As per Intent Market Research, the Lung Cancer Surgery Market was valued at USD 5.7 Billion in 2024-e and will surpass USD 7.9 Billion by 2030; growing at a CAGR of 5.5% during 2025-2030.

The lung cancer surgery market is driven by the growing incidence of lung cancer worldwide, alongside advancements in surgical technologies and techniques. Surgical resection remains one of the most effective treatments for non-small cell lung cancer (NSCLC) and small-cell lung cancer (SCLC), particularly when diagnosed at an early stage. As the market evolves, there is an increasing shift towards minimally invasive surgical techniques, which offer benefits such as reduced recovery times, shorter hospital stays, and lower complication rates. This shift in surgical approach, coupled with the growing adoption of robotic-assisted surgery, is shaping the future of lung cancer treatment. This market is poised for growth, supported by the rising number of patients diagnosed with lung cancer and increasing healthcare spending on advanced surgical procedures.

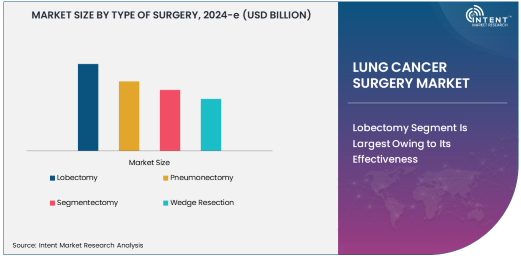

Lobectomy Segment Is Largest Owing to Its Effectiveness

Lobectomy is the most common surgical procedure for lung cancer, particularly in cases where the cancer is localized to one of the lung's lobes. This procedure involves the removal of an entire lung lobe and is considered the gold standard for treating early-stage non-small cell lung cancer (NSCLC). As the largest segment in the lung cancer surgery market, lobectomy remains the most preferred surgical option due to its proven effectiveness in removing tumors while preserving lung function. Given that lung cancer is often detected at an operable stage, the demand for lobectomies continues to rise, especially in regions with advanced healthcare systems.

The growth of this segment is supported by advancements in surgical techniques, making lobectomy less invasive and more precise. The increasing use of video-assisted thoracoscopic surgery (VATS) and robotic surgery has further enhanced the safety and recovery time associated with lobectomies. As a result, patients are benefiting from shorter hospital stays and reduced post-surgical complications, driving the continued dominance of lobectomy in lung cancer treatment.

Minimally Invasive Surgery (MIS) Is Fastest Growing Owing to Technological Advancements

Minimally invasive surgery (MIS) is the fastest-growing procedure type in lung cancer surgery, primarily due to technological advancements and its proven advantages over traditional open surgery. MIS techniques, such as video-assisted thoracoscopic surgery (VATS), allow surgeons to remove tumors with smaller incisions, which reduces blood loss, minimizes pain, and shortens recovery times. As a result, patients experience faster recovery and are able to resume normal activities sooner compared to open surgery.

The growing popularity of MIS can be attributed to the increasing adoption of robotic-assisted surgery systems, such as the da Vinci Surgical System. These systems enhance precision and control, allowing for more complex surgeries to be performed with minimal invasiveness. Furthermore, as the global focus shifts toward improving patient outcomes and reducing healthcare costs, MIS has become a preferred option in lung cancer surgery, leading to its rapid growth in the market.

Hospitals Are Largest End-User Due to High Surgery Volume

Hospitals remain the largest end-user segment in the lung cancer surgery market, primarily due to their comprehensive capabilities in handling complex surgical procedures and their ability to provide post-surgical care. Hospitals have the necessary infrastructure, skilled personnel, and advanced surgical equipment required for lung cancer surgeries. Additionally, hospitals serve as key centers for diagnosis, surgery, and post-operative care, making them the central hub for lung cancer treatment.

Hospitals also benefit from their ability to perform a wide range of surgeries, including open surgeries, minimally invasive procedures, and robotic-assisted surgeries, depending on the patient's needs. The large volume of surgeries performed in hospitals, alongside the growing adoption of new technologies, ensures that hospitals will continue to dominate this segment for the foreseeable future.

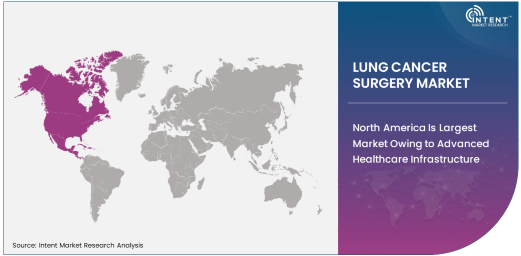

North America Is Largest Market Owing to Advanced Healthcare Infrastructure

North America holds the largest share of the global lung cancer surgery market, driven by its advanced healthcare infrastructure, high healthcare spending, and widespread access to cutting-edge surgical technologies. The United States, in particular, is a major contributor to the market, with a high prevalence of lung cancer and significant investments in medical research and innovation. North American hospitals are equipped with the latest technologies, including robotic surgical systems and minimally invasive techniques, which are increasingly being adopted for lung cancer surgeries.

Moreover, the region benefits from a high level of awareness regarding lung cancer and the available treatment options, which encourages early detection and timely intervention. This has helped North America maintain its leadership in the market, with hospitals and surgical centers offering comprehensive lung cancer care that includes surgery, chemotherapy, and radiation therapy.

Competitive Landscape and Leading Companies

The lung cancer surgery market is characterized by the presence of several prominent players offering a range of surgical systems, technologies, and services. Leading companies in the market include Medtronic, Intuitive Surgical, Johnson & Johnson, and Zimmer Biomet, all of which have invested significantly in the development of robotic-assisted and minimally invasive surgical technologies. Medtronic and Intuitive Surgical, in particular, are at the forefront of robotic surgery innovations, with their robotic-assisted systems being widely adopted in hospitals and surgical centers globally.

Other key players like Stryker Corporation, Boston Scientific, and Olympus Corporation also play a significant role in the market by providing advanced surgical instruments and imaging systems that support lung cancer surgeries. The competitive landscape is marked by continuous innovation, with companies focusing on enhancing the precision, safety, and efficiency of lung cancer surgeries. As the demand for minimally invasive procedures increases, these companies are expected to continue driving technological advancements to improve patient outcomes and expand their market presence.

Recent Developments:

- Medtronic announced the launch of its Hugo™ robotic-assisted surgery platform, enhancing precision in lung cancer surgeries with advanced technology and improved surgical outcomes.

- Intuitive Surgical introduced new features for its da Vinci™ robotic surgery system, aimed at improving lung cancer resection with greater precision and fewer complications.

- Boston Scientific's new self-expanding stent designed for airway management in lung cancer patients received FDA approval, expanding its offering in the lung cancer treatment market.

- Johnson & Johnson's medical devices division announced a major investment in the development of robotic-assisted surgery technologies, enhancing its presence in the lung cancer surgery market.

- Zimmer Biomet entered a partnership with leading cancer centers to integrate advanced surgical tools and robotic systems into lung cancer surgeries, improving patient outcomes and recovery times.

List of Leading Companies:

- Medtronic

- Intuitive Surgical

- Johnson & Johnson

- Stryker Corporation

- Zimmer Biomet

- Boston Scientific

- Smith & Nephew

- Olympus Corporation

- Karl Storz GmbH & Co. KG

- Ethicon (Johnson & Johnson)

- CONMED Corporation

- Hansen Medical

- Johnson & Johnson Medical Devices

- Karl Storz GmbH & Co. KG

- Mazor Robotics

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 5.7 Billion |

|

Forecasted Value (2030) |

USD 7.9 Billion |

|

CAGR (2025 – 2030) |

5.5% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Lung Cancer Surgery Market By Type of Surgery (Lobectomy, Pneumonectomy, Segmentectomy, Wedge Resection), By Procedure Type (Open Surgery, Minimally Invasive Surgery, Robotic Surgery), By End-User (Hospitals, Surgical Centers, Cancer Research Institutes) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Medtronic, Intuitive Surgical, Johnson & Johnson, Stryker Corporation, Zimmer Biomet, Boston Scientific, Smith & Nephew, Olympus Corporation, Karl Storz GmbH & Co. KG, Ethicon (Johnson & Johnson), CONMED Corporation, Hansen Medical, Johnson & Johnson Medical Devices, Karl Storz GmbH & Co. KG, Mazor Robotics |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Lung Cancer Surgery Market, by Type of Surgery (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Lobectomy |

|

4.2. Pneumonectomy |

|

4.3. Segmentectomy |

|

4.4. Wedge Resection |

|

5. Lung Cancer Surgery Market, by Procedure Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Open Surgery |

|

5.2. Minimally Invasive Surgery (MIS) |

|

5.3. Robotic Surgery |

|

6. Lung Cancer Surgery Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Hospitals |

|

6.2. Surgical Centers |

|

6.3. Cancer Research Institutes |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Lung Cancer Surgery Market, by Type of Surgery |

|

7.2.7. North America Lung Cancer Surgery Market, by Procedure Type |

|

7.2.8. North America Lung Cancer Surgery Market, by End-User |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Lung Cancer Surgery Market, by Type of Surgery |

|

7.2.9.1.2. US Lung Cancer Surgery Market, by Procedure Type |

|

7.2.9.1.3. US Lung Cancer Surgery Market, by End-User |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Medtronic |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Intuitive Surgical |

|

9.3. Johnson & Johnson |

|

9.4. Stryker Corporation |

|

9.5. Zimmer Biomet |

|

9.6. Boston Scientific |

|

9.7. Smith & Nephew |

|

9.8. Olympus Corporation |

|

9.9. Karl Storz GmbH & Co. KG |

|

9.10. Ethicon (Johnson & Johnson) |

|

9.11. CONMED Corporation |

|

9.12. Hansen Medical |

|

9.13. Johnson & Johnson Medical Devices |

|

9.14. Karl Storz GmbH & Co. KG |

|

9.15. Mazor Robotics |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Lung Cancer Surgery Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Lung Cancer Surgery Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Lung Cancer Surgery Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA