popularity of personalized beauty routines.

Colored or Treated Hair Segment Leads with Specialized Care

The colored or treated hair segment dominates the hair type category, as consumers increasingly seek products tailored to protect and enhance their hair's color and texture. Luxury hair care brands offer specialized shampoos, conditioners, and treatments formulated with UV filters, color-locking technology, and nourishing agents to address the unique needs of treated hair.

The rise in hair coloring trends, coupled with the growing popularity of chemical treatments like straightening and perming, has propelled this segment's growth. Consumers are willing to invest in premium products to maintain the vibrancy and health of their treated hair, ensuring the longevity of their salon investments. This focus on specialized care is expected to sustain the segment's leadership in the market.

Women Drive Demand with Increased Spending on Premium Products

Women represent the largest end-user segment in the luxury hair care market, driven by their propensity to invest in high-quality beauty and personal care products. The demand for luxury hair care among women is fueled by the growing influence of social media and beauty influencers, as well as an increased focus on self-care and grooming.

Luxury brands cater to this segment with a diverse range of products addressing various hair types and concerns, from frizz control to hydration and damage repair. Packaging aesthetics and brand reputation also play a crucial role in appealing to female consumers, who often view luxury hair care as an indulgence and a lifestyle statement.

Online Retailers Propel Growth with Convenience and Accessibility

Online retailers are the fastest-growing distribution channel, driven by the rising popularity of e-commerce platforms and direct-to-consumer (DTC) models. The convenience of online shopping, coupled with detailed product descriptions, reviews, and personalized recommendations, has made digital platforms a preferred choice for purchasing luxury hair care products.

E-commerce platforms enable brands to reach a broader audience, particularly in emerging markets where brick-and-mortar specialty stores may be limited. Additionally, the availability of exclusive online discounts, subscription models, and influencer partnerships has further fueled this channel's growth. As digital transformation continues to reshape the retail landscape, online platforms are expected to play an increasingly pivotal role in the luxury hair care market.

North America Dominates with High Spending Power

North America is the largest market for luxury hair care products, driven by high consumer spending power and a strong emphasis on premium personal care. The region's mature beauty industry, coupled with a robust presence of luxury brands and salon networks, ensures steady demand for high-end hair care products.

The growing trend of personalized beauty routines and an increasing preference for clean and sustainable products also contribute to market growth in North America. The influence of celebrity-endorsed brands and the integration of advanced technologies in product formulations further strengthen the region's leadership in the luxury hair care market.

Competitive Landscape and Leading Players

The luxury hair care market is characterized by intense competition, with prominent players such as L’Oréal S.A., Procter & Gamble, Estée Lauder Companies, and Oribe Hair Care dominating the landscape. These companies focus on innovation, leveraging premium ingredients and advanced technologies to cater to the evolving preferences of luxury consumers.

Strategic partnerships, influencer collaborations, and expansion into emerging markets are key strategies employed by these brands to maintain their competitive edge. The market also sees the rise of niche and indie brands, which appeal to consumers seeking unique, personalized, and eco-friendly hair care solutions. The competitive dynamics ensure continuous innovation and diversification, keeping the market vibrant and growth-oriented.

Recent Developments:

- In December 2024, L'Oréal launched a new organic luxury hair care line under the Kérastase brand, focusing on sustainability and natural ingredients.

- In November 2024, Estée Lauder Companies introduced advanced scalp care solutions through its Aveda brand, targeting premium customers.

- In October 2024, Olaplex Holdings unveiled a professional hair repair treatment designed for use in high-end salons.

- In September 2024, Unilever partnered with a celebrity stylist to co-create a new line of luxury hair serums and oils under its Dove brand.

- In August 2024, Moroccanoil expanded its product portfolio with a sulfate-free shampoo targeting sensitive scalps in the luxury segment.

List of Leading Companies:

- L'Oréal S.A.

- Procter & Gamble Co. (P&G)

- Unilever

- Estée Lauder Companies Inc.

- Henkel AG & Co. KGaA

- Coty Inc.

- Oribe Hair Care, LLC

- Aveda Corporation (a subsidiary of Estée Lauder)

- Kérastase (a brand of L'Oréal)

- Bumble and bumble (a brand of Estée Lauder)

- Davines Group

- Amika

- Olaplex Holdings, Inc.

- Briogeo Hair Care

- Moroccanoil

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 17.8 Billion |

|

Forecasted Value (2030) |

USD 37.1 Billion |

|

CAGR (2025 – 2030) |

13.1% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Luxury Hair Care Market by Product Type (Shampoos, Conditioners, Hair Oils, Hair Serums, Hair Masks), Hair Type (Normal, Oily, Dry/Damaged, Colored/Treated), End-User (Men, Women, Unisex), Distribution Channel (Online, Specialty Stores, Supermarkets, Salons) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

L'Oréal S.A., Procter & Gamble Co. (P&G), Unilever, Estée Lauder Companies Inc., Henkel AG & Co. KGaA, Coty Inc., Oribe Hair Care, LLC, Aveda Corporation (a subsidiary of Estée Lauder), Kérastase (a brand of L'Oréal), Bumble and bumble (a brand of Estée Lauder), Davines Group, Amika, Olaplex Holdings, Inc., Briogeo Hair Care, Moroccanoil |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Luxury Hair Care Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Shampoos |

|

4.2. Conditioners |

|

4.3. Hair Oils |

|

4.4. Hair Serums |

|

4.5. Hair Masks and Treatments |

|

5. Luxury Hair Care Market, by Hair Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Normal Hair |

|

5.2. Oily Hair |

|

5.3. Dry and Damaged Hair |

|

5.4. Colored or Treated Hair |

|

6. Luxury Hair Care Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Men |

|

6.2. Women |

|

6.3. Unisex |

|

7. Luxury Hair Care Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Online Retailers |

|

7.2. Specialty Stores |

|

7.3. Supermarkets and Hypermarkets |

|

7.4. Salons |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Luxury Hair Care Market, by Product Type |

|

8.2.7. North America Luxury Hair Care Market, by Hair Type |

|

8.2.8. North America Luxury Hair Care Market, by End-User |

|

8.2.9. North America Luxury Hair Care Market, by Distribution Channel |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Luxury Hair Care Market, by Product Type |

|

8.2.10.1.2. US Luxury Hair Care Market, by Hair Type |

|

8.2.10.1.3. US Luxury Hair Care Market, by End-User |

|

8.2.10.1.4. US Luxury Hair Care Market, by Distribution Channel |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. L'Oréal S.A. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Procter & Gamble Co. (P&G) |

|

10.3. Unilever |

|

10.4. Estée Lauder Companies Inc. |

|

10.5. Henkel AG & Co. KGaA |

|

10.6. Coty Inc. |

|

10.7. Oribe Hair Care, LLC |

|

10.8. Aveda Corporation (a subsidiary of Estée Lauder) |

|

10.9. Kérastase (a brand of L'Oréal) |

|

10.10. Bumble and bumble (a brand of Estée Lauder) |

|

10.11. Davines Group |

|

10.12. Amika |

|

10.13. Olaplex Holdings, Inc. |

|

10.14. Briogeo Hair Care |

|

10.15. Moroccanoil |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Luxury Hair Care Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Luxury Hair Care Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Luxury Hair Care Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA