According to Intent Market Research, the Wheelchair Accessible Vehicles Market is expected to grow from USD 20.9 billion in 2023-e at a CAGR of 4.1% to touch USD 27.7 billion by 2030. Prominent players include Adaptive Mobility Systems, Assisted Transportation Systems, ATC Innovative Mobility, Automotive Group, BraunAbility, Brotherwood Automobility, Diamond Coach, Rollx Vans, among others. Technological innovation and accessibility enhancement are driving the market growth.

.jpg)

Click here to: Get FREE Sample Pages of this Report

A wheelchair accessible vehicle (WAV) is a car that has been modified and tailored to a wheelchair user's specifications. Vehicles designated as wheelchair accessible is modified in order to safely secure the wheelchair and make operating it easier for the user. As a result, the vehicle's exterior and interior have been modified to give wheelchair users security and comfort. Reshaping the front and back entryways to provide room for a wheelchair is part of the modification.

The primary and secondary control systems are adjusted in several ways to accommodate wheelchair users who need a Drive from Wheelchair (DFW) vehicle. Improvements to the gearbox, brakes, ignition, and steering wheel provide for more comfort and control when driving.

Wheelchair Accessible Vehicles Market Dynamics

Technological Advancements in the Wheelchair Accessible Vehicles to Boost Market Growth

Wheelchair is undergoing a fundamental transformation due to the fast advancement of technology. For wheelchair users, innovations such as smart wheelchairs with sensors, GPS, and networking capabilities are completely changing their mobility. With the help of these sophisticated capabilities, users safely and independently explore complicated areas by identifying barriers and determining the best pathways.

Furthermore, advances in material science and design have led to the creation of robust, lightweight wheelchairs that provide enhanced agility without sacrificing stability. These technological developments, which range from augmented reality navigation systems to robotic exoskeletons, are not only improving accessibility but also encouraging greater independence and participation for people with impairments.

Assistive technology is evolving and wheelchair users' interactions with their environment are being revolutionized, to enhance their quality of life. Continuous research and development in the field offers disabled people more mobility and freedom. Further addressing the unique requirements and preferences of users, innovations in assistive technology are enabling more individualized solutions. More user happiness and total assistive device efficacy are being achieved as a result of this customized approach.

Wheelchair Accessible Vehicles Market Segmental Insights

Rising Demand for Side Entry Wheelchair Accessible Vehicle is Thriving the Market Growth

Side entry WAV’s are more common than the rear entry as majority of the disables prefer side entry. Side entry vehicles offer several advantages for wheelchair users such as variety of seating options due to removable front and passenger seats, allowing for more flexibility in accommodating additional passengers or extra wheelchairs. Additionally, these vehicles are well-suited for both drivers and passengers, as they feature accessible driver and front passenger positions, enabling wheelchair users to drive or occupy the front seat. Another benefit is the unobstructed cargo room, as the ramp or lift does not impede the trunk space, allowing for the storage of other items.

Key market players are involved into the launch of new products to offer mobility solution to the disabled and to their families. For instance, in January 2021, MobilityWorks launched the Accessibility 4 All Side-Entry vehicle with newly engineered Quiet Ride technology. With the Dodge Grand Caravan, Quiet Ride technology reduces interior noise and offers handling and performance that are similar to those of an unconverted minivan.

.jpg)

Technology Advancement for Ramps in Entry Mechanism is Responsible for Market Growth

Wheelchair accessible cars with the side entrance ramps at the side doors are costlier but gives more flexibility for drivers and passengers. Rear entry ramps in the back of cars, such as minivans or SUVs, offer advantages like simple parking and plenty of space for passengers. Manual ramps are more affordable, while automatic ramps are more convenient. While half-cut conversions preserve conventional seats, full-cut conversions optimize wheelchair room but may be more expensive. Ramp sizes vary to accommodate different needs, from compact to bariatric wheelchairs, ensuring safe entry and exit.

Innovative technology is being introduced by market participants to make life easier for the disabled. For instance, in September 2023, Cruise, the autonomous vehicle company backed by General Motors, revealed a wheelchair accessible robotaxi that could start picking up disabled passengers as soon as in 2024. The increasing technology advancement for ramps in entry mechanism is propelling the market's growth.

Wheelchair Users are More into Adapting the Passenger Car to Travel

Passenger wheelchair accessible vehicles are the most common type of WAV that are adapted to allow a wheelchair user to either travel as a passenger in the rear or in the upfront passenger position. For those with mobility disabilities, passenger wheelchair accessible vehicles offer a secure and pleasant mode of transportation.

There are a number of advantages to upgrading an existing car to accommodate wheelchairs. First of all, there's a big financial benefit: changing the present car usually costs between USD 20,000 and USD 40,000, which is a lot cheaper than buying a brand-new, handicap-accessible car, which may cost between USD 70,000 and USD 90,000. Furthermore, consumers may keep the comfort and features they originally selected by converting the current car, which removes the need to choose between accessibility and desire. Moreover, there are many choices for customization available when converting a car, providing the chance to make it unique and catered to the requirements and tastes of the buyer.

High Demand of Personal Use WAV’s is Contributing to the Market Growth

The personal use of wheelchair accessible vehicles is more, as they don't have to depend on other commercially available WAVs. These vehicles are more convenient and offers greater independence to disabled’s. Having their own wheelchair accessible vehicle allows them to have more control over their transportation schedule, flexibility in their daily activities, higher quality of life and increased opportunities for social participation.

Additionally, they can customize the vehicle to meet their specific needs and preferences. These modifications include the installation of ramps or wheelchair lifts, adjustments to the vehicle's floor height to accommodate the user's needs and the implementation of wheelchair restraint systems for secure transportation. In addition to these, the adaptation of seating arrangements allows maneuvering space, and, optionally, the incorporation of specialized controls for drivers with disabilities.

These modifications collectively aim to enhance accessibility, comfort, and safety, empowering wheelchair users with greater independence and mobility in their daily lives. Therefore, the customization of their vehicles gives more advantage to the wheelchair user and will contribute the market growth over the forecast period.

Regional Insights

Favorable Government Accessibility Regulations and Standards in North America are Driving Market Growth

The regulations mandate accessibility requirements across various sectors, including transportation, housing, healthcare, and public accommodations. By setting minimum standards for accessibility, these laws ensure that businesses, organizations, and government entities take proactive measures to remove barriers and provide equal access to individuals with disabilities.

The enforcement of accessibility regulations creates a legal framework that incentivizes businesses and industries to invest in wheelchair accessible infrastructure, products, and services. This has led to the expansion of the wheelchair accessible market as companies strive to comply with regulations and cater to the needs of individuals with disabilities. Such implementation of these laws by regulatory authorities are expected to propel the North American wheelchair accessible vehicles market.

Competitive Landscape

Collaboration is the Key Strategy for the Product Development

Key market players are collaborating to bring innovative technology and solution to launch their product as well as services regionally and globally. For instance, in April 2022, May Mobility and BraunAbility entered into a collaboration to modify the May Mobility Toyota Sienna Autono-MaaS (S-AM) fleet to include ADA-compliant vehicles. The partnership with BraunAbility will produce an ADA-compliant, rear-entry conversion of May Mobility’s S-AM vehicles. The vehicles have the capacity to accommodate four ambulatory riders, or two non-wheelchair users and one wheelchair user.

Click here to: Get your custom research report today

Wheelchair Accessible Vehicles Market Coverage

The report provides key insights into the wheelchair accessible vehicles market, and it focuses on technological developments, trends, and initiatives taken by the government. In this sector analysis explores market drivers, restraints, opportunities, and other relevant factors. It also examines key players and the competitive landscape within the market for wheelchair accessible vehicles.

.jpg)

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 20.9 billion |

|

Forecasted Market Size (2030) |

USD 27.7 billion |

|

CAGR (2024-2030) |

4.1% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

By Entry Type (Side Entry, Rear Entry), By Entry Mechanism (Ramp, Lift), By Vehicle Type (Passenger Car, Commercial Vehicle), By Application Type (Personal Use, Public Transport, Medical Assistance, and Others), By Propulsion Type (ICE Vehicle, Hybrid Vehicle, and Electric Vehicle), By Purchase Type (New Vehicle, Converted Vehicle) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Italy), Asia-Pacific (China, Japan, South Korea, India), Latin America (Brazil, Mexico, Argentina), Middle East and Africa (Saudi Arabia, South Africa, United Arab Emirates) |

|

Competitive Landscape |

Adaptive Mobility Systems, Assisted Transportation Systems, ATC Innovative Mobility, Automotive Group, BraunAbility, Brotherwood Automobility, Diamond Coach, Rollx Vans, among others. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

|

|

1. 1.Key Research Objectives |

|

|

|

1.2.Market Definition |

|

|

|

1.3.Report Scope |

|

|

|

1.4.Currency & Conversion |

|

|

|

2.Research Methodology |

|

|

|

2.1.Research Design |

|

|

|

2.2.Market Size Estimation & Data Triangulation |

|

|

|

2.3.Key Sources |

|

|

|

2.4.Research Assumptions & Limitations |

|

|

|

3.Executive Summary |

|

|

|

4.Market Insights |

|

|

|

4.1.Market Growth Drivers |

|

|

|

4.1.1.Rise In Technology Advancement For Wheelchair Accessible Vehicles |

|

|

|

4.1.2.Government Funding To Increase Wheelchair Accessible Vehicle Services |

|

|

|

4.1.3.Rising Accessibility Advocacy & Collaboration |

|

|

|

4.2.Market Growth Restraint |

|

|

|

4.2.1.High Cost of Investment |

|

|

|

4.3.Market Growth Opportunity |

|

|

|

4.3.1.Personalized Mobility Experience |

|

|

|

4.3.Market Growth Challenge |

|

|

|

4.3.1.Technical & Design Challenges in Retrofitting EVs for Wheelchair Accessibility |

|

|

|

5. Wheelchair Accessible Vehicles Market Outlook |

|

|

|

5.1. Regulatory Analysis |

|

|

|

5.1.1.US |

|

|

|

5.1.2.Canada |

|

|

|

5.1.3.Germany |

|

|

|

5.1.4.Japan |

|

|

|

5.2.Supply Chain Analysis |

|

|

|

5.3. PORTER’s Five Forces Analysis |

|

|

|

5.3.1.Threat of New Entrants |

|

|

|

5.3.2.Bargaining Power of Suppliers |

|

|

|

5.3.3.Bargaining Power of Buyers |

|

|

|

5.3.4.Threat of Substitute Products |

|

|

|

5.3.5.Intensity of Competitive Rivalry |

|

|

|

6.Global Wheelchair Accessible Vehicles Market, by Entry Type (Market Size & Forecast: USD Million, 2024 – 2030) |

|

|

|

6.1.Introduction |

|

|

|

6.2.Side Entry |

|

|

|

6.3.Rear Entry |

|

|

|

7.Global Wheelchair Accessible Vehicles Market, by Entry Mechanism (Market Size & Forecast: USD Million, 2024 – 2030) |

|

|

|

7.1.Introduction |

|

|

|

7.2.Ramp |

|

|

|

7.3.Lift |

|

|

|

8.Global Wheelchair Accessible Vehicles Market, by Vehicle Type (Market Size & Forecast: USD Million, 2024 – 2030) |

|

|

|

8.1.Introduction |

|

|

|

8.2.Passenger Car |

|

|

|

8.3.Commercial Vehicle |

|

|

|

9.Global Wheelchair Accessible Vehicles Market, by Application (Market Size & Forecast: USD Million, 2024 – 2030) |

|

|

|

9.1.Introduction |

|

|

|

9.2.Personal Use |

|

|

|

9.3.Public Transport |

|

|

|

9.4.Medical Assistance |

|

|

|

9.5.Other Application |

|

|

|

10.Global Wheelchair Accessible Vehicles Market, by Propulsion Type (Market Size & Forecast: USD Million, 2024 – 2030) |

|

|

|

10.1.Introduction |

|

|

|

10.2.Internal Combustion Engine (ICE) Vehicle |

|

|

|

10.3.Hybrid Vehicle |

|

|

|

10.4.Electric Vehicle |

|

|

|

11.Global Wheelchair Accessible Vehicles Market, by Purchase Type (Market Size & Forecast: USD Million, 2024 – 2030) |

|

|

|

11.1.Introduction |

|

|

|

11.2.New Vehicle |

|

|

|

11.3.Converted Vehicle |

|

|

|

12.Global Wheelchair Accessible Vehicles Market, by Region (Market Size & Forecast: USD Million, 2024 – 2030) |

|

|

|

12.1.Introduction |

|

|

|

12.2.North America |

|

|

|

12.2.1.Growth Drivers |

|

|

|

12.2.1.1.The Increasing Implementation of Accessibility Regulations and Standards is Driving the Market Growth |

|

|

|

12.2.2.Growth Barriers |

|

|

|

12.2.2.1. Lack of Uniform Accessibility Regulations and Standards Across Different Jurisdictions May Hinder the Growth of the Market |

|

|

|

12.2.3.Opportunities |

|

|

|

12.2.3.1.Advancement In Technology is Expected to Offer High Growth Opportunities |

|

|

|

12.2.4.North America Wheelchair Accessible Vehicles Market, by Entry Type |

|

|

|

12.2.5.North America Wheelchair Accessible Vehicles Market, by Entry Mechanism |

|

|

|

12.2.6.North America Wheelchair Accessible Vehicles Market, by Vehicle Type |

|

|

|

12.2.7.North America Wheelchair Accessible Vehicles Market, by Application |

|

|

|

12.2.8.North America Wheelchair Accessible Vehicles Market, by Propulsion Type |

|

|

|

12.2.9.North America Wheelchair Accessible Vehicles Market, by Purchase Type |

|

|

|

*Similar segmentation will be provided at each regional level |

|

|

|

12.2.10.North America Wheelchair Accessible Vehicles Market, by Country |

|

|

|

12.2.1.US |

|

|

|

|

12.2.1.1.US Wheelchair Accessible Vehicles Market, by Entry Type |

|

|

|

12.2.1.2.US Wheelchair Accessible Vehicles Market, by Entry Mechanism |

|

|

|

12.2.1.3.US Wheelchair Accessible Vehicles Market, by Vehicle Type |

|

|

|

12.2.1.4.US Wheelchair Accessible Vehicles Market, by Application |

|

|

|

12.2.1.5.US Wheelchair Accessible Vehicles Market, by Propulsion Type |

|

|

|

12.2.1.6.US Wheelchair Accessible Vehicles Market, by Purchase Type |

|

|

12.2.2.Canada |

|

|

|

*Similar segmentation will be provided at each country level |

|

|

|

12.3.Europe |

|

|

|

12.3.1.United Kingdom |

|

|

|

12.3.2.Germany |

|

|

|

12.3.3.France |

|

|

|

12.3.4.Italy |

|

|

|

12.3.5.Rest of Europe |

|

|

|

12.4.APAC |

|

|

|

12.4.1.China |

|

|

|

12.4.2.India |

|

|

|

12.4.3.South Korea |

|

|

|

12.4.4.Rest of Asia Pacific |

|

|

|

12.5.Latin America |

|

|

|

12.5.1.Brazil |

|

|

|

12.5.2.Mexico |

|

|

|

12.5.3.Argentina |

|

|

|

12.5.4.Rest of Latin America |

|

|

|

12.6.Middle East & Africa |

|

|

|

12.6.1.United Arab Emirates |

|

|

|

12.6.2.Saudi Arabia |

|

|

|

12.6.3.South Africa |

|

|

|

12.6.4.Rest of Middle East & Africa |

|

|

|

13.Competitive Landscape |

|

|

|

13.1.Introduction |

|

|

|

13.2.Ranking of Market Players |

|

|

|

13.3.Wheelchair Accessible Vehicle Market: Competitive Matrix of Market Players |

|

|

|

13.4.Wheelchair Accessible Vehicle Market Players & Product Depth |

|

|

|

13.5.Wheelchair Accessible Vehicle Market Players & Their Business Excellence |

|

|

|

14.Company Profiles |

|

|

|

14.1.Key Market Companies |

|

|

|

14.1.1.Adaptive Mobility Systems |

|

|

|

14.1.1.1.Business Overview |

|

|

|

14.1.1.2.Product Portfolio |

|

|

|

14.1.1.3.Recent Developments |

|

|

|

14.1.1.4.SWOT Analysis |

|

|

|

14.1.1.5.Consultant’s View |

|

|

|

*Similar information will be provided for other companies |

|

|

|

14.1.2.Assisted Transportation Systems, Inc. |

|

|

|

14.1.3.ATC Innovative Mobility |

|

|

|

14.1.4.Automotive Group |

|

|

|

14.1.5.BraunAbility |

|

|

|

14.1.6.Brotherwood Automobility Limited |

|

|

|

14.1.7.Diamond Coach |

|

|

|

14.1.8.FR Conversions |

|

|

|

14.1.9.Freedom Motors USA |

|

|

|

14.1.10.PARAVAN GmbH |

|

|

|

14.1.11.Rollx Vans |

|

|

|

14.1.14.Ryno Mobility |

|

|

|

14.1.13.Triple S Mobility |

|

|

|

14.1.14.Vantage Mobility International |

|

|

|

14.1.15.Creative Carriage Ltd. |

|

|

|

15.Appendix |

|

|

|

15.1.Discussion Guidelines |

|

|

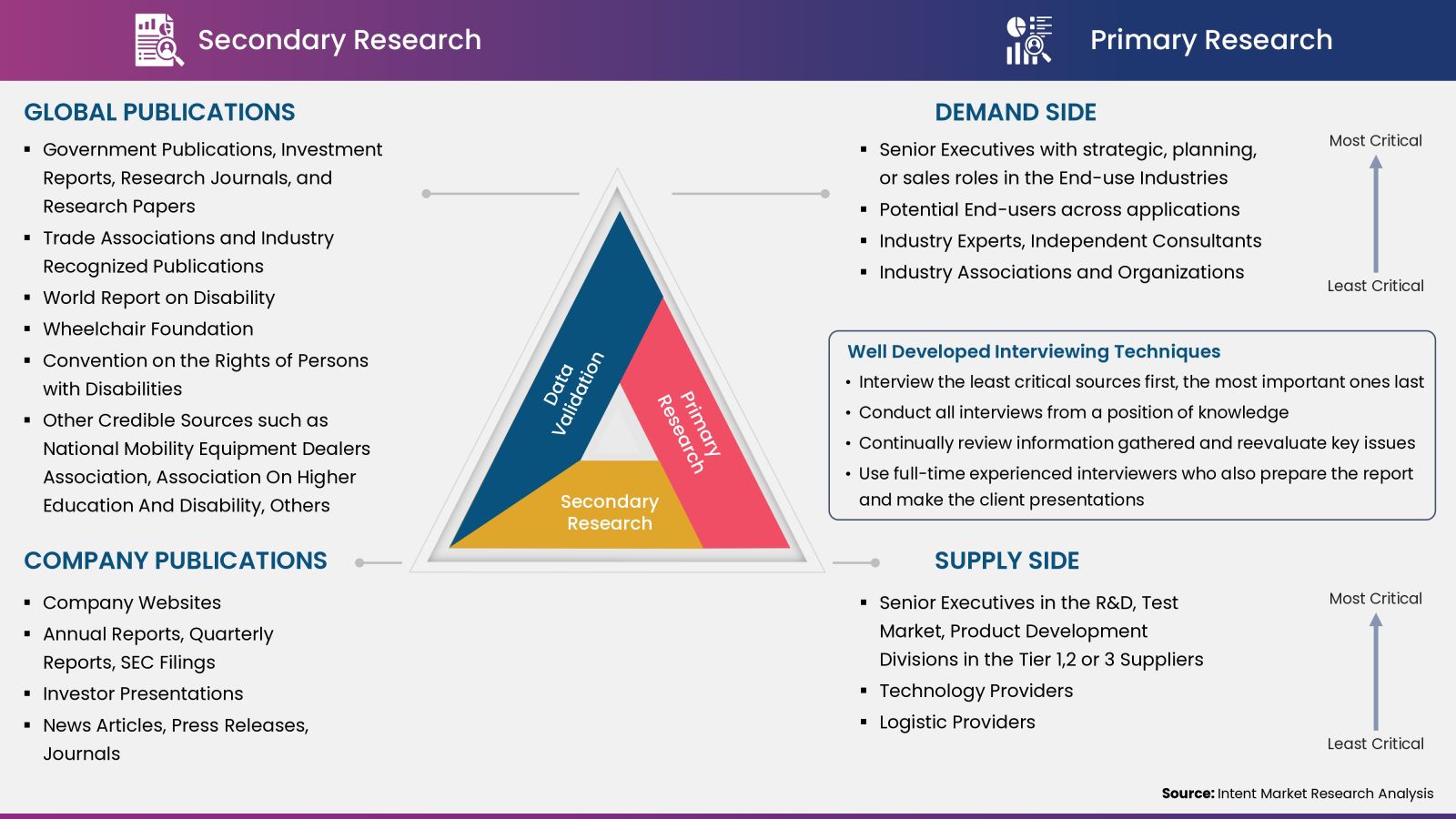

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation process to verify all the market numbers, and assumptions and validate the findings by engaging with subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.

.jpg)