As per Intent Market Research, the IoT Based Asset Tracking and Monitoring Market was valued at USD 9.4 Billion in 2024-e and will surpass USD 24.7 Billion by 2030; growing at a CAGR of 17.4% during 2025 - 2030.

The IoT-based asset tracking and monitoring market has experienced rapid growth due to the increasing need for real-time monitoring and management of assets across various industries. This technology integrates Internet of Things (IoT) devices with tracking systems to allow businesses to remotely monitor and manage their valuable assets, ensuring greater efficiency, security, and operational insights. With the adoption of IoT sensors, RFID tags, GPS systems, and cloud-based platforms, businesses can track assets in real-time, streamline inventory management, and improve asset utilization. Industries such as logistics, healthcare, and manufacturing have recognized the immense potential of this technology to improve supply chain operations, reduce theft, and ensure regulatory compliance.

The market is growing in response to the increasing demand for visibility and control over high-value assets, with a clear focus on reducing losses, enhancing security, and optimizing operations. As businesses embrace digital transformation, the integration of IoT-based solutions into asset tracking systems has become crucial for improving operational performance and reducing costs. Furthermore, advancements in wireless communication technologies, including RFID, GPS, and Bluetooth, are enhancing the functionality of asset tracking and monitoring systems, fueling the market's rapid expansion.

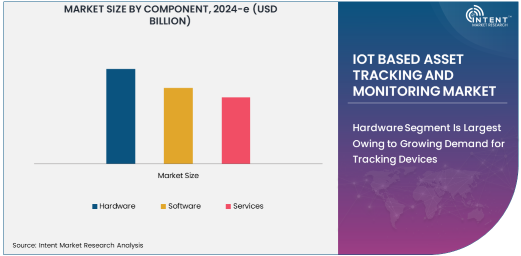

Hardware Segment Is Largest Owing to Growing Demand for Tracking Devices

The hardware segment dominates the IoT-based asset tracking and monitoring market, driven by the increasing need for tracking devices and sensors that form the backbone of asset tracking systems. IoT hardware such as RFID tags, GPS-enabled devices, sensors, and other tracking devices are essential for collecting and transmitting data on asset location, condition, and status in real time. These devices are equipped with advanced features like temperature sensors, motion detection, and geofencing capabilities, which enhance the ability to monitor assets effectively across different environments.

As industries across logistics, manufacturing, and healthcare sectors deploy IoT solutions for asset tracking, the demand for reliable and durable hardware components continues to rise. The growing adoption of RFID tags in warehouses and supply chain management systems is also a major contributor to the hardware segment's dominance. Moreover, the trend of asset tracking in high-value industries, including pharmaceuticals and electronics, is further boosting the demand for specialized hardware. The hardware segment is expected to maintain its leadership as more companies seek to integrate comprehensive IoT solutions into their asset management practices.

RFID Technology Is Fastest Growing Owing to Its Efficiency and Cost-effectiveness

RFID technology is the fastest-growing technology in the IoT-based asset tracking and monitoring market, primarily due to its efficiency, cost-effectiveness, and widespread applicability. RFID (Radio Frequency Identification) offers several advantages for asset tracking, including the ability to track multiple assets simultaneously, without the need for line-of-sight, and its compatibility with a wide range of industries. RFID tags are easily attached to assets, and they use radio waves to transmit data to nearby RFID readers, enabling real-time tracking of asset movements and conditions. This makes RFID particularly useful in large-scale operations like logistics, warehousing, and manufacturing, where tracking numerous assets is essential.

RFID also offers a high level of accuracy and scalability, making it an ideal solution for businesses looking to streamline inventory management, prevent asset loss, and improve supply chain visibility. Its adoption is growing rapidly in industries such as retail, logistics, and healthcare, where real-time tracking and traceability of products and equipment are critical. The increasing affordability of RFID tags and readers, combined with advances in data analytics platforms, is contributing to the accelerated growth of this technology in the asset tracking market.

Logistics and Transportation Is Largest End-Use Industry Due to High Demand for Asset Visibility

The logistics and transportation industry is the largest end-use sector in the IoT-based asset tracking and monitoring market, driven by the increasing need for visibility and control over assets during transportation and in storage. Logistics companies require real-time tracking of goods, containers, and vehicles to optimize routes, prevent theft, and reduce delays in delivery. IoT-based asset tracking solutions provide critical insights into the location, status, and condition of shipments, allowing businesses to make data-driven decisions to improve operational efficiency and customer satisfaction.

The growing complexity of global supply chains and the rise of e-commerce have intensified the need for advanced tracking systems in the logistics sector. IoT technologies, including RFID and GPS, help logistics providers reduce operational inefficiencies and improve asset management, leading to reduced costs and enhanced service delivery. The logistics and transportation industry's increasing reliance on real-time data for inventory management, route optimization, and predictive maintenance will continue to drive the adoption of IoT-based asset tracking solutions in the coming years.

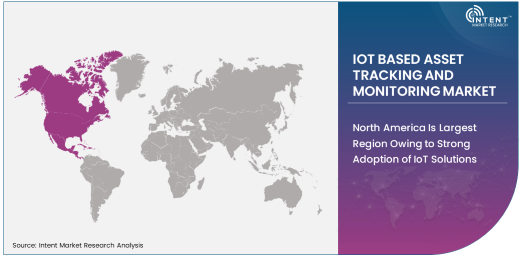

North America Is Largest Region Owing to Strong Adoption of IoT Solutions

North America is the largest region in the IoT-based asset tracking and monitoring market, fueled by a strong adoption of IoT technologies across various industries and well-established infrastructure in logistics, healthcare, and manufacturing. The United States, in particular, is at the forefront of this technological transformation, with businesses in the retail, logistics, and healthcare sectors heavily investing in IoT solutions to streamline operations and enhance supply chain efficiency. The presence of key technology providers, such as Cisco Systems, Zebra Technologies, and Honeywell, further bolsters the region's dominance in the market.

North America's robust regulatory environment, coupled with the rapid digital transformation in industries such as transportation, manufacturing, and healthcare, makes it an ideal market for IoT-based asset tracking and monitoring solutions. Additionally, the region's high level of investment in research and development, combined with an advanced technology ecosystem, is accelerating the adoption of these solutions. As the demand for real-time tracking and visibility continues to grow, North America is poised to maintain its leadership in the IoT-based asset tracking market.

Leading Companies and Competitive Landscape

The IoT-based asset tracking and monitoring market is highly competitive, with a number of key players offering innovative solutions to cater to the growing demand for real-time asset management. Leading companies in the market include Zebra Technologies, Honeywell International, Cisco Systems, Intel Corporation, and Ubisense Group. These companies are focused on developing advanced hardware and software solutions, as well as providing comprehensive services for IoT-based asset tracking.

The competitive landscape is characterized by ongoing innovation in IoT technologies, particularly in the areas of RFID, GPS, and Bluetooth. Companies are increasingly forming strategic partnerships and collaborations to integrate advanced tracking solutions with cloud platforms, analytics tools, and enterprise resource planning (ERP) systems. Additionally, as the market expands, there is growing emphasis on the development of customizable and scalable solutions to meet the unique needs of various industries. Leading players are also focusing on enhancing product features such as data security, ease of integration, and real-time analytics to gain a competitive edge in the market.

Recent Developments:

- Zebra Technologies launched an advanced RFID-based asset tracking solution, enabling enhanced visibility for supply chain and warehouse operations.

- Honeywell International Inc. expanded its IoT-based asset tracking offerings with a new suite of software solutions to improve real-time asset visibility in healthcare and manufacturing.

- Trimble Inc. entered a strategic partnership with a leading logistics company to deploy IoT-based asset tracking systems, optimizing fleet management and asset utilization.

- Sierra Wireless unveiled a new cellular-based asset tracking solution for remote monitoring in the oil and gas industry, improving operational efficiency.

- Cisco Systems, Inc. introduced a new IoT platform for seamless integration of asset tracking and monitoring across industries, enhancing data-driven decision-making processes.

List of Leading Companies:

- Zebra Technologies

- Honeywell International Inc.

- Cisco Systems, Inc.

- Thingstream

- Trimble Inc.

- Sierra Wireless

- Geotab Inc.

- Teletrac Navman

- Ubisense

- Vodafone Group PLC

- NXP Semiconductors

- Intel Corporation

- Google (Alphabet Inc.)

- Apple Inc.

- IBM Corporation

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 9.4 Billion |

|

Forecasted Value (2030) |

USD 24.7 Billion |

|

CAGR (2025 – 2030) |

17.4% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Global IoT-Based Asset Tracking and Monitoring Market by Component (Hardware, Software, Services), by Technology (RFID, GPS, Bluetooth), by End-Use Industry (Logistics and Transportation, Manufacturing, Healthcare), and by Region |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Zebra Technologies, Honeywell International Inc., Cisco Systems, Inc., Thingstream, Trimble Inc., Sierra Wireless, Teletrac Navman, Ubisense, Vodafone Group PLC, NXP Semiconductors, Intel Corporation, Google (Alphabet Inc.), IBM Corporation |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. IoT Based Asset Tracking and Monitoring Market, by Component (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Hardware |

|

4.2. Software |

|

4.3. Services |

|

5. IoT Based Asset Tracking and Monitoring Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. RFID |

|

5.2. GPS |

|

5.3. Bluetooth |

|

5.4. Others |

|

6. IoT Based Asset Tracking and Monitoring Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Logistics and Transportation |

|

6.2. Manufacturing |

|

6.3. Healthcare |

|

6.4. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America IoT Based Asset Tracking and Monitoring Market, by Component |

|

7.2.7. North America IoT Based Asset Tracking and Monitoring Market, by Technology |

|

7.2.8. North America IoT Based Asset Tracking and Monitoring Market, by End-Use Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US IoT Based Asset Tracking and Monitoring Market, by Component |

|

7.2.9.1.2. US IoT Based Asset Tracking and Monitoring Market, by Technology |

|

7.2.9.1.3. US IoT Based Asset Tracking and Monitoring Market, by End-Use Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Zebra Technologies |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Honeywell International Inc. |

|

9.3. Cisco Systems, Inc. |

|

9.4. Thingstream |

|

9.5. Trimble Inc. |

|

9.6. Sierra Wireless |

|

9.7. Geotab Inc. |

|

9.8. Teletrac Navman |

|

9.9. Ubisense |

|

9.10. Vodafone Group PLC |

|

9.11. NXP Semiconductors |

|

9.12. Intel Corporation |

|

9.13. Google (Alphabet Inc.) |

|

9.14. Apple Inc. |

|

9.15. IBM Corporation |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the IoT-Based Asset Tracking and Monitoring Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the IoT-Based Asset Tracking and Monitoring Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the IoT-Based Asset Tracking and Monitoring Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA