As per Intent Market Research, the Lithium Market was valued at USD 7.8 Billion in 2024-e and will surpass USD 18.1 Billion by 2030; growing at a CAGR of 15.2% during 2025-2030.

The lithium market has become a cornerstone of the global energy transition, driven by surging demand for energy storage solutions and lightweight, high-performance materials. Lithium is a critical raw material used across diverse applications, with its most prominent role in the production of lithium-ion batteries for electric vehicles (EVs), consumer electronics, and grid energy storage. The shift toward renewable energy, coupled with rapid advancements in battery technology, has propelled the demand for lithium, leading to substantial investments in mining, refining, and recycling capacities worldwide.

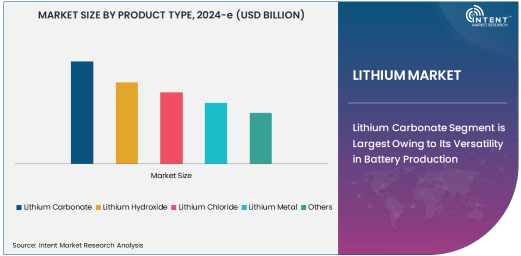

Lithium Carbonate Segment is Largest Owing to Its Versatility in Battery Production

Lithium carbonate holds the largest share in the lithium market due to its pivotal role as a precursor material in the production of cathodes for lithium-ion batteries. This compound is widely used in energy storage applications for electric vehicles, portable electronics, and renewable energy systems. The automotive sector's accelerated transition to electric mobility is a key driver of lithium carbonate demand, with governments and industries promoting EV adoption to meet decarbonization goals.

Additionally, lithium carbonate is used in glass and ceramic applications, offering thermal resistance and mechanical durability. With its versatile applications and high demand in the battery industry, lithium carbonate remains a cornerstone of the global lithium market, supported by continued investments in mining and refining operations to meet growing demand.

Brine Source is the Largest Due to Lower Extraction Costs

Lithium extracted from brine sources dominates the market, as brine-based extraction is more cost-effective and environmentally favorable compared to hard rock mining. Major lithium-producing regions such as the "Lithium Triangle" in South America, encompassing Chile, Argentina, and Bolivia, rely heavily on brine deposits. These sources are naturally rich in lithium, allowing for large-scale production with lower energy and material input.

Brine extraction involves pumping lithium-rich saline water to the surface, where it undergoes evaporation and purification processes. As global lithium demand continues to rise, brine extraction offers a scalable and efficient solution, with advancements in direct lithium extraction (DLE) technology further enhancing its economic viability and reducing environmental impact.

Battery Application is the Fastest Growing Segment Due to the EV Boom

The battery application segment is the fastest growing in the lithium market, fueled by the explosive demand for electric vehicles and renewable energy storage systems. Lithium-ion batteries, known for their high energy density, long cycle life, and lightweight properties, are integral to powering EVs and storing intermittent renewable energy from solar and wind sources.

With governments and automakers committing to EV targets, lithium demand for battery applications is expected to skyrocket. Leading automotive companies are ramping up battery production capacities and securing long-term lithium supply contracts to ensure a steady flow of materials. Additionally, innovations in battery chemistry, such as solid-state batteries, are poised to drive further growth in this segment.

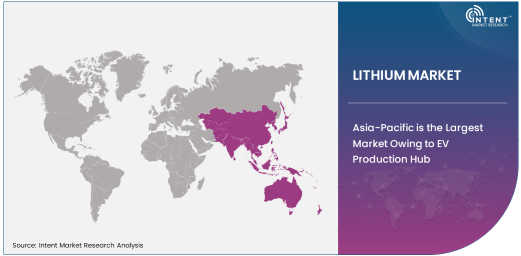

Asia-Pacific is the Largest Market Owing to EV Production Hub

Asia-Pacific dominates the lithium market, driven by the region's status as a global hub for electric vehicle and battery manufacturing. Countries such as China, Japan, and South Korea host leading battery producers, including CATL, LG Chem, and Panasonic, which are driving significant lithium consumption. China, in particular, has established itself as the largest EV market globally, with substantial government support through subsidies and infrastructure development.

The region is also investing in upstream lithium production, with Australia being a major supplier of hard rock lithium, and Chinese companies increasingly engaging in mining and refining activities in South America and Africa. The combination of robust demand, extensive production capabilities, and strategic investments positions Asia-Pacific as the dominant force in the lithium market.

Competitive Landscape and Leading Companies

The lithium market is highly competitive, with major players including Albemarle Corporation, SQM, Ganfeng Lithium, and Livent Corporation. These companies are focusing on expanding their production capacities, exploring new resources, and adopting sustainable extraction technologies to meet the surging demand.

Strategic partnerships between lithium producers and battery manufacturers are shaping the market, ensuring long-term supply stability. The competitive landscape is also seeing increased activity in recycling and circular economy initiatives, as companies look to recover lithium from end-of-life batteries. With demand continuing to outpace supply, innovation and strategic resource management will remain critical to maintaining leadership in the lithium market.

Recent Developments:

- Albemarle Corporation announced the expansion of its lithium processing capacity to meet growing EV battery demand.

- SQM collaborated with an automotive manufacturer to ensure sustainable lithium sourcing for EV production.

- Ganfeng Lithium Co., Ltd. launched a new recycling initiative to recover lithium from used batteries.

- Livent Corporation signed a long-term supply agreement with a major energy storage solutions provider.

- Tianqi Lithium Industries, Inc. completed the acquisition of additional stakes in a lithium mining project to boost production.

List of Leading Companies:

- Albemarle Corporation

- SQM (Sociedad Química y Minera de Chile)

- Ganfeng Lithium Co., Ltd.

- Livent Corporation

- Tianqi Lithium Industries, Inc.

- Orocobre Limited

- FMC Corporation

- Nemaska Lithium

- Mineral Resources Limited

- Lithium Americas Corp.

- Avalon Advanced Materials Inc.

- Pilbara Minerals Limited

- Neo Lithium Corporation

- Bacanora Lithium PLC

- Global Lithium Resources

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 7.8 Billion |

|

Forecasted Value (2030) |

USD 18.1 Billion |

|

CAGR (2025 – 2030) |

15.2% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Lithium Market By Product Type (Lithium Carbonate, Lithium Hydroxide, Lithium Chloride, Lithium Metal), By Source (Brine, Hard Rock), and By Application (Batteries, Glass & Ceramics, Lubricants, Air Treatment, Pharmaceuticals) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Albemarle Corporation, SQM (Sociedad Química y Minera de Chile), Ganfeng Lithium Co., Ltd., Livent Corporation, Tianqi Lithium Industries, Inc., Orocobre Limited, FMC Corporation, Nemaska Lithium, Mineral Resources Limited, Lithium Americas Corp., Avalon Advanced Materials Inc., Pilbara Minerals Limited, Neo Lithium Corporation, Bacanora Lithium PLC, Global Lithium Resources |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Lithium Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Lithium Carbonate |

|

4.2. Lithium Hydroxide |

|

4.3. Lithium Chloride |

|

4.4. Lithium Metal |

|

4.5. Others |

|

5. Lithium Market, by Source (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Brine |

|

5.2. Hard Rock |

|

5.3. Others |

|

6. Lithium Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Batteries |

|

6.2. Glass & Ceramics |

|

6.3. Lubricants |

|

6.4. Air Treatment |

|

6.5. Pharmaceuticals |

|

6.6. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Lithium Market, by Product Type |

|

7.2.7. North America Lithium Market, by Source |

|

7.2.8. North America Lithium Market, by Application |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Lithium Market, by Product Type |

|

7.2.9.1.2. US Lithium Market, by Source |

|

7.2.9.1.3. US Lithium Market, by Application |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Albemarle Corporation |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. SQM (Sociedad Química y Minera de Chile) |

|

9.3. Ganfeng Lithium Co., Ltd. |

|

9.4. Livent Corporation |

|

9.5. Tianqi Lithium Industries, Inc. |

|

9.6. Orocobre Limited |

|

9.7. FMC Corporation |

|

9.8. Nemaska Lithium |

|

9.9. Mineral Resources Limited |

|

9.10. Lithium Americas Corp. |

|

9.11. Avalon Advanced Materials Inc. |

|

9.12. Pilbara Minerals Limited |

|

9.13. Neo Lithium Corporation |

|

9.14. Bacanora Lithium PLC |

|

9.15. Global Lithium Resources |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Lithium Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Lithium Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Lithium Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA