As per Intent Market Research, the Logistics Market was valued at USD 8.9 Billion in 2024-e and will surpass USD 14.6 Billion by 2030; growing at a CAGR of 8.7% during 2025-2030.

The logistics market plays a pivotal role in global trade and supply chains, encompassing a wide range of services, including transportation, warehousing, inventory management, and order fulfillment. As businesses increasingly operate on a global scale, the need for efficient logistics solutions has become more critical. The logistics market is driven by factors such as the growth of e-commerce, globalization, technological advancements in supply chain management, and the demand for faster, more cost-effective shipping. Logistics companies provide services that ensure goods are moved efficiently, securely, and on time, helping businesses meet customer demands while reducing operational costs.

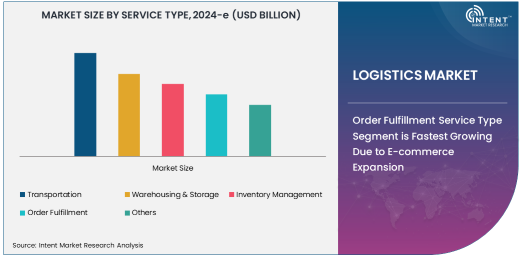

Transportation services are the largest segment in the logistics market, accounting for a substantial portion of the overall market share. The demand for transportation services is driven by the movement of goods across various regions and countries, whether via road, rail, air, or sea. Transportation is the backbone of the logistics industry, enabling the flow of raw materials, finished products, and components between suppliers, manufacturers, and consumers. As global trade continues to expand and e-commerce demands faster deliveries, transportation services remain essential for maintaining an effective and competitive supply chain. This makes transportation services the largest and most critical segment in the logistics market.

Order Fulfillment Service Type Segment is Fastest Growing Due to E-commerce Expansion

In the service type segment, order fulfillment is the fastest-growing subsegment. With the rapid growth of e-commerce, the demand for efficient and scalable order fulfillment services has surged. Order fulfillment involves receiving, processing, and delivering customer orders, and its importance has grown as retailers strive to meet consumer expectations for fast and reliable deliveries. The expansion of e-commerce platforms, along with consumer preferences for faster shipping times and personalized services, has placed order fulfillment at the center of logistics operations.

Order fulfillment services are increasingly being optimized through automation, artificial intelligence, and data analytics, which enable faster processing and more accurate deliveries. Companies are also exploring new business models, such as same-day and next-day deliveries, to meet consumer demand for quick turnarounds. The rapid growth of online retail, particularly in regions with high internet penetration and growing consumer bases, is expected to further drive the demand for order fulfillment services, making it the fastest-growing service type segment in the logistics market.

Road Transport Mode of Transport is Largest Due to Widespread Adoption and Flexibility

Among the mode of transport segments, road transport is the largest, owing to its widespread use and flexibility. Road transport provides a crucial link in the logistics supply chain, allowing for the movement of goods over short and long distances, both within countries and across borders. It offers significant flexibility compared to other modes of transport, as it can serve areas that are inaccessible by rail or sea, and it can be adapted to meet varying cargo volumes. Road transport is also essential for the "last mile" delivery, particularly in urban areas where goods need to be delivered directly to consumers or retail locations.

The growth of the e-commerce industry, combined with the increasing demand for quick and efficient deliveries, has cemented the dominance of road transport in the logistics market. Advances in transportation technologies, such as electric vehicles and autonomous trucks, are expected to enhance the efficiency and sustainability of road transport, further driving its prominence. As such, road transport remains the largest mode of transport within the logistics market, supporting the backbone of modern supply chains.

E-commerce & Retail End-User Industry is Largest Due to Growing Demand for Fast Delivery

The largest end-user industry segment in the logistics market is e-commerce and retail, which has seen an unprecedented rise in demand for logistics services. The surge in online shopping, especially in the wake of the COVID-19 pandemic, has amplified the need for efficient logistics networks that can handle large volumes of orders and provide fast, reliable delivery options. Logistics plays a critical role in ensuring that e-commerce businesses can deliver products to customers promptly and efficiently, often with services such as same-day or next-day delivery.

E-commerce companies are increasingly relying on advanced logistics solutions to manage their inventory, streamline order fulfillment, and optimize transportation routes. The growing popularity of online retail, along with the increasing expectations for quick and personalized deliveries, has made logistics services a cornerstone of the e-commerce and retail sectors. As e-commerce continues to expand globally and more consumers shift to online shopping, the e-commerce and retail industry will remain the largest end-user segment in the logistics market.

Asia-Pacific is Fastest Growing Region Due to Economic Growth and E-commerce Boom

Asia-Pacific (APAC) is the fastest-growing region in the logistics market, driven by the rapid economic growth, rising consumer demand, and booming e-commerce market. Countries like China, India, and Japan are major players in global trade, with well-developed infrastructure and manufacturing bases that contribute to the region's growth. The rise of middle-class consumers in APAC, coupled with the increasing penetration of e-commerce platforms, is driving demand for faster and more efficient logistics solutions. Logistics providers are investing heavily in the region, expanding their networks and capabilities to support growing e-commerce operations and trade across borders.

The APAC region's strategic position in global supply chains, coupled with its dynamic economic landscape, makes it a key area for logistics market expansion. The demand for road, rail, and air transport is particularly high, as businesses seek to streamline their supply chains and meet the needs of increasingly mobile and digitally-savvy consumers. As logistics companies continue to invest in infrastructure and technology to meet the demands of the rapidly growing e-commerce sector, Asia-Pacific will continue to be the fastest-growing region in the global logistics market.

Leading Companies and Competitive Landscape

The logistics market is highly competitive, with numerous global and regional players offering a variety of services to cater to the diverse needs of businesses. Leading companies in the logistics space include DHL, FedEx, UPS, Maersk, and XPO Logistics. These companies dominate the market due to their extensive global networks, advanced technologies, and ability to provide integrated logistics solutions that span across multiple modes of transport and service types. They have the infrastructure and resources to handle the complexities of modern supply chains, including warehousing, inventory management, transportation, and last-mile delivery.

The competitive landscape is characterized by ongoing innovation, particularly in technology-driven solutions. Logistics companies are investing in automation, AI, and Internet of Things (IoT) technologies to improve efficiency, reduce costs, and enhance customer experiences. Additionally, the rise of digital platforms and the shift towards more sustainable practices are reshaping the logistics industry. As the demand for faster, more reliable, and cost-effective logistics solutions continues to grow, competition among market players will intensify, leading to further advancements in logistics technology and service offerings.

Recent Developments:

- Deutsche Post DHL Group unveiled a new blockchain-based solution to optimize its global supply chain and enhance transparency in logistics.

- FedEx Corporation launched an AI-powered platform to improve its logistics operations, focusing on predictive analytics and route optimization.

- XPO Logistics announced an expansion of its warehousing facilities to better serve e-commerce clients and improve order fulfillment efficiency.

- Maersk Group partnered with a major retail chain to provide integrated logistics and transportation solutions for their global supply chain needs.

- C.H. Robinson Worldwide, Inc. introduced a new tool for real-time tracking and supply chain visibility to enhance logistics management for businesses.

List of Leading Companies:

- Deutsche Post DHL Group

- FedEx Corporation

- United Parcel Service (UPS)

- Maersk Group

- XPO Logistics

- Kuehne + Nagel International AG

- DB Schenker

- C.H. Robinson Worldwide, Inc.

- Panasonic Logistics

- Nippon Express Co., Ltd.

- DSV Panalpina

- CMA CGM Group

- Expeditors International of Washington, Inc.

- Sinotrans Limited

- Geodis

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 8.9 Billion |

|

Forecasted Value (2030) |

USD 14.6 Billion |

|

CAGR (2025 – 2030) |

8.7% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Logistics Market By Service Type (Transportation, Warehousing & Storage, Inventory Management, Order Fulfillment), By Mode of Transport (Road Transport, Rail Transport, Air Transport, Sea Transport), and By End-User Industry (E-commerce & Retail, Automotive, Manufacturing, Healthcare & Pharmaceuticals, Food & Beverage) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Deutsche Post DHL Group, FedEx Corporation, United Parcel Service (UPS), Maersk Group, XPO Logistics, Kuehne + Nagel International AG, DB Schenker, C.H. Robinson Worldwide, Inc., Panasonic Logistics, Nippon Express Co., Ltd., DSV Panalpina, CMA CGM Group, Expeditors International of Washington, Inc., Sinotrans Limited, Geodis |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Logistics Market, by Service Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Transportation |

|

4.2. Warehousing & Storage |

|

4.3. Inventory Management |

|

4.4. Order Fulfillment |

|

4.5. Others |

|

5. Logistics Market, by Mode of Transport (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Road Transport |

|

5.2. Rail Transport |

|

5.3. Air Transport |

|

5.4. Sea Transport |

|

5.5. Others |

|

6. Logistics Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. E-commerce & Retail |

|

6.2. Automotive |

|

6.3. Manufacturing |

|

6.4. Healthcare & Pharmaceuticals |

|

6.5. Food & Beverage |

|

6.6. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Logistics Market, by Service Type |

|

7.2.7. North America Logistics Market, by Mode of Transport |

|

7.2.8. North America Logistics Market, by End-User Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Logistics Market, by Service Type |

|

7.2.9.1.2. US Logistics Market, by Mode of Transport |

|

7.2.9.1.3. US Logistics Market, by End-User Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Deutsche Post DHL Group |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. FedEx Corporation |

|

9.3. United Parcel Service (UPS) |

|

9.4. Maersk Group |

|

9.5. XPO Logistics |

|

9.6. Kuehne + Nagel International AG |

|

9.7. DB Schenker |

|

9.8. C.H. Robinson Worldwide, Inc. |

|

9.9. Panasonic Logistics |

|

9.10. Nippon Express Co., Ltd. |

|

9.11. DSV Panalpina |

|

9.12. CMA CGM Group |

|

9.13. Expeditors International of Washington, Inc. |

|

9.14. Sinotrans Limited |

|

9.15. Geodis |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Logistics Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Logistics Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Logistics Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA