As per Intent Market Research, the Lung Cancer Screening Software Market was valued at USD 36.6 billion in 2024-e and will surpass USD 154.9 billion by 2030; growing at a CAGR of 22.9% during 2025 - 2030.

The lung cancer screening software market is growing rapidly as the healthcare sector increasingly focuses on early detection and diagnosis of lung cancer. Early diagnosis is crucial to improving survival rates, and the introduction of advanced technologies like artificial intelligence (AI), machine learning, and deep learning has revolutionized lung cancer screening. These software solutions aid in analyzing imaging data, predicting patient risk, and supporting clinical decision-making. As the global prevalence of lung cancer continues to rise, there is heightened awareness among healthcare providers and governments about the need for early detection tools that can reduce mortality rates.

The market is segmented by product type, technology, end-user, and deployment model, with various software solutions playing key roles in this evolving landscape. Among these, AI and machine learning technologies are leading the way in improving the accuracy and efficiency of lung cancer screening. These technologies can identify patterns in imaging data that may be difficult for the human eye to detect, thus enabling quicker and more accurate diagnosis. As healthcare systems continue to invest in digitization and AI-based tools, the demand for lung cancer screening software is expected to grow significantly in the coming years.

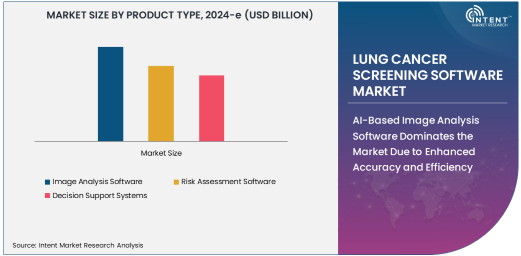

AI-Based Image Analysis Software Dominates the Market Due to Enhanced Accuracy and Efficiency

Image analysis software is the largest product type in the lung cancer screening software market, largely due to its ability to process and analyze large volumes of medical imaging data, such as CT scans and X-rays, with high accuracy. AI-based image analysis software leverages advanced algorithms to identify early signs of lung cancer, enabling clinicians to make faster, more accurate diagnoses. This software can detect subtle patterns in imaging data that might be overlooked by human radiologists, leading to earlier and more accurate detection of abnormalities, including tumors and nodules.

The growing adoption of AI and machine learning technologies in image analysis software is further boosting its market share. These technologies allow for continuous improvement in diagnostic accuracy as the software learns from a vast amount of imaging data. As the healthcare industry increasingly embraces AI to improve clinical workflows and outcomes, the demand for AI-based image analysis software in lung cancer screening is expected to continue expanding, making it the largest product segment in the market.

AI and Deep Learning Technologies Are Key to Revolutionizing Early Diagnosis

The integration of artificial intelligence (AI), machine learning, and deep learning technologies is driving significant advancements in lung cancer screening. AI algorithms, when combined with deep learning, can analyze large sets of medical data, such as radiographic images, and detect signs of lung cancer that might not be visible to the human eye. Deep learning, a subset of machine learning, is particularly effective in processing complex medical images, offering greater precision and accuracy in detecting abnormalities such as tumors or lesions in the lungs.

These technologies are rapidly transforming the landscape of lung cancer screening, offering more reliable results with faster processing times. AI-based deep learning systems can reduce human error, improve detection rates, and enhance diagnostic workflows in clinical settings. As the algorithms continue to evolve and learn from new data, their effectiveness in diagnosing lung cancer early will only increase, making AI and deep learning key drivers in the future growth of the lung cancer screening software market.

Hospitals Are Largest End-User Segment Due to High Adoption of Screening Programs

Hospitals represent the largest end-user segment in the lung cancer screening software market, driven by the growing emphasis on early detection and the need for comprehensive diagnostic tools. Hospitals typically have more advanced infrastructure and greater resources for implementing cutting-edge technologies, such as AI-based screening software, to enhance patient care. With lung cancer being one of the most common and deadly cancers worldwide, hospitals are increasingly investing in advanced diagnostic solutions that can aid in the timely detection of the disease.

The adoption of lung cancer screening software in hospitals is also supported by government initiatives aimed at improving healthcare outcomes. Many hospitals are now incorporating AI-based diagnostic tools into their screening programs to provide more accurate results and optimize patient care. As the global healthcare industry focuses on improving early detection capabilities, hospitals will continue to be the largest consumers of lung cancer screening software, further driving market growth.

Cloud-Based Deployment Model Is Gaining Traction Due to Flexibility and Scalability

The cloud-based deployment model is gaining significant traction in the lung cancer screening software market, primarily due to its flexibility, scalability, and cost-effectiveness. Cloud-based solutions allow healthcare providers to access the software remotely, reducing the need for heavy infrastructure investments while also enabling real-time data sharing and collaboration among clinicians. This is especially valuable in lung cancer screening, where quick and accurate diagnoses can significantly impact patient outcomes.

Cloud-based solutions also offer the advantage of easy updates and continuous access to the latest software versions, ensuring that healthcare providers are using the most advanced tools for screening. Additionally, the ability to scale the solution based on the healthcare provider’s needs makes cloud-based deployment an attractive option for hospitals, diagnostic centers, and research institutions. As cloud computing becomes more integrated into healthcare systems globally, the cloud-based deployment model is expected to become increasingly popular in the lung cancer screening software market.

North America Leads the Market Due to Advanced Healthcare Infrastructure and Research Investments

North America is the largest region in the lung cancer screening software market, driven by the region's advanced healthcare infrastructure, strong research activities, and high adoption of AI technologies. The United States, in particular, is home to some of the world’s leading healthcare institutions and research centers that are at the forefront of adopting new diagnostic technologies. The region’s focus on improving healthcare outcomes and reducing cancer mortality rates is accelerating the demand for lung cancer screening solutions.

In addition to advanced healthcare systems, government programs aimed at increasing awareness and access to early cancer screening have contributed to the adoption of these technologies. As more hospitals, clinics, and research institutions in North America implement AI-based screening solutions, the region is expected to maintain its dominance in the global lung cancer screening software market. Moreover, the ongoing investments in AI research and development are poised to drive further growth in the region.

Competitive Landscape and Leading Companies

The lung cancer screening software market is highly competitive, with numerous global and regional players vying for market share. Leading companies in this market include IBM Watson Health, Philips Healthcare, GE Healthcare, and Siemens Healthineers. These companies are focused on the development and integration of AI-based software solutions that enhance the accuracy and efficiency of lung cancer screening.

The competitive landscape is characterized by rapid technological innovation, strategic partnerships, and a focus on research and development to improve diagnostic capabilities. As more healthcare providers and research institutions adopt AI-powered lung cancer screening solutions, companies are leveraging their technological expertise to offer differentiated products that cater to the growing demand for early and accurate cancer detection. In this dynamic market, partnerships between software providers and healthcare institutions will continue to play a crucial role in shaping the competitive landscape.

Recent Developments:

- In December 2024, IBM announced an upgraded version of its AI-powered lung cancer screening software, improving the software's ability to detect early-stage cancers with greater accuracy.

- In November 2024, GE Healthcare launched a new machine learning-driven diagnostic platform that assists clinicians in interpreting lung scans more efficiently and accurately, leading to quicker detection of lung cancer.

- In October 2024, Optellum secured a strategic partnership with a major hospital group to expand the use of its AI-based lung cancer screening software, which uses predictive algorithms for early detection.

- In September 2024, Siemens Healthineers unveiled a new AI-powered imaging tool to support the detection of lung cancer in routine clinical practice, significantly reducing the time needed for interpretation of CT scans.

- In August 2024, Lunit Inc. expanded its AI-driven lung cancer screening software, incorporating new deep learning techniques for more precise identification of malignant nodules on CT scans.

List of Leading Companies:

- IBM Corporation

- Siemens Healthineers

- GE Healthcare

- Philips Healthcare

- Hitachi Ltd.

- Toshiba Medical Systems Corporation

- Optellum

- VoxelCloud

- Qure.ai

- Medtronic

- Zebra Medical Vision

- Aidoc

- Lunit Inc.

- PathAI

- Viz.ai

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 36.6 Billion |

|

Forecasted Value (2030) |

USD 154.9 Billion |

|

CAGR (2025 – 2030) |

22.9% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Lung Cancer Screening Software Market by Product Type (Image Analysis Software, Risk Assessment Software, Decision Support Systems), Technology (Artificial Intelligence, Machine Learning, Deep Learning, Radiomics), End-User (Hospitals, Diagnostic Centers, Research Institutions, Government & Public Health), Deployment Model (On-premise, Cloud-based) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

IBM Corporation, Siemens Healthineers, GE Healthcare, Philips Healthcare, Hitachi Ltd., Toshiba Medical Systems Corporation, Optellum, VoxelCloud, Qure.ai, Medtronic, Zebra Medical Vision, Aidoc, Lunit Inc., PathAI, Viz.ai |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Lung Cancer Screening Software Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Image Analysis Software |

|

4.2. Risk Assessment Software |

|

4.3. Decision Support Systems |

|

5. Lung Cancer Screening Software Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Artificial Intelligence (AI) |

|

5.2. Machine Learning |

|

5.3. Deep Learning |

|

5.4. Radiomics |

|

6. Lung Cancer Screening Software Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Hospitals |

|

6.2. Diagnostic Centers |

|

6.3. Research Institutions |

|

6.4. Government & Public Health |

|

7. Lung Cancer Screening Software Market, by Deployment Model (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. On-premise |

|

7.2. Cloud-based |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Lung Cancer Screening Software Market, by Product Type |

|

8.2.7. North America Lung Cancer Screening Software Market, by Technology |

|

8.2.8. North America Lung Cancer Screening Software Market, by End-User |

|

8.2.9. North America Lung Cancer Screening Software Market, by Deployment Model |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Lung Cancer Screening Software Market, by Product Type |

|

8.2.10.1.2. US Lung Cancer Screening Software Market, by Technology |

|

8.2.10.1.3. US Lung Cancer Screening Software Market, by End-User |

|

8.2.10.1.4. US Lung Cancer Screening Software Market, by Deployment Model |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. IBM Corporation |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Siemens Healthineers |

|

10.3. GE Healthcare |

|

10.4. Philips Healthcare |

|

10.5. Hitachi Ltd. |

|

10.6. Toshiba Medical Systems Corporation |

|

10.7. Optellum |

|

10.8. VoxelCloud |

|

10.9. Qure.ai |

|

10.10. Medtronic |

|

10.11. Zebra Medical Vision |

|

10.12. Aidoc |

|

10.13. Lunit Inc. |

|

10.14. PathAI |

|

10.15. Viz.ai |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Lung Cancer Screening Software Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Lung Cancer Screening Software Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Lung Cancer Screening Software Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA