As per Intent Market Research, the Livestock Farm Equipment Market was valued at USD 11.2 Billion in 2024-e and will surpass USD 17.7 Billion by 2030; growing at a CAGR of 7.9% during 2025-2030.

The livestock farm equipment market is a vital segment within the agricultural sector, driven by technological advancements and the increasing need for enhanced productivity and efficiency in livestock farming. As farms scale up to meet the growing demand for animal-based products, such as milk, meat, and eggs, there is a continuous push towards adopting advanced equipment that streamlines farm operations. The market is witnessing significant growth due to innovations in automation, precision farming, and IoT, which help farmers optimize feeding, milking, manure handling, and housing systems.

With the rising need for sustainable and efficient farming practices, livestock farm equipment has become more sophisticated, integrating technologies such as artificial intelligence (AI) and IoT to improve farm management. These technologies enable farmers to monitor animal health, optimize feed, and increase overall productivity while reducing costs. Moreover, the growing awareness about animal welfare and environmental sustainability is prompting the adoption of more advanced systems that enhance the quality of life for animals and minimize the ecological footprint of farming activities.

The livestock farm equipment market is expanding across various types of farms, including dairy, meat, poultry, and mixed farms, as each farm type requires specialized equipment to meet its unique needs. Additionally, advancements in automation and AI are revolutionizing farm management by reducing manual labor, increasing precision in operations, and enabling more informed decision-making.

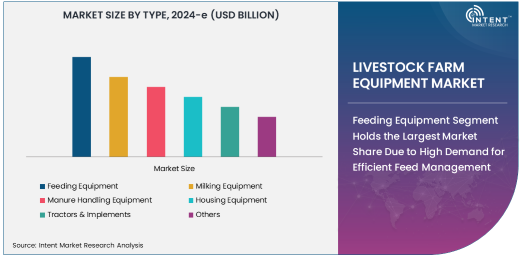

Feeding Equipment Segment Holds the Largest Market Share Due to High Demand for Efficient Feed Management

The feeding equipment segment is the largest in the livestock farm equipment market, driven by the growing need for efficient and automated feed management in livestock farming. Feeding equipment, such as automatic feeders, augers, and mixers, play a crucial role in ensuring that animals receive the right amount of nutrition at the right time, which is essential for improving animal growth rates and overall farm productivity.

With the increasing trend toward large-scale farming and the rising demand for high-quality animal products, farmers are investing in automated feeding systems to reduce labor costs, minimize feed wastage, and enhance feed efficiency. Furthermore, advancements in precision farming technologies are allowing feeding equipment to be more tailored to the specific needs of different animal species, improving the nutritional value of feed and supporting healthier livestock.

The growing adoption of IoT and AI technologies in feeding equipment is also driving the growth of this segment, as these technologies enable real-time monitoring of feed intake and animal health, allowing farmers to adjust feed parameters accordingly for optimal results.

Milking Equipment Segment is Expected to Grow Due to Increased Demand for Dairy Products

The milking equipment segment is experiencing substantial growth, driven by the rising global demand for dairy products. With the increasing need for efficient, hygienic, and high-capacity milking systems, dairy farms are adopting automated milking machines and robotic systems to streamline milking processes. These systems not only increase the milking efficiency but also improve animal welfare by reducing manual handling.

Technological advancements, such as automated milking parlors and robotic milking systems, allow farmers to milk animals more frequently and with greater precision. These innovations not only reduce labor costs but also enhance milk yield and quality, supporting the global dairy industry. The integration of AI and machine learning in milking equipment is further improving the detection of abnormalities in milk production, helping farmers identify health issues in dairy cows early and improve herd management practices.

Technology Integration Drives Automation and IoT Adoption in Livestock Farming

The adoption of automation and IoT technologies in livestock farming is significantly influencing the market. Automation reduces the need for manual labor and allows farmers to monitor and control various farm operations with higher precision. This is particularly relevant in large-scale operations, where managing multiple tasks efficiently is critical to profitability and sustainability.

IoT integration allows for the real-time collection of data from various equipment, such as feeding systems, milking machines, and manure handling systems. This data can be analyzed to monitor the health and productivity of livestock, optimize feeding schedules, and improve overall farm management. For instance, IoT-enabled devices can monitor animal behavior, alerting farmers to potential issues such as illness or stress, which can then be addressed quickly to avoid larger problems.

Additionally, AI and machine learning technologies are enabling predictive analytics, helping farmers forecast issues such as feed shortages or disease outbreaks before they occur. By leveraging these technologies, livestock farms can improve decision-making, reduce costs, and increase profitability.

Dairy Farms to Lead End-User Demand for Livestock Farm Equipment

Dairy farms are expected to be the leading end-user of livestock farm equipment, as dairy farming requires specialized equipment to manage milking, feeding, and housing of dairy cattle. As demand for dairy products continues to rise globally, the need for efficient and sustainable dairy farm management has never been greater. Dairy farms are adopting advanced equipment such as robotic milkers, automated feeding systems, and precision farming tools to increase milk production while ensuring the welfare of animals.

In addition to dairy farms, poultry farms, meat farms, and mixed farms are also significant contributors to the livestock farm equipment market. Each of these farm types requires specific equipment tailored to their operations. For instance, poultry farms are focusing on advanced feeding and housing equipment to optimize egg production and maintain healthy poultry, while meat farms are investing in manure handling systems and precision farming tools to improve operational efficiency.

Asia Pacific Region to Witness High Growth in Livestock Farm Equipment Market

The Asia Pacific region is expected to witness the highest growth in the livestock farm equipment market due to the increasing demand for animal products, particularly in countries such as China and India. As the population in these regions continues to grow, the demand for dairy, meat, and poultry products is also rising, prompting farmers to adopt advanced equipment to enhance productivity and efficiency. Additionally, governments in these countries are supporting the growth of the agricultural sector through initiatives aimed at improving farm mechanization and promoting sustainable farming practices.

The increasing adoption of IoT and automation technologies in livestock farming in the region is further fueling the market’s growth. The shift towards modern farming practices, supported by government policies and the growing interest in sustainable agriculture, is driving the demand for advanced livestock farm equipment.

Competitive Landscape and Key Players

The livestock farm equipment market is highly competitive, with numerous global and regional players offering a wide range of products and technologies. Key players in the market include companies like AGCO Corporation, DeLaval, Lely, GEA Group, and Tetra Laval. These companies are focusing on innovation and strategic partnerships to maintain their competitive edge in the market.

AGCO Corporation, for example, offers a wide array of equipment for livestock farms, including feeding, milking, and housing solutions. DeLaval and Lely are leaders in automated milking systems, while GEA Group provides solutions for feeding, manure handling, and animal health management.

To stay competitive, these companies are increasingly investing in research and development to create more efficient and sustainable equipment, as well as incorporating AI, IoT, and other cutting-edge technologies into their products. The market is also witnessing a trend towards mergers and acquisitions, as companies seek to expand their product portfolios and strengthen their market presence.

Recent Developments:

- DeLaval introduced a new fully automated milking system designed to improve efficiency and animal welfare.

- AGCO Corporation launched a range of smart farming equipment to enhance livestock management and data-driven farming.

- Kubota Corporation partnered with an ag-tech startup to integrate AI into livestock farm equipment for precision farming.

- GEA Group unveiled a new manure management system aimed at reducing environmental impact for livestock farms.

- Trimble Inc. expanded its precision farming solutions by adding advanced livestock tracking and management features.

List of Leading Companies:

- DeLaval

- GEA Group

- AGCO Corporation

- Kubota Corporation

- CLAAS Group

- CNH Industrial

- Trimble Inc.

- Big Dutchman International

- Lely Industries N.V.

- Zoetis Inc.

- Vicon Machinery

- Buhler Industries

- JF Agricultural Machinery

- Mahindra & Mahindra Ltd.

- Komatsu Ltd.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 11.2 Billion |

|

Forecasted Value (2030) |

USD 17.7 Billion |

|

CAGR (2025 – 2030) |

7.9% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Livestock Farm Equipment Market By Type (Feeding Equipment, Milking Equipment, Manure Handling Equipment, Housing Equipment, Tractors & Implements), By End-User (Dairy Farms, Meat Farms, Poultry Farms, Mixed Farms), and By Technology (Automation, Precision Farming, Internet of Things (IoT), Artificial Intelligence (AI)) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

DeLaval, GEA Group, AGCO Corporation, Kubota Corporation, CLAAS Group, CNH Industrial, Trimble Inc., Big Dutchman International, Lely Industries N.V., Zoetis Inc., Vicon Machinery, Buhler Industries, JF Agricultural Machinery, Mahindra & Mahindra Ltd., Komatsu Ltd. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Livestock Farm Equipment Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Feeding Equipment |

|

4.2. Milking Equipment |

|

4.3. Manure Handling Equipment |

|

4.4. Housing Equipment |

|

4.5. Tractors & Implements |

|

4.6. Others |

|

5. Livestock Farm Equipment Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Dairy Farms |

|

5.2. Meat Farms |

|

5.3. Poultry Farms |

|

5.4. Mixed Farms |

|

5.5. Others |

|

6. Livestock Farm Equipment Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Automation |

|

6.2. Precision Farming |

|

6.3. Internet of Things (IoT) |

|

6.4. Artificial Intelligence (AI) |

|

6.5. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Livestock Farm Equipment Market, by Type |

|

7.2.7. North America Livestock Farm Equipment Market, by End-User |

|

7.2.8. North America Livestock Farm Equipment Market, by Technology |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Livestock Farm Equipment Market, by Type |

|

7.2.9.1.2. US Livestock Farm Equipment Market, by End-User |

|

7.2.9.1.3. US Livestock Farm Equipment Market, by Technology |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. DeLaval |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. GEA Group |

|

9.3. AGCO Corporation |

|

9.4. Kubota Corporation |

|

9.5. CLAAS Group |

|

9.6. CNH Industrial |

|

9.7. Trimble Inc. |

|

9.8. Big Dutchman International |

|

9.9. Lely Industries N.V. |

|

9.10. Zoetis Inc. |

|

9.11. Vicon Machinery |

|

9.12. Buhler Industries |

|

9.13. JF Agricultural Machinery |

|

9.14. Mahindra & Mahindra Ltd. |

|

9.15. Komatsu Ltd. |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Livestock Farm Equipment Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Livestock Farm Equipment Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Livestock Farm Equipment Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA