As per Intent Market Research, the Intragastric Balloon Market was valued at USD 1.1 Billion in 2024-e and will surpass USD 2.1 Billion by 2030; growing at a CAGR of 11.5% during 2025 - 2030.

The Intragastric Balloon Market is witnessing strong growth, primarily driven by the increasing prevalence of obesity and related health complications, such as diabetes and cardiovascular diseases. Intragastric balloon therapy is a non-surgical weight-loss procedure where a balloon is placed in the stomach to reduce its capacity and induce a feeling of fullness, aiding in weight loss. This treatment is gaining popularity as a minimally invasive alternative to bariatric surgery, especially for individuals who are not eligible for surgery or prefer less invasive options.

The growing awareness regarding obesity-related health risks, along with advancements in intragastric balloon technologies, is fueling market expansion. The development of more comfortable and effective balloon types, along with improvements in patient care and monitoring systems, is driving increased adoption across various healthcare settings. The market is also supported by the rise in healthcare investments in obesity treatments, along with increasing demand for non-surgical weight management solutions.

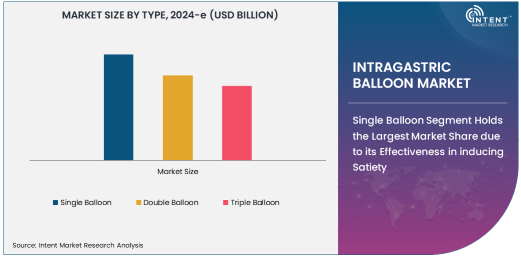

Single Balloon Segment Holds the Largest Market Share due to its Effectiveness in inducing Satiety

The single balloon segment is the largest within the intragastric balloon market. The single balloon device is the most commonly used type of intragastric balloon for weight loss management, primarily because it is relatively simple to insert, less expensive, and generally has fewer complications compared to other types. The single balloon occupies a dominant market share due to its effectiveness in inducing satiety and contributing to gradual weight loss.

This type of balloon is particularly popular among patients looking for an alternative to surgical weight-loss methods. The balloon is typically inserted endoscopically and filled with a sterile saline solution, expanding to take up space in the stomach and reducing its overall volume. As a result, patients feel full with less food intake. The popularity of single balloon devices is expected to continue growing, especially in regions where healthcare infrastructure supports endoscopic procedures.

Weight Loss Management is the Leading Application Area

Weight loss management is the leading application segment in the intragastric balloon market, as the therapy is primarily used for non-surgical weight loss. This segment includes individuals with obesity who are looking for less invasive alternatives to traditional weight-loss surgery (bariatric surgery). As obesity rates continue to rise globally, the demand for non-invasive weight loss procedures, such as intragastric balloon therapy, is expected to increase.

Obesity-related health conditions, including diabetes, hypertension, and cardiovascular diseases, have increased the focus on weight loss management, further driving the adoption of intragastric balloons. Additionally, the rising awareness about the importance of weight management for overall health is likely to contribute to the sustained demand for such treatments.

Hospitals and Clinics Dominate the End-Use Industry

Hospitals and clinics are the largest end-use industry segment for intragastric balloon procedures. These healthcare settings have the required infrastructure, skilled professionals, and advanced medical equipment to perform the procedure safely and effectively. The growing adoption of non-surgical weight loss options in hospitals, coupled with increasing patient awareness about non-invasive procedures, has bolstered the demand for intragastric balloons.

Hospitals and clinics are well-positioned to offer comprehensive care for obesity and weight loss, including the placement of intragastric balloons and follow-up support for weight management. As the global obesity epidemic continues, healthcare providers in hospitals and clinics are expected to be at the forefront of offering these innovative, minimally invasive treatment options.

Ambulatory Surgical Centers Experience Rapid Growth due to the Increasing Preference for Outpatient Procedures

Ambulatory surgical centers (ASCs) represent a fast-growing end-use segment due to the increasing preference for outpatient procedures. ASCs offer patients the advantage of receiving intragastric balloon procedures without the need for prolonged hospitalization, leading to shorter recovery times and reduced costs. The growth of ASCs is driven by the rising demand for minimally invasive procedures, including weight loss management solutions, that can be performed on an outpatient basis.

ASCs are equipped with modern medical technologies and offer flexibility for patients seeking convenient options. The market for intragastric balloons in ASCs is expected to grow rapidly as patients and healthcare providers continue to seek alternatives to more invasive and costly weight-loss surgeries.

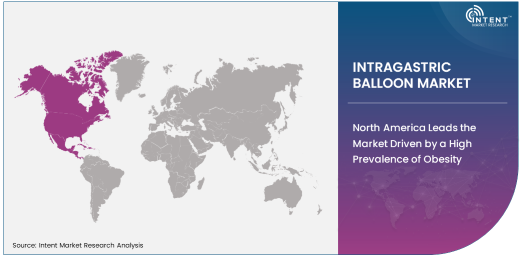

North America Leads the Market Driven by a High Prevalence of Obesity

North America is the largest regional market for intragastric balloons, driven by a high prevalence of obesity, advanced healthcare infrastructure, and increasing demand for non-invasive weight loss treatments. The United States, in particular, is the largest market due to a high rate of obesity and the availability of state-of-the-art medical centers offering intragastric balloon therapies. The region is also seeing increased adoption of weight management solutions among patients seeking alternatives to bariatric surgery.

With a well-established healthcare system and strong awareness campaigns about obesity and weight management, North America is expected to continue leading the intragastric balloon market. Additionally, growing investments in research and development for improving intragastric balloon technologies will further contribute to the region's market dominance.

Competitive Landscape and Leading Companies

The Intragastric Balloon Market is competitive, with key players focused on developing innovative products, expanding their market presence, and improving patient outcomes. Major companies in the market include Apollo Endosurgery, Allergan, Obalon Therapeutics, ReShape Lifesciences, and Endalis, among others. These companies lead the market through strategic partnerships, product launches, and advancements in balloon technologies.

To stay competitive, companies are focusing on improving the design of intragastric balloons to increase patient comfort, reduce side effects, and enhance the overall effectiveness of weight loss treatments. Additionally, ongoing research into expanding the indications for intragastric balloons beyond weight loss to other gastrointestinal conditions will likely spur further market growth.

Recent Developments:

- Apollo Endosurgery, Inc. launched a new generation of intragastric balloons designed to improve patient comfort during the procedure.

- Obalon Therapeutics, Inc. received FDA approval for its expanded range of intragastric balloon treatments.

- Medtronic plc announced a strategic partnership to develop advanced intragastric balloon systems with enhanced efficacy.

- ReShape Lifesciences Inc. expanded its product offerings to include a new version of its weight loss balloon.

- EndoBloom, Inc. raised $20 million in Series B funding to advance research and development of innovative gastric balloon solutions.

List of Leading Companies:

- Apollo Endosurgery, Inc.

- Obalon Therapeutics, Inc.

- EndoBloom, Inc.

- Intragastric Balloon Systems

- Allergan (AbbVie)

- ReShape Lifesciences Inc.

- Spatz FGIA, Inc.

- Medtronic plc

- Mint Medical GmbH

- Gastric Balloon Solutions

- LBT Medical

- BaroSense, Inc.

- Flexion Therapeutics, Inc.

- IntraPill Ltd.

- Orbera Intragastric Balloon

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.1 Billion |

|

Forecasted Value (2030) |

USD 2.1 Billion |

|

CAGR (2025 – 2030) |

11.5% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Global Intragastric Balloon Market by Type (Single Balloon, Double Balloon, Triple Balloon), by Application (Weight Loss Management, Obesity Treatment), by End-Use Industry (Hospitals and Clinics, Ambulatory Surgical Centers), and by Region |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Apollo Endosurgery, Inc., Obalon Therapeutics, Inc., EndoBloom, Inc., Intragastric Balloon Systems, Allergan (AbbVie), ReShape Lifesciences Inc., Medtronic plc, Mint Medical GmbH, Gastric Balloon Solutions, LBT Medical, BaroSense, Inc., Flexion Therapeutics, Inc., Orbera Intragastric Balloon |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Intragastric Balloon Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Single Balloon |

|

4.2. Double Balloon |

|

4.3. Triple Balloon |

|

5. Intragastric Balloon Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Weight Loss Management |

|

5.2. Obesity Treatment |

|

5.3. Others |

|

6. Intragastric Balloon Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Hospitals and Clinics |

|

6.2. Ambulatory Surgical Centers |

|

6.3. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Intragastric Balloon Market, by Type |

|

7.2.7. North America Intragastric Balloon Market, by Application |

|

7.2.8. North America Intragastric Balloon Market, by End-Use Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Intragastric Balloon Market, by Type |

|

7.2.9.1.2. US Intragastric Balloon Market, by Application |

|

7.2.9.1.3. US Intragastric Balloon Market, by End-Use Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Apollo Endosurgery, Inc. |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Obalon Therapeutics, Inc. |

|

9.3. EndoBloom, Inc. |

|

9.4. Intragastric Balloon Systems |

|

9.5. Allergan (AbbVie) |

|

9.6. ReShape Lifesciences Inc. |

|

9.7. Spatz FGIA, Inc. |

|

9.8. Medtronic plc |

|

9.9. Mint Medical GmbH |

|

9.10. Gastric Balloon Solutions |

|

9.11. LBT Medical |

|

9.12. BaroSense, Inc. |

|

9.13. Flexion Therapeutics, Inc. |

|

9.14. IntraPill Ltd. |

|

9.15. Orbera Intragastric Balloon |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Intragastric Balloon Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Intragastric Balloon Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Intragastric Balloon Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA