As per Intent Market Research, the Location-based Entertainment Market was valued at USD 7.0 Billion in 2024-e and will surpass USD 18.8 Billion by 2030; growing at a CAGR of 17.8% during 2025-2030.

The location-based entertainment (LBE) market has rapidly evolved, driven by consumers' increasing desire for immersive and interactive experiences that go beyond traditional entertainment offerings. LBE leverages location-specific data to create engaging activities that integrate the real world with digital experiences. These can include virtual reality (VR) and augmented reality (AR) games, immersive theaters, interactive museum exhibits, and location-based events such as festivals. As advancements in technology enable more seamless and accessible LBE experiences, demand continues to rise across various industries, making it a major market sector. This demand has led to the widespread adoption of location-based solutions, which enhance user engagement by creating personalized, location-triggered entertainment.

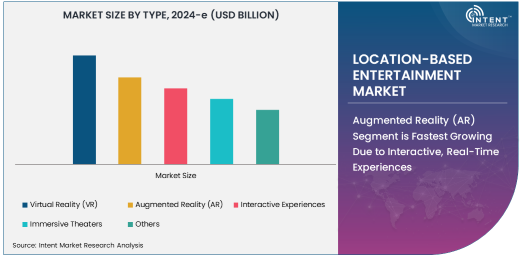

Among the various types of LBE, Virtual Reality (VR) stands as the largest subsegment. VR is at the forefront of the market’s expansion, providing highly immersive, interactive experiences where users can be fully transported to different environments or scenarios. VR-based experiences are particularly popular in gaming zones, arcades, and theme parks, where users can engage in activities that are enriched by location data. The ability of VR to offer a fully immersive experience, where users interact with the environment in real time, makes it the most dominant form of location-based entertainment. With the continuous improvement of VR hardware and the reduction in costs, the demand for VR experiences is expected to continue to grow, solidifying its place as the largest subsegment within the location-based entertainment market.

Augmented Reality (AR) Segment is Fastest Growing Due to Interactive, Real-Time Experiences

In the type segment, augmented reality (AR) is the fastest-growing subsegment, fueled by its ability to blend the digital and physical worlds in real-time. AR enables location-based experiences that allow users to interact with virtual elements overlaid on their real-world surroundings, creating highly engaging and context-aware entertainment. This technology has rapidly gained traction in sectors like retail, museums, and gaming, where real-time interactions with the environment provide an enhanced user experience. Unlike VR, which requires users to be fully immersed in a digital world, AR allows users to maintain awareness of their physical surroundings, making it perfect for applications like interactive exhibits, location-based treasure hunts, and digital art installations.

AR’s popularity in the location-based entertainment market is largely due to its versatility and accessibility. It can be deployed through smartphones, tablets, and AR glasses, which makes it more accessible to a wider audience. In addition, AR’s ability to provide context-sensitive information and experiences based on users’ locations is driving its adoption in theme parks, shopping malls, and events. The rapid growth of AR is expected to continue as consumers demand more interactive and personalized experiences, making it the fastest-growing segment in the location-based entertainment market.

Amusement Parks & Resorts End-User Segment is Largest Due to Integration of Immersive Experiences

Among the end-user segments, amusement parks and resorts represent the largest market share in the location-based entertainment industry. These venues have long been pioneers in providing immersive experiences and have increasingly adopted location-based technologies to enhance their offerings. The integration of VR, AR, and motion sensing into rides, attractions, and themed experiences allows visitors to engage in more dynamic and personalized entertainment. For instance, theme parks have incorporated VR into roller coasters, and AR is used in interactive walking tours, transforming traditional amusement park experiences into digitally enriched adventures.

Amusement parks and resorts are continually expanding their use of location-based technologies to provide more interactive experiences that encourage visitors to return and engage for longer periods. With the growth of digital technologies and the demand for more immersive and personalized entertainment, amusement parks and resorts are at the forefront of this innovation. As these venues continue to evolve and embrace more sophisticated location-based experiences, the amusement parks and resorts segment will remain the largest in the location-based entertainment market.

North America is Fastest Growing Region Due to Technological Advancements and Consumer Demand

Geographically, North America is the fastest-growing region in the location-based entertainment market, driven by the rapid adoption of emerging technologies such as AR and VR. The region has a strong presence of major entertainment players, including large theme park operators and tech companies that are leading innovations in location-based entertainment. As the region continues to embrace smart city initiatives and digital entertainment, demand for immersive experiences is growing, particularly in the U.S. and Canada, where consumer appetite for cutting-edge, interactive entertainment is high.

North America’s technological infrastructure and the prevalence of early adopters of entertainment technology provide an ideal environment for the expansion of location-based entertainment solutions. The region’s robust market for amusement parks, resorts, shopping malls, and immersive entertainment venues continues to fuel the rapid adoption of AR/VR technologies. With a growing number of digital-native consumers looking for personalized and immersive experiences, North America is set to maintain its leadership in the location-based entertainment market, ensuring its position as the fastest-growing region globally.

Leading Companies and Competitive Landscape

The location-based entertainment market is highly competitive, with numerous players focusing on the integration of immersive technologies such as VR, AR, and motion sensing. Key companies in this space include Disney, Universal Studios, and Sony, which are leveraging location-specific technologies to create engaging experiences in theme parks and entertainment centers. Additionally, tech companies like Microsoft, Google, and Apple are playing significant roles in developing platforms that enable location-based AR and VR applications.

The competitive landscape is characterized by a focus on innovation and the creation of new, immersive experiences that incorporate location-aware technologies. Companies are investing in R&D to develop more advanced VR and AR solutions, and partnerships between entertainment providers and tech firms are becoming increasingly common. The growing demand for highly personalized and immersive experiences in entertainment venues is pushing companies to continuously refine and expand their offerings. As the location-based entertainment market continues to grow, competition will intensify, with an increasing emphasis on providing users with unique, interactive, and context-sensitive experiences.

Recent Developments:

- The Walt Disney Company launched a new AR-based immersive experience in its theme parks, blending virtual and physical attractions for enhanced guest engagement.

- Universal Parks & Resorts unveiled a new VR-based ride, providing visitors with an interactive, location-based experience at its theme parks.

- HTC Corporation partnered with several amusement parks to bring cutting-edge VR entertainment experiences to their visitors.

- IMAX Corporation introduced immersive 3D theater technology designed to provide a more engaging cinema experience for location-based entertainment venues.

- SimEx-Iwerks Entertainment announced the opening of a new interactive entertainment center featuring motion-sensing games and augmented reality attractions.

List of Leading Companies:

- The Walt Disney Company

- Universal Parks & Resorts

- Sony Interactive Entertainment

- Nintendo Co., Ltd.

- IMAX Corporation

- LEGOLAND (Merlin Entertainments)

- Six Flags Entertainment Corporation

- SeaWorld Entertainment, Inc.

- Madame Tussauds (Merlin Entertainments)

- Location-Based Entertainment (LBE) Solutions, Inc.

- HTC Corporation

- SimEx-Iwerks Entertainment

- EON Reality, Inc.

- Dreamscape Immersive

- Virtuix

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 7.0 Billion |

|

Forecasted Value (2030) |

USD 18.8 Billion |

|

CAGR (2025 – 2030) |

17.8% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Location-based Entertainment Market By Type (Virtual Reality (VR), Augmented Reality (AR), Interactive Experiences, Immersive Theaters), By Technology (VR & AR Technologies, Geospatial Mapping, Cloud Computing, Motion Sensing), and By End-User (Amusement Parks & Resorts, Shopping Malls, Cinemas & Theaters, Fairs & Festivals); Global Insights & Forecast (2024 - 2030) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

The Walt Disney Company, Universal Parks & Resorts, Sony Interactive Entertainment, Nintendo Co., Ltd., IMAX Corporation, LEGOLAND (Merlin Entertainments), Six Flags Entertainment Corporation, SeaWorld Entertainment, Inc., Madame Tussauds (Merlin Entertainments), Location-Based Entertainment (LBE) Solutions, Inc., HTC Corporation, SimEx-Iwerks Entertainment, EON Reality, Inc., Dreamscape Immersive, Virtuix |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Location-based Entertainment Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Virtual Reality (VR) |

|

4.2. Augmented Reality (AR) |

|

4.3. Interactive Experiences |

|

4.4. Immersive Theaters |

|

4.5. Others |

|

5. Location-based Entertainment Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. VR & AR Technologies |

|

5.2. Geospatial Mapping |

|

5.3. Cloud Computing |

|

5.4. Motion Sensing |

|

5.5. Others |

|

6. Location-based Entertainment Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Amusement Parks & Resorts |

|

6.2. Shopping Malls |

|

6.3. Cinemas & Theaters |

|

6.4. Fairs & Festivals |

|

6.5. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Location-based Entertainment Market, by Type |

|

7.2.7. North America Location-based Entertainment Market, by Technology |

|

7.2.8. North America Location-based Entertainment Market, by End-User |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Location-based Entertainment Market, by Type |

|

7.2.9.1.2. US Location-based Entertainment Market, by Technology |

|

7.2.9.1.3. US Location-based Entertainment Market, by End-User |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. The Walt Disney Company |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Universal Parks & Resorts |

|

9.3. Sony Interactive Entertainment |

|

9.4. Nintendo Co., Ltd. |

|

9.5. IMAX Corporation |

|

9.6. LEGOLAND (Merlin Entertainments) |

|

9.7. Six Flags Entertainment Corporation |

|

9.8. SeaWorld Entertainment, Inc. |

|

9.9. Madame Tussauds (Merlin Entertainments) |

|

9.10. Location-Based Entertainment (LBE) Solutions, Inc. |

|

9.11. HTC Corporation |

|

9.12. SimEx-Iwerks Entertainment |

|

9.13. EON Reality, Inc. |

|

9.14. Dreamscape Immersive |

|

9.15. Virtuix |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Location-based Entertainment Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Location-based Entertainment Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Location-based Entertainment Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA