As per Intent Market Research, the IV Infusion Products Market was valued at USD 10.8 billion in 2024-e and will surpass USD 14.2 billion by 2030; growing at a CAGR of 3.9% during 2025 - 2030.

The IV infusion products market is an essential component of the broader healthcare industry, providing critical solutions for the administration of fluids, medications, and nutrients to patients. IV infusion products are widely used in various therapeutic applications, including pain management, chemotherapy infusions, fluid and electrolyte replacement, and parenteral nutrition. The market has seen substantial growth due to the increasing prevalence of chronic diseases, the rising number of surgical procedures, and the growing demand for home healthcare solutions. As medical technology advances, the need for precision and safe infusion devices has heightened, driving demand for high-quality IV infusion products across different healthcare settings.

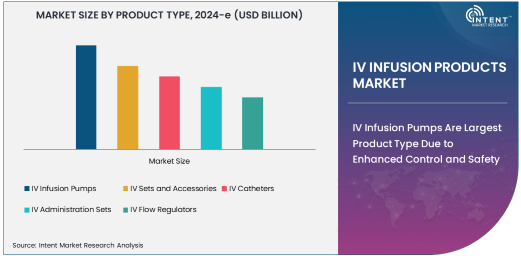

Key market segments in IV infusion products include pumps, sets and accessories, catheters, administration sets, and flow regulators. These products are integral in ensuring the controlled and accurate delivery of intravenous therapies. Hospitals remain the largest end-user segment due to their high volume of surgical and critical care procedures, but the growing popularity of home healthcare is also contributing to the rise in demand for portable and user-friendly IV infusion products. The competitive landscape is characterized by the ongoing innovation in infusion technology, including the development of smart pumps and digital infusion systems designed to improve patient safety and optimize treatment outcomes.

IV Infusion Pumps Are Largest Product Type Due to Enhanced Control and Safety

IV infusion pumps represent the largest product type in the IV infusion products market, primarily due to their enhanced control and precision in delivering fluids, medications, and nutrients. These pumps allow healthcare providers to administer specific volumes of fluids at controlled rates, ensuring that patients receive the correct dosages for their treatment regimens. The integration of advanced features such as programmable settings, alarms, and wireless connectivity has increased the adoption of infusion pumps in hospitals, clinics, and home healthcare settings, where accuracy and patient safety are paramount.

The growing use of IV infusion pumps is also driven by the rise in chronic diseases, such as diabetes and cancer, which require ongoing intravenous therapies. Additionally, the use of infusion pumps in chemotherapy and pain management is on the rise, as these treatments demand precise control over the delivery of medication. The demand for more automated and intelligent infusion systems continues to increase, with an emphasis on reducing human error and improving clinical outcomes. As a result, IV infusion pumps are expected to remain the largest segment in this market, with continuous innovation in technology to improve the patient experience and safety.

Fluid and Electrolyte Replacement Is Largest Application Due to Widespread Need in Critical Care

Fluid and electrolyte replacement is the largest application in the IV infusion products market, driven by its widespread use in critical care, emergency medicine, and various medical conditions such as dehydration, trauma, and surgery. IV infusion products used in fluid and electrolyte replacement include crystalloid solutions, which are commonly administered to patients who have lost fluids and electrolytes due to illnesses such as gastroenteritis, heatstroke, or excessive bleeding. These solutions are crucial in maintaining the body’s balance of electrolytes and ensuring normal cellular function.

The increasing number of surgeries and emergency care cases, along with the rise in chronic diseases that affect fluid balance, has significantly contributed to the demand for IV infusion products in this application. In addition, the expansion of healthcare access and the growing elderly population are fueling the need for efficient and accurate fluid replacement therapies. As healthcare systems focus on improving patient outcomes, the demand for IV infusion products for fluid and electrolyte replacement is expected to remain robust, particularly in intensive care units (ICUs) and emergency departments.

Hospitals Are Largest End-User Segment Due to High Demand for Critical Care Infusions

Hospitals are the largest end-user segment in the IV infusion products market, owing to the high demand for IV therapies in both critical and routine care settings. Hospitals require a wide variety of infusion products, including pumps, catheters, sets, and flow regulators, to manage a range of medical conditions such as pain management, chemotherapy, fluid replacement, and antibiotic therapy. The hospital setting demands the highest volume of IV infusion products, particularly in intensive care units (ICUs), emergency departments, and surgical theaters where precise and continuous medication delivery is critical for patient survival.

Hospitals are also at the forefront of adopting the latest infusion technologies, including smart infusion pumps that help prevent medication errors, automate processes, and ensure accurate drug delivery. As the healthcare industry continues to evolve, hospitals are increasingly focusing on enhancing patient safety and improving treatment outcomes, which further drives the need for high-quality IV infusion products. With an expanding range of medical conditions requiring IV therapies, hospitals will continue to be the largest consumers of these products, ensuring ongoing market growth.

Direct Sales Are Largest Distribution Channel Due to Customization and Provider Relationships

Direct sales are the largest distribution channel in the IV infusion products market, primarily due to the long-term relationships and tailored offerings provided to healthcare providers. Through direct sales, manufacturers can offer a comprehensive range of IV infusion products, including customized solutions that meet the specific needs of hospitals, ambulatory surgical centers, and home healthcare providers. This channel also allows for greater control over the supply chain, ensuring timely delivery and consistent quality of infusion products, which is crucial for patient care.

In addition, direct sales enable manufacturers to build strong partnerships with healthcare institutions, providing training, support, and troubleshooting for infusion devices. These relationships are key to maintaining customer loyalty and ensuring the proper use of infusion products in clinical settings. As the demand for specialized and advanced infusion devices grows, the direct sales model remains the most effective distribution strategy for companies looking to cater to the unique needs of healthcare providers.

North America Is Largest Region Owing to Advanced Healthcare Systems and High Demand for Infusion Therapies

North America is the largest region in the IV infusion products market, driven by the advanced healthcare systems, high healthcare expenditure, and the growing demand for infusion therapies in hospitals and outpatient settings. The U.S. is the dominant market within the region, where the prevalence of chronic diseases such as diabetes, cancer, and cardiovascular conditions has led to an increased need for intravenous therapies. Moreover, the expanding healthcare infrastructure and the adoption of advanced infusion technology in hospitals and clinics further support the growth of the IV infusion products market in this region.

The strong regulatory frameworks and robust healthcare policies in North America also foster the widespread adoption of safe and effective infusion products. As the demand for home healthcare services continues to rise, the market for portable IV infusion devices is expected to grow in North America as well, contributing to the region’s dominance. The ongoing shift toward value-based care, along with a focus on patient safety and treatment outcomes, will continue to drive growth in the IV infusion products market in North America.

Competitive Landscape and Leading Companies

The IV infusion products market is highly competitive, with several major players vying for market share through innovation, product quality, and strategic partnerships. Leading companies in this market include B. Braun Melsungen AG, Baxter International Inc., Medtronic, and Smiths Medical. These companies are well-established in the healthcare sector, offering a wide range of IV infusion products such as pumps, catheters, and administration sets.

Innovation in infusion technology, such as the development of smart pumps, wireless connectivity, and user-friendly interfaces, is a key focus for these companies, as they seek to improve patient safety and reduce the risk of medication errors. Additionally, manufacturers are expanding their product portfolios to meet the increasing demand for home healthcare solutions and customized infusion therapies. As competition intensifies, companies are also focusing on expanding their geographic presence and enhancing customer relationships through direct sales and support services. The competitive landscape is expected to remain dynamic as companies continue to innovate and adapt to evolving healthcare needs.

Recent Developments:

- In December 2024, Baxter International Inc. launched a new smart IV infusion pump that integrates with hospital management systems to improve infusion accuracy and reduce human error.

- In November 2024, Fresenius Kabi AG expanded its product line to include a new series of IV administration sets designed for pediatric and neonatal patients.

- In October 2024, Medtronic introduced a new home healthcare infusion pump to help patients manage chronic conditions such as diabetes and dehydration from home.

- In September 2024, Grifols S.A. received FDA approval for a new range of IV fluid solutions aimed at enhancing the delivery of parenteral nutrition for critically ill patients.

- In August 2024, ICU Medical, Inc. launched a new IV flow regulator that offers more precise control over infusion rates, targeting high-acuity care settings

List of Leading Companies:

- B. Braun Melsungen AG

- Baxter International Inc.

- Fresenius Kabi AG

- Smiths Medical

- Terumo Corporation

- Hospira (Pfizer Inc.)

- ICU Medical, Inc.

- Grifols S.A.

- Jiangsu Hengrui Medicine Co., Ltd.

- Johnson & Johnson

- Medtronic

- Nipro Corporation

- Becton Dickinson and Company (BD)

- Zyno Medical

- Ambu A/S

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 10.8 Billion |

|

Forecasted Value (2030) |

USD 14.2 Billion |

|

CAGR (2025 – 2030) |

3.9% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

IV Infusion Products Market by Product Type (IV Infusion Pumps, IV Sets and Accessories, IV Catheters, IV Administration Sets, IV Flow Regulators), Application (Pain Management, Parenteral Nutrition, Fluid and Electrolyte Replacement, Chemotherapy Infusions, Antibiotic Infusions), End-User (Hospitals, Ambulatory Surgical Centers, Home Healthcare Providers, Clinics), Distribution Channel (Direct Sales, Retail Pharmacies, Hospitals/Clinics) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

B. Braun Melsungen AG, Baxter International Inc., Fresenius Kabi AG, Smiths Medical, Terumo Corporation, Hospira (Pfizer Inc.), ICU Medical, Inc., Grifols S.A., Jiangsu Hengrui Medicine Co., Ltd., Johnson & Johnson, Medtronic, Nipro Corporation, Becton Dickinson and Company (BD), Zyno Medical, Ambu A/S |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. IV Infusion Products Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. IV Infusion Pumps |

|

4.2. IV Sets and Accessories |

|

4.3. IV Catheters |

|

4.4. IV Administration Sets |

|

4.5. IV Flow Regulators |

|

5. IV Infusion Products Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Pain Management |

|

5.2. Parenteral Nutrition |

|

5.3. Fluid and Electrolyte Replacement |

|

5.4. Chemotherapy Infusions |

|

5.5. Antibiotic Infusions |

|

6. IV Infusion Products Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Hospitals |

|

6.2. Ambulatory Surgical Centers |

|

6.3. Home Healthcare Providers |

|

6.4. Clinics |

|

7. IV Infusion Products Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Direct Sales |

|

7.2. Retail Pharmacies |

|

7.3. Hospitals/Clinics |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America IV Infusion Products Market, by Product Type |

|

8.2.7. North America IV Infusion Products Market, by Application |

|

8.2.8. North America IV Infusion Products Market, by End-User |

|

8.2.9. North America IV Infusion Products Market, by Distribution Channel |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US IV Infusion Products Market, by Product Type |

|

8.2.10.1.2. US IV Infusion Products Market, by Application |

|

8.2.10.1.3. US IV Infusion Products Market, by End-User |

|

8.2.10.1.4. US IV Infusion Products Market, by Distribution Channel |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. B. Braun Melsungen AG |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Baxter International Inc. |

|

10.3. Fresenius Kabi AG |

|

10.4. Smiths Medical |

|

10.5. Terumo Corporation |

|

10.6. Hospira (Pfizer Inc.) |

|

10.7. ICU Medical, Inc. |

|

10.8. Grifols S.A. |

|

10.9. Jiangsu Hengrui Medicine Co., Ltd. |

|

10.10. Johnson & Johnson |

|

10.11. Medtronic |

|

10.12. Nipro Corporation |

|

10.13. Becton Dickinson and Company (BD) |

|

10.14. Zyno Medical |

|

10.15. Ambu A/S |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the IV Infusion Products Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the IV Infusion Products Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the IV Infusion Products Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA