As per Intent Market Research, the Intravenous (IV) Solutions Market was valued at USD 12.9 billion in 2024-e and will surpass USD 25.1 billion by 2030; growing at a CAGR of 10.1% during 2025 - 2030.

The intravenous (IV) solutions market is critical in modern healthcare, playing an essential role in the delivery of fluids, electrolytes, nutrients, and medications to patients. IV solutions are used across various medical applications, including fluid and electrolyte replacement, parenteral nutrition, and antibiotic and chemotherapy infusions. These solutions are essential for managing a variety of conditions, ranging from dehydration and nutritional deficiencies to severe infections and cancer treatments. As the global healthcare system continues to evolve, the demand for IV solutions has been driven by the increasing incidence of chronic diseases, the rise in surgical procedures, and the growing need for home healthcare.

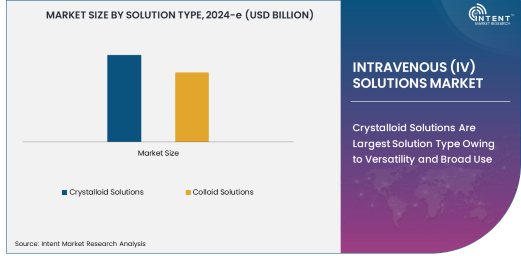

The market for IV solutions is segmented by solution type, therapeutic application, end-user, and distribution channel, with crystalloid and colloid solutions being the primary types. Crystalloid solutions, typically used for fluid and electrolyte replacement, dominate the market due to their widespread use in hospitals, emergency care, and surgical procedures. Colloid solutions, on the other hand, are increasingly used for blood volume replacement and in critical care settings. The market is also driven by the demand for safe and effective distribution channels, with hospitals and clinics continuing to be the dominant end-users, while home healthcare is gaining traction due to the rise in chronic conditions that require long-term IV therapy.

Crystalloid Solutions Are Largest Solution Type Owing to Versatility and Broad Use

Crystalloid solutions represent the largest solution type in the IV solutions market, owing to their versatility and widespread use in healthcare settings. These solutions contain water and electrolytes, making them ideal for fluid and electrolyte replacement in patients who are dehydrated or have undergone surgery. Crystalloid solutions are used in a variety of clinical scenarios, including the treatment of trauma patients, burn victims, and individuals with gastrointestinal illnesses, all of which require immediate fluid replacement.

The broad applicability of crystalloid solutions is a major factor driving their dominance in the market. They are available in various forms, including saline and Ringer's lactate, which allows for flexibility in meeting the diverse needs of patients across different therapeutic applications. Crystalloid solutions are not only inexpensive and easy to produce but also have a relatively low risk of complications when compared to other IV solutions. This makes them the first choice for many healthcare providers, particularly in emergency care and critical settings, ensuring continued growth for this segment.

Fluid and Electrolyte Replacement Is Largest Therapeutic Application Due to Common Medical Needs

Fluid and electrolyte replacement is the largest therapeutic application in the IV solutions market, driven by the high incidence of conditions that require rapid fluid restoration. This includes dehydration from gastrointestinal diseases, heatstroke, or severe blood loss due to trauma or surgery. Fluid and electrolyte replacement IV solutions are used in hospitals, ambulatory surgical centers, and emergency care units as a first-line treatment for patients who have lost fluids and electrolytes. Their immediate and effective action makes them essential in critical care situations.

The growing prevalence of conditions such as chronic kidney disease, diabetes, and gastrointestinal disorders further fuels the demand for IV solutions in fluid and electrolyte replacement. In addition, the increasing number of surgical procedures and trauma-related incidents in hospitals contributes to the ongoing need for these solutions. The versatility of crystalloid solutions in addressing these needs ensures that fluid and electrolyte replacement will continue to be the largest therapeutic application for IV solutions, especially in acute care and emergency settings.

Hospitals Are Largest End-User Segment Due to High Demand for Critical Care

Hospitals represent the largest end-user segment in the IV solutions market, owing to the high demand for IV therapies in critical and emergency care. Hospitals require large volumes of IV solutions across various departments, including emergency rooms, surgical units, and intensive care units, where fluid and electrolyte replacement, parenteral nutrition, and blood volume replacement are commonly needed. The hospital setting accounts for a significant share of the overall demand for IV solutions, as these institutions manage complex and urgent medical conditions that often require intravenous therapies.

Hospitals continue to be the primary consumers of IV solutions because they are at the forefront of treating acute illnesses, trauma, and chronic conditions that require long-term care. As the global healthcare burden rises with an aging population and the increasing prevalence of chronic diseases, hospitals will remain the key drivers of growth in the IV solutions market. Moreover, advancements in hospital-based technology, such as automated IV pumps and monitoring systems, are expected to further enhance the demand for safe and precise IV therapies within hospital settings.

Direct Sales Are Largest Distribution Channel Due to Hospital and Clinic Partnerships

Direct sales represent the largest distribution channel for IV solutions, primarily due to the strong partnerships between manufacturers and healthcare institutions such as hospitals, ambulatory surgical centers, and clinics. Direct sales ensure that hospitals and other healthcare providers receive timely and tailored deliveries of IV solutions that meet their specific needs. This distribution model allows manufacturers to build long-term relationships with healthcare institutions and ensure the supply of critical IV solutions during times of high demand.

Direct sales also enable manufacturers to offer comprehensive services to healthcare providers, including product education, training on the safe use of IV solutions, and support in managing inventory. This channel also allows for better quality control, as manufacturers can work directly with end-users to address any concerns regarding the efficacy and safety of their products. Given the critical nature of IV solutions in healthcare, the direct sales model remains the most efficient and trusted way to distribute these essential products to hospitals and clinics.

North America Is Largest Region Owing to Advanced Healthcare Systems and High Demand

North America is the largest region in the intravenous solutions market, driven by the presence of advanced healthcare systems, high healthcare expenditure, and a large patient population requiring critical care. The U.S. is the dominant market within the region, where hospitals and healthcare providers heavily rely on IV solutions for a variety of therapeutic applications, including fluid replacement, parenteral nutrition, and blood volume replacement. The demand for IV solutions is particularly high in emergency care, trauma care, and surgery, where rapid interventions are crucial for patient survival.

The region’s robust healthcare infrastructure, coupled with a growing aging population, drives the need for advanced IV solutions that support patients with chronic conditions and complex medical treatments. Additionally, the rise in outpatient surgeries, cancer treatments, and diabetes management further increases the demand for intravenous therapies. As healthcare providers continue to adopt more integrated and patient-centered care models, the North American market for IV solutions is expected to maintain its dominance and see continued growth.

Competitive Landscape and Leading Companies

The intravenous solutions market is highly competitive, with several key players dominating the industry. Leading companies include Baxter International Inc., B. Braun Melsungen AG, and Fresenius Kabi, which are known for their comprehensive portfolios of IV solutions, including crystalloid and colloid solutions, as well as advanced delivery systems. These companies are focusing on product innovation, regulatory compliance, and expanding their global presence to maintain a competitive edge in the market.

In addition to large multinational companies, several regional players are also entering the market, providing specialized IV solutions tailored to local healthcare needs. Competition is intense as companies strive to improve the safety, quality, and efficacy of IV solutions, especially with growing concerns about adverse events related to intravenous therapies. The increasing demand for home healthcare and outpatient services is also prompting companies to develop more patient-friendly IV solutions and delivery systems. As the market continues to grow, leading players are expected to intensify their efforts in research and development to create solutions that meet evolving healthcare demands.

Recent Developments:

- In December 2024, Baxter International announced the launch of a new IV infusion system that integrates smart technologies for better patient monitoring during fluid and electrolyte administration.

- In November 2024, Fresenius Kabi introduced an advanced colloid solution designed to improve blood volume replacement in trauma patients.

- In October 2024, Hospira (Pfizer Inc.) received FDA approval for a new range of parenteral nutrition IV solutions aimed at pediatric patients.

- In September 2024, B. Braun Melsungen AG expanded its IV solutions production capacity in Europe to meet growing demand for home healthcare IV therapy.

