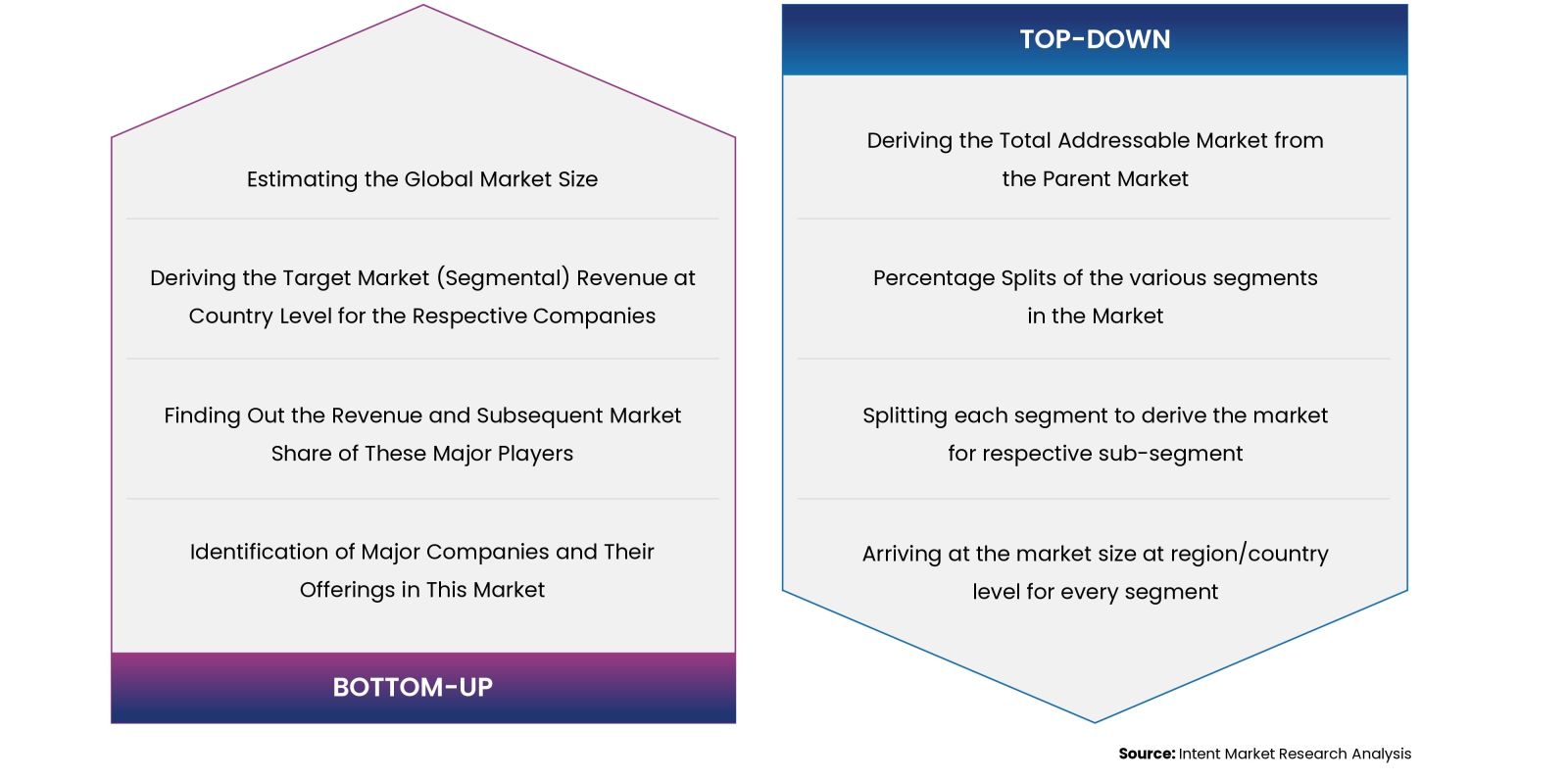

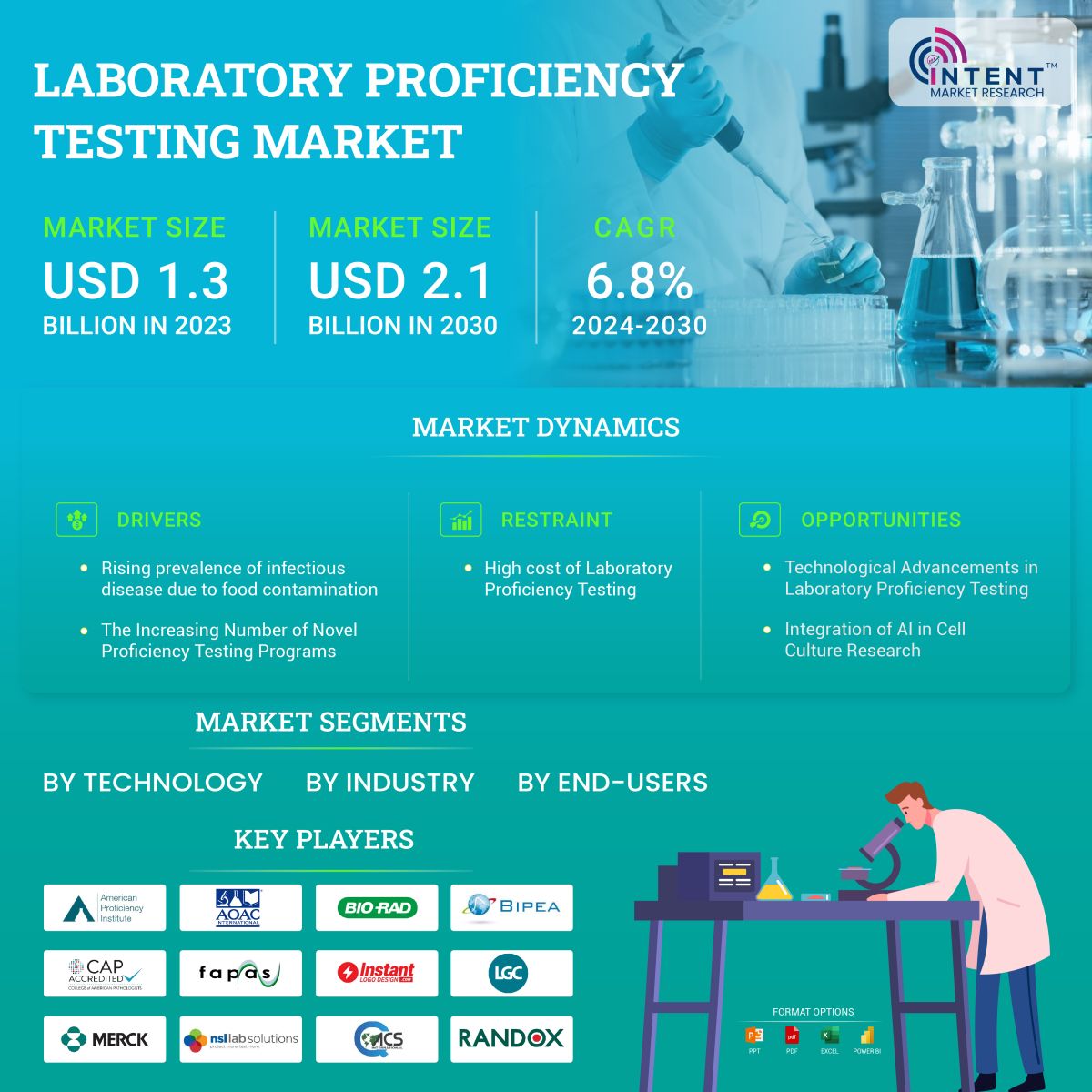

The Laboratory Proficiency Testing Market is expected to grow from USD 1.3 billion in 2023-e to USD 2.1 billion by 2030, at a CAGR of 6.8% during the forecast period. The laboratory proficiency testing is a competitive market, the prominent players in the global market include American Proficiency Institute, AOAC International, Bio-Rad, BIPEA, College of American Pathologists, Fapas, INSTAND, LGC, Merck, NSI Lab Solutions, QACS, Randox, Trilogy, Waters, and Weqas. The increasing number of novel proficiency testing programs is driving the laboratory proficiency testing market growth.

Click here to: Get FREE Sample Pages of this Report

The laboratory proficiency testing market is expected to grow significantly over the forecast period due to stringent regulatory frameworks and guidelines to maintain the quality of products. Proficiency testing assesses how well individual laboratories perform specific tests or measurements and serves as a tool to monitor their ongoing performance. The demand for laboratory proficiency testing continues to grow for quality assurance of products to enhance patient safety thereby driving ongoing research & development in this space.

Laboratory Proficiency Testing Market Dynamics

Rising Prevalence of Infectious Diseases Due to Food Contamination Will Drive the Market

The laboratory proficiency testing market is primarily driven by the rising number of foodborne diseases. Laboratory proficiency testing is widely used in the identification, prevention, and control of foodborne illness through quality assurance testing of food products, detection of pathogens and contaminants, and compliance with safety requirements for food products. For instance, according to WHO, unhealthy food is responsible for 420,000 deaths and 600 million cases of foodborne illness globally each year. Consuming unsafe food results in the loss of 33 million years of healthy life annually worldwide and Children under the age of five account for 30% of foodborne deaths.

High Capital Costs Associated with Laboratory Testing May Hinder Market Growth

Laboratories, particularly those with limited budgets and of smaller to medium sizes, face considerable expenses associated with regularly conducting proficiency testing in a range of assays and analyses. This includes costs related to sample and kit purchases, instrument acquisition and maintenance, specialized staff training and recruitment, implementing corrective actions, and maintaining comprehensive records. These high capital investments pose a potential hindrance to the market growth.

Laboratory Proficiency Testing Market Segment Insights

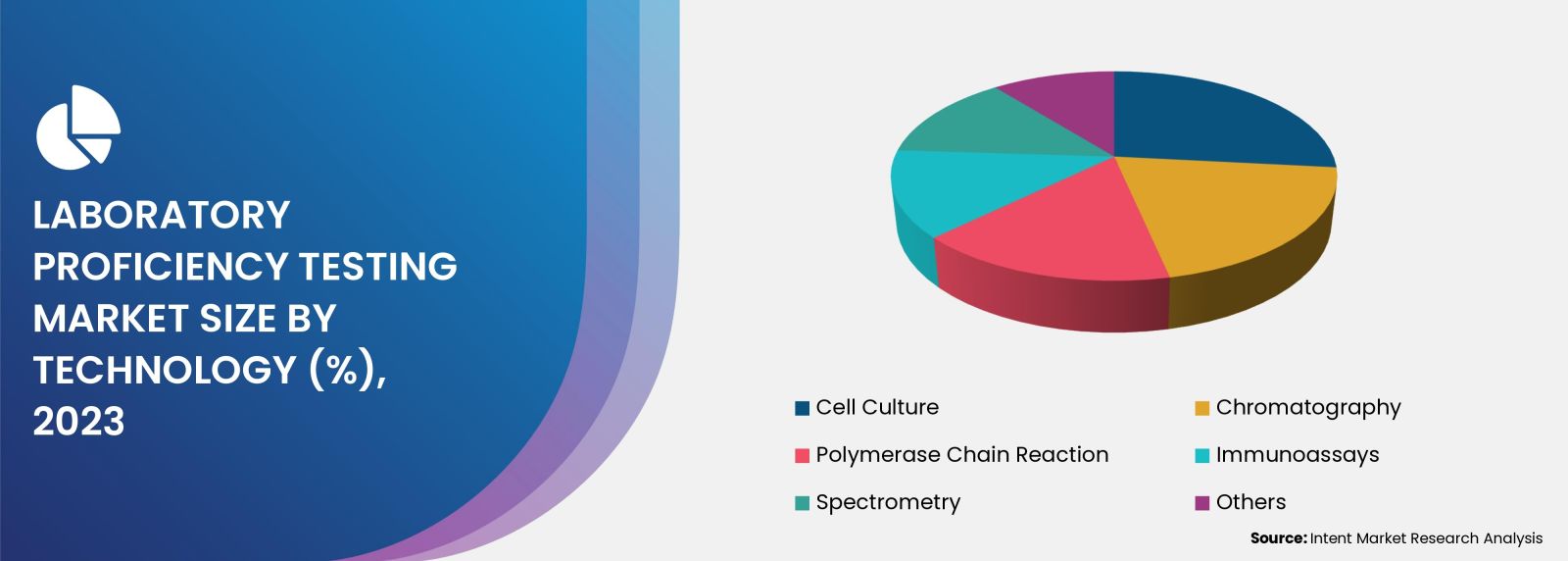

The Cell Culture Segment Held the Predominant Market Share

Cell cultures are widely used in the identification of infectious microorganisms, clinical diagnostics, and pharmaceutical testing of biological. The increasing adoption of cell-based assays in research and diagnostic laboratories has led to a significant rise in their usage. As a consequence, prominent market players are actively engaged in advancing cell culture technologies to meet the growing demand for improved research and testing methodologies. For instance, in May 2023, Lonza launched a cell culture medium known as TheraPEAK. It is a unique chemically specified medium created to maximize the production of CAR T cells. The medium, which is free of ingredients derived from animals, enhances consistency and process control while streamlining regulatory approval for a quicker time to market.

Clinical Diagnostics Segment is Expected to hold Major Market Share

The clinical diagnostics segment is expected to hold major market share owing to the advantages it offers such as the high rate of early diagnosis due to the development of complicated diagnostic techniques, which makes proficiency testing and quality control a crucial component of clinical diagnostics.

Moreover, clinical diagnostics' efficiency, repeatability, and accuracy can be enhanced by proficiency testing. The high rate of proficiency testing adoption to lower mistakes and preserve accurate results and clinical diagnostic test quality is a major factor contributing to the growth of this segment. For instance, in November 2022, BIPEA launched a new laboratory proficiency testing PTS-111 which allows laboratories to detect the presence of 2 types of Staphylococcal enterotoxins type including pyrogenic and emetic toxins in food.

Hospitals Segment Held the Dominant Share in the Laboratory Proficiency Testing Market

The hospitals segment is the dominant sector, driven by the growing demand for regular competence evaluation and to deliver accurate results in hospitals. The increasing number of tests offered necessitates proficiency testing to ensure the accuracy of diagnostic testing and maintain compliance with regulatory standards, thus monitoring lab standards. For instance, in 2020, the American Proficiency Institute (API) developed one of the earliest proficiency testing programs for SARS-CoV-2, the virus that is causing the coronavirus infectious disease pandemic (COVID-19. With the help of this proficiency testing program, laboratories will have an impartial way to evaluate how well they performed in the COVID-19 test.

North America is Poised for Significant Market Growth in the Forecast Period

North America held the largest market share in the laboratory proficiency testing market. The regional growth can be attributed to the presence of well-established diagnostics and pharmaceutical companies, a strict regulatory environment surrounding laboratory certification, and the increasing use of laboratory competency evaluation.

Major players in this region are working towards the development of feasible solutions to improve outcomes and quality of laboratory testing solutions. For instance, in July 2021, Microbiome Insights, a comprehensive bioinformatics analysis and end-to-end Microbiome sequencing company, declared that it has been accredited by the College of American Pathologists (CAP). By receiving CAP accreditation, the business shows that it is dedicated to operating to the highest standards of clinical laboratory testing, record-keeping, reporting, safety, and quality. It also joins an exclusive community of clinical laboratories worldwide.

Major Industry Players are Enhancing their Positions by Actively Developing Proficiency Testing Programs

The market is characterized by intense competition due to the presence of numerous international and domestic players. The laboratory proficiency testing market, in particular, is dominated by key players such as American Proficiency Institute, AOAC International, Bio-Rad, BIPEA, College of American Pathologists, Fapas, INSTAND, LGC, Merck, NSI Lab Solutions, QACS, Randox, Trilogy, Waters, and Weqas amongst others. These industry leaders primarily focused on acquiring smaller players and innovating their product lines to cater to changing consumer preferences and needs. The success of market players is heavily dependent on their ability to adapt to changing market trends and consumer preferences.

- In May 2022, AOAC International is scientific association announced its strategic partnership with Signature Science, LLC to develop and launch the Cannabis/Hemp Proficiency Testing (PT) Program. Through this collaboration, both companies ensure the safety and integrity of cannabis- and hemp-based goods and help labs compete in the global economy by proving that they adhere to the strictest international standards for accuracy, reliability, and compliance.

- In August 2022, Controllab launched laboratory proficiency testing for Monkey pox virus and helps the diagnostic sector. It is imperative to promptly identify any suspected cases to stop the disease from spreading. Precise lab results support timely patient isolation and effective diagnosis because laboratory procedures are essential to the primary processes of public health event detection, assessment, response, notification, and monitoring, they require ongoing monitoring as well as periodic evaluation.

Click here to: Get your custom research report today

Laboratory Proficiency Testing Market Coverage

The report provides key insights into the laboratory proficiency testing market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The report delves into market drivers, restraints, and opportunities, and analyzes key players as well as the competitive landscape within the market. The report offers the market size and forecasts for the laboratory proficiency testing market in value (USD billion) for all the above segments.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 1.3 billion |

|

Forecast Revenue (2030) |

USD 2.1 billion |

|

CAGR (2024-2030) |

6.8% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

By Technology (Polymerase Chain Reaction, Immunoassays, Chromatography, Spectrometry, Cell Culture, Others), By Industry (Clinical Diagnostics, Pharmaceuticals, Microbiology, Food and Beverages, Nutraceuticals, Cosmetics, Cannabis, Others), By End-users (Hospitals, Contract Research Organizations, Pharmaceutical and Biotechnology Companies, Academic Research Institutes, Diagnostic Laboratories, Specialty Laboratories, Others) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy), Asia-Pacific (China, Japan, South Korea, India), Latin America (Brazil, Mexico, Argentina), Middle East and Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates) |

|

Competitive Landscape |

American Proficiency Institute, AOAC International, Bio-Rad, BIPEA, College of American Pathologists, Fapas, INSTAND, LGC, Merck, NSI Lab Solutions, QACS, Randox, Trilogy, Waters, and Weqas |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1.Study Assumptions and Market Definition |

|

1.2.Scope of the Study |

|

2.Research Methodology |

|

3.Executive Summary |

|

4.Market Dynamics |

|

4.1.Market Growth Drivers |

|

4.1.1.Rising Prevalence of Infectious Disease Due to Food Contamination |

|

4.1.2.Increasing the Number of Novel Proficiency Testing Programs |

|

4.1.3.Technological Advancements in Laboratory Proficiency Testing |

|

4.2.Market Growth Restraints |

|

4.2.1.High Cost Associated with the Laboratory Proficiency Testing |

|

4.3.Market Growth Opportunities |

|

4.3.1.Implementation of AI Solutions in Cell-Culture Research |

|

5.Market Outlook |

|

5.1.Supply Chain Analysis |

|

5.2.Technology Trends |

|

5.3.Patent Analysis |

|

6.Market Segment Outlook |

|

6.1.Segment Synopsis |

|

6.2.By Technology |

|

6.2.1.Polymerase Chain Reaction |

|

6.2.2.Immunoassays |

|

6.2.3.Chromatography |

|

6.2.4.Spectrometry |

|

6.2.5.Cell Culture |

|

6.2.6.Others |

|

6.3.By Industry |

|

6.3.1.Clinical Diagnostics |

|

6.3.2.Pharmaceuticals |

|

6.3.3.Microbiology |

|

6.3.4.Food and Beverages |

|

6.3.5.Nutraceuticals |

|

6.3.6.Cosmetics |

|

6.3.7.Cannabis |

|

6.3.8.Others |

|

6.4.By End-use |

|

6.4.1.Hospitals |

|

6.4.2.Contract Research Organizations |

|

6.4.3.Pharmaceutical and Biotechnology Companies |

|

6.4.4.Academic Research Institutes |

|

6.4.5.Diagnostic Laboratories |

|

6.4.6.Specialty Laboratories |

|

6.4.7.Others |

|

7.Regional Outlook |

|

7.1.Global Market Synopsis |

|

7.2.North America |

|

7.2.1.North America Laboratory Proficiency Testing Market Outlook |

|

7.2.2.US |

|

7.2.2.1.US Laboratory Proficiency Testing Market, By Technology |

|

7.2.2.2.US Laboratory Proficiency Testing Market, By Industry |

|

7.2.2.3.US Laboratory Proficiency Testing Market, By End-users |

|

*Note: Cross-segmentation by segments for each country will be covered as shown above. |

|

7.2.3.Canada |

|

7.2.4.Mexico |

|

7.3.Europe |

|

7.3.1.Europe Laboratory Proficiency Testing Market Outlook |

|

7.3.2.Germany |

|

7.3.3.UK |

|

7.3.4.France |

|

7.3.5.Spain |

|

7.3.6.Italy |

|

7.4.Asia-Pacific |

|

7.4.1.Asia-Pacific Laboratory Proficiency Testing Market Outlook |

|

7.4.2.China |

|

7.4.3.India |

|

7.4.4.Japan |

|

7.4.5.South Korea |

|

7.4.6.Australia |

|

7.5.Latin America |

|

7.5.1.Latin America Laboratory Proficiency Testing Market Outlook |

|

7.5.2.Brazil |

|

7.5.3.Argentina |

|

7.6.Middle East & Africa |

|

7.6.1.Middle East & Africa Laboratory Proficiency Testing Market Outlook |

|

7.6.2.Saudi Arabia |

|

7.6.3.UAE |

|

8.Competitive Landscape |

|

8.1.Market Share Analysis |

|

8.2.Company Strategy Analysis |

|

8.3.Competitive Matrix |

|

9.Company Profiles |

|

9.1. Laboratory Proficiency Testing Companies (Supply-Side) |

|

9.1.1.American Proficiency Institute |

|

9.1.1.1. Company Synopsis |

|

9.1.1.2. Company Financials |

|

9.1.1.3. Product/Service Portfolio |

|

9.1.1.4. Recent Developments |

|

*Note: All the companies in the section 9.1 will cover same sub-chapters as above. |

|

9.1.2.AOAC International |

|

9.1.3.Bio-Rad |

|

9.1.4.BIPEA |

|

9.1.5.College of American Pathologists |

|

9.1.6.Fapas |

|

9.1.7.INSTAND |

|

9.1.8.LGC |

|

9.1.9.Merck |

|

9.1.10. NSI Lab Solutions |

|

9.1.11. QACS |

|

9.1.12. Randox |

|

9.1.13. Trilogy |

|

9.1.14. Waters |

|

9.1.15. Weqas |

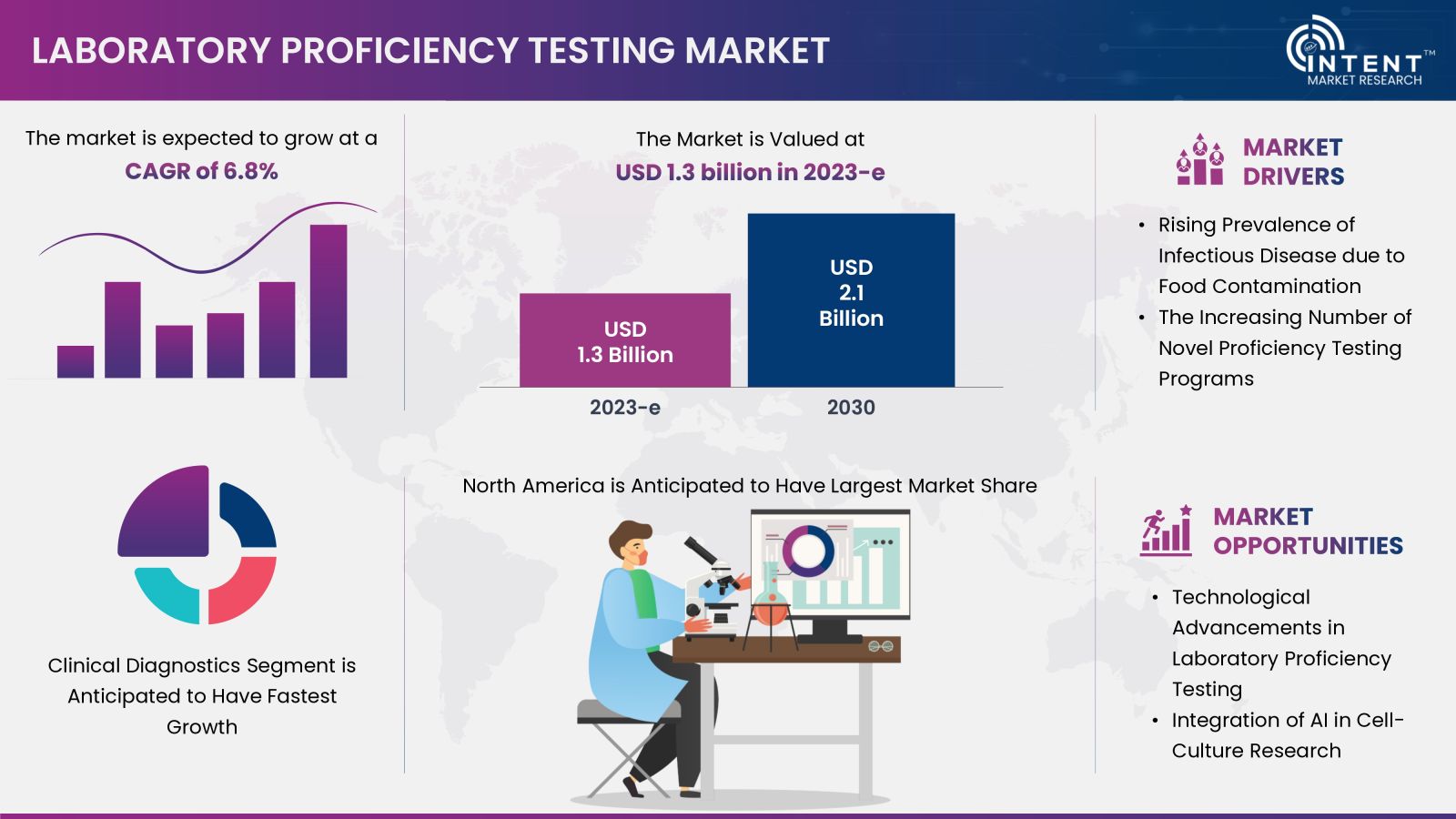

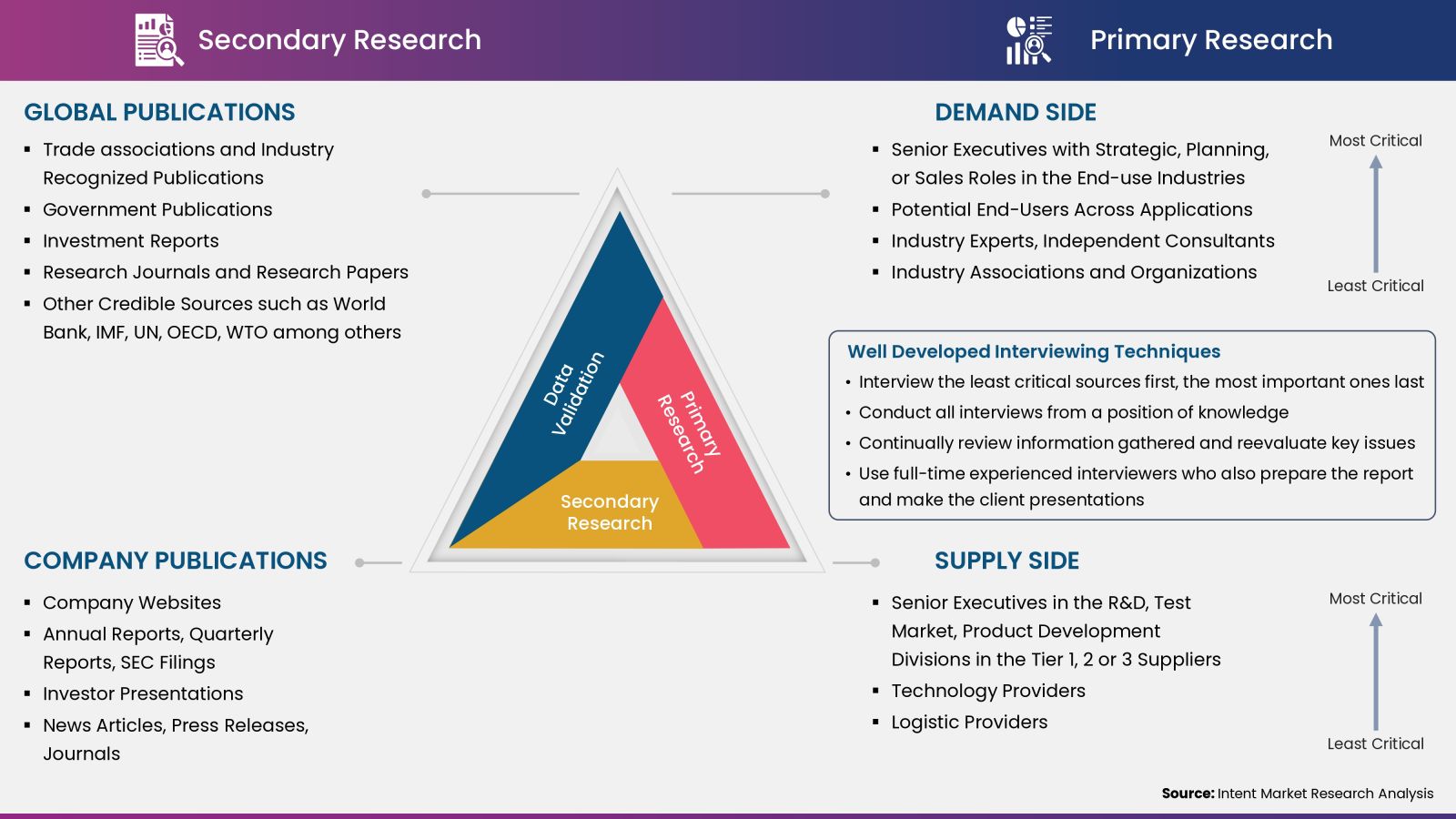

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

.jpg)

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation and verification process to verify all the market numbers and assumptions by engaging with the subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.