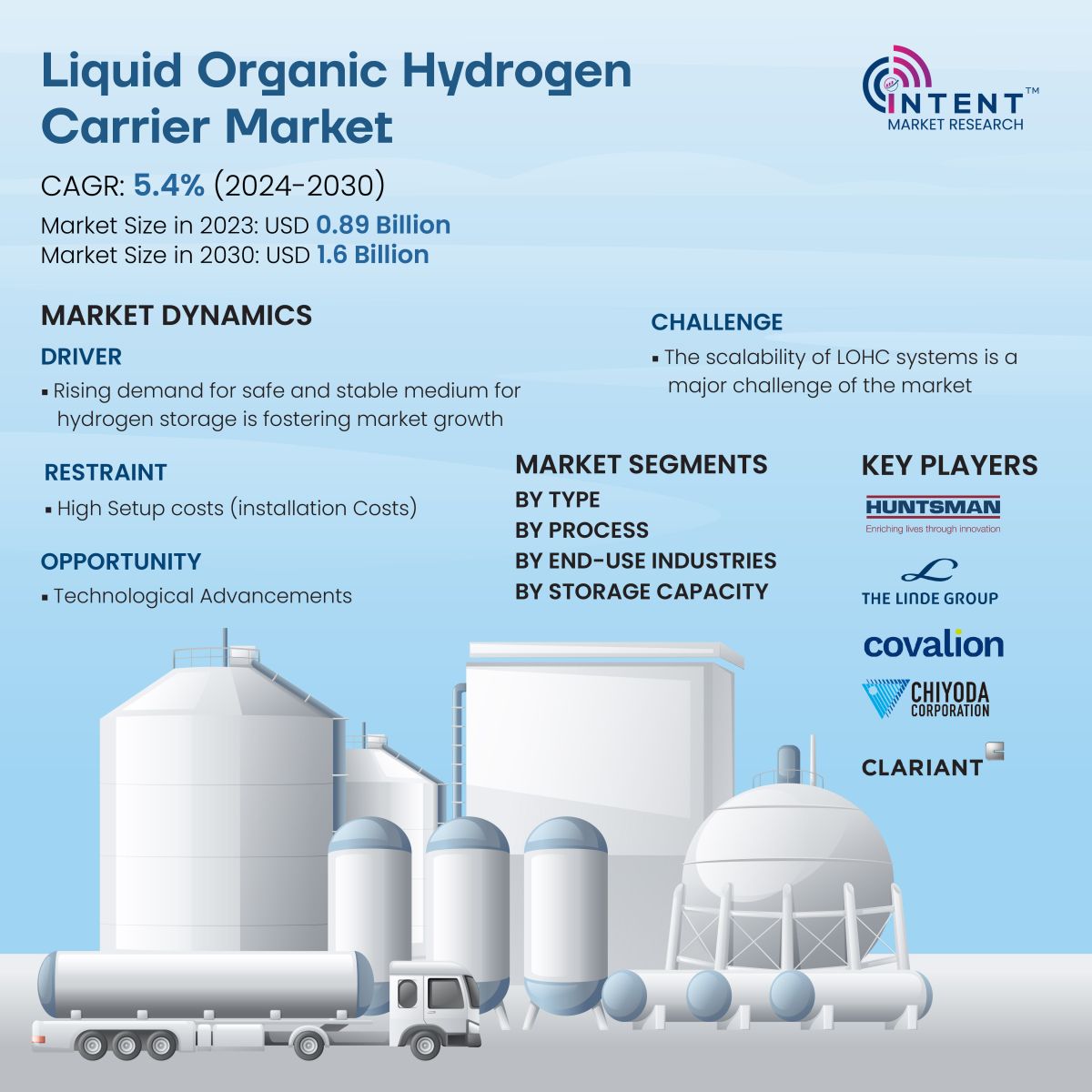

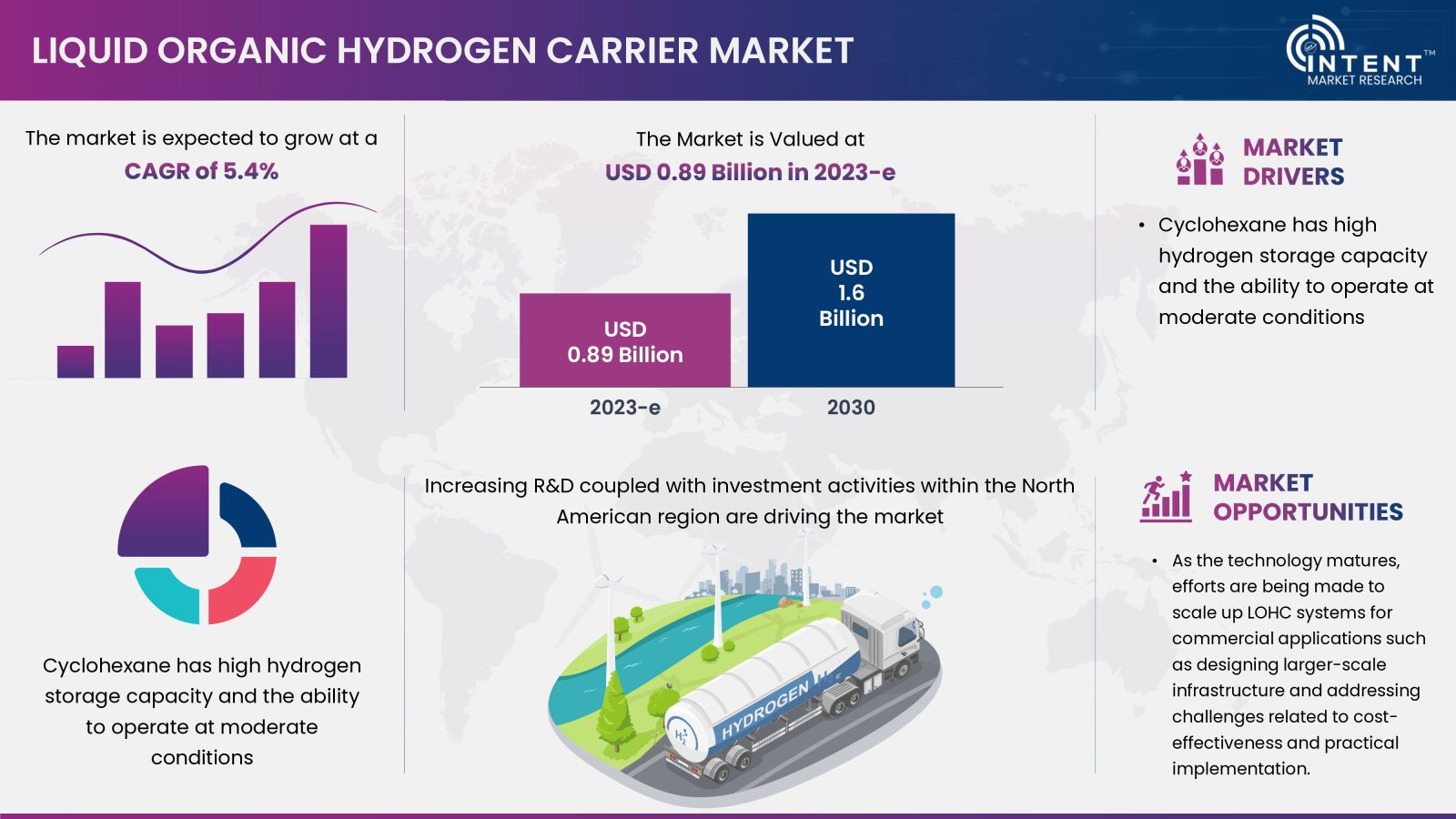

According to Intent Market Research, the Liquid Organic Hydrogen Carrier Market is expected to grow from USD 0.89 billion in 2023-e at a CAGR of 5.4% to touch USD 1.6 billion by 2030. Prominent players include Chiyoda Corporation, Clariant, Covalion, CRI Company, Fraunhofer Institute for Solar Energy Systems, Hydrogen Application & Energy (HTEC), Huntsman, Hydrogenious LOHC Technologies, Hynertech, Nippon Shokub, The Linde Group, Wuhuan Engineering.

Liquid organic hydrogen carriers are compounds that can store and transport hydrogen safely and efficiently. These are used to store and release hydrogen in a variety of applications, especially those related to energy storage and transport. LOHC works by chemically binding and releasing hydrogen through reversible hydrogenation and dehydrogenation reactions. Essentially, these carriers absorb hydrogen when exposed to it under certain conditions and store it within their molecular structure. The stored hydrogen can then be released as needed by reversing the chemical process.

Liquid Organic Hydrogen Carrier Market Dynamics

Rising demand for safe and stable medium for hydrogen storage is fostering market growth

LOHC provides an efficient and safe way to store and transport hydrogen, making it an important part of the hydrogen economy. LOHC provides a safe and stable medium for hydrogen storage, allowing for long-distance transportation without the risks associated with compressed or liquefied hydrogen. Hydrogen fuel cells are becoming increasingly popular as a clean and efficient vehicle drive technology. LOHCs play a key role in the widespread adoption of hydrogen fuel cells by providing a reliable and convenient source of hydrogen on demand. LOHC technology is continually advancing, making it more efficient, cost-effective, and environmentally sustainable.

These factors are expected to drive the growth of the LOHC market and significantly contribute to the transition to a clean and sustainable energy future. The advantage of using LOHC is that hydrogen can be stored at ambient conditions and atmospheric pressure. This makes handling and transportation safer and more practical compared to high-pressure gas or cryogenic liquid storage methods. LOHC provides the potential for efficient and reversible hydrogen storage, contributing to the ongoing development of hydrogen-based energy systems and fuel cell technology.

Liquid Organic Hydrogen Carrier Segment Insights

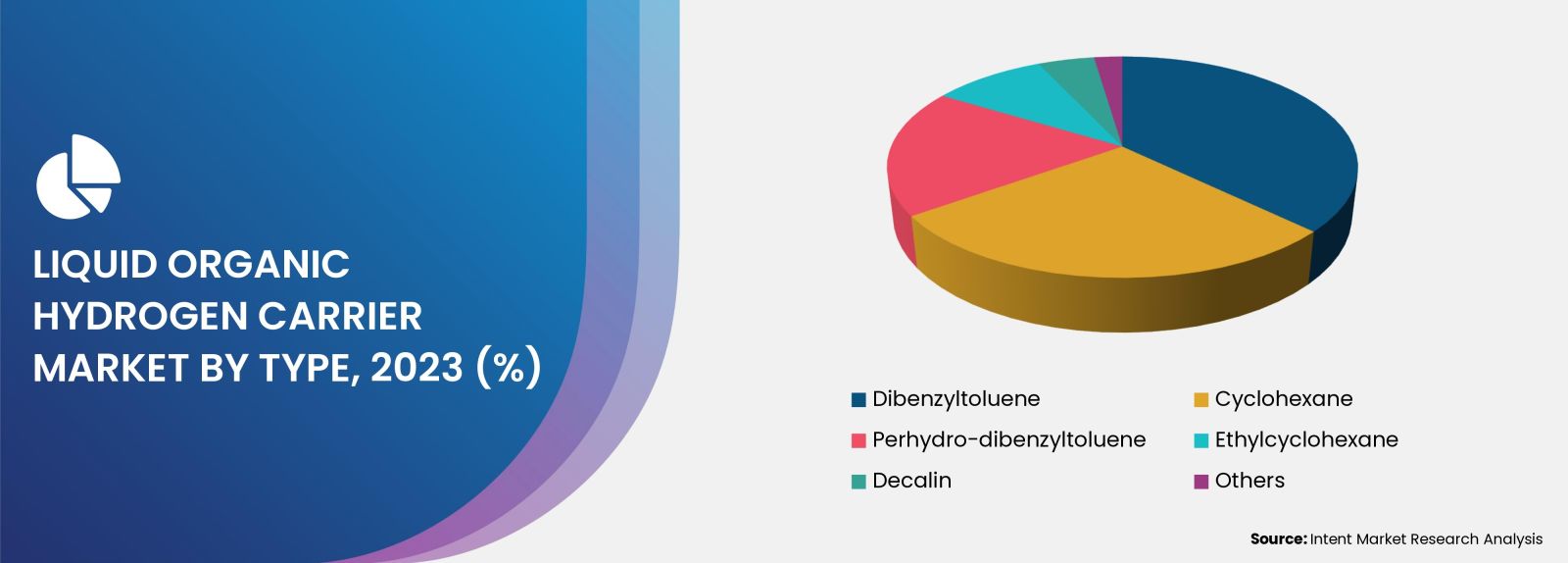

Cyclohexane has high hydrogen storage capacity and the ability to operate at moderate conditions

Cyclohexane is often used for hydrogen storage and transport as cyclohexane undergoes a reversible hydrogenation reaction and efficiently absorbs and releases hydrogen. In this process, cyclohexane is converted to methylcyclohexane when hydrogen is absorbed and back to cyclohexane when hydrogen is released. This reversible process enables safe and efficient storage of hydrogen. The use of cyclohexane in this process demonstrates the inventive solutions being developed by scientists and engineers to tackle the challenges of a clean energy future.

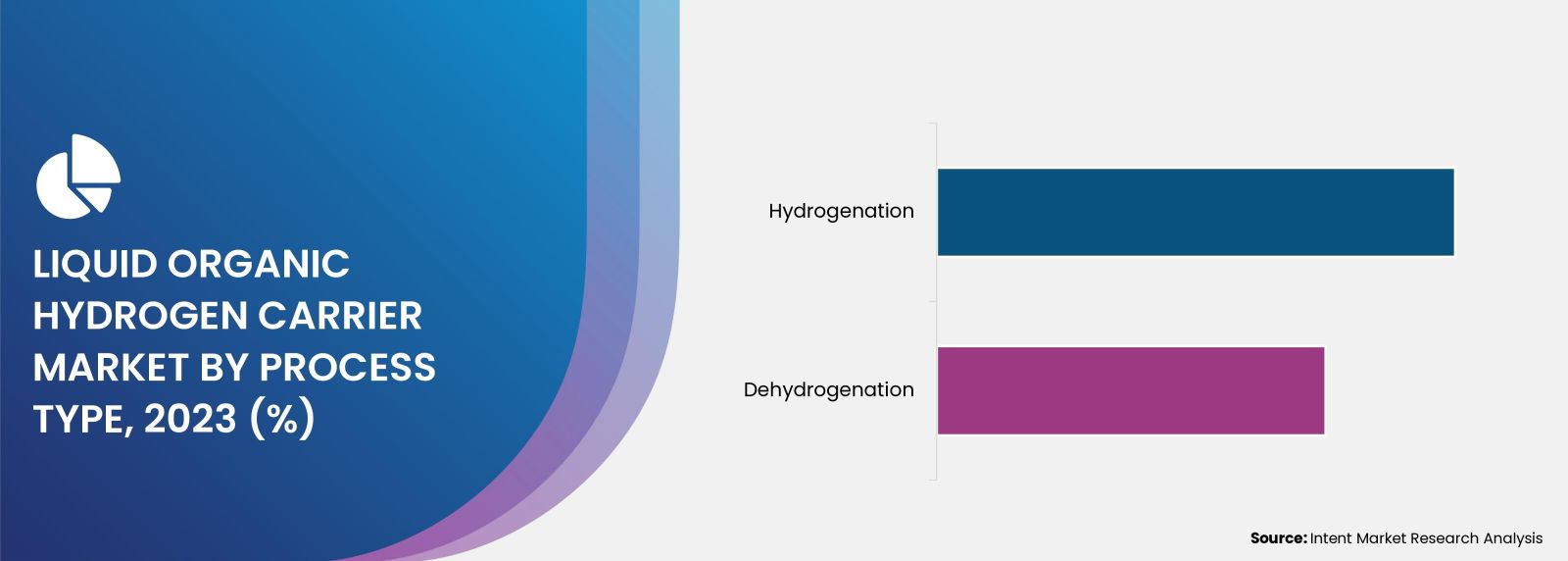

The reversible nature of hydrogenation makes LOHCS compatible with existing liquid fuel infrastructure

In LOHC (Liquid Organic Hydrogen Carrier) systems, hydrogenation is actually the most commonly used process. During hydrogenation, LOHC absorbs hydrogen, undergoes chemical changes, and stores it. This is, for example, a process that converts cyclohexane to methylcyclohexane in the presence of hydrogen.

The advantage of hydrogenation is that hydrogen can be stored in chemically bonded form and can be stored safely and efficiently under mild conditions. This reversible process, in which LOHC easily absorbs and release hydrogen, makes it practical for various applications such as transportation and energy storage.

Increasing inclination toward a cleaner and sustainable future leads to the adoption of LOHCs in transportation

LOHC provides a safe and efficient way to store and transport hydrogen. In the transportation sector, LOHC can be used for hydrogen storage and release for fuel cell vehicles. LOHC's reversible hydrogenation and dehydrogenation reactions enable the production of hydrogen onboard ships, which are used in fuel cells to generate electricity for vehicles. This approach has advantages compared to high-pressure gas storage, including increased safety and the ability to operate at ambient temperature and pressure. This makes hydrogen a viable and practical fuel for transportation, reducing dependence on traditional fossil fuels and helping reduce carbon emissions. The use of LOHC in transportation is a promising step towards a cleaner and more sustainable future.

The high storage capacity is crucial for making hydrogen a practical and competitive energy carrier

High storage capacity is essential for hydrogen to become a practical and competitive energy source. LOHC can store large amounts of hydrogen within its molecular structure. The ability to tightly pack hydrogen within LOHC molecules contributes to their efficiency in storing large amounts of hydrogen. The high storage capacity is a valuable property, particularly when compared to other hydrogen storage methods such as high-pressure gas or cryogenic liquid storage. These alternatives have limited energy density and practicality. Through research and development efforts, the storage capacity of LOHCs continues to be optimized and improved, making them even more attractive for various applications such as energy storage and transportation.

Regional Insights

Increasing R&D coupled with investment activities within the Asia-Pacific region are driving the market

Countries in the Asia-Pacific region, particularly Japan and South Korea, have been actively investing in and researching various hydrogen technologies, including LOHC. For example, Japan has shown interest in hydrogen as a clean energy source and is working on research and projects related to hydrogen storage and transportation. Japan is heavily investing in its LOHC technology, with the government setting a goal of having 100,000 fuel-cell vehicles on the road by 2030. LOHC is considered a key element in achieving this ambitious target. Several Japanese companies have developed his LOHC technology, including JGC Corporation, IHI Corporation, and Toyota Motor Corporation.

Competitive Landscape

Novel product launches are the major strategy adopted by the key players for regional growth

The wireless network topology market is competitive due to the presence of large, established companies and a number of smaller, innovative startups. Prominent players include Chiyoda Corporation, Clariant, Covalion, CRI Company, Fraunhofer Institute for Solar Energy Systems, Hydrogen Application & Energy Corporation (HTEC), Huntsman, Hydrogenious LOHC Technologies, Hynertech, Nippon Shokub, Linde, Wuhuan Engineering.. In January 2023, Hydrogenious and Vopak announced the launch of a new LOHC plant in Rotterdam, Netherlands. The plant will have a capacity of 1,000 tons of hydrogen per year and will be used to supply hydrogen for fuel cell vehicles and other applications.

Liquid Organic Hydrogen Carrier Market Coverage

The report provides key insights into the liquid organic hydrogen carrier market, and it focuses on technological developments, trends, and initiatives taken by the government. In this sector, the analysis delves into market drivers, restraints, opportunities, and other pertinent factors. The report also scrutinizes key players and the competitive landscape in the liquid organic hydrogen carriers market.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 0.89 billion |

|

Forecast Revenue (2030) |

USD 1.6 billion |

|

CAGR (2024-2030) |

5.4% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

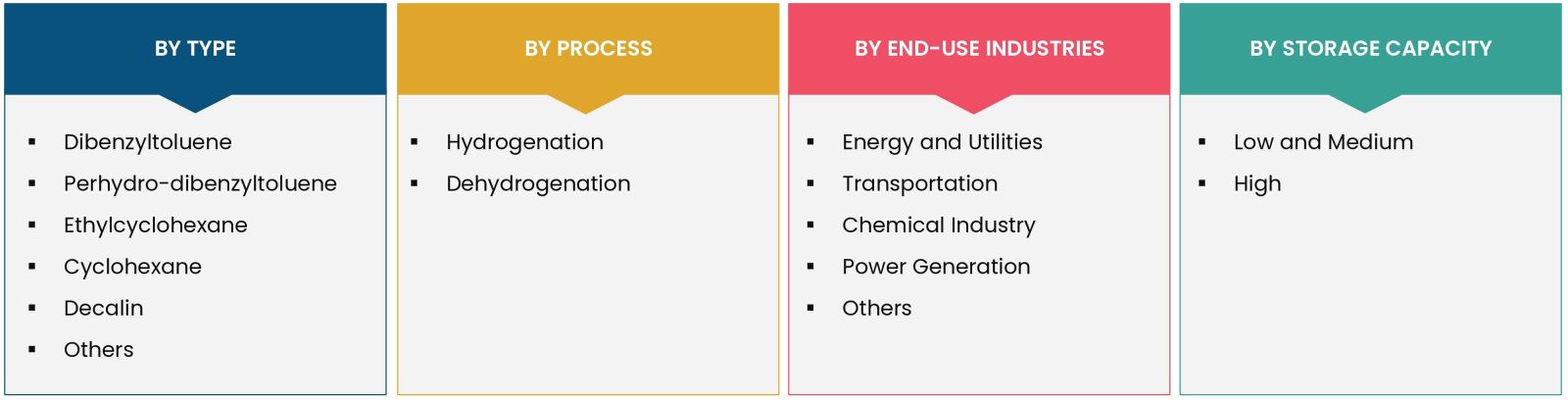

Segments Covered |

Type (Dibenzyltoluene, Perhydro-dibenzyl-toluene, Ethylcyclohexane, Cyclohexane, Decalin, and Others), Process (Hydrogenation and Dehydrogenation), End-Use Industries (Energy and Utilities, Transportation, Chemical Industry, Power Generation and Others) and Storage Capacity (Low and Medium and High) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Italy), Asia-Pacific (China, Japan, South Korea, India), Latin America (Brazil, Mexico, Argentina), Middle East and Africa (Saudi Arabia, South Africa, United Arab Emirates) |

|

Competitive Landscape |

Chiyoda Corporation, Clariant, Covalion, CRI Company, Fraunhofer Institute for Solar Energy Systems, Hydrogen Application & Energy Corporation (HTEC), Huntsman, Hydrogenious LOHC Technologies, Hynertech, Nippon Shokub, Linde, Wuhuan Engineering |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1. Introduction |

|

1. 1. Study Assumptions and Liquid Organic Hydrogen Carrier Market Definition |

|

1.2. Scope of the Study |

|

2. Research Methodology |

|

3. Executive Summary |

|

4. Liquid Organic Hydrogen Carrier Market Dynamics |

|

4.1. Market Growth Drivers |

|

4.2 Market Challenges |

|

5. Liquid Organic Hydrogen Carrier Market Outlook |

|

5.1.Technological and Market Developments |

|

5.2 Regulatory Framework |

|

5.3. Market Investment Scenario & Strategic Recommendations Analysis |

|

5.4 Key Hydrogen Storage Technologies |

|

5.5. Energy consumption for different types of hydrogen storage (hydrogenation) systems |

|

5.6 Capital cost (in USD, 2020) for major system components of the hydrogenation process |

|

5.7. Value Chain Status |

|

5.8 Porter's Five Forces |

|

5.9. Pestle Analysis |

|

5.10. Catalyst used in Liquid Organic Hydrogen |

|

5.11. Energy Storage analysis |

|

5.12. Biobased Liquid hydrogen carrier analysis |

|

6. Global Liquid Organic Hydrogen Carrier Market Segmentation (Market Size & Forecast: USD billion, 2024 – 2030) |

|

6.1 Type |

|

6.1.1 Dibenzyltoluene |

|

6.1.2 Perhydro-dibenzyltoluene |

|

6.1.3 Ethylcyclohexane |

|

6.1.4 Cyclohexane |

|

6.1.5 Decalin |

|

6.1.6 Others |

|

6.2 Process |

|

6.2.1 Hydrogenation |

|

6.2.2 Dehydrogenation |

|

6.3 End-Use Industry |

|

6.3.1 Energy & Utilities |

|

6.3.2 Power Generation |

|

6.3.3 Chemical Industry |

|

6.3.4 Transportation |

|

6.3.5 Others |

|

6.4 Storage Capacity |

|

6.4.1 High |

|

6.4.2 Low & Medium & Low |

|

6.5 Region |

|

6.5.1 North America |

|

6.5.2 Europe |

|

6.5.3 Asia-Pacific |

|

6.5.4 Latin America |

|

6.5.5 Middle East and Africa |

|

7. North America Liquid Organic Hydrogen Carrier Market Segmentation (Market Size & Forecast: USD billion, 2024 – 2030) |

|

7.1 Type |

|

7.1.1 Dibenzyltoluene |

|

7.1.2 Perhydro-dibenzyltoluene |

|

7.1.3 Ethylcyclohexane |

|

7.1.4 Cyclohexane |

|

7.1.5 Decalin |

|

7.1.6 Others |

|

7.2 Process |

|

7.2.1 Hydrogenation |

|

7.2.2 Dehydrogenation |

|

7.3 End-Use Industry |

|

7.3.1 Energy & Utilities |

|

7.3.2 Power Generation |

|

7.3.3 Chemical Industry |

|

7.3.4 Transportation |

|

7.3.5 Others |

|

7.4 Storage Capacity |

|

7.4.1 High |

|

7.4.2 Medium & Low |

|

7.5 Country |

|

7.5.1 United States |

|

7.5.1.1 Type |

|

7.5.1.1.1 Dibenzyltoluene |

|

7.5.1.1.2 Perhydro-dibenzyltoluene |

|

7.5.1.1.3 Ethylcyclohexane |

|

7.5.1.1.4 Cyclohexane |

|

7.5.1.1.5 Decalin |

|

7.5.1.1.6 Others |

|

7.5.1.2 Process |

|

7.5.1.2.1 Hydrogenation |

|

7.5.1.2.2 Dehydrogenation |

|

7.5.1.3 End-Use Industry |

|

7.5.1.3.1 Energy & Utilities |

|

7.5.1.3.2 Power Generation |

|

7.5.1.3.3 Chemical Industry |

|

7.5.1.3.4 Transportation |

|

7.5.1.3.4 Others |

|

7.5.1.4 Storage Capacity |

|

7.5.1.4.1 High |

|

7.7.1.4.2 Medium & Low |

|

7.5.2 Canada |

|

7.5.2.1 Type |

|

7.5.2.1.1 Dibenzyltoluene |

|

7.5.2.1.2 Perhydro-dibenzyltoluene |

|

7.5.2.1.3 Ethylcyclohexane |

|

7.5.2.1.4 Cyclohexane |

|

7.5.2.1.5 Decalin |

|

7.5.2.1.6 Others |

|

7.5.2.2 Process |

|

7.5.2.2.1 Hydrogenation |

|

7.5.2.2.2 Dehydrogenation |

|

7.5.2.3 End-Use Industry |

|

7.5.2.3.1 Energy & Utilities |

|

7.5.2.3.2 Power Generation |

|

7.5.2.3.3 Chemical Industry |

|

7.5.2.3.4 Transportation |

|

7.5.2.3.4 Others |

|

7.5.2.4 Storage Capacity |

|

7.5.2.4.1 High |

|

7.5.2.4.2 Medium & Low |

|

8. Europe Market Liquid Organic Hydrogen Carrier Segmentation (Market Size & Forecast: USD billion, 2024 – 2030) |

|

8.1 Type |

|

8.1.1 Dibenzyltoluene |

|

8.1.2 Perhydro-dibenzyltoluene |

|

8.1.3 Ethylcyclohexane |

|

8.1.4 Cyclohexane |

|

8.1.5 Decalin |

|

8.1.6 Others |

|

8.2 Process |

|

8.2.1 Hydrogenation |

|

8.2.2 Dehydrogenation |

|

8.3 End-Use Industry |

|

8.3.1 Energy & Utilities |

|

8.3.2 Power Generation |

|

8.3.3 Chemical Industry |

|

8.3.4 Transportation |

|

8.3.5 Others |

|

8.4 Storage Capacity |

|

8.4.1 High |

|

8.4.2 Medium & Low |

|

8.5 Country |

|

8.5.1 United Kingdom |

|

8.5.1.1 Type |

|

8.5.1.1.1 Dibenzyltoluene |

|

8.5.1.1.2 Perhydro-dibenzyltoluene |

|

8.5.1.1.3 Ethylcyclohexane |

|

8.5.1.1.4 Cyclohexane |

|

8.5.1.1.5 Decalin |

|

8.5.1.1.6 Others |

|

8.5.1.2 Process |

|

8.5.1.2.1 Hydrogenation |

|

8.5.1.2.2 Dehydrogenation |

|

8.5.1.3 End-Use Industry |

|

8.5.1.3.1 Energy & Utilities |

|

8.5.1.3.2 Power Generation |

|

8.5.1.3.3 Chemical Industry |

|

8.5.1.3.4 Transportation |

|

8.5.1.3.4 Others |

|

8.5.1.4 Storage Capacity |

|

8.5.1.4.1 High |

|

8.5.1.4.2 Medium & Low |

|

8.5.2 France |

|

8.5.2.1 Type |

|

8.5.2.1.1 Dibenzyltoluene |

|

8.5.2.1.2 Perhydro-dibenzyltoluene |

|

8.5.2.1.3 Ethylcyclohexane |

|

8.5.2.1.4 Cyclohexane |

|

8.5.2.1.5 Decalin |

|

8.5.2.1.6 Others |

|

8.5.2.2 Process |

|

8.5.2.2.1 Hydrogenation |

|

8.5.2.2.2 Dehydrogenation |

|

8.5.2.3 End-Use Industry |

|

8.5.2.3.1 Energy & Utilities |

|

8.5.2.3.2 Power Generation |

|

8.5.2.3.3 Chemical Industry |

|

8.5.2.3.4 Transportation |

|

8.5.2.3.4 Others |

|

8.5.2.4 Storage Capacity |

|

8.5.2.4.1 High |

|

8.5.2.4.2 Medium & Low |

|

8.5.3 Germany |

|

8.5.3.1 Type |

|

8.5.3.1.1 Dibenzyltoluene |

|

8.5.3.1.2 Perhydro-dibenzyltoluene |

|

8.5.3.1.3 Ethylcyclohexane |

|

8.5.3.1.4 Cyclohexane |

|

8.5.3.1.5 Decalin |

|

8.5.3.1.6 Others |

|

8.5.3.2 Process |

|

8.5.3.2.1 Hydrogenation |

|

8.5.3.2.2 Dehydrogenation |

|

8.5.3.3 End-Use Industry |

|

8.5.3.3.1 Energy & Utilities |

|

8.5.3.3.2 Power Generation |

|

8.5.3.3.3 Chemical Industry |

|

8.5.3.3.4 Transportation |

|

8.5.3.3.4 Others |

|

8.5.3.4 Storage Capacity |

|

8.5.3.4.1 High |

|

8.5.3.4.2 Medium & Low |

|

8.5.4 Italy |

|

8.5.4.1 Type |

|

8.5.4.1.1 Dibenzyltoluene |

|

8.5.4.1.2 Perhydro-dibenzyltoluene |

|

8.5.4.1.3 Ethylcyclohexane |

|

8.5.4.1.4 Cyclohexane |

|

8.5.4.1.5 Decalin |

|

8.5.4.1.6 Others |

|

8.5.4.2 Process |

|

8.5.4.2.1 Hydrogenation |

|

8.5.4.2.2 Dehydrogenation |

|

8.5.4.3 End-Use Industry |

|

8.5.4.3.1 Energy & Utilities |

|

8.5.4.3.2 Power Generation |

|

8.5.4.3.3 Chemical Industry |

|

8.5.4.3.4 Transportation |

|

8.5.4.3.4 Others |

|

8.5.4.4 Storage Capacity |

|

8.5.4.4.1 High |

|

8.5.4.4.2 Medium & Low |

|

9. Asia Pacific Liquid Organic Hydrogen Carrier Market Segmentation (Market Size & Forecast: USD billion, 2024 – 2030) |

|

9.1 Type |

|

9.1.1 Dibenzyltoluene |

|

9.1.2 Perhydro-dibenzyltoluene |

|

9.1.3 Ethylcyclohexane |

|

9.1.4 Cyclohexane |

|

9.1.5 Decalin |

|

9.1.6 Others |

|

9.2 Process |

|

9.2.1 Hydrogenation |

|

9.2.2 Dehydrogenation |

|

9.3 End-Use Industry |

|

9.3.1 Energy & Utilities |

|

9.3.2 Power Generation |

|

9.3.3 Chemical Industry |

|

9.3.4 Transportation |

|

9.3.5 Others |

|

9.4 Storage Capacity |

|

9.4.1 High |

|

9.4.2 Medium & Low |

|

9.5 Country |

|

9.5.1 China |

|

9.5.1.1 Type |

|

9.5.1.1.1 Dibenzyltoluene |

|

9.5.1.1.2 Perhydro-dibenzyltoluene |

|

9.5.1.1.3 Ethylcyclohexane |

|

9.5.1.1.4 Cyclohexane |

|

9.5.1.1.5 Decalin |

|

9.5.1.1.6 Others |

|

9.5.1.2 Process |

|

9.5.1.2.1 Hydrogenation |

|

9.5.1.2.2 Dehydrogenation |

|

9.5.1.3 End-Use Industry |

|

9.5.1.3.1 Energy & Utilities |

|

9.5.1.3.2 Power Generation |

|

9.5.1.3.3 Chemical Industry |

|

9.5.1.3.4 Transportation |

|

9.5.1.3.4 Others |

|

9.7.1.4 Storage Capacity |

|

9.7.1.4.1 High |

|

9.7.1.4.2 Medium & Low |

|

9.5.2 Japan |

|

9.5.2.1 Type |

|

9.5.2.1.1 Dibenzyltoluene |

|

9.5.2.1.2 Perhydro-dibenzyltoluene |

|

9.5.2.1.3 Ethylcyclohexane |

|

9.5.2.1.4 Cyclohexane |

|

9.5.2.1.5 Decalin |

|

9.5.2.1.6 Others |

|

9.5.2.2 Process |

|

9.5.2.2.1 Hydrogenation |

|

9.5.2.2.2 Dehydrogenation |

|

9.5.2.3 End-Use Industry |

|

9.5.2.3.1 Energy & Utilities |

|

9.5.2.3.2 Power Generation |

|

9.5.2.3.3 Chemical Industry |

|

9.5.2.3.4 Transportation |

|

9.5.2.3.4 Others |

|

9.5.2.4 Storage Capacity |

|

9.5.2.4.1 High |

|

9.5.2.4.2 Medium & Low |

|

9.5.3 India |

|

9.5.3.1 Type |

|

9.5.3.1.1 Dibenzyltoluene |

|

9.5.3.1.2 Perhydro-dibenzyltoluene |

|

9.5.3.1.3 Ethylcyclohexane |

|

9.5.3.1.4 Cyclohexane |

|

9.5.3.1.5 Decalin |

|

9.5.3.1.6 Others |

|

9.5.3.2 Process |

|

9.5.3.2.1 Hydrogenation |

|

9.5.3.2.2 Dehydrogenation |

|

9.5.3.3 End-Use Industry |

|

9.5.3.3.1 Energy & Utilities |

|

9.5.3.3.2 Power Generation |

|

9.5.3.3.3 Chemical Industry |

|

9.5.3.3.4 Transportation |

|

9.5.3.3.4 Others |

|

9.5.3.4 Storage Capacity |

|

9.5.3.4.1 High |

|

9.5.3.4.2 Medium & Low |

|

9.5.4 South Korea |

|

9.5.4.1 Type |

|

9.5.4.1.1 Dibenzyltoluene |

|

9.5.4.1.2 Perhydro-dibenzyltoluene |

|

9.5.4.1.3 Ethylcyclohexane |

|

9.5.4.1.4 Cyclohexane |

|

9.5.4.1.5 Decalin |

|

9.5.4.1.6 Others |

|

9.5.4.2 Process |

|

9.5.4.2.1 Hydrogenation |

|

9.5.4.2.2 Dehydrogenation |

|

9.5.4.3 End-Use Industry |

|

9.5.4.3.1 Energy & Utilities |

|

9.5.4.3.2 Power Generation |

|

9.5.4.3.3 Chemical Industry |

|

9.5.4.3.4 Transportation |

|

9.5.4.3.4 Others |

|

9.5.4.4 Storage Capacity |

|

9.5.4.4.1 High |

|

9.5.4.4.2 Medium & Low |

|

10. Latin America Liquid Organic Hydrogen Carrier Market Segmentation (Market Size & Forecast: USD billion, 2024 – 2030) |

|

10.1 Type |

|

10.1.1 Dibenzyltoluene |

|

10.1.2 Perhydro-dibenzyltoluene |

|

10.1.3 Ethylcyclohexane |

|

10.1.4 Cyclohexane |

|

10.1.5 Decalin |

|

10.1.6 Others |

|

10.2 Process |

|

10.2.1 Hydrogenation |

|

10.2.2 Dehydrogenation |

|

10.3 End-Use Industry |

|

10.3.1 Energy & Utilities |

|

10.3.2 Power Generation |

|

10.3.3 Chemical Industry |

|

10.3.4 Transportation |

|

10.3.5 Others |

|

10.4 Storage Capacity |

|

10.4.1 High |

|

10.4.2 Medium & Low |

|

10.5 Country |

|

10.5.1 Brazil |

|

10.5.1.1 Type |

|

10.5.1.1.1 Dibenzyltoluene |

|

10.5.1.1.2 Perhydro-dibenzyltoluene |

|

10.5.1.1.3 Ethylcyclohexane |

|

10.5.1.1.4 Cyclohexane |

|

10.5.1.1.5 Decalin |

|

10.5.1.1.6 Others |

|

10.5.1.2 Process |

|

10.5.1.2.1 Hydrogenation |

|

10.5.1.2.2 Dehydrogenation |

|

10.5.1.3 End-Use Industry |

|

10.5.1.3.1 Energy & Utilities |

|

10.5.1.3.2 Power Generation |

|

10.5.1.3.3 Chemical Industry |

|

10.5.1.3.4 Transportation |

|

10.5.1.3.4 Others |

|

10.5.1.4 Storage Capacity |

|

10.5.1.4.1 High |

|

10.5.1.4.2 Medium & Low |

|

10.5.2 Mexico |

|

10.5.2.1 Type |

|

10.5.2.1.1 Dibenzyltoluene |

|

10.5.2.1.2 Perhydro-dibenzyltoluene |

|

10.5.2.1.3 Ethylcyclohexane |

|

10.5.2.1.4 Cyclohexane |

|

10.5.2.1.5 Decalin |

|

10.5.2.1.6 Others |

|

10.5.2.2 Process |

|

10.5.2.2.1 Hydrogenation |

|

10.5.2.2.2 Dehydrogenation |

|

10.5.2.3 End-Use Industry |

|

10.5.2.3.1 Energy & Utilities |

|

10.5.2.3.2 Power Generation |

|

10.5.2.3.3 Chemical Industry |

|

10.5.2.3.4 Transportation |

|

10.7.2.3.4 Others |

|

10.7.2.4 Storage Capacity |

|

10.7.2.4.1 High |

|

10.7.2.4.2 Medium & Low |

|

10.5.3 Argentina |

|

10.5.3.1 Type |

|

10.5.3.1.1 Dibenzyltoluene |

|

10.5.3.1.2 Perhydro-dibenzyltoluene |

|

10.5.3.1.3 Ethylcyclohexane |

|

10.5.3.1.4 Cyclohexane |

|

10.5.3.1.5 Decalin |

|

10.5.3.1.6 Others |

|

10.5.3.2 Process |

|

10.5.3.2.1 Hydrogenation |

|

10.5.3.2.2 Dehydrogenation |

|

10.5.3.3 End-Use Industry |

|

10.5.3.3.1 Energy & Utilities |

|

10.5.3.3.2 Power Generation |

|

10.7.3.3.3 Chemical Industry |

|

10.7.3.3.4 Transportation |

|

10.7.3.3.4 Others |

|

10.5.3.4 Storage Capacity |

|

10.5.3.4.1 High |

|

10.5.3.4.2 Medium & Low |

|

11. Middle East & Africa Liquid Organic Hydrogen Carrier Market Segmentation (Market Size & Forecast: USD billion, 2024 – 2030) |

|

11.1 Type |

|

11.1.1 Dibenzyltoluene |

|

11.1.2 Perhydro-dibenzyltoluene |

|

11.1.3 Ethylcyclohexane |

|

11.1.4 Cyclohexane |

|

11.1.5 Decalin |

|

11.1.6 Others |

|

11.2 Process |

|

11.2.1 Hydrogenation |

|

11.2.2 Dehydrogenation |

|

11.3 End-Use Industry |

|

11.3.1 Energy & Utilities |

|

11.3.2 Power Generation |

|

11.3.3 Chemical Industry |

|

11.3.4 Transportation |

|

11.3.5 Others |

|

11.4 Storage Capacity |

|

11.4.1 High |

|

11.4.2 Medium & Low |

|

11.5 Country |

|

11.5.1 Saudi Arabia |

|

11.5.1.1 Type |

|

11.5.1.1.1 Dibenzyltoluene |

|

11.5.1.1.2 Perhydro-dibenzyltoluene |

|

11.5.1.1.3 Ethylcyclohexane |

|

11.5.1.1.4 Cyclohexane |

|

11.5.1.1.5 Decalin |

|

11.5.1.1.6 Others |

|

11.5.1.2 Process |

|

11.5.1.2.1 Hydrogenation |

|

11.5.1.2.2 Dehydrogenation |

|

11.5.1.3 End-Use Industry |

|

11.5.1.3.1 Energy & Utilities |

|

11.5.1.3.2 Power Generation |

|

11.5.1.3.3 Chemical Industry |

|

11.5.1.3.4 Transportation |

|

11.5.1.3.4 Others |

|

11.5.1.4 Storage Capacity |

|

11.5.1.4.1 High |

|

11.5.1.4.2 Medium & Low |

|

11.5.2 South Africa |

|

11.5.2.1 Type |

|

11.5.2.1.1 Dibenzyltoluene |

|

11.5.2.1.2 Perhydro-dibenzyltoluene |

|

11.5.2.1.3 Ethylcyclohexane |

|

11.5.2.1.4 Cyclohexane |

|

11.5.2.1.5 Decalin |

|

11.5.2.1.6 Others |

|

11.5.2.2 Process |

|

11.5.2.2.1 Hydrogenation |

|

11.5.2.2.2 Dehydrogenation |

|

11.5.2.3 End-Use Industry |

|

11.5.2.3.1 Energy & Utilities |

|

11.5.2.3.2 Power Generation |

|

11.5.2.3.3 Chemical Industry |

|

11.5.2.3.4 Transportation |

|

11.5.2.3.4 Others |

|

11.5.2.4 Storage Capacity |

|

11.5.2.4.1 High |

|

11.5.2.4.2 Medium & Low |

|

11.5.3 United Arab Emirates |

|

11.5.3.1 Type |

|

11.5.3.1.1 Dibenzyltoluene |

|

11.5.3.1.2 Perhydro-dibenzyltoluene |

|

11.5.3.1.3 Ethylcyclohexane |

|

11.5.3.1.4 Cyclohexane |

|

11.5.3.1.5 Decalin |

|

11.5.3.1.6 Others |

|

11.5.3.2 Process |

|

11.5.3.2.1 Hydrogenation |

|

11.5.3.2.2 Dehydrogenation |

|

11.5.3.3 End-Use Industry |

|

11.5.3.3.1 Energy & Utilities |

|

11.5.3.3.2 Power Generation |

|

11.5.3.3.3 Chemical Industry |

|

11.5.3.3.4 Transportation |

|

11.5.3.3.4 Others |

|

11.5.3.4 Storage Capacity |

|

11.5.3.4.1 High |

|

11.5.3.4.2 Medium & Low |

|

12. Competitive Landscape |

|

12.1 Company Market Share Analysis |

|

12.2 Competitive Matrix |

|

12.2 Product Benchmarking |

|

13. Company Profiles (Manufacturers of Liquid Organic Hydrogen Carrier) |

|

13.1. Hydrogenous LOHC Technologies |

|

13.1.1 Company Synopsis |

|

13.1.2 Company Financials |

|

13.1.3 Product/ Service Portfolio |

|

13.1.4 Recent Developments |

|

13.2 CRI Catalyst Company |

|

13.3 Clariant |

|

13.4 The Linde Group (Now Linde plc) |

|

13.5 Fraunhofer Institute for Solar Energy Systems ISE |

|

13.6 HTEC (Hydrogen Technology & Energy Corporation) |

|

13.7 Huntsman Corporation |

|

13.8 Nippon Shokub |

|

13.9 Hynertech |

|

13.10 Chiyoda Corporation |

|

13.11 Covalion |

|

13.12 Wuhuan Engineering |

|

14. Company Profiles (Demand Side) |

|

14.1 Toyota Motor Corporation |

|

14.1.1 Company Synopsis |

|

14.1.2 Company Financials |

|

14.1.3 Product/ Service Portfolio |

|

14.1.4 Recent Developments |

|

14.2 Verizon |

|

14.3 UPS |

|

14.4 FedEx |

|

14.5 Schneider Electric |

|

15. Analyst Recommendations |

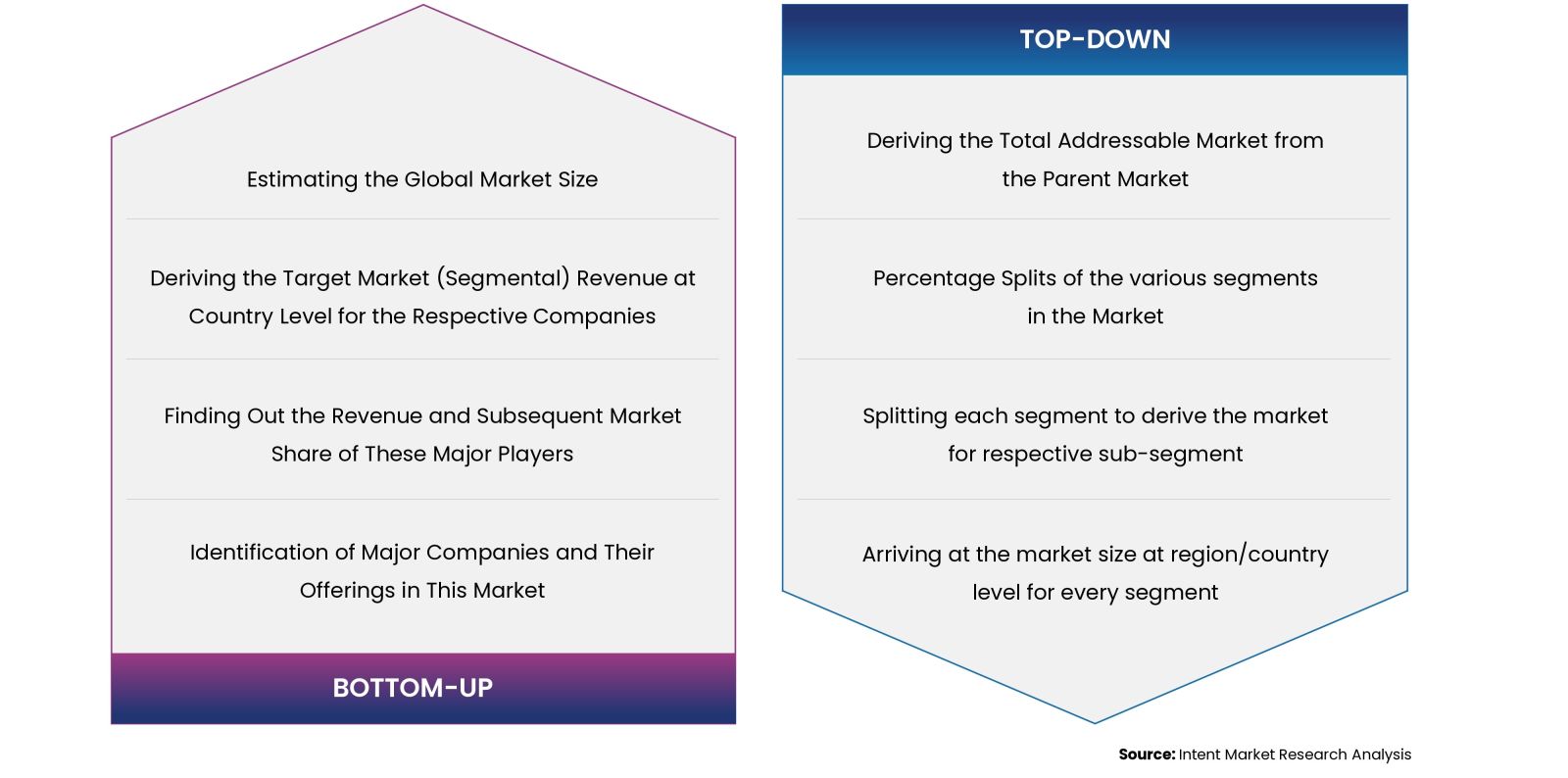

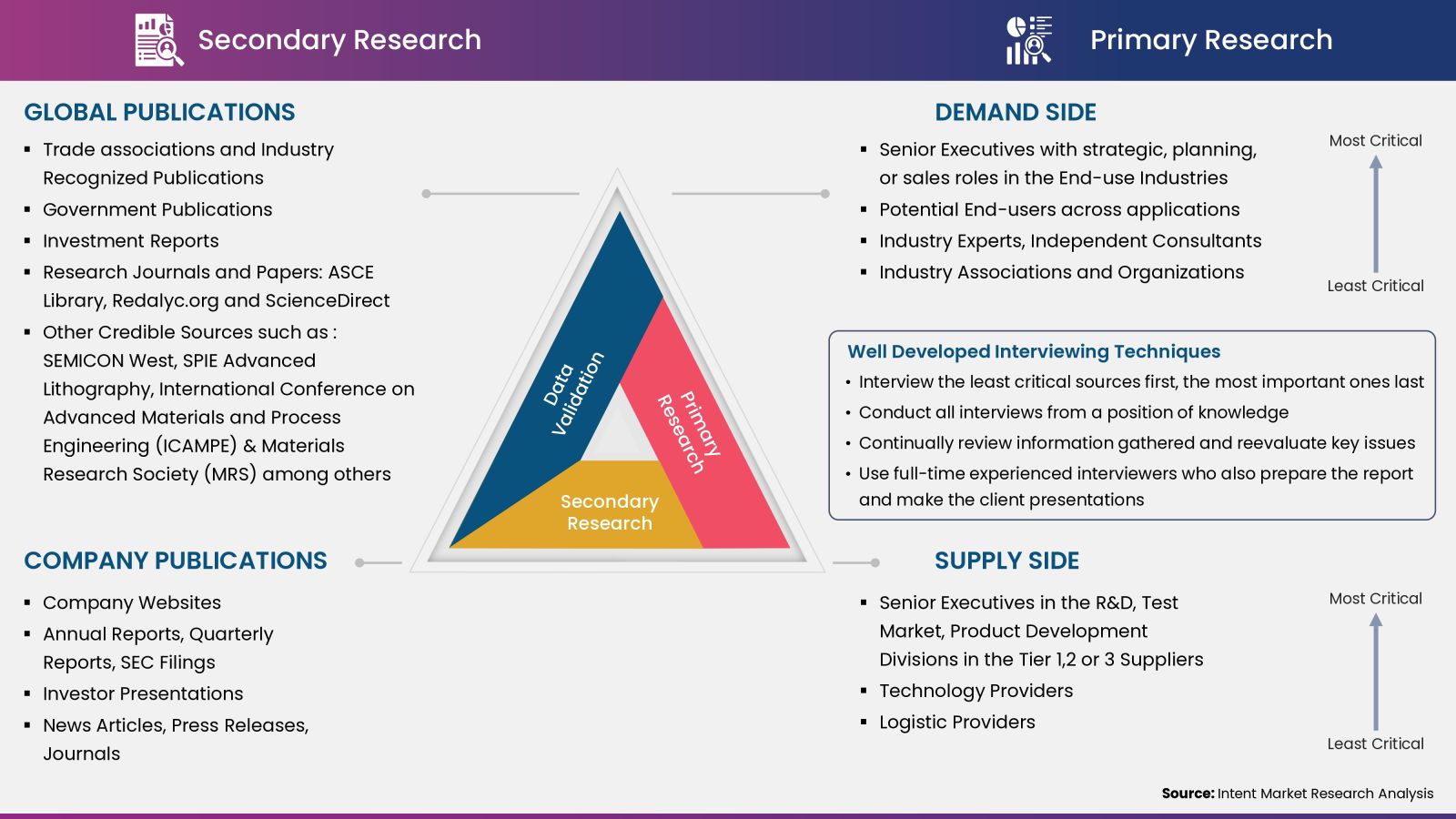

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation process to verify all the market numbers, and assumptions and validate the findings by engaging with subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.