- In August 2024, Terumo Corporation launched a new line of sterile IV fluids for use in ambulatory surgical centers to optimize fluid management during outpatient procedures.

List of Leading Companies:

- Baxter International Inc.

- B. Braun Melsungen AG

- Fresenius Kabi AG

- Hospira (Pfizer Inc.)

- Terumo Corporation

- Otsuka Pharmaceutical Co., Ltd.

- Smiths Medical

- Grifols S.A.

- ICU Medical, Inc.

- ICU Medical, Inc.

- Jiangsu Hengrui Medicine Co., Ltd.

- Halyard Health, Inc. (part of Owens & Minor)

- Zambon S.p.A.

- Amgen Inc.

- Daiichi Sankyo Company, Limited

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 12.9 Billion |

|

Forecasted Value (2030) |

USD 25.1 Billion |

|

CAGR (2025 – 2030) |

10.1% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Intravenous (IV) Solutions Market by Solution Type (Crystalloid Solutions, Colloid Solutions), Therapeutic Application (Fluid and Electrolyte Replacement, Parenteral Nutrition, Antibiotic and Chemotherapy Infusions, Blood Volume Replacement), End-User (Hospitals, Ambulatory Surgical Centers, Home Healthcare), Distribution Channel (Direct Sales, Retail Pharmacies, Hospitals/Clinics) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Baxter International Inc., B. Braun Melsungen AG, Fresenius Kabi AG, Hospira (Pfizer Inc.), Terumo Corporation, Otsuka Pharmaceutical Co., Ltd., Smiths Medical, Grifols S.A., ICU Medical, Inc., ICU Medical, Inc., Jiangsu Hengrui Medicine Co., Ltd., Halyard Health, Inc. (part of Owens & Minor), Zambon S.p.A., Amgen Inc., Daiichi Sankyo Company, Limited |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Intravenous (IV) Solutions Market, by Solution Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Crystalloid Solutions |

|

4.2. Colloid Solutions |

|

5. Intravenous (IV) Solutions Market, by Therapeutic Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Fluid and Electrolyte Replacement |

|

5.2. Parenteral Nutrition |

|

5.3. Antibiotic and Chemotherapy Infusions |

|

5.4. Blood Volume Replacement |

|

6. Intravenous (IV) Solutions Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Hospitals |

|

6.2. Ambulatory Surgical Centers |

|

6.3. Home Healthcare |

|

7. Intravenous (IV) Solutions Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Direct Sales |

|

7.2. Retail Pharmacies |

|

7.3. Hospitals/Clinics |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Intravenous (IV) Solutions Market, by Solution Type |

|

8.2.7. North America Intravenous (IV) Solutions Market, by Therapeutic Application |

|

8.2.8. North America Intravenous (IV) Solutions Market, by End-User |

|

8.2.9. North America Intravenous (IV) Solutions Market, by Distribution Channel |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Intravenous (IV) Solutions Market, by Solution Type |

|

8.2.10.1.2. US Intravenous (IV) Solutions Market, by Therapeutic Application |

|

8.2.10.1.3. US Intravenous (IV) Solutions Market, by End-User |

|

8.2.10.1.4. US Intravenous (IV) Solutions Market, by Distribution Channel |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Baxter International Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. B. Braun Melsungen AG |

|

10.3. Fresenius Kabi AG |

|

10.4. Hospira (Pfizer Inc.) |

|

10.5. Terumo Corporation |

|

10.6. Otsuka Pharmaceutical Co., Ltd. |

|

10.7. Smiths Medical |

|

10.8. Grifols S.A. |

|

10.9. ICU Medical, Inc. |

|

10.10. ICU Medical, Inc. |

|

10.11. Jiangsu Hengrui Medicine Co., Ltd. |

|

10.12. Halyard Health, Inc. (part of Owens & Minor) |

|

10.13. Zambon S.p.A. |

|

10.14. Amgen Inc. |

|

10.15. Daiichi Sankyo Company, Limited |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Intravenous (IV) Solutions Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Intravenous (IV) Solutions Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Intravenous (IV) Solutions Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA